AQA Specification focus:

‘Changes in a particular market are likely to affect other markets; the implications of joint demand, competitive demand, composite demand, derived demand and joint supply; explore the impact of changes in demand, supply and price in one market upon other related markets.’

Understanding how markets are interconnected is essential in economics. Changes in demand, supply, or price in one market often create significant ripple effects in related markets.

Intermarket Links

Intermarket links describe the ways in which changes in one market affect other related markets. These connections explain why no market exists in isolation and why firms, consumers, and governments must account for wider effects.

Joint Demand

Joint demand occurs when two or more goods are demanded together because they are complementary.

Joint Demand: When the demand for one good is linked to the demand for another because the goods are consumed together.

Classic examples include cars and petrol or printers and ink cartridges.

A rise in demand for cars typically increases demand for petrol.

If the price of a complementary good rises, the demand for the linked good often falls.

This relationship can have important policy implications. For instance, subsidies for electric cars will also affect markets for batteries and charging infrastructure.

Competitive Demand

Competitive demand arises when goods are substitutes for each other, and an increase in demand for one reduces the demand for the other.

Competitive Demand: When two goods are substitutes, so that an increase in demand for one reduces demand for the other.

Examples include tea and coffee or Coca-Cola and Pepsi.

If the price of coffee rises, demand for tea may increase.

Firms operating in these markets must remain responsive to competitor pricing and consumer preferences.

Competitive demand highlights the importance of price elasticity of demand in shaping consumer choice across similar products.

Composite Demand

Composite demand occurs when a good has multiple possible uses, meaning that a change in demand in one use can affect availability in others.

Composite Demand: When a good is demanded for multiple distinct purposes, so that an increase in demand in one use reduces availability for other uses.

Example: oil can be used for fuel, plastics, and chemicals.

An increase in oil demand for energy may reduce supply for plastics, raising prices in that market.

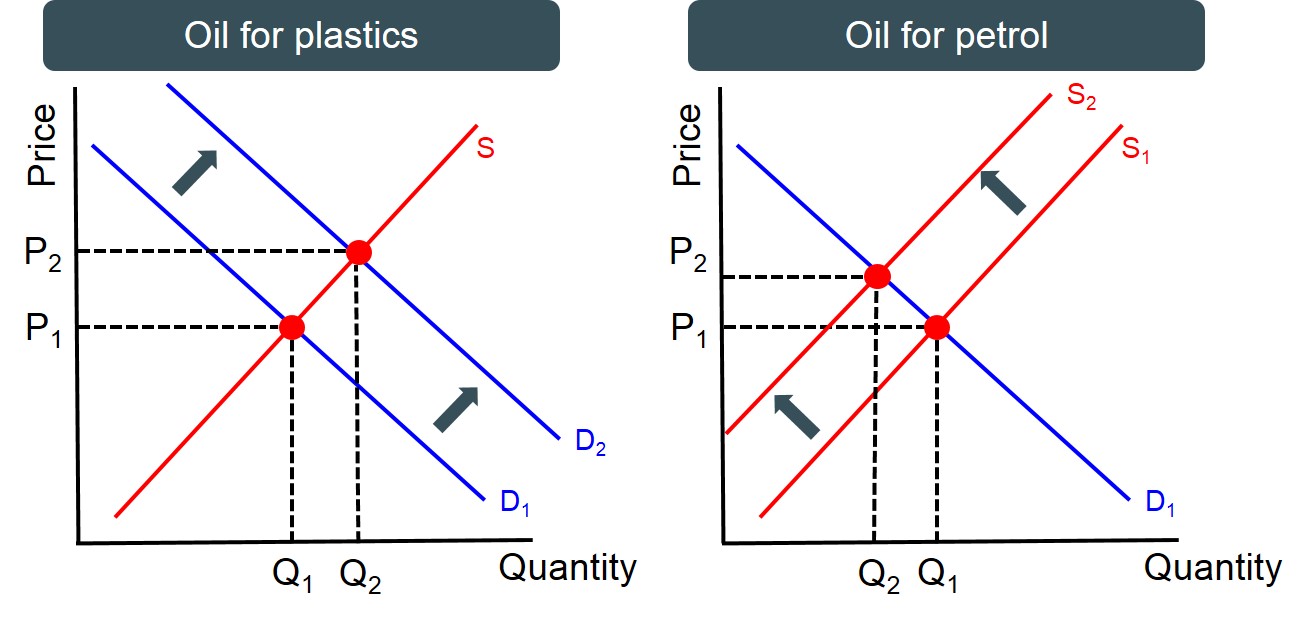

The diagram demonstrates composite demand, where a good is used for multiple purposes. An increase in demand for one use can reduce availability for other uses, raising prices. Source

