AQA Specification focus:

‘The reasons for and the consequences of a divorce of ownership from control. Students should be able to discuss how the divorce of ownership from control may affect the objectives of firms, their conduct and performance.’

Introduction

In modern firms, the divorce of ownership from control occurs when shareholders own a company but professional managers make day-to-day decisions, potentially shifting objectives and behaviour.

Understanding the Divorce of Ownership from Control

Ownership vs Control

Ownership: Refers to shareholders who provide capital and legally own the firm.

Control: Refers to managers and executives who make operational and strategic decisions.

Divorce of Ownership from Control: The separation between those who legally own a company (shareholders) and those who manage and control its operations (directors/managers).

This separation is especially significant in public limited companies (PLCs) where ownership is widely dispersed among thousands of shareholders.

Reasons for the Divorce of Ownership from Control

Several factors contribute to this separation:

Size of Firms: As firms expand, shareholders cannot be involved in daily operations, so they hire professional managers.

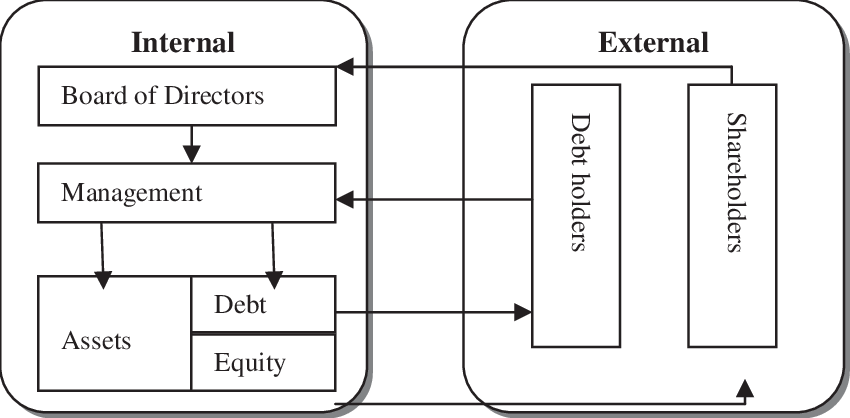

This diagram depicts the structural separation between ownership and control in a firm, highlighting the roles of shareholders and managers. It visually represents the principal-agent relationship, where shareholders (principals) delegate decision-making authority to managers (agents), potentially leading to conflicts of interest. Source

Dispersed Shareholding: With many shareholders holding small stakes, none has sufficient power to directly control decisions.

Specialisation of Roles: Owners often lack managerial expertise, so decision-making is delegated to skilled professionals.

Separation of Time Horizons: Shareholders may focus on long-term returns, while managers focus on short- to medium-term objectives.

Consequences of the Divorce of Ownership from Control

The Principal-Agent Problem

The separation creates the principal-agent problem:

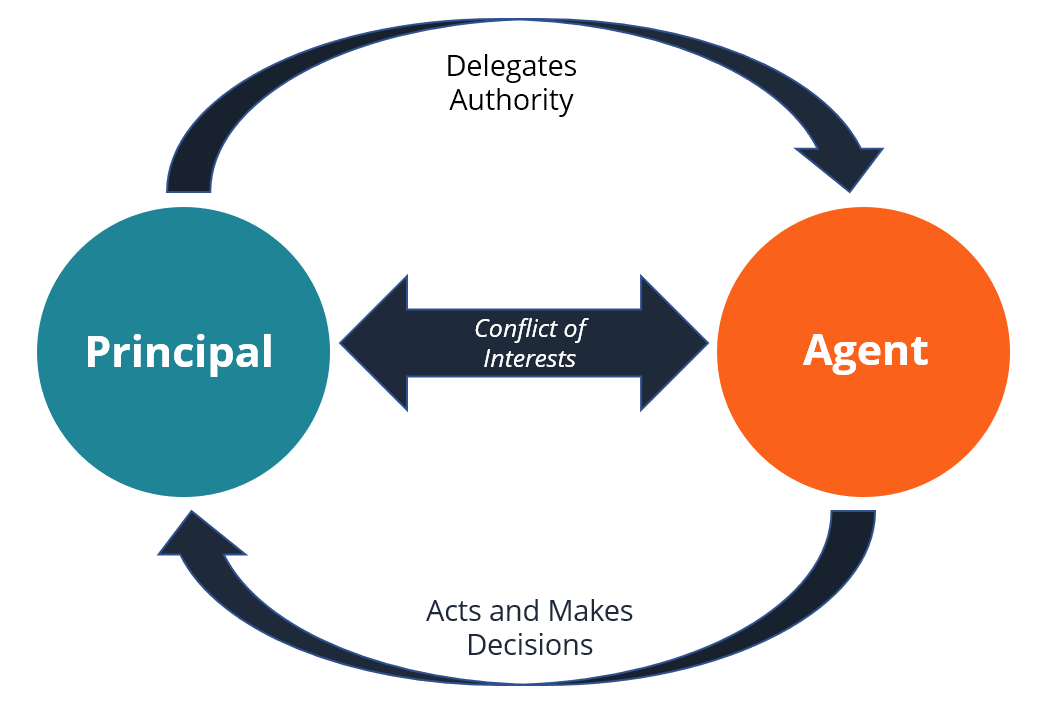

Principal-Agent Problem: A conflict of interest where the owners (principals) want to maximise returns, but the managers (agents) may pursue their own objectives.

