AQA Specification focus:

‘Students should be able to provide examples to inform their discussion of each of these causes of market failure.’

Introduction

Markets do not always allocate resources efficiently. Market failure occurs when outcomes deviate from what is socially optimal. Examples clarify why failures arise and their broader consequences.

Understanding Market Failure

Market failure arises whenever markets misallocate resources, meaning that scarce inputs are not used in the way that maximises welfare. This can occur because of structural features of markets, missing information, or distortions created by behaviour.

Market Failure: A situation in which the free market fails to allocate resources efficiently, resulting in a loss of economic welfare.

The key causes of market failure include public goods, externalities, merit and demerit goods, monopoly power, and inequalities of income and wealth.

Public Goods

Public goods are characterised by non-rivalry (one person’s consumption does not reduce availability for others) and non-excludability (people cannot be prevented from consumption).

Rivalry vs excludability matrix classifying private goods, club/toll goods, common resources, and public goods. The non-rival, non-excludable quadrant highlights where public goods sit and why markets under-provide them. Source

Public Good: A good that is non-rival and non-excludable, meaning markets struggle to provide it efficiently.

Examples:

National defence: Protects all citizens equally, regardless of individual payment.

Street lighting: Illumination cannot be confined to paying individuals.

The inability to charge directly for consumption creates the free-rider problem, leading to missing markets and under-provision.

Positive and Negative Externalities

Externalities occur when third parties experience costs or benefits not captured in market transactions.

Externality: A spillover effect from consumption or production affecting third parties, not reflected in market prices.

Negative externalities in production:

Pollution from factories damages health and the environment, causing over-production relative to the social optimum.

