AQA Specification focus:

‘The costs and benefits of such policies.’

Competition policy seeks to regulate markets to promote efficiency and consumer welfare. Students must understand both the benefits and costs of such government interventions.

Understanding Competition Policy

Competition policy refers to government measures aimed at promoting competition, preventing monopolistic behaviour, and protecting consumer interests. In the UK, the Competition and Markets Authority (CMA) enforces such policies, often in line with EU principles.

Competition Policy: Government intervention through regulation and enforcement to prevent anti-competitive practices, promote efficiency, and protect consumers in markets.

Benefits of Competition Policy

Competition policy can generate several advantages, many of which align with broader economic goals of efficiency and fairness.

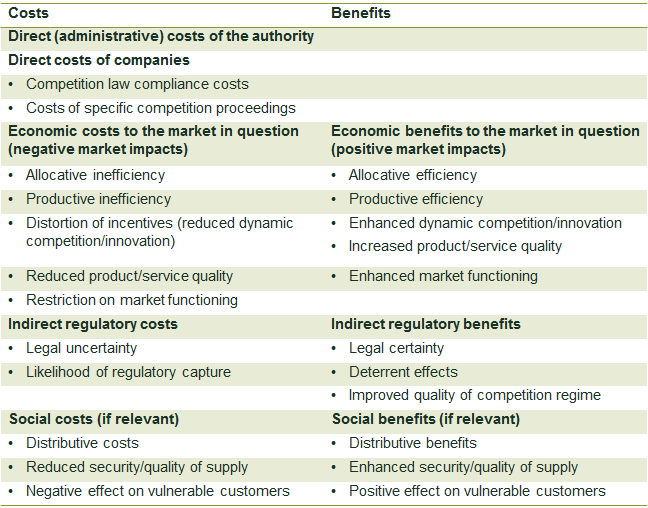

This table outlines the main categories of costs and benefits associated with competition policy. It distinguishes between direct costs, economic benefits, and wider social impacts. Source

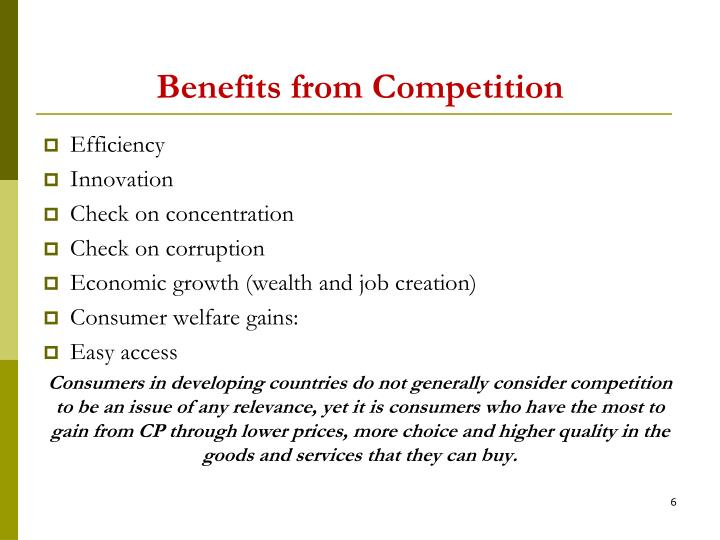

This slide enumerates the benefits of competition, including efficiency, innovation, and consumer welfare gains. It illustrates how competition can deliver lower prices and greater consumer choice. Source

Consumer Benefits

Lower prices: Increased competition forces firms to reduce prices, benefitting consumers.

Improved quality: Rivalry encourages firms to innovate and improve standards.

Greater choice: Breaking down monopolies increases the variety of goods and services available.

Protection from exploitation: Prevents price-fixing, predatory pricing, and collusion that harm consumers.

Efficiency Gains

Allocative efficiency: Resources are allocated where consumer demand is greatest.

Productive efficiency: Firms reduce costs to remain competitive.

Dynamic efficiency: Innovation is encouraged as firms seek long-term survival and growth.

Allocative Efficiency: When resources are distributed to maximise consumer satisfaction, where price equals marginal cost (P = MC).

Wider Economic Benefits

Encourages entrepreneurship: New firms can enter markets more easily.

Increases international competitiveness: Efficient domestic industries are better placed to succeed globally.

Reduces inequality: Preventing monopolies stops excessive profit concentration among a few firms.

Costs of Competition Policy

While beneficial, competition policy also involves drawbacks and unintended consequences.

