AQA Specification focus:

‘Be able to calculate price elasticity of demand; the relationships between price elasticity of demand and firms’ total revenue (total expenditure); the factors that influence these elasticities of demand; students should be able to interpret numerical values of elasticity.’

Introduction

Price elasticity of demand (PED) measures how responsive quantity demanded is to changes in price. It is a crucial tool for firms in pricing, strategy, and revenue management.

Understanding Price Elasticity of Demand

Definition of Price Elasticity of Demand

Price Elasticity of Demand (PED): A measure of the responsiveness of quantity demanded to a change in price, calculated as the percentage change in quantity demanded divided by the percentage change in price.

The concept highlights the sensitivity of consumers to price movements. A small price change can cause a large shift in demand if demand is highly elastic, or a minor change if demand is inelastic.

The Formula for Price Elasticity of Demand

Price Elasticity of Demand (PED) = %ΔQd ÷ %ΔP

%ΔQd = Percentage change in quantity demanded

%ΔP = Percentage change in price

A PED value greater than 1 indicates elastic demand, while a value less than 1 indicates inelastic demand. A value equal to 1 means demand is unit elastic.

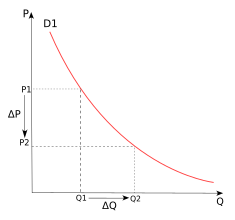

This diagram depicts different demand curves representing various elasticity coefficients. It shows how elasticity varies along the demand curve, with the slope indicating responsiveness of quantity demanded to price changes. Source

Interpreting Values of PED

Elastic Demand

PED > 1

A percentage change in price leads to a greater percentage change in demand.

Consumers are highly responsive to price changes.

Typical for luxury goods, goods with many substitutes, or non-essential items.

Inelastic Demand

PED < 1

A percentage change in price leads to a smaller percentage change in demand.

Consumers are less responsive to price changes.

Typical for necessities, addictive goods, or goods with few substitutes.

Unit Elastic Demand

PED = 1

Percentage change in price equals the percentage change in demand.

Total revenue remains constant when price changes.

Perfectly Inelastic Demand

PED = 0

Demand does not change regardless of price.

Rare in reality, but a useful theoretical concept for essential goods like life-saving medicine.

Perfectly Elastic Demand

PED = ∞

Consumers will only purchase at one price, and demand falls to zero if the price rises above that level.

Theoretical, often used in perfect competition models.

Factors Affecting Price Elasticity of Demand

Several influences determine whether demand for a product is elastic or inelastic:

Availability of Substitutes

The more close substitutes available, the more elastic demand becomes.

A rise in price encourages consumers to switch to alternatives.

Proportion of Income Spent

Goods taking up a large share of income (e.g., housing, cars) are more elastic.

Goods taking a small share (e.g., matches, pens) are more inelastic.

Necessity versus Luxury

Necessities (e.g., bread, electricity) are typically inelastic.

Luxuries (e.g., holidays, designer clothing) are more elastic.

Time Horizon

In the short run, demand is often inelastic, as consumers need time to adjust.

In the long run, demand may become more elastic as substitutes are found or habits change.

Habit-Forming or Addictive Goods

Addictive products such as tobacco or alcohol tend to be inelastic because consumers are less responsive to price increases.

Definition of the Market

Narrowly defined markets (e.g., branded cola) usually have more elastic demand than broadly defined markets (e.g., soft drinks).

The Relationship Between PED and Total Revenue

Definition of Total Revenue

Total Revenue (TR): The total money a firm receives from sales, calculated as price multiplied by quantity sold (TR = P × Q).

The link between PED and total revenue is vital for firms in making pricing decisions:

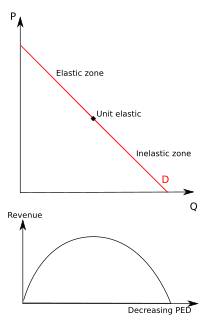

This graph demonstrates how total revenue changes with price adjustments under different elasticity scenarios. It highlights the inverse relationship between price and total revenue when demand is elastic and the direct relationship when demand is inelastic. Source

Elastic Demand (PED > 1):

A fall in price increases total revenue.

A rise in price decreases total revenue.

Inelastic Demand (PED < 1):

A fall in price decreases total revenue.

A rise in price increases total revenue.

Unit Elastic Demand (PED = 1):

Changes in price leave total revenue unchanged.

Business Implications

Firms producing goods with inelastic demand (e.g., utilities, addictive goods) can raise prices to boost revenue.

Firms with elastic demand (e.g., luxury or competitive markets) may need to cut prices to expand sales and increase revenue.

Importance of PED in Economics

For Businesses

Helps firms set optimal pricing strategies.

Assists in revenue forecasting.

Influences decisions about advertising and product differentiation to reduce elasticity.

For Governments

Important for taxation policy.

Taxes on inelastic goods (e.g., cigarettes, fuel) raise substantial revenue with minimal reduction in consumption.

For Consumers

PED reflects consumer responsiveness.

Understanding price sensitivity helps explain consumer behaviour in different markets.

FAQ

PED values are typically negative because price and quantity demanded usually move in opposite directions. A price rise leads to a fall in demand, while a price fall leads to an increase in demand.

In practice, economists often ignore the negative sign and focus on the magnitude of the number when classifying demand as elastic, inelastic, or unitary elastic.

In competitive markets, firms have limited control over prices. Knowing whether demand is elastic or inelastic helps firms decide whether lowering prices could increase total revenue.

If demand is elastic, cutting prices may attract consumers away from rivals.

If demand is inelastic, raising prices might increase revenue without losing many customers.

In the short run, demand is often inelastic because consumers need time to adjust consumption habits. Substitutes may not be immediately accessible.

In the long run, demand becomes more elastic as consumers find alternatives, adjust lifestyles, or change preferences. Firms may also innovate, increasing market options and raising elasticity further.

Governments use PED to predict the impact of indirect taxes, such as VAT or excise duties.

Taxing goods with inelastic demand (e.g., petrol, cigarettes) raises significant revenue with smaller reductions in demand.

Taxing goods with elastic demand risks reducing sales substantially, lowering overall tax revenue.

While PED is useful, it has several practical limits:

Estimates of elasticity may be inaccurate due to limited or outdated data.

Elasticity values can change over time as consumer preferences and market conditions evolve.

PED assumes ceteris paribus (other factors unchanged), which rarely holds in dynamic markets.

These factors mean firms and governments must treat PED as a guide rather than an absolute rule.

Practice Questions

Define price elasticity of demand (PED). (2 marks)

1 mark for identifying that PED measures the responsiveness of demand to a change in price.

1 mark for stating the formula: percentage change in quantity demanded divided by percentage change in price.

Explain the relationship between price elasticity of demand and a firm’s total revenue. Use appropriate economic terminology in your answer. (6 marks)

1 mark for defining total revenue as price × quantity sold.

1 mark for recognising that when demand is elastic (PED > 1), a fall in price increases total revenue.

1 mark for recognising that when demand is elastic (PED > 1), a rise in price decreases total revenue.

1 mark for recognising that when demand is inelastic (PED < 1), a fall in price decreases total revenue.

1 mark for recognising that when demand is inelastic (PED < 1), a rise in price increases total revenue.

1 mark for recognising that when demand is unit elastic (PED = 1), total revenue remains unchanged when price changes.

(Maximum 6 marks)