AQA Specification focus:

‘The difference between a public good and a private good.’

The distinction between public and private goods is central in economics, influencing how resources are allocated, markets operate, and governments decide when intervention is necessary.

Understanding Public and Private Goods

Public Goods

Public goods are characterised by being non-rivalrous and non-excludable. These two features mean they cannot be efficiently provided by the free market.

Non-rivalrous: A good is non-rivalrous if one person’s consumption does not reduce the availability of the good for others.

For example, national defence benefits all citizens equally regardless of how many people are “consuming” it.

Non-excludable: A good is non-excludable if it is impossible or very costly to prevent someone from using it once it is provided.

Street lighting illustrates this: once installed, no individual can be excluded from its benefits.

Street lighting demonstrates non-excludability (benefits cannot feasibly be withheld from non-payers) and non-rivalry (one person’s use doesn’t diminish another’s). Photographed on the Marine Parade in Lyme Regis, Dorset. Source

Because of these features, private firms lack incentive to supply public goods as they cannot charge users effectively, leading to market failure.

Private Goods

Private goods dominate market economies and have opposite characteristics: they are rivalrous and excludable.

Rivalrous: A good is rivalrous if consumption by one person reduces the amount available for others.

For instance, if one student buys and eats a sandwich, it cannot be eaten by anyone else.

Excludable: A good is excludable if producers can prevent those who do not pay from consuming it.

For example, a cinema ticket allows access to a film only if purchased.

Private goods are supplied efficiently by markets because prices can be charged, ensuring both incentive for firms and rationing of limited resources.

Distinguishing Features

Characteristics at a Glance

Public goods: non-rivalrous, non-excludable.

Private goods: rivalrous, excludable.

These features shape how resources are allocated:

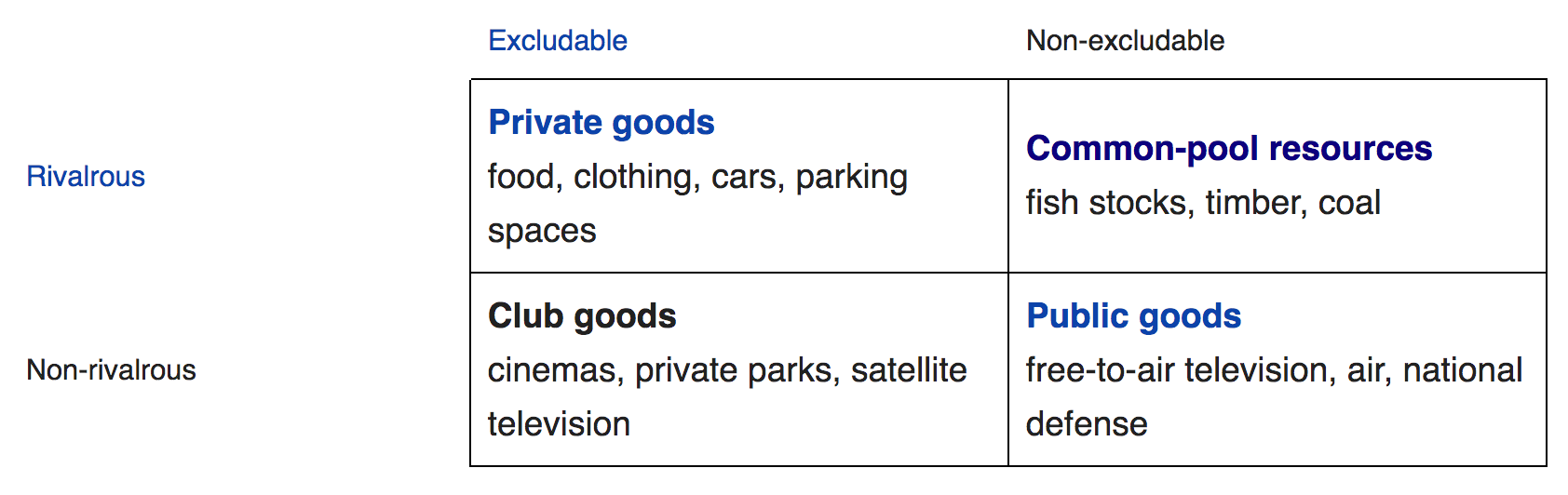

A classification matrix of goods by excludability and rivalry. Focus on the public goods quadrant (non-excludable, non-rival) versus the private goods quadrant (excludable, rival). This figure also includes club goods and common-pool resources, which are beyond the scope of this subsubtopic. Source

Public goods → under-provision without government intervention.

