AQA Specification focus:

‘Inadequate information, conflicting objectives and administrative costs are possible sources of government failure.’

Introduction

Government intervention aims to correct market failure, but imperfect processes can create inefficiencies themselves. Understanding sources of government failure is crucial to evaluating intervention effectiveness.

Inadequate Information

Governments often lack the same detailed knowledge as market participants. This creates a risk of misjudging the scale, type, or timing of intervention.

Information Gaps

Incomplete data: Governments may not have full information about costs, benefits, or consumer preferences.

Forecasting difficulties: Predicting future market behaviour, inflation, or unemployment can be highly uncertain.

Asymmetric information: Governments may rely on data provided by interest groups, leading to bias.

Asymmetric Information: A situation where one party in an economic transaction possesses more or better information than the other.

This makes it challenging to implement policies that improve welfare. For example, subsidies for renewable energy may be set too high if the government overestimates production costs.

Consequences of Inadequate Information

Misallocation of resources due to inappropriate policies.

Higher risk of over-subsidisation or over-taxation.

Creation of inefficiencies that may worsen the original problem.

Conflicting Objectives

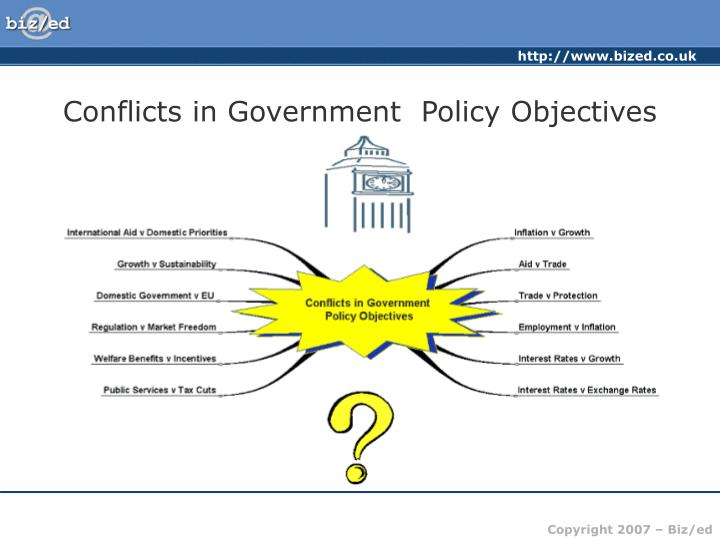

Governments pursue multiple goals, which can clash, leading to policy inconsistency.

This diagram depicts various policy objectives and the potential conflicts between them, such as balancing economic growth with environmental sustainability. It highlights the challenges governments face in aligning diverse goals, leading to policy inconsistencies and potential inefficiencies. Source

Examples of Conflicts

Economic growth vs environmental protection: Promoting industrial expansion may increase pollution, conflicting with climate targets.

Inflation control vs unemployment reduction: Reducing inflation through tighter monetary policy may increase unemployment.

Equity vs efficiency: Redistributive policies, such as progressive taxation, may reduce incentives for investment and work.

Policy Trade-off: A situation where achieving one economic objective reduces the ability to achieve another.

Short-Term vs Long-Term Objectives

Governments may prioritise short-term political gains over long-term economic stability. For instance, cutting taxes before an election can boost popularity but worsen public debt.

Consequences of Conflicting Objectives

Policy reversals that create uncertainty for businesses and households.

Loss of credibility when targets are repeatedly missed.

Failure to solve underlying market failures effectively.

