AQA Specification focus:

‘The main objectives of government macroeconomic policy: economic growth, price stability, minimising unemployment and a stable balance of payments on current account.’

Macroeconomic policy objectives guide governments in shaping the economy’s performance. These objectives influence fiscal and monetary policies, balancing growth, stability, employment, and external equilibrium to sustain long-term economic wellbeing.

Core Macroeconomic Objectives

The four core macroeconomic objectives specified by AQA are:

Economic growth

Price stability

Minimising unemployment

Stable balance of payments on current account

Each objective contributes to overall economic stability but may generate trade-offs when pursued simultaneously.

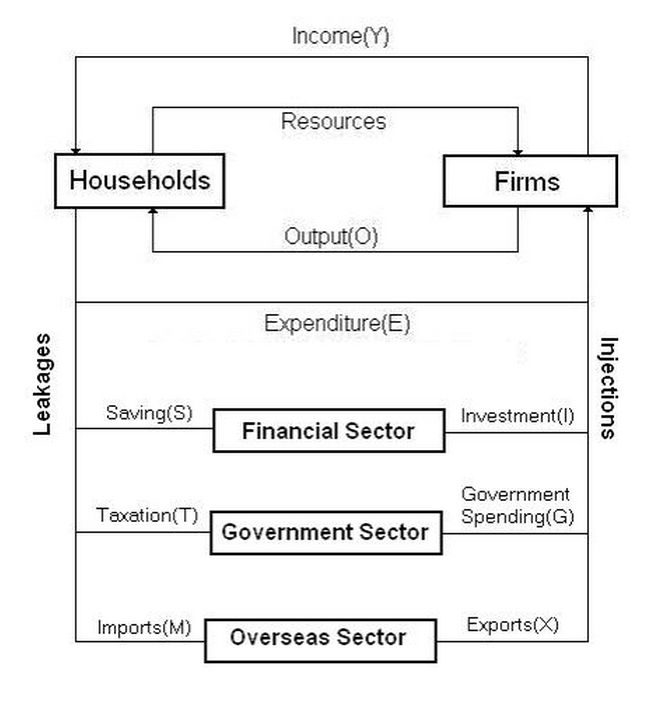

The Circular Flow of Income diagram demonstrates the movement of money and goods between different sectors of the economy, highlighting the interconnectedness essential for achieving macroeconomic objectives like economic growth and balance of payments. Source

Economic Growth

Economic growth refers to an increase in the output of goods and services within an economy, usually measured by real Gross Domestic Product (GDP).

Economic Growth: The sustained rise in real GDP over time, representing increased production and economic capacity.

Importance of Growth

Higher living standards as incomes rise.

Greater tax revenues for government spending.

Encourages investment and innovation.

Reduces relative poverty when growth is inclusive.

Limitations of Growth

Environmental degradation and depletion of natural resources.

Unequal distribution of gains across social groups.

Growth may be short-lived if based on unsustainable factors such as credit booms.

Price Stability

Price stability is a situation where the general price level rises slowly and predictably, avoiding both high inflation and deflation. The UK government sets the Bank of England an inflation target (currently 2% CPI).

Price Stability: The absence of significant inflation or deflation, where prices remain relatively stable over time.

Why Stability Matters

Protects purchasing power of households.

Reduces uncertainty, encouraging investment.

Prevents wage–price spirals.

Maintains international competitiveness if inflation aligns with trading partners.

Risks of Instability

High inflation erodes savings, reduces real wages, and destabilises the economy.

Deflation discourages spending, increases debt burdens, and risks economic stagnation.

Minimising Unemployment

Unemployment occurs when individuals who are willing and able to work cannot find jobs. High unemployment wastes labour resources and causes social problems.

