AQA Specification focus:

‘Students should understand that if firms have monopoly power and are making large profits, over time there will be an incentive for new firms to enter the market and to innovate to overcome the existing barriers to entry.’

Introduction

Creative destruction highlights how innovation transforms industries, displacing outdated firms and methods. In AQA A-Level Economics, this concept links monopoly profits to long-term competitive incentives.

Understanding Creative Destruction

Creative destruction is a concept popularised by economist Joseph Schumpeter.

Creative Destruction: The process by which innovation leads to the decline of existing firms, products, or industries, and the emergence of new, more efficient ones.

It explains how economies progress through cycles of innovation, disruption, and renewal. New firms enter with improved technologies or practices, often displacing older incumbents.

Monopoly Power and Profits

When firms enjoy monopoly power, they can generate supernormal profits by restricting output and charging higher prices. These profits are not just rewards but act as signals to potential competitors.

High profits signal opportunities for rival firms.

New firms innovate to overcome barriers such as patents, branding, or economies of scale.

Incumbents must respond by investing in research and development (R&D) to maintain dominance.

This interaction drives economic dynamism.

If firms have monopoly power and are making large profits, over time there will be an incentive for new firms to enter and to innovate to overcome the existing barriers to entry.

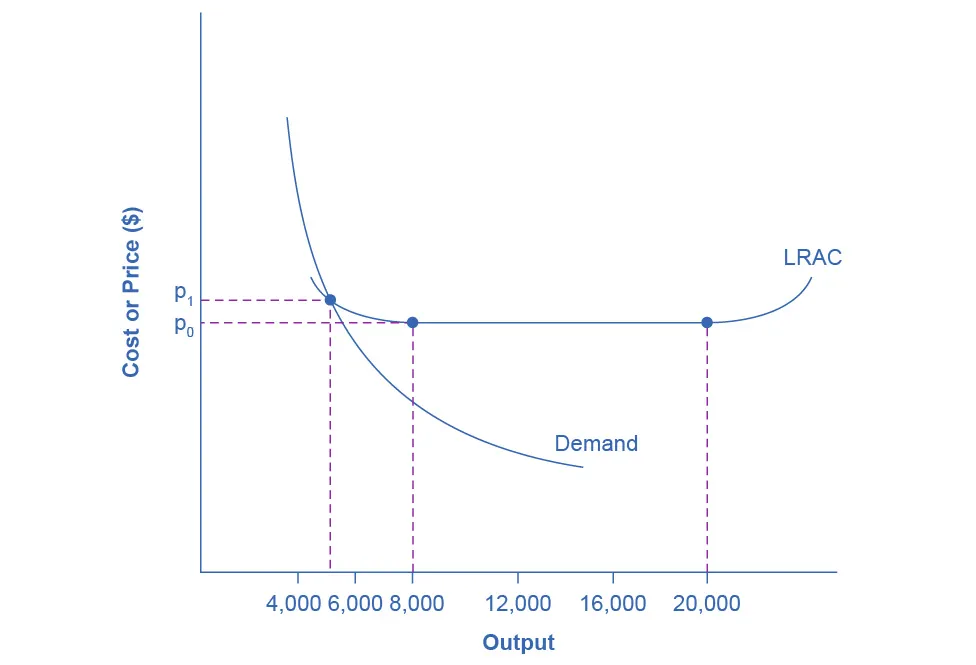

Economies of scale can make one firm the lowest-cost supplier at all relevant outputs, creating a natural monopoly. Persistent profits arise because average costs fall over the relevant range, deterring entry. Innovation or regulatory change can erode these barriers by shifting costs or expanding feasible demand. Source

Incentives for Innovation

Innovation incentives arise when new entrants or existing competitors seek to capture market share. These incentives include:

Technological change: Developing new production processes or technologies.

Product innovation: Launching goods with new features or higher quality.

Process innovation: Reducing costs through more efficient methods.

Service innovation: Improving delivery, aftercare, or customer experience.

By innovating, firms can gain a competitive advantage and temporarily secure monopoly profits themselves.

Barriers to Entry and How Innovation Overcomes Them

Barriers to entry in monopolistic markets include economies of scale, patents, branding, advertising, and high sunk costs. Innovation weakens these barriers:

A new technology can reduce the cost advantages of large incumbents.

Innovative marketing can erode strong brand loyalty.

