AQA Specification focus:

‘The models that comprise the traditional theory of the firm are based upon the assumption that firms aim to maximise profits. The profit-maximising rule (MC=MR).’

Introduction

Profit maximisation lies at the heart of traditional economic theory. Understanding the MR=MC rule is central to explaining how firms make decisions about output and pricing strategies.

The Assumption of Profit Maximisation

Economic models of the firm usually begin with the assumption that firms seek to maximise profits. This means choosing the level of output and price where total profit — the difference between total revenue and total cost — is at its highest.

Profit Maximisation: The process of determining the level of output and price that allows a firm to achieve the greatest possible difference between total revenue and total cost.

This assumption provides a benchmark for analysing firm behaviour, even if in reality firms may pursue alternative objectives.

Key Concepts: Revenue and Costs

Total Revenue (TR), Average Revenue (AR) and Marginal Revenue (MR)

Total Revenue (TR): The total income a firm receives from selling its output.

Average Revenue (AR): TR divided by the quantity sold; equal to price when all units are sold at the same price.

Marginal Revenue (MR): The additional revenue earned by selling one more unit of output.

Marginal Revenue (MR): The extra revenue gained from selling one additional unit of output.

Total Cost (TC), Average Cost (AC) and Marginal Cost (MC)

Total Cost (TC): All the costs of production at a given output level.

Average Cost (AC): TC divided by output.

Marginal Cost (MC): The cost of producing one additional unit of output.

Marginal Cost (MC): The increase in total cost resulting from the production of one extra unit of output.

The Profit-Maximising Rule: MR = MC

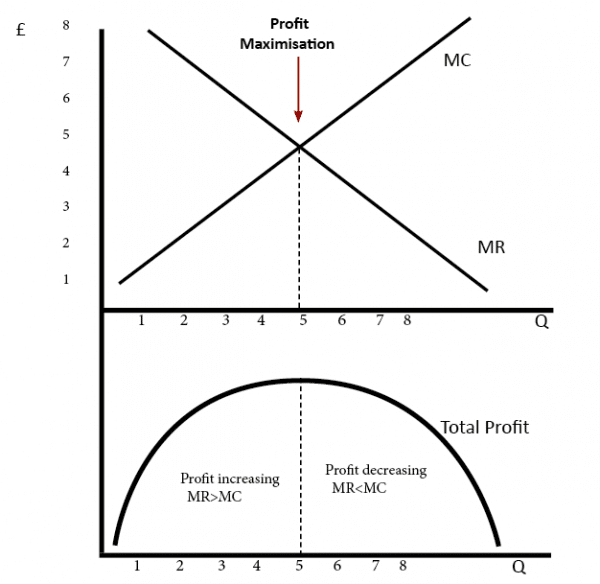

According to traditional theory, firms maximise profit where marginal revenue equals marginal cost (MR=MC). This is because:

If MR > MC, producing more increases profit since the extra revenue from the additional unit exceeds the extra cost.

If MC > MR, producing more reduces profit since the extra cost is greater than the revenue gained.

Therefore, the maximum profit occurs at the output where MR = MC.

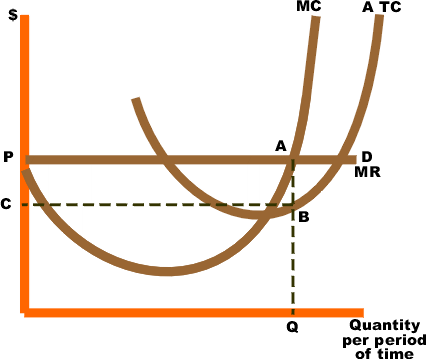

The diagram shows the profit-maximising output level (Q) in a perfectly competitive market, where the marginal cost (MC) curve intersects the marginal revenue (MR) curve. The price (P) is determined by the demand curve, and the firm's total profit is represented by the area between the price and average cost (AC) curves. Source

Profit-Maximising Rule: MR = MC

MR (Marginal Revenue) = Change in Total Revenue ÷ Change in Quantity

MC (Marginal Cost) = Change in Total Cost ÷ Change in Quantity

This condition is universal across market structures (perfect competition, monopoly, oligopoly, monopolistic competition), though the shapes of the curves differ.