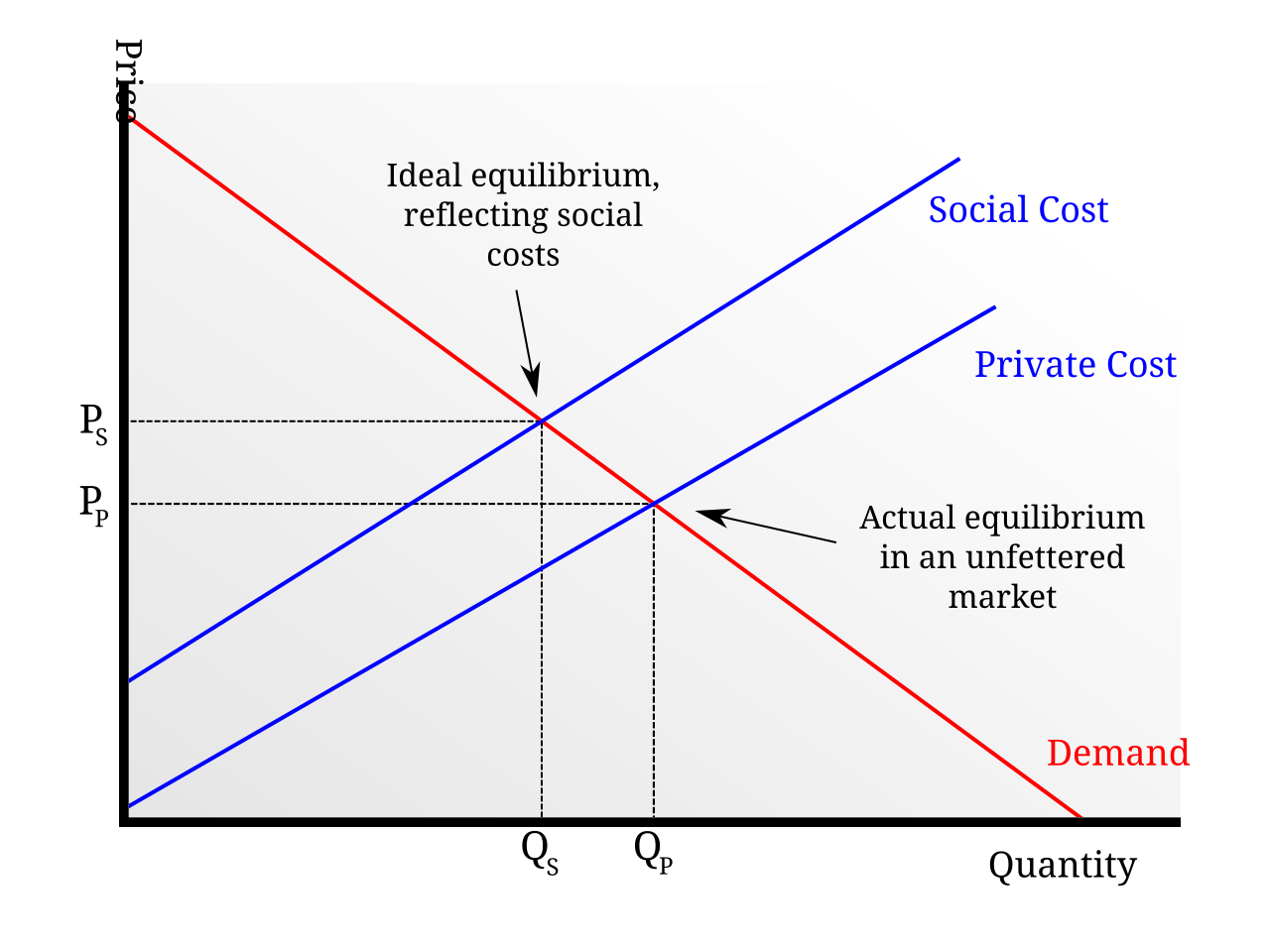

Negative production externality with MSC above MPC, where the unregulated market produces at Q_market while the social optimum is Q_social. The shaded wedge indicates the deadweight welfare loss from over-production. Source

Positive externalities in consumption:

Vaccinations protect individuals but also provide herd immunity, leading to under-consumption if left solely to the market.

These cases show how private decisions diverge from socially desirable outcomes, necessitating correction.

Merit and Demerit Goods

Markets often misallocate resources when imperfect information leads consumers to undervalue or overvalue goods.

Merit goods (e.g. education, healthcare) are under-consumed because individuals underestimate long-term benefits.

Demerit goods (e.g. cigarettes, junk food) are over-consumed as consumers neglect harmful long-term effects.

Government intervention may be justified to correct the misallocation and ensure outcomes closer to the social optimum.

Monopoly and Market Power

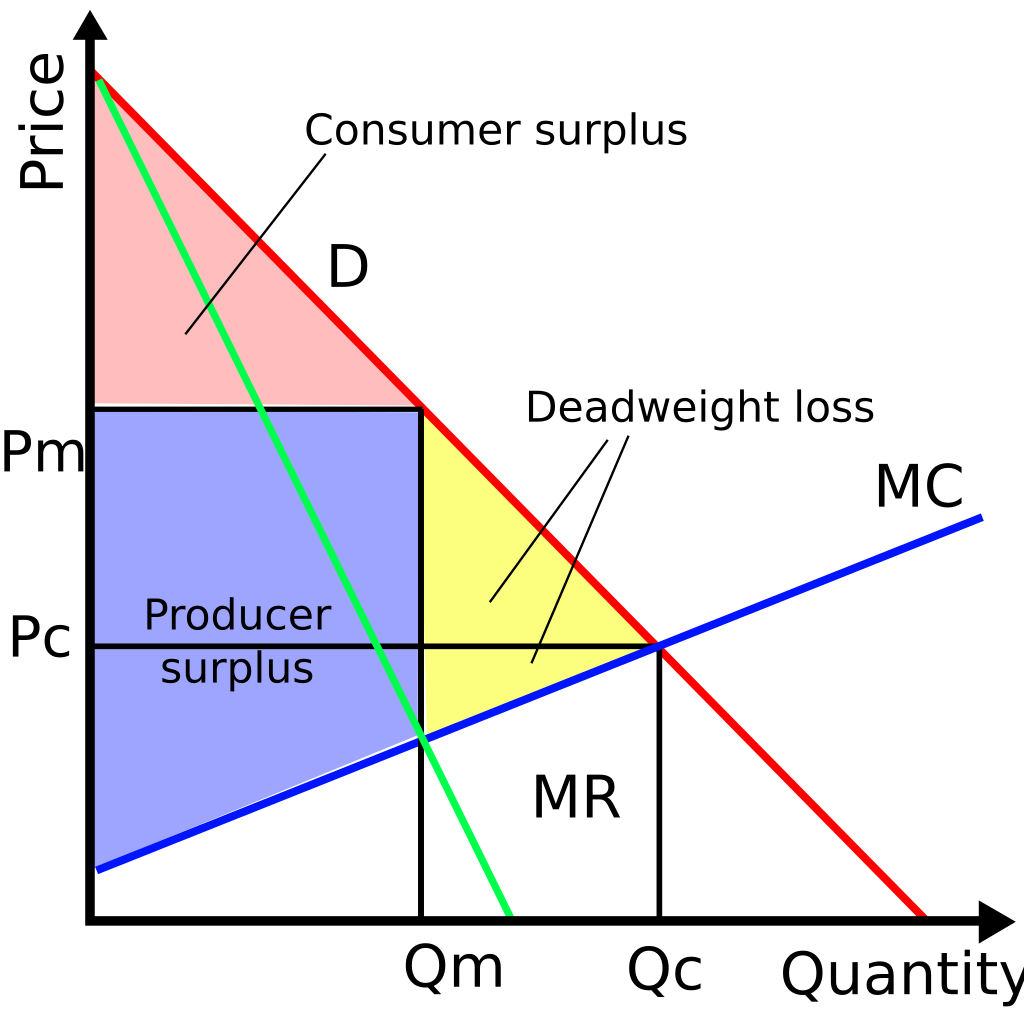

When firms gain significant monopoly power, they can distort outcomes by restricting supply and raising prices above competitive levels.