Wheat is another example, demanded for both food and biofuel.

Composite demand can create tensions between industries, often requiring government regulation or subsidies to manage competing priorities.

Derived Demand

Derived demand refers to when the demand for a factor of production depends on the demand for the final good it helps produce.

DEFINITION

Derived Demand: The demand for a factor of production that arises from the demand for the final goods and services it is used to produce.

Example: The demand for labour in car manufacturing is derived from the demand for cars.

Similarly, the demand for steel is derived from demand in construction and manufacturing industries.

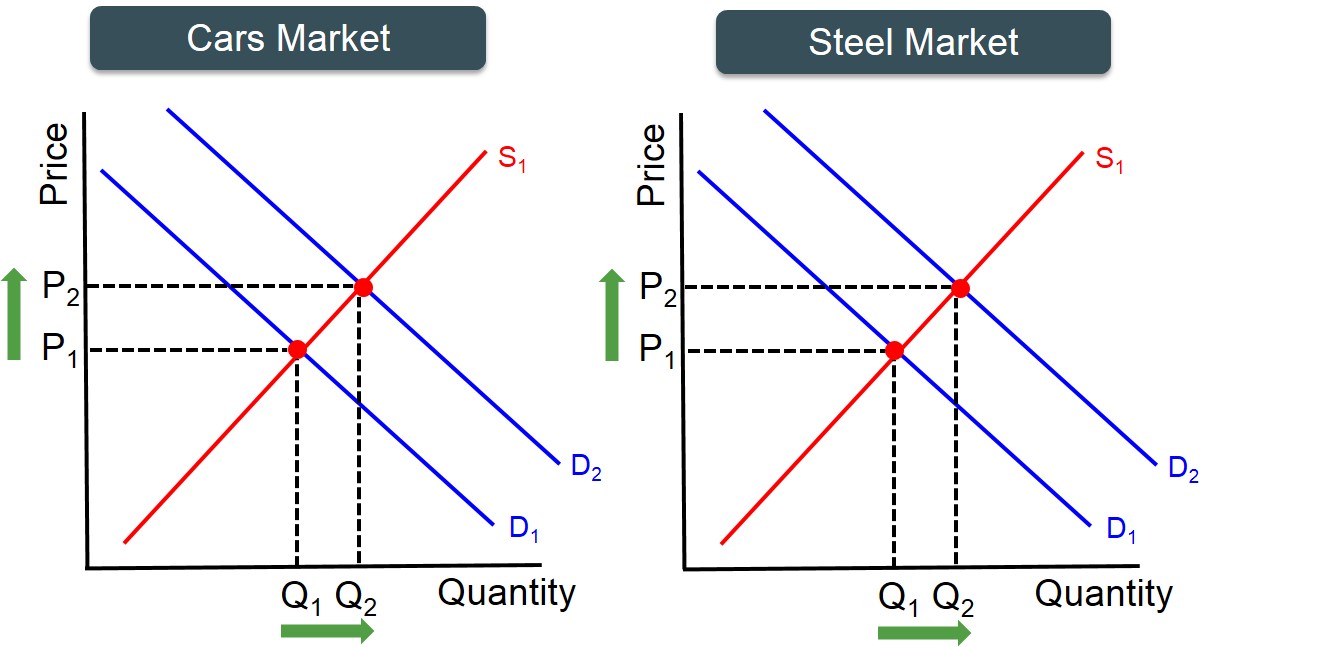

The diagram illustrates derived demand, where the demand for a factor of production, such as steel, is dependent on the demand for the final product, like cars. Source

A fall in demand for cars leads to reduced demand for steel and automotive workers.