Administrative and Financial Costs

Monitoring and enforcement: Investigations by regulators, such as the CMA, are expensive and resource-intensive.

Legal disputes: Firms often challenge regulatory decisions, adding to costs.

Delays: Extended investigations can hold up mergers and investment decisions.

Risk of Inefficiency

Over-regulation: Excessive intervention may discourage legitimate business growth.

Reduced economies of scale: Preventing mergers can stop firms achieving cost reductions through large-scale production.

Misjudged interventions: Regulators may mistakenly block beneficial mergers or allow harmful ones.

Dynamic Drawbacks

Reduced innovation incentives: If profit potential is capped by regulation, firms may innovate less.

Deterring foreign investment: Overly strict rules may discourage multinational companies from entering the UK market.

Uncertainty: Constant regulatory scrutiny can make firms risk-averse, reducing dynamic efficiency.

Balancing Costs and Benefits

The overall impact of competition policy depends on its implementation and the specific context of intervention.

When Benefits Dominate

In markets with clear monopolistic behaviour (e.g. price fixing cartels).

When consumer exploitation is evident.

In industries where competition drives rapid technological advancement.

When Costs Dominate

In markets requiring large fixed costs and economies of scale (e.g. utilities), where breaking up firms may reduce efficiency.

When regulatory resources are stretched, reducing effectiveness.

In global markets where foreign rivals face weaker regulation, leaving UK firms disadvantaged.

Evaluation of Competition Policy

Students must be able to evaluate competition policy by weighing its potential to improve market outcomes against the risks of inefficiency.

Key Evaluation Points

Effectiveness depends on enforcement: Policies only work if regulators are well-resourced and independent.

Trade-offs between efficiency types: Promoting small-scale competition may improve allocative efficiency but harm productive efficiency.

Global considerations: UK competition policy cannot always address the power of global digital platforms.

Dynamic impacts: Long-term innovation benefits may outweigh short-term costs, but this balance is uncertain.

Real-World Relevance

Technology firms: Regulators face challenges in dealing with monopolistic practices of global tech giants like Google and Amazon.

UK supermarkets: Mergers have been blocked to prevent reduced consumer choice.

Energy markets: Price caps are used to prevent consumer exploitation but risk discouraging investment.

Through these cases, it becomes clear that competition policy is a double-edged sword: it can deliver significant consumer and efficiency benefits but also carries risks of overreach, cost, and inefficiency.

FAQ

The CMA investigates anti-competitive behaviour, such as cartels, abuse of dominant market positions, and anti-competitive mergers.

It has powers to impose fines, block mergers, and enforce changes to business practices. Its work ensures that the costs and benefits of competition policy are realised in practice by holding firms accountable.

Competition policy can prevent mergers or break up large firms to increase market competition.

This may stop businesses from expanding production to achieve lower average costs. In industries with high fixed costs (e.g. utilities), preventing scale economies can increase consumer prices instead of reducing them.

When firms appeal against regulatory decisions, it creates delays and additional legal expenses.

These challenges increase administrative costs for regulators and can reduce the effectiveness of enforcement.

Lengthy legal processes also create uncertainty for firms, potentially discouraging investment and innovation during the investigation period.

Competition policy tends to be most effective in:

Retail markets, where consumer choice is wide.

Technology, where innovation is crucial.

Financial services, where preventing collusion protects millions of consumers.

These industries show clear consumer welfare improvements when competition is enforced.

Strict enforcement may discourage multinational firms from entering a market if they expect heavy regulatory oversight.

However, clear and transparent competition rules can also make a country more attractive by ensuring fair competition and reducing the risk of monopolistic behaviour by domestic incumbents.

Practice Questions

Identify one benefit and one cost of competition policy. (2 marks)

1 mark for a correct benefit (e.g. lower prices, improved efficiency, greater consumer choice).

1 mark for a correct cost (e.g. high enforcement costs, over-regulation, reduced economies of scale).

Explain how competition policy can improve economic efficiency but may also create inefficiencies. (6 marks)

1–2 marks: Basic explanation of how competition policy improves efficiency (e.g. allocative efficiency through lower prices, productive efficiency through cost reduction, dynamic efficiency through innovation).

1–2 marks: Explanation of how competition policy may create inefficiencies (e.g. over-regulation discouraging investment, preventing economies of scale, regulatory delays).

1–2 marks: Development with use of key terms and economic reasoning (e.g. linking allocative efficiency to P = MC, identifying trade-offs between short-term and long-term efficiency).

Total: 6 marks.