AQA Specification focus:

‘Students should be aware that governments may also have other objectives of macroeconomic policy, such as balancing the budget and achieving an equitable distribution of income.’

Governments pursue macroeconomic goals beyond growth, inflation, unemployment, and the balance of payments. Two significant additional objectives are achieving a budget balance and promoting equity in income distribution. These aims reflect wider political, social, and fiscal priorities, and their relative importance may shift depending on economic circumstances.

Budget Balance

What is the Budget Balance?

The budget balance refers to the difference between government revenue (mainly taxation) and government expenditure (spending on goods, services, and transfers).

Budget Balance: The gap between government revenue and government expenditure in a given financial year.

When revenue equals expenditure, the government has a balanced budget. Deviations from this position can lead to:

Budget deficit: expenditure exceeds revenue.

Budget surplus: revenue exceeds expenditure.

A balanced budget is often cited as an objective to promote fiscal sustainability and limit the burden of debt on future generations.

Reasons for Targeting a Balanced Budget

Governments may pursue budget balance for several reasons:

To reduce long-term debt levels and interest payments.

To improve investor confidence in government bonds and fiscal discipline.

To ensure intergenerational fairness by avoiding passing debt burdens onto future taxpayers.

Cyclical vs Structural Factors

Budget outcomes are shaped by both cyclical and structural influences:

Cyclical budget position: affected by the state of the economic cycle. During recessions, revenues fall (e.g., lower income tax receipts), while spending rises (e.g., unemployment benefits), often creating a deficit.

Structural budget position: reflects underlying policies and spending commitments that persist regardless of the cycle, such as pensions or defence spending.

Policy Implications of Pursuing Balance

Efforts to achieve budget balance can involve:

Fiscal consolidation (austerity): cutting government spending or raising taxes.

Fiscal rules: legally binding commitments, e.g., limiting borrowing to investment spending only.

Medium-term targets: reducing deficits gradually to avoid economic disruption.

However, strict pursuit of budget balance may conflict with other macroeconomic objectives. For example, cutting spending in a recession could deepen unemployment and slow growth.

Equity

Understanding Equity

Equity in economics relates to fairness in the distribution of income and wealth. Unlike efficiency, which maximises output, equity considers how resources are shared across society.

Equity: The principle of fairness in the distribution of income and wealth within an economy.

There are two main forms of equity:

Horizontal equity: people in similar circumstances should be treated equally.

Vertical equity: people with higher incomes or wealth should contribute proportionately more to society, often through progressive taxation.

Why Governments Target Equity

Governments may aim for equity as part of macroeconomic policy for reasons including:

Reducing relative poverty and social exclusion.

Enhancing social cohesion and political stability.

Promoting equality of opportunity, e.g., through access to healthcare and education.

Correcting market outcomes that lead to excessive inequality.