Online platforms have reduced sunk costs, making entry easier.

Thus, creative destruction ensures that no monopoly remains unchallenged forever.

The Dynamic Process of Competition

Dynamic efficiency is central to creative destruction.

Dynamic Efficiency: When resources are allocated efficiently over time, often achieved through innovation, R&D, and investment in human and physical capital.

Creative destruction exemplifies this, as competition is not just about current prices but about long-term improvements in quality, efficiency, and consumer choice.

Stakeholder Impacts

Consumers

Benefit from lower prices in the long run due to improved efficiency.

Gain access to better products and services through innovation.

May face short-term disruption if established products disappear.

Firms

Incumbents may lose dominance if they fail to innovate.

Successful innovators can grow rapidly, becoming new industry leaders.

R&D investment carries risk but can yield high rewards.

Workers

Creative destruction can lead to job losses in declining firms or industries.

However, new industries create employment opportunities in innovative sectors.

Skills may need to be updated to meet new demands.

The Economy

Encourages technological progress and overall economic growth.

Leads to resource reallocation from less efficient to more efficient uses.

May create periods of instability but ultimately enhances productivity.

Real-World Examples of Creative Destruction

Creative destruction is the process by which new innovations displace older technologies and firms, reallocating resources towards higher-value uses.

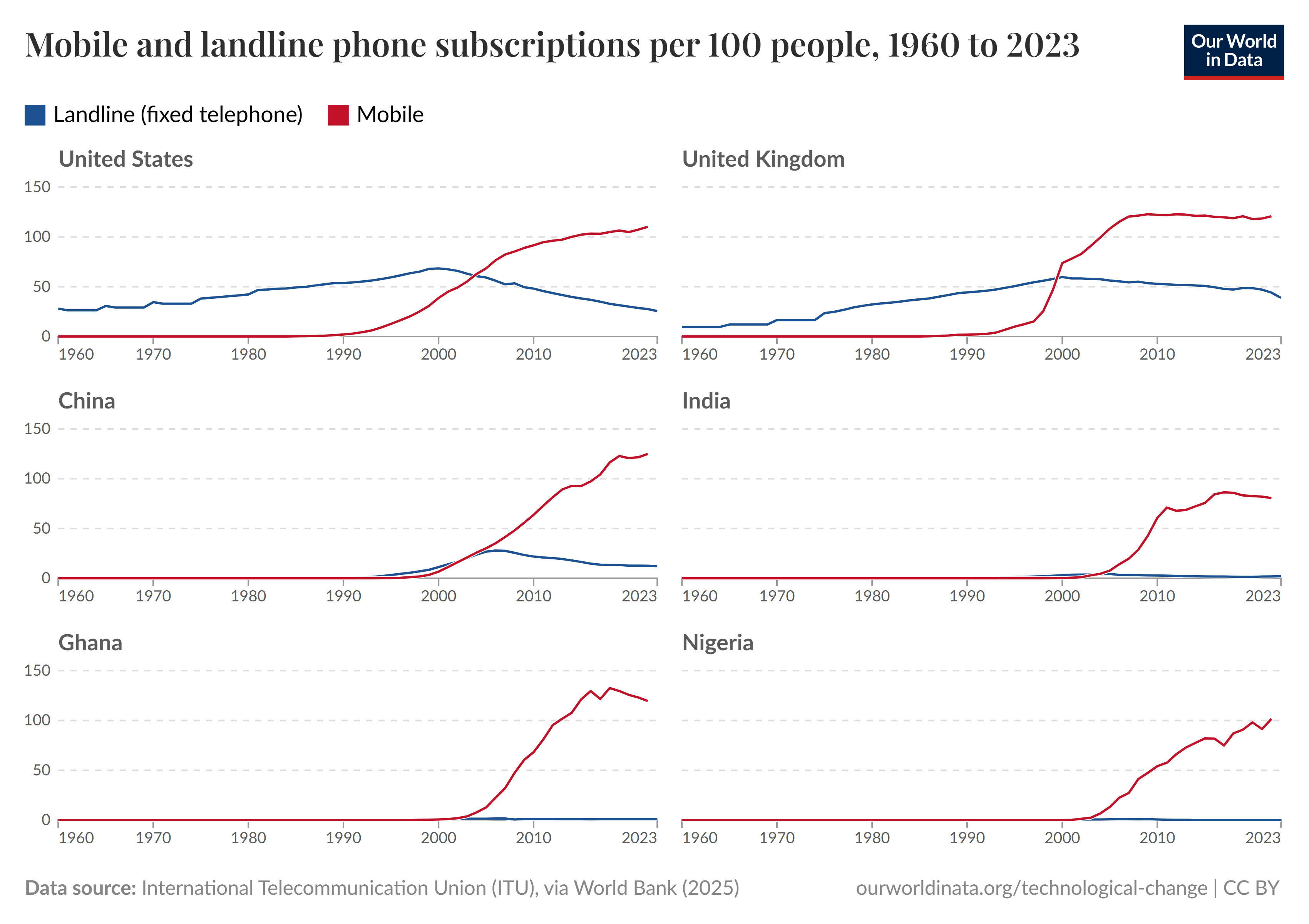

Global adoption of mobile telephony rose rapidly while landline subscriptions declined, exemplifying new-for-old replacement. This pattern captures the dynamic competitive process emphasised in AQA 5.8.3. The chart provides a concise empirical picture of technological succession. Source

Telecommunications: Landline operators lost ground as mobile technology advanced.

Retail: High-street shops faced decline due to e-commerce platforms.

Transport: Ride-hailing apps disrupted traditional taxi industries.

Energy: Renewable technologies challenge fossil fuel industries.

In each case, monopoly power and profits attracted new entrants who innovated, reshaping markets.

The Role of Policy and Regulation

Government policy can influence the pace of creative destruction:

Competition policy prevents monopolies from stifling innovation.

Intellectual property rights protect innovators but may also delay new entrants.

Industrial policy can encourage R&D through subsidies or tax incentives.

Balancing protection of innovation with promotion of competition is essential.

Evaluation of Creative Destruction

Creative destruction is not universally positive. While it drives efficiency and innovation, it can also produce short-term inefficiencies and social costs:

Workers in disrupted industries face unemployment.

Consumers may experience uncertainty during transitions.

Regional economies reliant on a single industry may suffer.