This concept is crucial for understanding fluctuations in employment and investment levels across industries.

Joint Supply

Joint supply occurs when the production of one good inevitably produces another.

Joint Supply: When two or more goods are produced together, so an increase in the supply of one leads to an increase in the supply of the other.

Example: beef and leather — producing beef automatically produces leather as a by-product.

An increase in demand for beef increases the supply of leather, potentially reducing its price.

Similarly, refining crude oil produces both petrol and diesel.

Joint supply means that producers must consider not just the primary product but also the implications for related markets.

Impacts of Changes Across Markets

Changes in one market often spill over into others due to these intermarket links. Some examples include:

Joint demand: A rise in electric car demand boosts battery markets but may reduce petrol consumption.

Competitive demand: A sharp fall in the price of coffee can lower tea sales.

Composite demand: Increased demand for wheat in biofuels can raise bread prices.

Derived demand: A slowdown in housing demand reduces demand for construction labour and raw materials.

Joint supply: Growth in beef consumption raises leather supply, affecting global leather prices.

Factors Influencing the Strength of Links

The strength of these intermarket connections depends on several factors:

Price elasticity of demand and supply: Elastic markets transmit effects more strongly.

Substitutability of goods: The closer the substitutes, the stronger the competitive demand relationship.

Technological change: Innovation can alter joint or composite demand by creating new uses.

Global trade patterns: International links can amplify domestic intermarket effects.

Government policy: Taxes, subsidies, and regulations can strengthen or weaken intermarket links.

Understanding these connections enables economists to predict ripple effects and helps policymakers manage wider economic stability.

FAQ

Joint demand refers to when two goods are consumed together, so demand for one increases demand for the other (e.g. cars and petrol).

Joint supply, however, occurs when producing one good automatically produces another as a by-product (e.g. beef and leather).

The key difference is that joint demand is driven by consumption relationships, while joint supply arises from production processes.

Government intervention can strengthen or weaken intermarket connections:

Subsidies on electric cars increase demand for batteries (joint demand).

Taxes on petrol reduce competitive demand between petrol and electricity.

Regulation of biofuels affects composite demand for crops such as maize or wheat.

Policies often have unintended ripple effects across related markets, making intermarket analysis essential.

Composite demand occurs when one good has multiple uses. Industries compete for the same resource, leading to trade-offs.

For example:

Farmers may divert wheat to biofuel production, reducing supply for bread.

Oil used in plastics may become more expensive if diverted to energy.

These conflicts can raise prices, create shortages, and even prompt government rationing or subsidies.

Employment often fluctuates with derived demand. When demand for final goods rises, so does demand for labour and raw materials in linked industries.

For instance:

A rise in housing demand increases demand for construction workers, timber, and steel.

A fall in car demand can reduce employment in automotive manufacturing and supply chains.

This explains why cyclical industries often see volatile job markets.

Markets rarely operate with just one link in isolation. Overlaps amplify economic effects.

For example:

A surge in electric car demand creates joint demand for batteries, derived demand for lithium mining, and reduces competitive demand for petrol.

Joint supply may also be affected if oil refining for petrol simultaneously changes diesel output.

Understanding these overlaps is crucial for predicting broader economic impacts and business strategy.

Practice Questions

Define derived demand and provide one example. (2 marks)

1 mark for correct definition: demand for a factor of production that depends on demand for the final good/service it helps produce.

1 mark for relevant example, e.g. demand for steel depending on demand for cars.

Using appropriate economic concepts, explain how an increase in demand for electric cars could affect at least two related markets. (6 marks)

Up to 2 marks for clear identification of at least two intermarket links (e.g. joint demand for batteries, competitive demand reducing petrol demand, derived demand for labour in battery production).

Up to 2 marks for clear explanation of how each market is affected (e.g. higher demand for batteries raises their price; fall in petrol demand reduces petrol consumption).

1–2 marks for use of economic terminology and logical development of the explanation (e.g. correctly applying concepts such as joint demand, competitive demand, derived demand).

Maximum 6 marks.