AQA Specification focus:

‘How supply-side policies, such as tax changes designed to change personal incentives, may increase the potential output of the economy and improve the underlying trend rate of economic growth.’

Introduction

Supply-side policies are essential for shaping long-term economic growth. By targeting incentives, governments can influence potential output and the trend rate of economic growth effectively.

Understanding Incentives in Economics

Incentives are mechanisms that influence the behaviour of individuals, firms, and institutions. They can be financial, social, or regulatory, and in economic policy, they are crucial for encouraging productivity, innovation, and efficiency.

Taxation and Incentives

Fiscal adjustments, such as changes in income tax, corporation tax, or capital gains tax, alter the relative rewards of work, saving, and investment.

Incentive: A factor, such as a reward or penalty, that motivates an individual or firm to behave in a particular way.

For example:

Lower income tax rates increase the net income of workers, encouraging labour supply.

Reduced corporation tax increases post-tax profits, incentivising investment by firms.

Adjustments to capital gains tax affect risk-taking and entrepreneurship.

Potential Output and Productive Capacity

Potential output represents the maximum sustainable level of real GDP an economy can produce when operating at full employment of resources. It reflects the productive capacity of the economy rather than short-term fluctuations.

Potential Output: The maximum level of output an economy can sustain in the long run without generating inflationary pressure.

Changes in incentives can shift the economy’s productive capacity by encouraging higher labour participation, increased capital formation, and technological innovation.

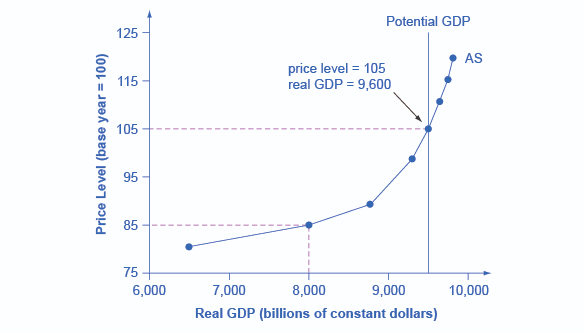

The diagram depicts the aggregate supply curve, showing how shifts can occur due to changes in incentives, affecting the economy's potential output. The vertical line represents potential GDP, indicating the maximum sustainable output. Source

Trend Rate of Economic Growth

The trend rate of economic growth is the long-term average rate at which an economy can grow without accelerating inflation. It is determined by the growth of productive capacity and efficiency improvements.

Trend Rate of Economic Growth: The average rate of growth of an economy’s potential output over time, reflecting improvements in productivity, labour, and capital use.

Supply-side policies that alter incentives play a central role in raising the underlying trend rate, ensuring that growth is both sustainable and non-inflationary.

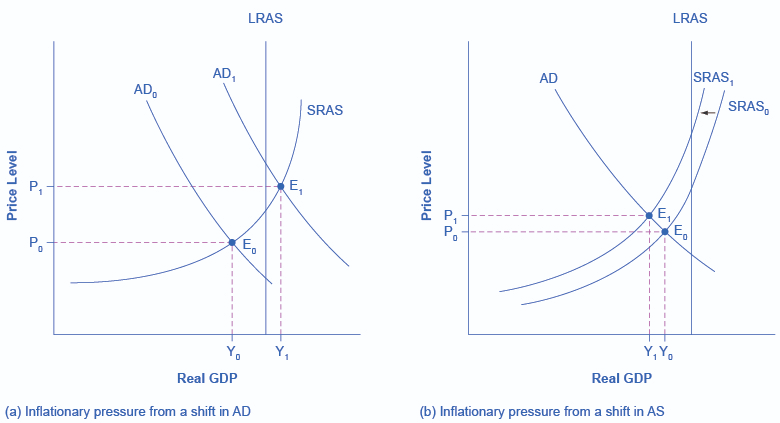

The graph illustrates the long-run aggregate supply curve and its rightward shift over time, representing sustained economic growth. This shift indicates an increase in potential output due to factors like improved productivity and capital accumulation. Source

How Incentives Influence Potential Output

Labour Market Incentives

Lower marginal tax rates encourage individuals to work longer hours or join the workforce.

Reforms to benefits systems can reduce disincentives to work, boosting labour force participation.

Education and training incentives enhance worker productivity and adaptability.

Investment Incentives

Reduced corporation tax makes investment projects more profitable.

Tax allowances for research and development stimulate innovation and technological progress.

Lower capital gains tax increases the attractiveness of entrepreneurial ventures.