Standard monopoly diagram with demand and marginal revenue, where MR = MC sets monopoly output and the price is marked on the demand curve. Shaded regions show consumer and producer surplus and the resulting deadweight welfare loss relative to perfect competition. Source

Monopoly Power: The ability of a firm to influence prices and output by controlling a large share of the market.

Example: Utility companies controlling local electricity distribution may exploit consumers by charging excessive prices.

Result: Reduced consumer surplus and potential inefficiency as firms lack incentive to innovate or minimise costs.

Inequalities of Income and Wealth

Markets can deliver outcomes that increase inequality, leading to reduced overall welfare.

Example: In many economies, highly skilled workers receive disproportionately higher incomes, while low-skilled workers may face stagnant wages.

Result: Access to education, healthcare, and housing becomes uneven, reinforcing long-term disparities.

Although inequality is not always defined as a pure market failure, excessive inequality can distort incentives and reduce efficiency in labour and capital markets.

Linking Causes to Examples

Each source of market failure can be illustrated through specific cases:

Public Goods:

Missing markets for flood defences or military security.

Positive Externalities:

University education increases productivity and civic engagement beyond individual gains.

Negative Externalities:

Carbon emissions contribute to climate change, harming future generations.

Merit Goods:

Preventative healthcare reduces long-term treatment costs but is often underused.

Demerit Goods:

Alcohol consumption increases health service costs and road accidents.

Monopoly Power:

Digital platform giants (e.g. search engines) dominate markets, limiting consumer choice.

Inequality:

Unequal wealth distribution limits investment in human capital for disadvantaged groups.

These examples provide context for understanding how real-world situations align with theoretical causes of market failure.

Diagrammatic Representation

To analyse externalities and misallocation, economists use diagrams comparing marginal private benefit/cost (MPB/MPC) with marginal social benefit/cost (MSB/MSC).

Social Optimum: MSB = MSC

MSB = Marginal Social Benefit (private benefit + external benefit)

MSC = Marginal Social Cost (private cost + external cost)

At the social optimum, both private and external effects are accounted for. Divergences lead to either over-production (negative externalities) or under-production (positive externalities).

Conclusion of Content Coverage

Market failure has multiple causes, each with distinct mechanisms but shared consequences of resource misallocation and welfare loss. Understanding examples is essential to recognising how theory translates into practice and informs policy debates.

FAQ

Complete market failure happens when no market exists for a good, such as national defence, leaving provision entirely absent.

Partial market failure occurs when a market exists but resources are misallocated. For example, healthcare is under-consumed without intervention because people underestimate long-term benefits.

The free-rider problem arises when individuals benefit without contributing.

Street lighting: everyone gains illumination, but individuals have little incentive to pay.

Flood defences: once built, protection extends to all nearby, including non-payers.

This discourages private provision and leads to under-supply.

Inequality can restrict access to goods and services that enhance long-term welfare.

Poorer households may under-consume education or healthcare due to affordability issues.

Wealth concentration reduces social mobility and limits overall efficiency.

Thus, unequal distribution can distort market outcomes.

Education generates spillovers such as higher productivity and civic engagement, benefitting society beyond individual gains.

Healthcare creates spillovers like herd immunity or reduced future treatment costs.

While both are merit goods, the long-term impacts of education tend to affect labour markets, whereas healthcare influences public health and resource allocation.

Examples demonstrate abstract concepts in practical settings, making it easier to grasp misallocation.

Pollution clarifies negative production externalities.

Vaccinations highlight positive consumption externalities.

Monopoly behaviour shows welfare loss through restricted output.

Examiners reward application of examples because they connect theory to real-world scenarios.

Practice Questions

Define a public good and give one example. (2 marks)

1 mark for correctly stating that a public good is non-rivalrous.

1 mark for correctly stating that a public good is non-excludable.

A relevant example (e.g. national defence, street lighting) can gain credit if one of the characteristics is missing.

Using examples, explain how externalities can lead to market failure. (6 marks)

1 mark for identifying that negative externalities cause over-production relative to the social optimum.

1 mark for identifying that positive externalities cause under-consumption relative to the social optimum.

1 mark for explaining why negative externalities arise (e.g. pollution imposes costs on third parties not reflected in prices).

1 mark for explaining why positive externalities arise (e.g. vaccinations provide wider benefits not captured by private decision-making).

Up to 2 marks for use of relevant examples (e.g. pollution, vaccinations, education).

Maximum of 6 marks: balanced, clear use of theory and examples required for full credit.