AQA Specification focus:

‘The significance of market contestability for the performance of an industry.’

Introduction

Market contestability explains how the threat of entry into a market affects firm behaviour, efficiency, and consumer welfare, even when few firms actually operate.

Understanding Market Contestability

Definition of Contestable Markets

Contestable Market: A market in which entry and exit are easy and costless, meaning firms face the constant threat of potential competition that disciplines their behaviour.

A contestable market does not require a large number of competitors. Instead, what matters is that barriers to entry and exit are low enough to allow new firms to challenge incumbents if they attempt to exploit monopoly power.

Key Characteristics of Contestable Markets

Freedom of entry and exit — firms can move in and out of the market without significant restrictions.

Low or no sunk costs — investment is recoverable, allowing firms to exit without heavy losses.

Access to technology and resources — potential entrants must be able to replicate production techniques of incumbents.

Absence of predatory behaviour — incumbent firms cannot engage in anti-competitive practices that prevent new entry.

Sunk Costs: Irrecoverable costs that cannot be recovered once incurred, such as advertising expenditure or specialised capital investment.

When sunk costs are low, hit-and-run entry becomes feasible: new firms can enter the market, undercut incumbents, make profits, and exit if conditions worsen.

Market Performance under Contestability

Efficiency Outcomes

In highly contestable markets, incumbent firms behave as if competition is strong, even with only a few producers:

Allocative efficiency is more likely, as firms avoid charging prices above marginal cost to deter entry.

Productive efficiency improves, since firms minimise average total costs to stay competitive.

Dynamic efficiency is encouraged because firms must innovate to maintain customer loyalty against possible entrants.

Pricing and Output Decisions

Firms are less likely to exploit monopoly power since high prices invite new entry.

Prices may align closely with average cost, ensuring normal profits rather than sustained supernormal profits.

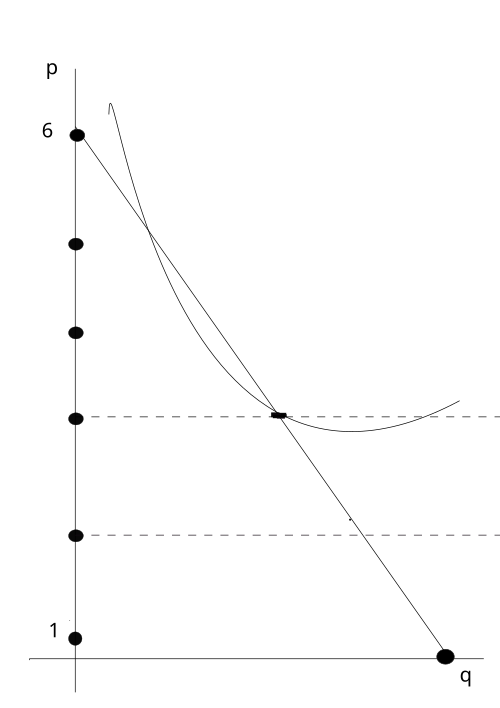

A diagram of contestable market equilibrium comparing cases where unit cost is above or below the competitive price. It shows how entry threats discipline prices and profits. Source

Output levels are set to maintain efficiency and discourage new firms from attempting to capture the market.

The Role of Barriers to Entry

Barriers to entry play a central role in determining contestability:

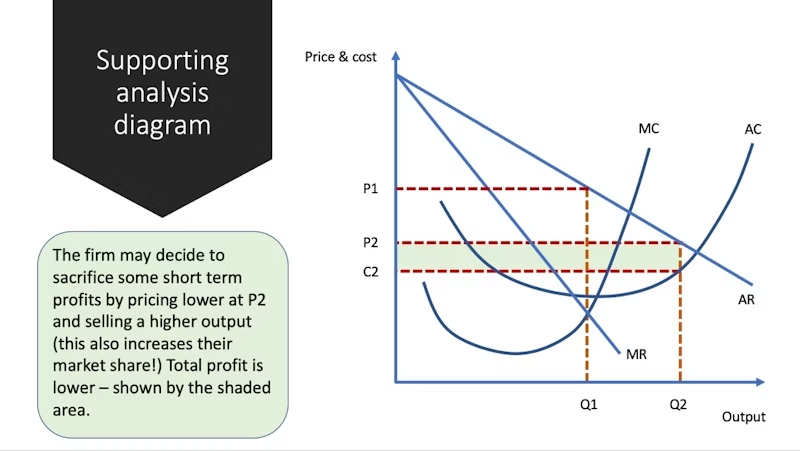

A cost–revenue diagram illustrating limit pricing, where incumbents set price below the profit-maximising level to deter entry. It highlights how entry threats shape firm behaviour. Source

Legal barriers (e.g., patents, licences).