Saving and Capital Accumulation

Tax incentives for saving increase funds available for investment.

Pension tax relief encourages long-term saving, expanding financial markets and funding capital projects.

Linking Incentives to Economic Growth

By improving incentives, governments can stimulate:

Higher productivity: Better-trained, more motivated workers increase output per hour.

Capital deepening: Firms invest in machinery, equipment, and innovation, raising efficiency.

Labour supply growth: More people entering the workforce increases potential output.

Economic Growth (ΔY) = ΔC + ΔI + ΔG + (ΔX – ΔM)

Y = Real GDP

C = Consumption

I = Investment

G = Government spending

X = Exports

M = Imports

Although fiscal policy directly influences aggregate demand, supply-side tax changes alter the investment (I) and labour participation components, thereby raising potential output.

Long-Term Trend Growth Improvements

Supply-side reforms are vital for shifting the long-run aggregate supply (LRAS) curve to the right. This reflects higher productive capacity and ensures the economy can grow faster without inflationary pressure.

Key Mechanisms

Productivity improvements from innovation and training.

Enhanced labour market flexibility through tax and benefit reforms.

Increased private-sector investment due to favourable tax environments.

Impacts on Macroeconomic Objectives

Employment: Higher incentives reduce voluntary and structural unemployment.

Inflation: Trend growth reduces inflationary pressure by expanding productive capacity.

Balance of payments: A more productive economy improves competitiveness in global markets.

Evaluation of Incentive-Based Policies

While incentive-driven supply-side policies can be powerful, their success depends on broader economic conditions.

Strengths

Promote sustainable long-term growth.

Encourage innovation and entrepreneurship.

Enhance global competitiveness.

Limitations

Time lags: It can take years for training or investment incentives to raise productivity.

Inequality concerns: Tax cuts may disproportionately benefit higher-income groups.

Fiscal costs: Reduced tax revenues may increase budget deficits if not offset by higher growth.

FAQ

Tax incentives can have uneven effects depending on income levels. For higher earners, lower marginal tax rates may encourage longer working hours or increased investment in skills.

For lower earners, tax credits and reduced withdrawal rates of benefits are often more effective, as they reduce the disincentives of moving into employment. This highlights why governments often design targeted fiscal incentives.

Tax changes, such as reductions in corporation tax, take time to influence investment and innovation decisions. Firms need planning horizons to adjust their strategies.

In the labour market, incentives like income tax cuts may lead to gradual changes in workforce participation as individuals retrain, relocate, or adjust working hours. The full effect on potential output may only be visible after several years.

Incentives encourage both labour and capital efficiency. For example:

Lower corporate tax boosts reinvestment into technology.

Reduced personal tax motivates individuals to upskill.

Targeted R&D allowances stimulate innovation.

By fostering productivity growth, incentives ensure that potential output expands, allowing the economy to achieve sustainable growth without inflationary pressure.

Yes. Supply-side incentives directly affect structural unemployment by making work more attractive and skills more relevant.

For instance, training subsidies and lower personal tax rates encourage workers to re-enter sectors with higher demand. In addition, investment incentives for firms can generate new industries, creating opportunities for those previously unemployed due to structural shifts.

Failures occur if incentives do not effectively change behaviour. For example, cutting corporation tax may not boost investment if firms lack confidence in future demand.

Similarly, lowering income tax may not increase labour supply if workers prefer leisure over extra income. Structural barriers, such as inadequate infrastructure or skills mismatches, can also limit the effectiveness of incentive-based policies.

Practice Questions

Define potential output and explain how it is related to the trend rate of economic growth. (2 marks)

1 mark for a correct definition of potential output: the maximum level of output an economy can produce when resources are fully employed without creating inflationary pressure.

1 mark for explaining the link: potential output determines the trend rate of growth, as increases in productive capacity raise the sustainable long-term growth rate.

Explain how changes in taxation can influence incentives and, in turn, affect the potential output of an economy. (6 marks)

1 mark for identifying a type of tax change (e.g., lower income tax, reduced corporation tax, lower capital gains tax).

1 mark for explaining how this tax change affects incentives (e.g., encourages labour supply, investment, or entrepreneurship).

1 mark for linking incentives to increased participation in the labour market or higher investment.

1 mark for linking this behaviour to greater productivity or innovation.

1 mark for showing how this raises potential output (e.g., expansion of productive capacity, shift in LRAS).

1 mark for mentioning broader implications such as improving the trend rate of economic growth or non-inflationary growth.