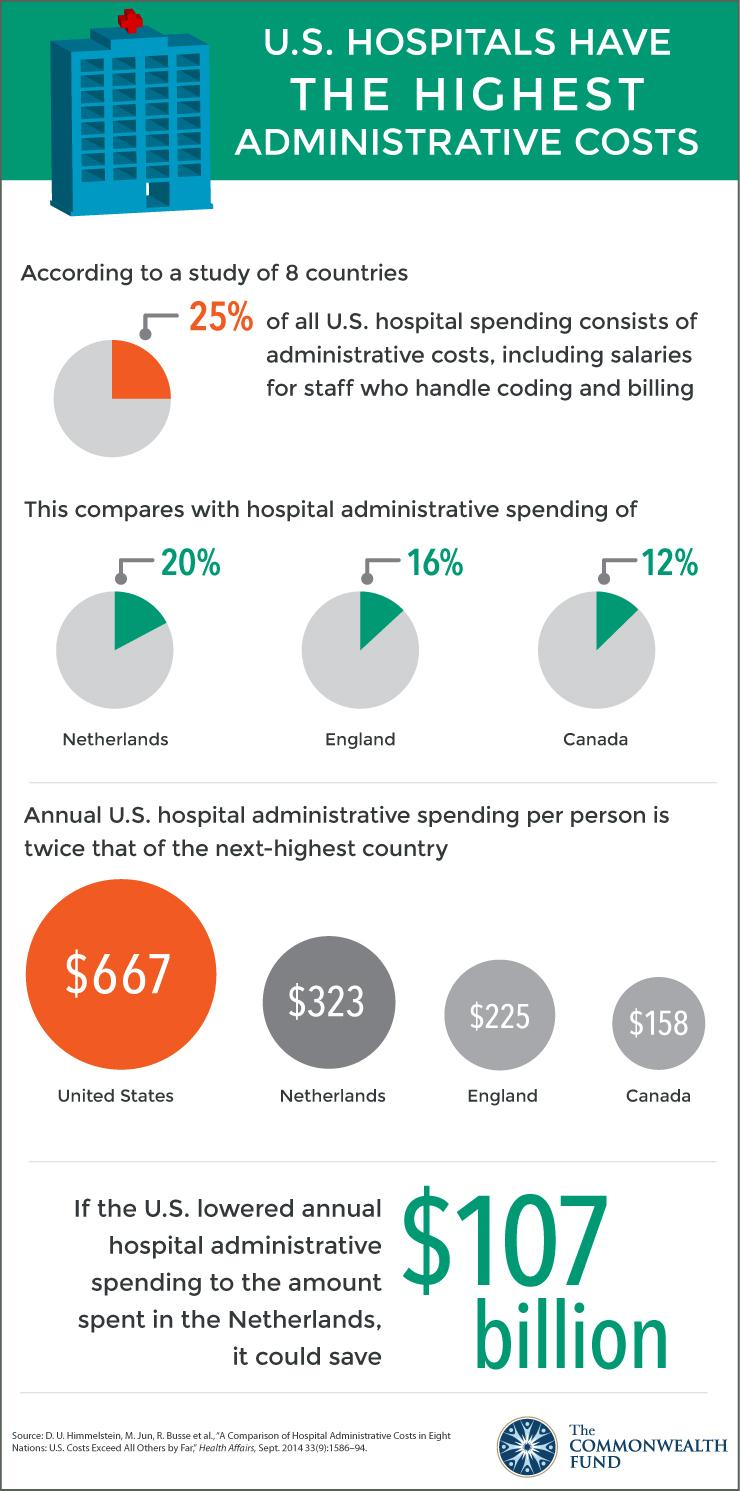

Administrative Costs

Implementing and enforcing government intervention requires significant bureaucratic resources.

This infographic compares administrative costs in U.S. hospitals to those in other high-income countries, highlighting the substantial bureaucratic expenses involved. It emphasizes the opportunity costs of such expenditures, which could otherwise be allocated to direct healthcare services. Source

Types of Administrative Costs

Monitoring: Ensuring firms comply with regulations, such as pollution limits.

Enforcement: Applying penalties or legal actions against violators.

Operational expenses: Running public bodies that deliver services, such as healthcare or education.

Administrative Costs: The expenses incurred by the government in designing, implementing, and monitoring policies and regulations.

For example, setting up a system of pollution permits involves designing trading rules, allocating permits, and monitoring emissions. These costs may outweigh the benefits if poorly managed.

Opportunity Costs

Money spent on administration could instead fund public goods, healthcare, or education. High administrative costs therefore risk worsening resource allocation.

Consequences of High Costs

Reduced effectiveness of policies if costs absorb most benefits.

Lower taxpayer confidence in government spending.

Possibility of inefficiency comparable to or worse than the original market failure.

Interaction of Sources

These sources often interact, compounding the risk of government failure.

Combined Effects

Inadequate information can magnify costs, as policies require frequent adjustment.

Conflicting objectives may increase bureaucracy, raising administrative costs further.

High costs and poor information together may generate distortions that reduce overall welfare.

Key Risks

Unintended consequences: Policies create new inefficiencies, such as black markets or overregulation.

Misallocation of resources: The very problem interventions aim to solve may be reproduced at the government level.

FAQ

Dynamic markets, such as technology or energy, change rapidly. Governments often base decisions on outdated or incomplete data, leading to poorly targeted policies.

This lag between policy design and market changes increases the risk of inefficiency. For example, subsidies for technologies that quickly become obsolete waste resources and may lock in inefficiency.

Governments often prioritise short-term electoral goals over long-term welfare. For instance, tax cuts or spending increases may be used to gain popularity before elections.

This can conflict with objectives such as debt reduction or sustainable investment, as policies are reversed after elections, creating uncertainty for firms and households.

Administrative costs are not limited to visible spending on regulators or enforcement agencies. Hidden costs include:

Time spent by firms on compliance paperwork.

Opportunity costs when resources are diverted from other projects.

Delays in decision-making due to bureaucracy.

These indirect costs can be as significant as direct government spending.

Yes. Governments may lack reliable data on international trade flows, cross-border capital movement, or global supply chains.

Without accurate international information, policies may be ineffective. For example, tariffs imposed to protect domestic industries may fail if governments underestimate global substitution effects.

High administrative costs signal inefficiency to taxpayers. If citizens perceive that more money is spent on bureaucracy than on services, trust in government weakens.

This mistrust can reduce public support for future interventions, even in areas where they are necessary, making it harder to correct genuine market failures.

Practice Questions

Define administrative costs as a source of government failure. (2 marks)

1 mark for identifying that administrative costs are the expenses linked to designing, implementing, and monitoring government policies.

1 mark for recognising that these costs reduce the efficiency of intervention or divert resources from other uses.

Explain how conflicting objectives can cause government failure. Use examples to support your answer. (6 marks)

1 mark for identifying that governments often pursue multiple economic objectives simultaneously.

1 mark for noting that these objectives can conflict, creating policy inconsistency.

1 mark for explaining growth vs environment conflict (e.g. industrial expansion leading to higher pollution).

1 mark for explaining inflation vs unemployment conflict (e.g. tighter monetary policy controlling inflation but raising unemployment).

1 mark for explaining equity vs efficiency conflict (e.g. progressive taxation reducing incentives to work or invest).

1 mark for overall application/example linked to government failure, showing how conflicting objectives may prevent effective correction of market failure.