AQA Specification focus:

‘The formal diagrammatic analysis of the monopolistically competitive model in the short and long run.’

Introduction

Monopolistic competition describes markets where many firms sell differentiated products with some price-making power. Its short-run and long-run outcomes differ significantly in efficiency and profitability.

Characteristics of Monopolistic Competition

Before analysing outcomes, it is important to recall the assumptions of monopolistic competition:

Many firms in the market, each with a small market share.

Product differentiation, meaning goods are similar but not identical.

Relatively free entry and exit, though not perfectly costless.

Imperfect knowledge, but buyers and sellers have reasonable awareness of alternatives.

Firms face a downward-sloping demand curve due to differentiation.

These features shape both short-run and long-run diagrammatic analysis.

Short-Run Analysis

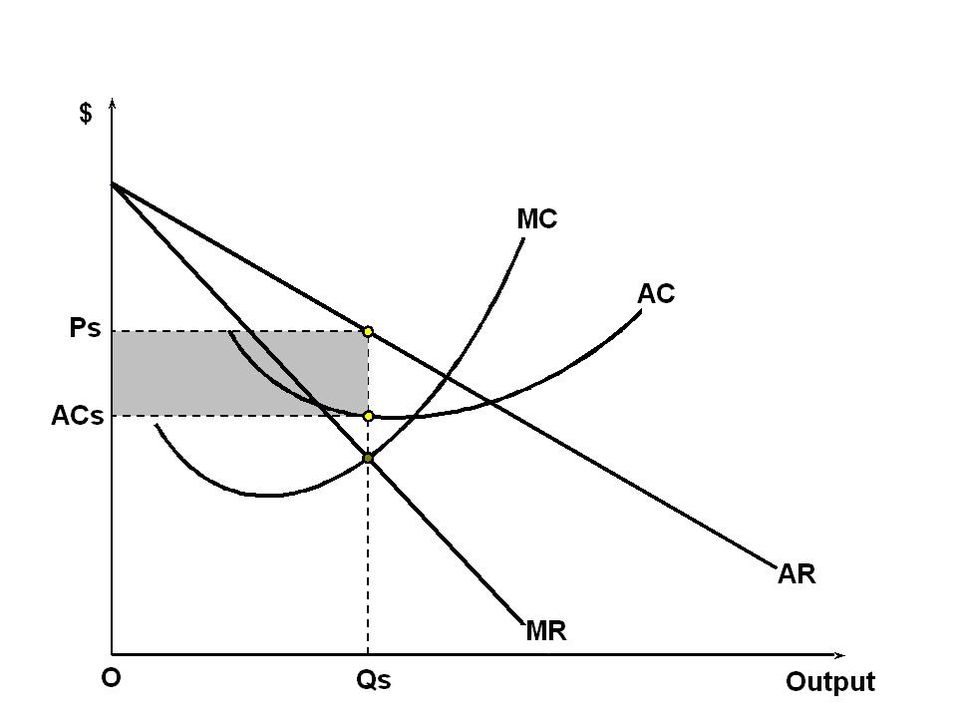

In the short run, firms can make supernormal profits, normal profits, or losses, depending on the relationship between revenue and costs.

Profit Maximisation Condition

Firms in monopolistic competition, like all profit-maximising firms, follow the standard rule:

Profit Maximisation Rule: MC = MR

MC (Marginal Cost) = Additional cost of producing one more unit

MR (Marginal Revenue) = Additional revenue gained from selling one more unit

By equating marginal cost (MC) and marginal revenue (MR), firms determine the profit-maximising output.

Short-Run Outcomes

If Average Revenue (AR) > Average Total Cost (ATC), the firm earns supernormal profit.

If AR = ATC, the firm earns normal profit.

If AR < ATC, the firm makes a loss.

Because demand is downward sloping, the AR curve lies above the MR curve, and equilibrium occurs where MC = MR, with price set from the AR curve.