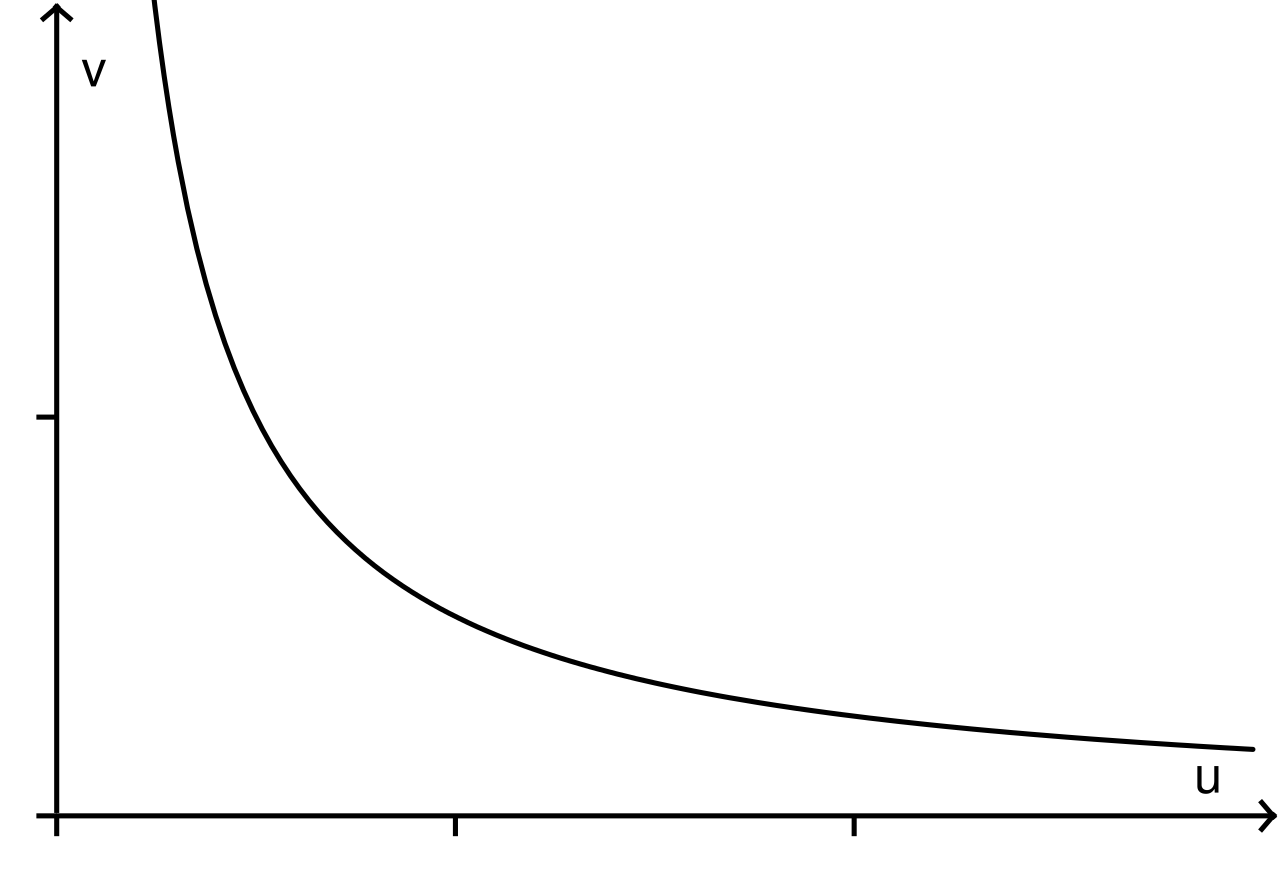

The Beveridge Curve shows the inverse relationship between the unemployment rate and the vacancy rate, reflecting the efficiency of the labour market in matching job seekers with available positions. Source

Unemployment: The situation in which those able and willing to work at the current wage rate are unable to find employment.

Benefits of Low Unemployment

Increases household incomes and consumption.

Reduces welfare expenditure.

Enhances government tax revenues.

Promotes social stability and reduces inequality.

Types of Unemployment

Frictional: Short-term, when people move between jobs.

Structural: Arising from mismatches in skills or geographic immobility.

Cyclical (demand-deficient): Linked to economic downturns.

Seasonal: Due to fluctuations in demand at different times of year.

Stable Balance of Payments on Current Account

The current account records trade in goods and services, investment income, and current transfers. A stable balance ensures the country can finance imports without excessive borrowing.

Balance of Payments on Current Account: A record of a nation’s transactions with the rest of the world in goods, services, income, and transfers.

Importance of External Stability

Prevents unsustainable reliance on foreign debt.

Maintains investor confidence.

Protects currency value from large depreciations.

Encourages long-term trade competitiveness.

Issues with Imbalances

A persistent deficit may signal low competitiveness or excessive imports.

A large surplus may create trade tensions with partners.

Interconnectedness of Objectives

Governments rarely pursue one objective in isolation. Policies designed to achieve one goal often affect others, producing both complementarities and conflicts. For example:

Strong economic growth can reduce unemployment, but may create inflationary pressure.

Policies to reduce inflation through higher interest rates may slow growth and raise unemployment.

Efforts to reduce a current account deficit via currency depreciation may temporarily raise inflation through more expensive imports.

Role of Policy in Balancing Objectives

To pursue these objectives, governments use:

Fiscal policy: Changes in government spending and taxation.

Monetary policy: Control of interest rates and money supply by the central bank.

Supply-side policies: Reforms to enhance productivity and competitiveness.

Each policy must be carefully balanced to address short-term fluctuations without jeopardising long-term stability.

FAQ

Economic growth involves increasing the productive capacity of the economy over time. This requires investment in capital, technology, and human skills, which take years to develop.

Short-term boosts in demand can temporarily raise output, but sustainable growth depends on structural improvements that enhance efficiency and productivity.

If domestic inflation is higher than that of trading partners, exports become relatively more expensive, reducing competitiveness abroad.

Conversely, low and stable inflation helps maintain export competitiveness and avoids pressure on the exchange rate.

Flexible labour markets make it easier for workers to move between jobs and for firms to adjust employment.

Examples of flexibility include:

Retraining schemes to address skill mismatches.

Reduced barriers to hiring and firing.

Geographic mobility through affordable housing and transport.

A deficit may be acceptable if it reflects high levels of investment that support future growth.

Short-term deficits can also occur when economies grow strongly, increasing imports. As long as deficits are financed sustainably, they may not be immediately harmful.

Yes, some objectives reinforce each other. For instance:

Strong economic growth can reduce unemployment as firms demand more labour.

Low unemployment raises incomes, which can support tax revenues and help maintain a balanced external account.

Complementarity is most likely when growth is sustainable, inflation remains controlled, and trade is balanced.

Practice Questions

Define economic growth and explain how it is usually measured in an economy. (2 marks)

1 mark for definition: a sustained increase in the output of goods and services over time (accept reference to real GDP).

1 mark for measurement: identified as real GDP or real GDP per capita.

Explain two possible conflicts that may arise when a government pursues the main macroeconomic objectives simultaneously. (6 marks)

Up to 2 marks for each conflict correctly identified (maximum of 2 conflicts). Examples include:

Economic growth vs price stability (growth can fuel inflation).

Low unemployment vs price stability (low unemployment can create wage–push inflation).

Economic growth vs balance of payments stability (growth may increase import demand, worsening the current account).

Up to 2 marks for explanation of each conflict (how or why the objectives clash).

Maximum 6 marks: 2 for identification + 4 for explanation.