AQA Specification focus:

‘Factors that affect growth and development, such as: investment, education and training.’

Introduction

Economic growth and development are shaped by numerous interconnected factors that determine a country’s ability to expand output, improve living standards, and achieve sustainable progress.

Investment

Investment plays a central role in boosting capital accumulation and increasing a country’s productive capacity. It includes spending by firms, governments, and households on goods that will be used for future production.

Physical capital investment: Investment in machinery, factories, and infrastructure directly raises productivity. For example, efficient transport networks lower costs and connect markets.

Public investment: Government spending on infrastructure (roads, power supply, digital networks) is often essential to support private sector activity.

Private sector investment: Domestic businesses investing in technology can enhance competitiveness.

Foreign direct investment (FDI): Multinational corporations contribute through technology transfer, management expertise, and integration into global supply chains.

Foreign Direct Investment (FDI): Long-term investment by foreign firms in another country, involving ownership or control of production facilities.

High levels of investment can generate a multiplier effect, where increased spending stimulates further rounds of income and consumption. However, in developing countries, weak financial markets or political instability may deter private investment.

Education and Human Capital

Human capital refers to the skills, knowledge, and abilities possessed by the workforce. Education and training are critical in raising productivity and enabling economies to shift towards higher-value industries.

Primary education provides basic literacy and numeracy, crucial for workforce participation.

Secondary and tertiary education develop advanced skills needed for industrialisation and technological advancement.

Vocational training ensures that workers acquire practical, job-specific skills.

Human Capital: The stock of skills, knowledge, and experience possessed by individuals that contribute to economic productivity.

A more skilled workforce can increase innovation, efficiency, and adaptability to technological change. For developing countries, investment in education is essential to break cycles of poverty, while in developed countries it supports competitiveness in a knowledge-based economy.

Image: insert image from https://krmangalamvaishali.com/blogs/what-is-the-role-of-education-in-human-capital-formation/

The illustration portrays individuals participating in educational and training activities, highlighting the importance of human capital development. Such investments are essential for enhancing productivity and driving economic growth, as discussed in the study notes. Source

Health and Workforce Productivity

Health is closely linked to economic development, as a healthy population is more productive and capable of sustained labour participation.

Healthcare access improves life expectancy, reduces absenteeism, and strengthens productivity.

Nutrition directly influences cognitive development and workforce capability.

Disease control (e.g., malaria eradication programmes) is vital in many less-developed countries.

Without adequate healthcare systems, workers may be unable to contribute effectively to economic output, creating barriers to long-term development.

Technology and Innovation

Technological progress is a driver of long-run economic growth, enabling economies to achieve higher output with the same inputs.

Research and development (R&D) fosters innovation and efficiency.

Technology transfer from multinational corporations helps developing economies leapfrog stages of industrialisation.

Digital infrastructure enables participation in global trade and services, such as financial technology (fintech).

In developed economies, maintaining an edge in innovation is key to sustaining high living standards, while for developing economies, adopting existing technologies may be more impactful than creating new ones.

Institutional Factors

Institutions create the framework in which economic activity occurs. Strong, reliable institutions are often a prerequisite for development.

Legal systems that protect property rights encourage investment.

Stable political systems reduce uncertainty for businesses.

Effective governments that reduce corruption and enforce contracts are crucial for long-term growth.

Property Rights: Legal rights that allow individuals and firms to own, use, and transfer resources and assets.

Weak institutions can lead to capital flight, low investor confidence, and poor utilisation of resources.

Infrastructure

Infrastructure underpins both domestic production and international competitiveness.

Transport infrastructure reduces costs and increases market access.

Energy supply ensures reliable production capacity.

Communications infrastructure supports integration with global markets.

Developing economies often face bottlenecks due to underdeveloped infrastructure, limiting their ability to attract investment and expand trade.

