AQA Specification focus:

‘Governments may create, rather than remove, market distortions. Government intervention can lead to unintended consequences.’

Government intervention is often intended to correct market failures, yet policies may distort resource allocation, create inefficiencies, and generate unintended consequences that undermine overall economic welfare.

Understanding Distortions

What Are Distortions?

Distortions occur when government policies change market incentives in ways that misallocate resources or reduce efficiency. Instead of correcting a failure, the intervention worsens outcomes.

Distortion: An economic outcome where resource allocation is altered away from efficiency due to government policies, leading to reduced welfare or unintended inefficiencies.

Examples include price controls, subsidies, or regulations that create artificial incentives, often resulting in deadweight loss and inefficiency.

Unintended Consequences

Unintended consequences are outcomes of intervention that policymakers did not foresee. They often arise due to information gaps, behavioural responses, or complexity in economic systems.

Unintended Consequences: Secondary or unforeseen effects of government action that occur alongside, or instead of, the intended policy objective.

Such consequences may include black markets, regulatory evasion, or worsening inequality.

Distortions from Price Controls

Minimum Prices

A minimum price (e.g. agricultural price floors) set above equilibrium can lead to:

Excess supply and government purchase of surpluses.

Waste of resources when goods are destroyed or unused.

Smuggling or black markets if producers sell below the floor illegally.

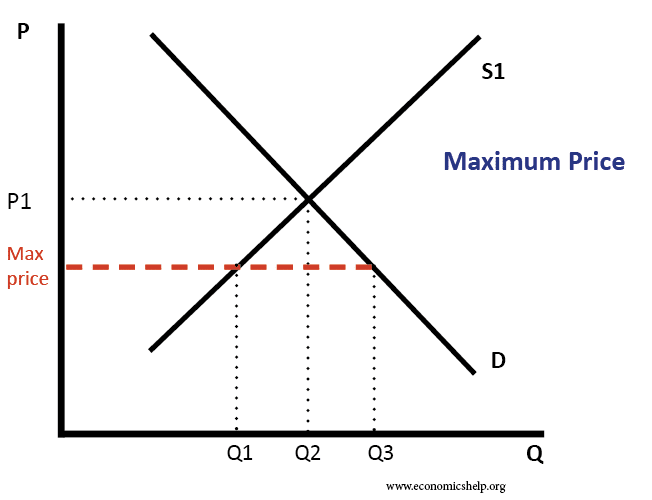

Maximum Prices

A maximum price (e.g. rent controls) set below equilibrium may cause:

Shortages as demand exceeds supply.

Quality reduction since producers lack incentive to maintain standards.

Black markets where higher unofficial prices are charged.

These distortions highlight how well-meaning policies may worsen scarcity or inefficiency.

This diagram shows the impact of a price ceiling below the market equilibrium price, leading to a shortage where quantity demanded exceeds quantity supplied. Such distortions can result in inefficiencies and unintended consequences in the market. Source

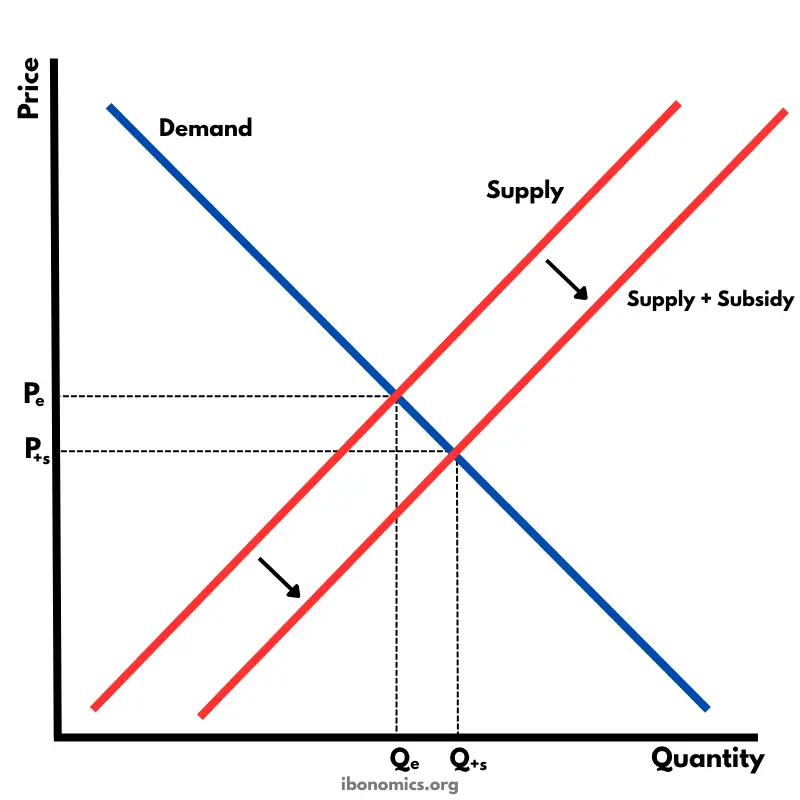

Subsidies and Unintended Effects

Overproduction Risks

Subsidies encourage production by lowering costs, but they may:

Create overproduction, leading to surplus disposal problems.

Encourage firms to remain in inefficient industries.

Distort comparative advantage in international trade.

The diagram illustrates how a subsidy shifts the supply curve downward, reducing prices for consumers and increasing quantity supplied, potentially leading to overproduction and inefficiency in resource allocation. Source

Environmental Impacts

Energy or fuel subsidies can lead to over-consumption of fossil fuels, exacerbating negative externalities such as pollution.

