AQA Specification focus:

‘Oligopoly can be defined in terms of market structure or in terms of market conduct (behaviour).’

Introduction

Oligopoly is a complex market structure where few dominant firms operate. Its analysis depends on whether it is defined by structure or conduct (behaviour).

Understanding Oligopoly

An oligopoly is a market structure characterised by a small number of large firms dominating supply, leading to significant interdependence among competitors. The definition of oligopoly can be approached from two distinct perspectives: market structure (the external features of the industry) and market conduct (the behavioural choices of firms within it). Both perspectives help economists explain the operation, outcomes, and efficiency of oligopolistic markets.

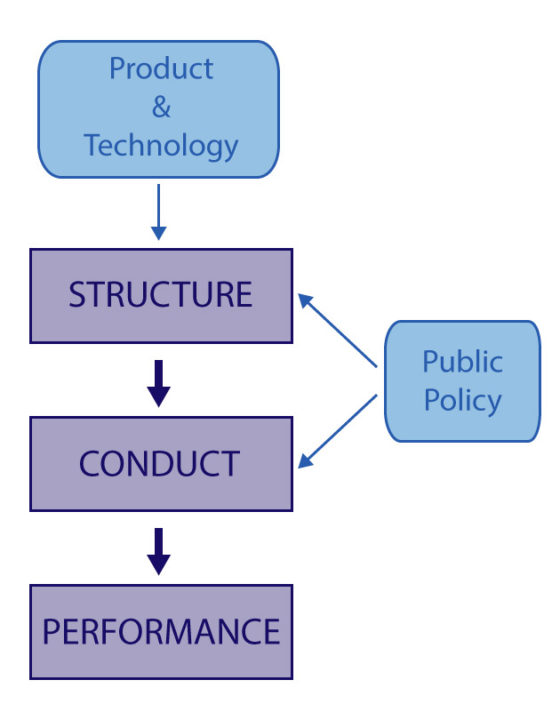

Diagram of the Structure–Conduct–Performance (SCP) paradigm showing arrows from industry structure to firm conduct to market performance, with external influences. It clarifies how defining oligopoly by structure relates to conduct. The policy box adds detail beyond the syllabus but aids interpretation. Source

Market Structure Approach

When defined in terms of market structure, an oligopoly is understood by focusing on the industry’s characteristics. This approach looks at measurable features that describe how the market is set up.

Key Features of Oligopolistic Market Structure

Number of firms: Typically a few large firms dominate the market, often accounting for the majority of total output.

High market concentration: A high concentration ratio indicates that a small number of firms control a significant proportion of industry sales.

Barriers to entry: These are usually high, preventing new firms from entering easily and sustaining the dominance of existing firms.

Product differentiation: Products may be homogenous (e.g., steel, oil) or differentiated (e.g., cars, soft drinks).

Interdependence: Firms are aware of their rivals’ actions, meaning one firm’s decision on price or output will affect others.

Market Structure: The observable characteristics of an industry, such as number of firms, barriers to entry, and product differentiation, which influence competition.

Structural definitions of oligopoly therefore emphasise the external market conditions and provide economists with a measurable framework, such as calculating concentration ratios, to determine whether a market is oligopolistic.

Market Conduct Approach

The market conduct approach defines oligopoly by the way firms behave within the market. Here, emphasis is placed on the strategies and interactions between firms rather than structural features.

Forms of Market Conduct in Oligopoly

Collusion: Firms may cooperate formally or informally to restrict competition, often leading to cartel-like behaviour.

Price competition: Firms may avoid aggressive price cuts due to the risk of retaliation, leading to price rigidity.

Non-price competition: Competition often occurs through advertising, branding, product quality, or innovation rather than price.

Strategic interdependence: Firms anticipate rivals’ responses when making decisions, creating an environment of uncertainty and game-theoretic behaviour.

Market Conduct: The behaviour and strategic decisions of firms in a market, including pricing, output, advertising, and collusion, influenced by the presence of rivals.

This approach acknowledges that markets with similar structural features may exhibit very different behaviours depending on the strategies adopted by firms.

Structure vs Conduct: Distinct Yet Interlinked

Although the specification distinguishes between structure and conduct, in practice, the two are closely connected. Market structure influences conduct, and conduct can shape or reinforce structural outcomes.

Comparison of Structure and Conduct

Market Structure highlights:

Concentration ratios

Number of firms

Barriers to entry

Market Conduct highlights:

Strategies of collusion or competition

Interdependence and uncertainty

Pricing and non-pricing decisions

For example:

In a highly concentrated oligopoly (structural feature), firms may choose to collude (conduct).

Conversely, even with similar structural concentration, firms may behave competitively by pursuing aggressive advertising or price wars.