Private goods → provided through normal market mechanisms.

Implications for Resource Allocation

Free-Rider Problem

One of the most important distinctions lies in the free-rider problem. With public goods, individuals can enjoy the benefits without contributing to their cost. This discourages private provision and results in under-supply.

In contrast, private goods avoid this issue because consumers must pay to access them, ensuring the producer recovers costs.

Efficiency Considerations

Private goods are subject to the price mechanism, ensuring efficiency if markets are competitive.

Public goods require collective financing, usually through taxation, because the market fails to allocate them properly.

Real-World Illustrations

Public Goods Examples

National defence

Flood defences

Lighthouses

Street lighting

Private Goods Examples

Clothing

Food and drink

Electronics

Cars

These examples highlight the practical differences in provision and consumption.

Why the Distinction Matters

Role of Government

The boundary between public and private goods explains why governments intervene. Public goods would be under-provided if left solely to the market. Taxation spreads costs fairly, while ensuring universal access.

Market Function

In contrast, private goods require little government involvement beyond enforcing property rights and contracts. The market mechanism is sufficient for their efficient allocation.

Blurring of Boundaries

Some goods may change characteristics due to technology or policy. For instance, television broadcasting was once a pure public good, but digital encryption has made it excludable, creating subscription-based services.

Key Takeaways for Students

When distinguishing between public and private goods, focus on the two defining features:

Non-rivalry vs rivalry

Non-excludability vs excludability

The differences have profound consequences: public goods highlight the limits of the market mechanism and justify government provision, while private goods illustrate how markets efficiently allocate scarce resources.

FAQ

The free market struggles to provide public goods because firms cannot easily charge individuals for their use. Since public goods are non-excludable, people can benefit without paying, leading to the free-rider problem.

This makes production unprofitable for private firms, even though society values the good. As a result, public goods are often under-provided or not provided at all without government intervention.

When a good is rivalrous, each unit consumed reduces availability for others. This creates competition for scarce resources.

In the case of private goods, rivalry ensures that prices ration consumption. Public goods, by contrast, are non-rival, meaning unlimited people can use them without diminishing others’ benefits, making sustainability less of a concern.

Yes, technological changes or new policies can shift a good’s classification.

Television broadcasting was once a public good but became excludable with digital encryption.

Toll roads convert what would otherwise be non-excludable infrastructure into excludable goods.

This demonstrates that excludability is not fixed, but dependent on human innovation and enforcement.

National defence is non-excludable because everyone within a nation is protected regardless of payment. It is also non-rival, as one person’s safety does not reduce another’s.

This makes it a pure public good — any attempt to provide it privately would fail due to the inability to exclude non-payers.

Taxation allows governments to overcome the free-rider problem by collecting compulsory payments to finance public goods.

It spreads costs across society fairly.

It ensures consistent provision of essential services like street lighting, policing, or flood defences.

Without taxation, many public goods would remain under-provided, reducing overall economic welfare.

Practice Questions

Define what is meant by a public good. (2 marks)

1 mark for reference to non-rivalry (consumption by one person does not reduce availability to others).

1 mark for reference to non-excludability (it is not possible or very costly to prevent others from consuming the good).

(Maximum 2 marks)

Explain two key differences between public goods and private goods. Use examples in your answer. (6 marks)

Up to 2 marks for identifying a key difference:

Public goods are non-excludable, private goods are excludable.

Public goods are non-rivalrous, private goods are rivalrous.

Up to 2 additional marks for accurate explanation of each difference (e.g. why these features matter in terms of provision or consumption).

Up to 2 further marks for supporting examples (e.g. national defence, street lighting for public goods; food, clothing for private goods).

(Maximum 6 marks)