Managers may prioritise their own interests (e.g., job security, bonuses, prestige) rather than profit maximisation.

This diagram illustrates the principal-agent problem, highlighting the conflict of interest between shareholders (principals) and managers (agents). It shows how differing objectives and information asymmetry can lead to agency problems, where managers may not act in the best interests of shareholders. Source

Alternative Objectives of Firms

When ownership and control are separated, managers may pursue objectives such as:

Sales Revenue Maximisation: Managers seek to increase sales, as growth often brings higher prestige and market power.

Market Share Maximisation: By undercutting prices, managers can dominate competitors even if it reduces short-term profits.

Growth and Expansion: Managers may value building larger organisations to boost status or secure promotion opportunities.

Managerial Utility Maximisation: Managers might prioritise higher salaries, perks, or larger departments under their control.

Satisficing: Instead of maximising profits, managers may settle for “good enough” results to balance multiple objectives.

Effects on Firm Objectives

Shift from Profit Maximisation: Traditional theory assumes firms aim to maximise profits using the MR = MC rule, but the divorce may lead to a focus on other goals.

Short-Term vs Long-Term Trade-offs: Managers may prioritise visible short-term performance to please shareholders or boards, potentially harming long-term profitability.

Survival and Risk Aversion: In uncertain environments, managers may prioritise stability and survival over risky but potentially profitable investments.

Effects on Firm Conduct

Pricing Strategies: Managers pursuing sales maximisation may lower prices aggressively, affecting competition.

Investment Decisions: Growth-focused managers may invest heavily in R&D or marketing, regardless of immediate returns.

Corporate Governance: Boards and shareholder meetings become essential mechanisms for monitoring managerial behaviour.

Takeover Threats: If managers underperform, firms risk hostile takeovers by more profit-oriented investors.

Effects on Firm Performance

Positive Effects:

Professional managers may bring expertise, efficiency, and innovation.

Alternative objectives (such as growth and market share) may improve long-term competitiveness.

Negative Effects:

Conflict between owners and managers may reduce efficiency.

Resources may be diverted towards managerial perks or prestige projects.

Failure to focus on profit can undermine shareholder returns and firm survival.

Mechanisms to Reduce the Divorce Problem

To align managerial interests with shareholder goals, firms may implement:

Performance-Related Pay: Linking bonuses to profits or share price.

Share Options: Giving managers shares or stock options to encourage profit-oriented decisions.

Corporate Governance Structures: Strong boards, shareholder activism, and audits to oversee managerial behaviour.

Market Discipline: The threat of takeovers can discipline managers to align with profit maximisation.

Wider Economic Implications

Resource Allocation: If firms deviate from profit maximisation, market efficiency may be reduced.

Innovation and Employment: Growth-focused strategies may encourage innovation and job creation, even if profits are lower.

Market Stability: Risk-averse managerial decisions may promote stability but limit entrepreneurial dynamism.

FAQ

Larger firms typically have dispersed ownership, meaning no single shareholder has enough influence to control decision-making directly.

Managers are therefore employed to run day-to-day operations. The complexity of operations in large corporations requires specialist skills, further separating owners from direct involvement in management.

Managers often have access to more detailed and accurate information about the firm’s operations than shareholders.

This information gap can lead to managers pursuing their own goals without shareholders being fully aware, reinforcing the principal-agent problem.

Shareholders can introduce:

Share-based incentives to align managers’ rewards with profit levels.

Independent non-executive directors on the board.

Regular shareholder meetings and votes to monitor decision-making.

Threat of takeovers if performance consistently falls short.

Satisficing occurs when managers aim for acceptable, rather than maximum, outcomes.

For example, managers may balance profitability with staff welfare or market expansion, meeting the minimum expectations of shareholders while pursuing less risky or more convenient goals.

If managers fail to deliver sufficient returns, rival firms may attempt a takeover.

This possibility acts as a disciplinary mechanism, as managers risk losing their positions if the company is undervalued due to poor performance or misaligned objectives.

Practice Questions

Define the term divorce of ownership from control in the context of a public limited company. (2 marks)

1 mark for identifying that ownership lies with shareholders.

1 mark for stating that control of decision-making lies with managers/directors.

Explain how the divorce of ownership from control may affect the objectives of a firm. (6 marks)

1 mark for recognising that shareholders (owners) usually aim for profit maximisation.

1 mark for recognising that managers (controllers) may have alternative objectives.

Up to 2 marks for identifying and explaining alternative managerial objectives (e.g., sales revenue maximisation, market share growth, satisficing, managerial utility).

1 mark for linking to the principal-agent problem (conflict of interest).

1 mark for explaining how this affects firm behaviour (e.g., different pricing strategies, investment decisions, or reduced focus on profit).