Diagrammatic Representation (Conceptual)

While not required here in diagram form, students should understand that:

The MR curve lies below the AR curve in imperfect competition due to the downward-sloping demand curve.

The MC curve typically has a U-shape due to diminishing returns.

Profit maximisation occurs where MR and MC intersect.

This intersection identifies the optimal level of output. The corresponding price is determined by the demand curve (AR).

Short-Run vs Long-Run Profit Maximisation

Short-Run

Firms may make supernormal profits, normal profits, or even losses.

The MR=MC condition still applies for determining output, but firms may temporarily operate at a loss if covering variable costs.

Long-Run

In perfectly competitive markets, new firms enter if supernormal profits exist, driving profits down to normal profit.

In monopolies or oligopolies, barriers to entry may allow sustained supernormal profits.

Implications Across Market Structures

Perfect Competition

Firms are price takers: MR = AR = Price.

Profit maximisation occurs at the output where MC = Price.

Monopoly

Firms are price makers: MR falls faster than AR.

The MR=MC rule determines the output; price is set above MC, creating potential inefficiency.

The diagram illustrates the profit-maximising output level (Q) in a monopoly, where the marginal cost (MC) curve intersects the marginal revenue (MR) curve. The monopolist sets the price (P) based on the demand curve at the profit-maximising output level. The area between the price and average cost (AC) curves represents the monopolist's total profit. Source

Oligopoly and Monopolistic Competition

Profit maximisation still follows MR=MC, but strategic interaction and product differentiation complicate outcomes.

Firms may focus on long-run strategies like branding or R&D while still aligning with the profit-maximising condition.

Importance of the MR=MC Rule

The MR=MC rule provides a consistent analytical framework to:

Explain firm behaviour in different market structures.

Predict pricing and output decisions.

Assess efficiency and welfare outcomes.

Key Points for Students:

Profit maximisation is assumed in the traditional theory of the firm.

MR=MC is the universal condition for maximum profit.

The application differs depending on market structure and time horizon.

FAQ

Normal profit occurs when total revenue just covers total cost, including opportunity cost, meaning resources are earning their best alternative return. At MR=MC, this is the long-run equilibrium in perfect competition.

Supernormal profit exists when total revenue exceeds total cost, allowing firms to earn above-normal returns. In imperfect competition, the MR=MC point can sustain supernormal profits if barriers to entry prevent new competitors.

The rule focuses on marginal, not total, values. Firms compare the extra revenue from selling one more unit (MR) with the extra cost of producing it (MC).

If MR exceeds MC, expansion adds profit.

If MC exceeds MR, contraction reduces losses.

At MR=MC, neither expansion nor contraction improves profit, making it the marginal decision point.

Yes, but this is usually temporary or strategic. Firms may:

Operate where MR > MC if aiming for growth or market share.

Accept MC > MR in the short run if covering variable costs while minimising losses.

However, in the long run, consistent deviation from MR=MC undermines profitability and sustainability.

If price (AR) falls below average variable cost (AVC), even though MR=MC could still be identified, the firm cannot cover variable costs.

In this case, shutting down is preferable, as continuing production would worsen losses. This shows that the MR=MC rule applies only when firms can cover variable costs in the short run.

In imperfect competition, firms face downward-sloping demand curves. To sell more units, they must lower the price of all units, not just the additional one.

AR represents the price of each unit.

MR reflects the extra revenue gained, which is always lower than AR after the first unit.

This explains why MR lies below AR and why the MR=MC equilibrium does not occur where price equals cost.

Practice Questions

Define the profit-maximising rule used in the traditional theory of the firm. (2 marks)

1 mark for stating that profit maximisation occurs where marginal revenue (MR) equals marginal cost (MC).

1 mark for explaining that at this point, producing one more or one less unit would reduce overall profit.

Using economic analysis, explain why the MR=MC rule determines the profit-maximising level of output for a firm. (6 marks)

1 mark for identifying that profit maximisation occurs at the output where MR=MC.

1 mark for explaining that if MR > MC, producing more increases profit.

1 mark for explaining that if MC > MR, producing more decreases profit.

1 mark for noting that only at MR=MC is profit at its maximum.

1 mark for recognising that this condition applies across different market structures.

1 mark for linking to economic reasoning, e.g. showing that this ensures the optimal allocation of resources for the firm’s objectives.