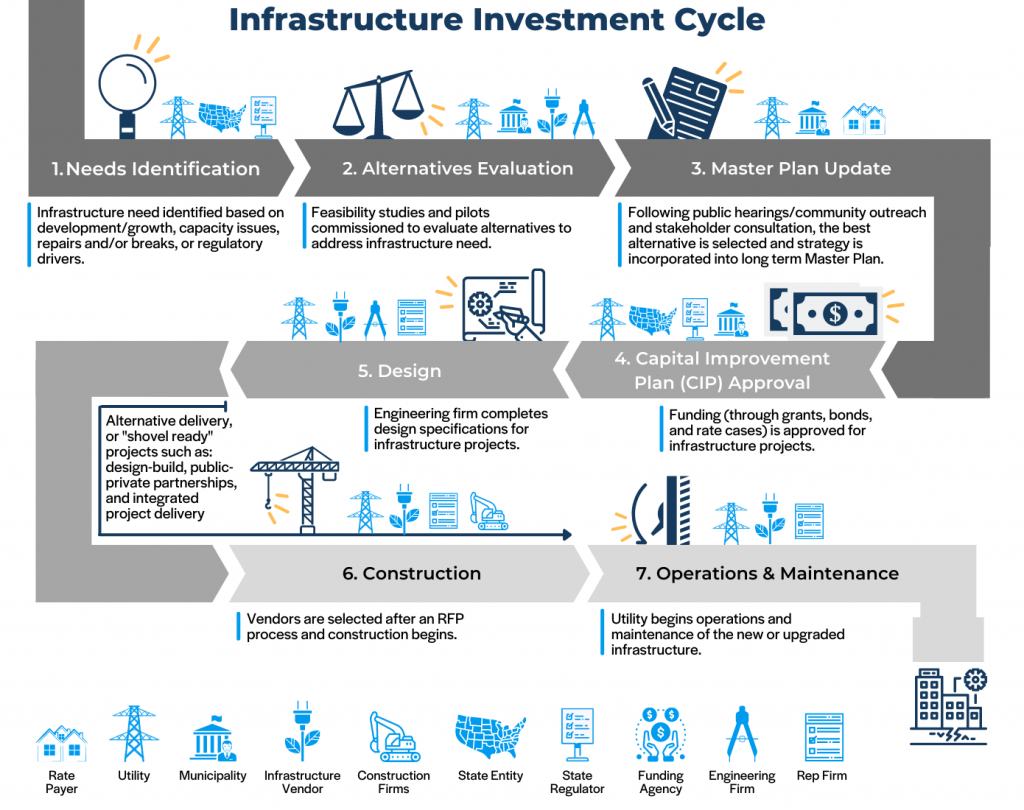

The Infrastructure Investment Cycle diagram outlines the sequential stages of planning, designing, constructing, and maintaining infrastructure projects. This process is crucial for enhancing productivity and supporting economic growth, as detailed in the study notes. Source

Access to Finance

Financial markets allow savings to be channelled into productive investment.

Banking systems provide loans for businesses and households.

Capital markets raise funds for large-scale projects.

Microfinance initiatives can provide credit to small businesses in less-developed economies.

Where access to finance is limited, small enterprises and entrepreneurs cannot expand, restricting development.

External Factors

Global economic conditions and international relationships also shape growth prospects.

Trade openness allows specialisation and market access but can also expose economies to volatility.

Commodity dependence in developing countries may cause instability when prices fluctuate.

Aid and remittances can support development, though reliance may reduce incentives for domestic reform.

Summary of Key Factors

Factors influencing growth and development include:

Investment (domestic and foreign).

Education and training to strengthen human capital.

Health improvements for productive workforces.

Technology and innovation to increase efficiency.

Institutional quality to foster stability and trust.

Infrastructure to support production and trade.

Access to finance for capital formation.

External influences, such as trade, aid, and global shocks.

Together, these factors create the foundations for sustained growth and long-term economic development.

FAQ

Political stability reduces uncertainty for investors and businesses, encouraging long-term projects and foreign direct investment.

Stable governments can enforce contracts and property rights more effectively, supporting efficient markets. In contrast, unstable regimes may face capital flight, reduced investment, and slower growth.

Developing economies often have large numbers of small enterprises that lack collateral to secure traditional loans.

Microfinance and mobile banking can help provide capital for business expansion, improve employment opportunities, and stimulate local economic activity. Without access to finance, entrepreneurship is limited and growth potential is constrained.

A healthy workforce is less prone to absenteeism, more capable of sustained effort, and able to engage in higher-skilled work.

Improvements in healthcare and nutrition can:

Extend life expectancy

Increase labour force participation

Reduce costs linked to disease treatment

This directly raises output and supports long-term development.

Developed countries often focus on creating new innovations through research and development.

Developing countries benefit more from adopting existing technologies, which allow them to catch up quickly. For example, mobile banking in Africa bypassed the need for traditional banking infrastructure, accelerating financial inclusion.

Infrastructure lowers transaction costs and opens access to markets, making production and trade more efficient.

Key areas include:

Transport (roads, ports, railways)

Energy supply (electricity access, renewable systems)

Communications (internet and mobile networks)

Without adequate infrastructure, businesses cannot operate efficiently, and economies struggle to integrate with global markets.

Practice Questions

Identify three factors that can affect economic growth and development. (3 marks)

1 mark for each correctly identified factor, up to 3 marks.

Investment (1 mark)

Education and training/human capital (1 mark)

Infrastructure (1 mark)

Accept other valid factors such as technology, health, institutions, access to finance, or external trade conditions.

Explain how investment in education and training can contribute to economic development. (6 marks)

Knowledge (up to 2 marks):

Defines or explains human capital (1 mark).

States that education and training raise skills and productivity (1 mark).

Application/Analysis (up to 3 marks):

Explains how skilled workers improve efficiency/innovation (1 mark).

Links to higher output and growth in higher-value industries (1 mark).

Notes impact on developing countries (e.g., breaking poverty cycles) or developed countries (e.g., competitiveness in knowledge-based economies) (1 mark).

Evaluation (up to 1 mark):

Acknowledges limitations such as time lag, cost of education, or inequality of access (1 mark).

Maximum: 6 marks.