Short-run equilibrium for a monopolistically competitive firm. Output is chosen where MR = MC, and price is read from the AR (demand) curve. Shaded areas indicate profits or losses depending on AR relative to ATC. Source

Long-Run Adjustments

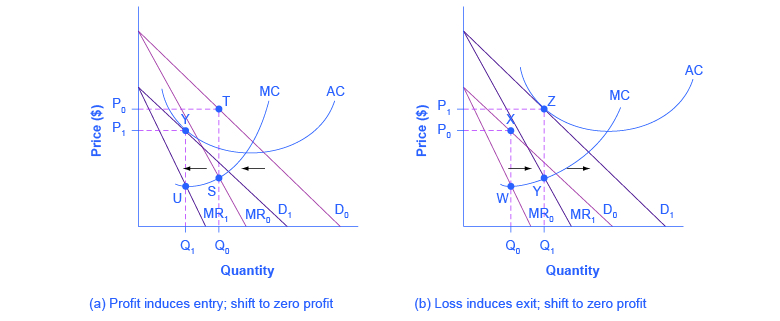

In monopolistic competition, the ability to earn supernormal profits in the short run encourages new firms to enter the market. Conversely, persistent losses cause firms to exit.

Entry and Exit Mechanism

Supernormal profits attract new firms → market supply increases → individual firms’ demand curves shift leftwards.

Losses force firms to leave → remaining firms gain larger demand → AR shifts rightwards until only normal profit remains.

This entry-exit process ensures that, in the long run, only normal profit is sustained.

Adjustment in monopolistic competition via entry and exit. Profits induce entry, shifting demand left, while losses induce exit, shifting demand right. Both converge to a zero-profit tangency in the long run. Source

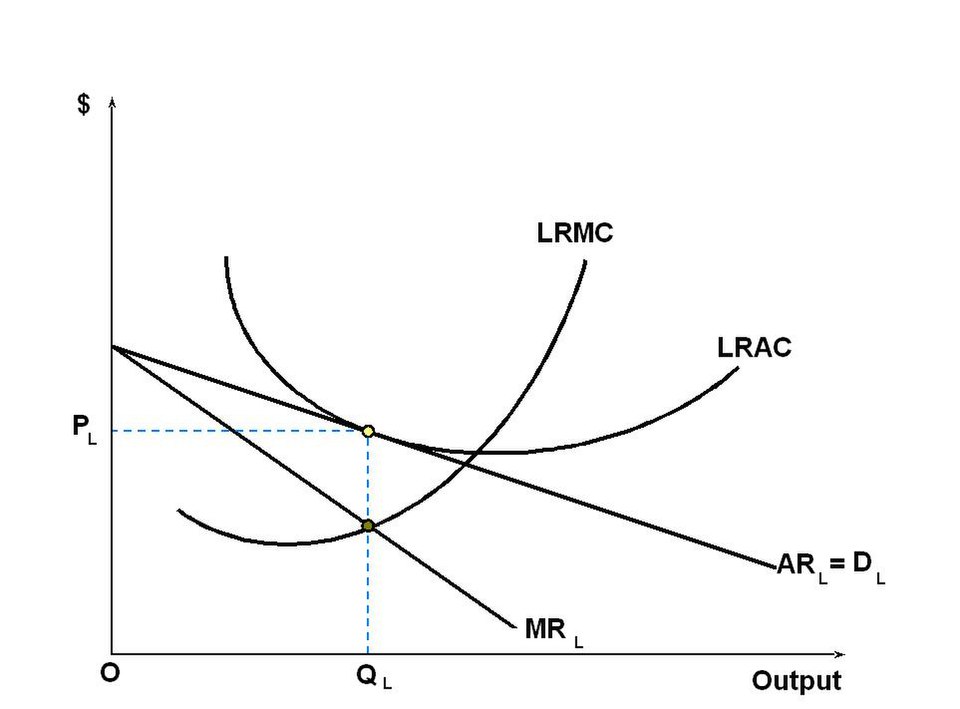

Long-Run Diagrammatic Outcomes

In the long run:

Firms produce where MC = MR, just as in the short run.

However, AR is tangent to ATC, ensuring only normal profit is earned.

The AR curve remains downward sloping, meaning firms still have some degree of price-making power.

Long-run equilibrium for a monopolistically competitive firm. AR is tangent to ATC, so only normal profit is earned. Tangency occurs away from minimum ATC, leaving excess capacity. Source

Efficiency Considerations in Monopolistic Competition

Allocative Efficiency

Allocative efficiency occurs when P = MC. In monopolistic competition:

Price (P) is greater than MC, as firms retain some monopoly power.