Structural barriers (e.g., high fixed costs in capital-intensive industries).

Strategic barriers (e.g., predatory pricing, limit pricing).

Limit Pricing: A strategy where incumbent firms set prices low enough to deter entry by making the market appear unprofitable for potential rivals.

Industries with strong barriers are less contestable, meaning incumbents enjoy greater monopoly power. By contrast, industries with weak barriers see stronger discipline on firms, even if concentration is high.

Industry Performance and Contestability

Improved Consumer Welfare

Contestable markets often produce outcomes similar to perfectly competitive markets, even if they are oligopolistic in structure:

Lower prices due to the constant threat of new entry.

Greater efficiency as firms avoid wasteful practices.

Innovation incentives because firms must improve quality and differentiate products to retain customers.

Risks and Limitations

If barriers exist, contestability weakens, and incumbents can exploit monopoly power.

In industries with high sunk costs (e.g., airlines, pharmaceuticals), contestability is often limited despite multiple firms.

Potential entrants may still face imperfect information, reducing the effectiveness of the contestability discipline.

Evaluating the Significance of Contestability

Advantages

Ensures firms operate efficiently without requiring a large number of competitors.

Provides a framework for assessing markets beyond traditional concentration ratios.

Encourages policymakers to focus on reducing barriers to entry rather than simply increasing the number of firms.

Disadvantages

Rarely do markets achieve perfect contestability in practice.

Strategic behaviour by incumbents can reduce contestability even if legal barriers are low.

The model assumes rational behaviour, which may not always reflect real-world complexities.

Application to Real-World Industries

Airlines

Airlines often illustrate contestability debates. While there are multiple carriers, sunk costs in the form of aircraft and airport slots reduce true contestability. However, deregulation has increased competition, forcing lower prices and better service.

Telecommunications

Markets such as broadband provision may appear oligopolistic but can still be contestable if technological advances and low switching costs make entry feasible.

Measuring Contestability and Performance

Economists assess contestability by analysing:

Sunk costs as a percentage of total costs.

Market turnover (entry and exit rates of firms).

Profit levels relative to costs — persistent supernormal profits suggest low contestability.

Consumer outcomes such as prices, quality, and innovation levels.

Hit-and-Run Competition: A form of entry where firms exploit temporarily high profits, enter the market, and exit quickly once conditions turn less favourable.

This type of behaviour illustrates how even the threat of entry influences incumbents’ decisions and ensures industries remain disciplined.

FAQ

Regulation can reduce barriers to entry by dismantling monopolistic structures, removing restrictive licences, or preventing anti-competitive practices.

For example, deregulation in industries like airlines and telecommunications has allowed new entrants to challenge established firms. Regulators may also enforce transparency rules, such as requiring incumbents to share infrastructure access, making entry more feasible.

Hit-and-run competition means firms may enter a market temporarily, exploit profits, and exit once conditions worsen.

To avoid this, incumbents may:

Set prices close to average costs.

Maintain spare capacity to respond quickly to rivals.

Invest in customer loyalty schemes to reduce switching.

This behaviour demonstrates how contestability disciplines firms, even without continuous new entry.

Advertising often creates brand loyalty, which acts as a barrier to entry. Even if entry is technically possible, consumers may remain loyal to established brands.

In markets such as soft drinks, high advertising expenditure makes it difficult for new entrants to capture market share, effectively raising sunk costs and lowering contestability.

Yes, contestability is not determined by the number of firms but by the ease of entry and exit.

If barriers are low and sunk costs minimal, even a monopoly may behave competitively because of the threat of potential entrants. This explains why structure alone does not always indicate performance.

Policymakers can encourage contestability by:

Subsidising entry costs or reducing capital requirements.

Enforcing policies to separate ownership of key infrastructure from service provision.

Encouraging innovation grants that allow new firms to overcome high initial costs.

These measures aim to lower effective barriers and ensure industries remain disciplined by the possibility of new competition.

Practice Questions

Define a contestable market. (2 marks)

1 mark for stating that a contestable market is one where entry and exit are easy or costless.

1 mark for recognising that firms face the threat of potential competition which disciplines their behaviour.

Explain how the level of sunk costs affects the contestability of a market. (6 marks)

Up to 2 marks for identifying sunk costs as costs that cannot be recovered once incurred (e.g., advertising expenditure, specialised capital equipment).

Up to 2 marks for explaining that low sunk costs make entry and exit easier, increasing contestability.

Up to 2 marks for analysis that high sunk costs act as a barrier to entry, reducing the ability of new firms to compete, thereby lowering contestability.

Maximum 6 marks in total: award marks for clarity and accuracy of explanation, not repetition.