Nonetheless, in the long term, the process ensures that economies remain dynamic and responsive to technological change.

FAQ

Entrepreneurship is central to creative destruction because entrepreneurs identify opportunities to introduce new products, processes, or business models that disrupt existing markets.

By challenging incumbents, entrepreneurs can break down established monopolies and encourage competition. This entrepreneurial drive often leads to faster innovation and greater efficiency in the economy.

In the short run, creative destruction may cause job losses in declining industries. Workers may struggle to adapt if their skills are industry-specific.

Over the long term, however, new sectors emerge that create alternative employment opportunities. Economic growth often results in higher demand for skilled labour, particularly in innovative and technology-driven industries.

Research and development (R&D) provides the foundation for creative destruction by enabling firms to develop innovations that challenge incumbents.

Process innovations lower production costs.

Product innovations increase consumer choice and demand.

Technological breakthroughs reshape industries altogether.

Without R&D, the competitive cycle of displacement and renewal slows down significantly.

Consumers adapt quickly to new technologies or services that improve quality, convenience, or price. This willingness to adopt new products accelerates creative destruction.

Brand loyalty can delay the process, but once consumers perceive strong advantages in a new product, adoption spreads rapidly, undermining older technologies or firms.

If creative destruction is hindered, inefficient firms may dominate markets for longer periods, reducing incentives for innovation.

This can lead to:

Higher consumer prices.

Lower product quality and fewer choices.

Slower economic growth and productivity gains.

Barriers such as excessive regulation or anti-competitive practices often contribute to this problem.

Practice Questions

Define the term creative destruction in the context of market structures. (2 marks)

1 mark for recognising that creative destruction involves innovation leading to the decline of existing firms, products, or industries.

1 mark for identifying that it results in the emergence of new, more efficient firms or industries.

Explain how the existence of supernormal profits in monopoly markets can act as an incentive for creative destruction. (6 marks)

1 mark for stating that monopolies can earn supernormal profits due to barriers to entry.

1 mark for recognising that these profits act as a signal to potential new entrants.

1 mark for identifying that new entrants may innovate to overcome barriers such as branding, patents, or economies of scale.

1 mark for explaining that innovation may occur through product, process, or technological change.

1 mark for noting that incumbents may be forced to invest in R&D to maintain market power.

1 mark for clear application to creative destruction — innovation drives the replacement of older firms/technologies by new, more efficient ones.