Therefore, allocative inefficiency arises because resources are not perfectly allocated.

Allocative Efficiency: A market outcome where the value consumers place on a good (reflected in price) equals the cost of producing the last unit (MC).

This inefficiency implies underproduction relative to the socially optimal output.

Productive Efficiency

Productive efficiency occurs when firms produce at the minimum point of the ATC curve.

In monopolistic competition, firms do not produce at this minimum because they restrict output to maximise profit.

This results in excess capacity, meaning firms operate at less than their lowest average cost.

Excess Capacity: The difference between the profit-maximising level of output and the output that minimises ATC.

Thus, monopolistic competition is not productively efficient.

Comparing Short-Run and Long-Run Positions

Short Run

Firms may earn supernormal profits, normal profits, or losses.

Market equilibrium determined at MC = MR, with price set from AR.

Long Run

Entry and exit adjust the market until all firms make only normal profit.

Demand curves shift due to increased competition.

Firms retain price-making power but cannot sustain supernormal profit.

Implications for Consumers and Firms

For Consumers

Consumers benefit from product variety due to differentiation.

Prices remain higher than in perfect competition, but choice compensates to some extent.

In the long run, only normal profit ensures that consumers are not exploited by persistent supernormal profit extraction.

For Firms

Firms may innovate and differentiate further to gain short-run profits.

Entry of new competitors erodes profitability.

Firms operate with excess capacity, indicating an ongoing inefficiency in output relative to potential.

Key Points to Remember

Monopolistic competition involves short-run supernormal profits but long-run normal profits.

Firms are allocatively and productively inefficient in both the short and long run.

The key difference between time horizons lies in the ability of new firms to enter and compete away profits.

Consumers gain from variety, but efficiency losses remain compared with perfect competition.

FAQ

Product differentiation allows firms to act as price makers rather than price takers, since each firm’s product is perceived as slightly unique.

In the short run, this enables firms to charge higher prices than in perfect competition, potentially leading to supernormal profits. The extent of differentiation also affects the slope of the demand curve: the more differentiated the product, the less elastic demand will be.

In the long run, entry of new firms erodes supernormal profits until only normal profit remains.

At this stage, the firm’s demand curve (AR) is tangent to ATC but not at its minimum point.

This means firms are not producing at the lowest possible average cost.

The difference between actual output and minimum-cost output is known as excess capacity.

In the short run, consumers may face fewer alternatives, as some firms may still be making supernormal profits.

In the long run, new firms enter the market due to profit opportunities. This increases the variety of products available, giving consumers greater choice, although average prices may stabilise at levels above those found in perfect competition.

As new firms enter, the industry demand is shared among a larger number of suppliers.

Each existing firm’s share of the market decreases.

This shifts their AR and MR curves leftward.

The process continues until AR is tangent to ATC, ensuring only normal profit remains.

If firms face losses in the short run (AR < ATC), some will exit the market.

Exit reduces the number of firms, shifting AR and MR rightwards for those remaining.

Over time, this adjustment allows surviving firms to restore normal profit in the long run.

Consumers may see fewer choices if many firms leave, though this balances with higher survival chances for remaining businesses.

Practice Questions

Using a diagram, explain why firms in monopolistic competition can earn supernormal profits in the short run but only normal profit in the long run. (6 marks)

1 mark for correctly identifying that short-run supernormal profits occur when AR > ATC at the profit-maximising output.

1 mark for stating that the profit-maximising output is where MR = MC.

1 mark for correctly explaining that new firms enter the market if supernormal profits exist.

1 mark for explaining that entry shifts AR and MR leftwards for existing firms.

1 mark for identifying that in the long run AR is tangent to ATC, leading to normal profit only.

1 mark for use of an accurately drawn and labelled diagram showing both the short-run supernormal profit and the long-run normal profit positions.

(Maximum 6 marks)

State two assumptions of monopolistic competition that influence short-run and long-run equilibrium outcomes. (2 marks)

1 mark for each correct assumption identified (maximum 2 marks).

Accept any two of the following:

Many firms in the market.

Product differentiation.

Freedom of entry and exit.

Downward-sloping demand curve.

Imperfect knowledge.