Agricultural subsidies may encourage intensive farming, harming biodiversity.

Taxation and Market Distortions

Indirect Taxes

While taxes can correct negative externalities, they may distort incentives:

High sin taxes (e.g. on alcohol or tobacco) may fuel illegal markets.

Firms may engage in tax avoidance or evasion.

Taxes can disproportionately affect lower-income groups, worsening inequality.

Deadweight Loss (DWL) = ½ × (Tax per unit) × (Reduction in quantity traded)

Tax per unit = Difference between consumer and producer price due to tax

Reduction in quantity traded = Fall in output after tax is applied

Deadweight loss illustrates how taxation can reduce overall welfare despite raising revenue.

Regulation and Compliance Problems

Overregulation

Excessive or poorly designed regulation can:

Increase administrative costs for firms.

Discourage entrepreneurship and innovation.

Drive small businesses out of the market.

Regulatory Evasion

Stricter rules may incentivise firms to find loopholes or operate informally.

Regulatory capture may occur, where regulators favour industry interests, distorting outcomes further.

Trade Policies and Global Distortions

Protectionism

Tariffs, quotas, and subsidies to domestic industries may shield local firms but:

Encourage inefficient resource allocation.

Trigger retaliation and trade wars.

Harm global efficiency and consumer welfare.

Agricultural Support

Common in developed economies, such support often leads to:

Dumping of surplus goods in poorer countries.

Disruption of local farmers’ livelihoods.

Labour Market Interventions

Minimum Wages

While raising incomes, minimum wages may create:

Unemployment if firms reduce hiring due to higher labour costs.

Growth of informal labour markets with poor working conditions.

Employment Protection Laws

Strong protections can reduce labour flexibility, leading firms to:

Avoid permanent contracts.

Increase temporary or informal work, reducing job security.

Environmental Policies

Green Taxes and Permits

Carbon taxes and pollution permits aim to reduce emissions, but:

Firms may relocate abroad, causing carbon leakage.

Permit systems may be manipulated, with firms hoarding allowances.

Renewable Energy Subsidies

While promoting clean energy, subsidies may:

Lead to overinvestment in inefficient technologies.

Place heavy fiscal burdens on governments.

Behavioural Distortions

Moral Hazard

Intervention can unintentionally encourage risky behaviour.

Bank bailouts create expectations of future rescue, incentivising excessive risk-taking.

Welfare support may reduce incentives to seek employment if not well-targeted.

Principal-Agent Problems

Government contracts may create misaligned incentives between policymakers (principals) and private providers (agents), leading to cost inflation or poor service delivery.

Evaluating Distortions and Consequences

Key Trade-Offs

Policymakers must balance:

Correcting market failure vs. creating new inefficiencies.

Equity goals vs. efficiency losses.

Short-term benefits vs. long-term distortions.

Importance of Information

Many distortions stem from governments lacking perfect information about demand, supply, or external costs. Poorly targeted policies amplify risks of misallocation.

By appreciating distortions and unintended consequences, students can critically assess whether intervention genuinely enhances welfare or simply replaces one inefficiency with another.

FAQ

Unintended consequences often include the emergence of black markets where goods are sold illegally at higher prices, reduced quality as producers cut corners, and long waiting lists due to shortages.

These outcomes reduce the effectiveness of the original policy by discouraging investment, lowering consumer satisfaction, and creating inefficiencies in resource allocation.

Subsidies can lock resources into inefficient industries by keeping uncompetitive firms alive. This prevents the reallocation of resources to more productive uses.

In the long term, this may:

Reduce innovation as firms rely on state support.

Distort international trade by encouraging overproduction and dumping.

Increase government expenditure and opportunity costs.

High taxes on goods such as alcohol or tobacco may push consumers towards black markets where unregulated, lower-quality substitutes are sold.

Firms may also respond by shifting production abroad or engaging in tax avoidance strategies, which undermines government revenue and reduces the policy’s intended impact on consumption.

Compliance with detailed regulations often imposes fixed costs that weigh more heavily on small firms than larger ones.

This can lead to:

Reduced market competition as small firms exit.

Increased market concentration benefiting large firms.

Reduced innovation as compliance diverts resources from research and development.

Permit trading schemes aim to reduce emissions efficiently, but unintended outcomes may include firms hoarding allowances to restrict rivals or relocating production abroad.

This may cause “carbon leakage”, where global emissions remain unchanged or even increase, undermining the effectiveness of domestic environmental policies.

Practice Questions

Define government failure and briefly explain what is meant by unintended consequences of intervention. (2 marks)

1 mark for correctly defining government failure: when government intervention leads to a misallocation of resources or a worsening of economic outcomes.

1 mark for explaining unintended consequences: unforeseen outcomes that result from intervention, such as black markets or reduced quality of goods.

Using examples, explain how price controls or subsidies may lead to distortions and unintended consequences in markets. (6 marks)

1–2 marks: Identification of a relevant policy (e.g. maximum price, minimum price, subsidy).

1–2 marks: Explanation of how the policy distorts market outcomes (e.g. shortages, surpluses, overproduction).

1–2 marks: Application of examples showing unintended consequences (e.g. black markets with rent controls, environmental harm from subsidies).

To reach the top of the band (5–6 marks), answers should include clear examples and coherent explanation of both distortion and unintended consequences.