The Interdependence of Firms

A central feature of oligopoly, recognised in both definitions, is interdependence. Each firm must account for the potential responses of rivals before making decisions on pricing, output, or investment. This is a key distinction between oligopoly and other market structures such as perfect competition or monopoly.

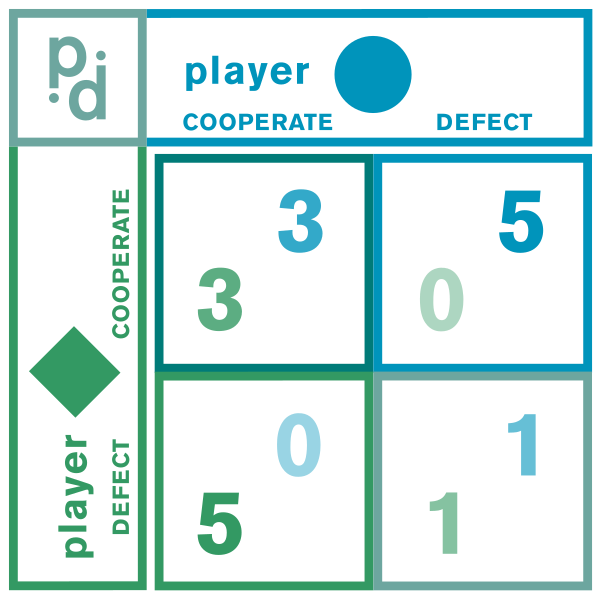

A 2×2 pay-off matrix representing two firms’ choices (cooperate vs defect) and their profits. It illustrates oligopoly interdependence: each firm’s outcome depends on its rival. The numeric pay-offs are illustrative and include extra detail, but they aid understanding of conduct. Source

Interdependence: A situation in which the actions of one firm directly influence the decisions and outcomes of rival firms within the market.

This interdependence underpins both structural and conduct-based definitions, as structure creates the conditions for interdependence, while conduct demonstrates how firms behave under it.

Why Both Approaches Matter

Economists and regulators use both definitions to understand and evaluate oligopolies:

Structural focus helps policymakers assess whether an industry is too concentrated and might require intervention (e.g., merger controls, competition law).

Conduct focus helps assess how firms actually behave, identifying whether they are engaging in anti-competitive practices such as tacit collusion or restrictive agreements.

By integrating both perspectives, economists gain a fuller picture of oligopoly performance, its efficiency outcomes, and its effects on consumers and producers.

FAQ

Concentration ratios measure the combined market share of the largest firms in an industry.

For example, a four-firm concentration ratio (CR4) looks at the top four firms’ total market share.

A high ratio (above 50%) usually suggests oligopoly.

A lower ratio indicates greater competition.

While useful, concentration ratios do not capture firm behaviour, so they must be considered alongside conduct.

In oligopolies, each firm’s pricing, output, or investment decision directly influences rivals’ profits.

This differs from perfect competition, where individual firms are too small to affect the market, and monopoly, where no rival exists.

Interdependence leads to uncertainty, as firms must anticipate rivals’ likely reactions before making decisions.

Collusion occurs when firms coordinate decisions to reduce competition.

Formal collusion: Agreements such as cartels where firms fix prices or limit output.

Tacit collusion: Informal cooperation, like following a dominant firm’s pricing decisions.

Both forms highlight behaviour, not just structure, making them examples of oligopoly conduct.

Yes, if a few firms hold substantial market power, even in a large industry.

For instance, airlines and supermarkets often have many small competitors, but consumer choices are dominated by a handful of firms.

In such cases, structural concentration ratios reveal oligopolistic tendencies despite numerous smaller rivals.

The distinction allows clearer analysis of competition policy and market outcomes.

Structure helps identify whether a market is dominated and potentially less competitive.

Conduct reveals how firms behave, which may be anti-competitive even in less concentrated markets.

This dual approach helps regulators and economists evaluate both potential and actual market power.

Practice Questions

Define an oligopoly in terms of market structure. (2 marks)

1 mark for recognising that an oligopoly is a market with a small number of large firms dominating supply.

1 mark for reference to high market concentration or barriers to entry.

Explain the difference between defining an oligopoly in terms of market structure and defining it in terms of market conduct. (6 marks)

1 mark for stating that market structure focuses on observable features of the industry (e.g., number of firms, concentration ratios, barriers to entry).

1 mark for reference to few dominant firms or product differentiation as structural features.

1 mark for stating that market conduct focuses on the behaviour and strategies of firms (e.g., collusion, price rigidity, non-price competition).

1 mark for reference to interdependence in conduct.

1–2 marks for clear development, comparison, or an example that distinguishes the two approaches (e.g., structure creates conditions, conduct shows behaviour).

Maximum 6 marks in total.