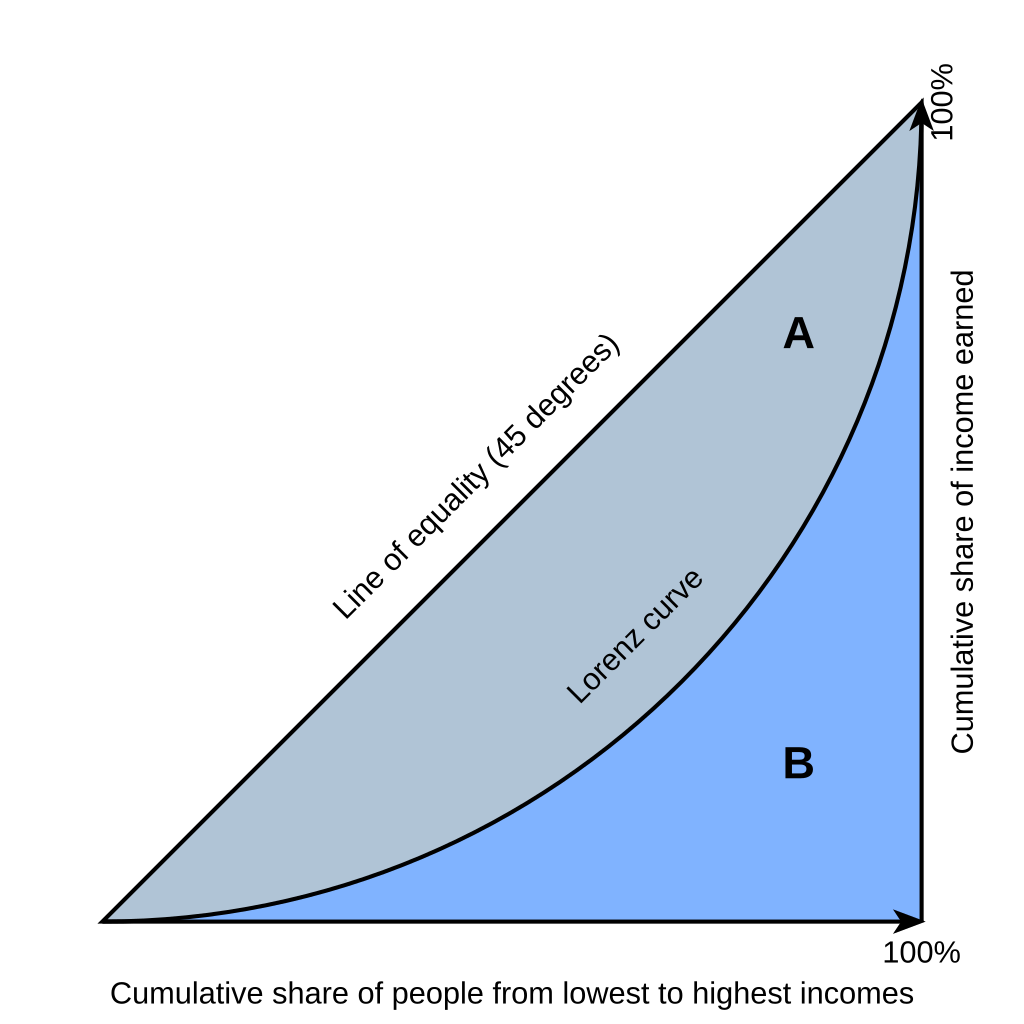

The Lorenz curve illustrates the cumulative distribution of income, with the Gini coefficient quantifying the area between the curve and the line of perfect equality, serving as a measure of income inequality within an economy. Source

Policies to Achieve Equity

Governments can use a range of measures:

Taxation: progressive income taxes place a higher burden on wealthier individuals.

Transfer payments: unemployment benefits, pensions, and subsidies to support low-income households.

Public services: free or subsidised education and healthcare improve equality of opportunity.

Minimum wage laws: ensure a basic standard of income for workers.

Potential Conflicts and Trade-offs

Equity can conflict with efficiency:

Higher taxation may discourage work effort or investment.

Generous benefits might reduce incentives to work.

However, reducing inequality can also boost economic performance by fostering demand and stability.

Interrelationship between Budget Balance and Equity

Complementary Goals

In some cases, equity and budget balance can align:

Progressive taxation raises revenue while redistributing income.

Efficient public spending on health and education can improve productivity and reduce long-term welfare dependency.

Conflicting Goals

In other cases, tension arises:

Fiscal austerity aimed at budget balance may disproportionately affect lower-income groups, reducing equity.

Redistributive policies (e.g., higher welfare spending) may increase budget deficits unless financed by higher taxes.

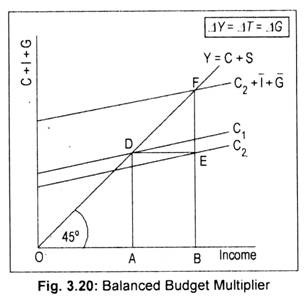

The diagram demonstrates the balanced budget multiplier, where an equal increase in government spending and taxation can lead to a net increase in national income, illustrating the potential for fiscal policy to influence economic activity even when the budget is balanced. Source

Political Priorities

The balance between budget discipline and equity depends on political ideology and economic context:

Conservative approaches often stress budget balance, fiscal prudence, and limited redistribution.

Progressive approaches emphasise equity, even if this requires higher spending and temporary deficits.

Conclusion within Specification Context

The AQA specification emphasises that alongside core macroeconomic aims, governments may also pursue budget balance and equity. These objectives highlight the broader scope of macroeconomic policy and illustrate how governments balance fiscal discipline with social fairness.

FAQ

Governments may prioritise equity in times of rising inequality or social unrest. Ensuring fairness can help maintain political stability and public trust.

For example, during recessions or crises, governments may expand welfare programmes or subsidies even if it worsens the budget deficit. The social and economic benefits of reducing hardship may outweigh the costs of fiscal imbalance.

Automatic stabilisers, such as progressive taxation and welfare benefits, operate without new government decisions.

In a downturn, tax revenues fall and welfare spending rises, worsening the budget balance but protecting low-income households (equity).

In a boom, tax revenues increase and benefit claims fall, improving the budget balance while reducing reliance on transfers.

Political ideology strongly shapes macroeconomic priorities.

Right-leaning governments often stress budget discipline, low taxation, and limited redistribution.

Left-leaning governments may tolerate higher deficits to support equity through welfare and public services.

Shifts in electoral cycles or public opinion can cause changes in emphasis between the two objectives.

Governments rely on investor confidence to borrow affordably. If deficits are high, investors may demand higher interest rates.

This pressure can push governments towards fiscal consolidation even if it reduces equity. Conversely, if investor confidence is strong, governments may feel more able to finance redistributive policies without immediate pressure to balance the budget.

Ignoring budget balance to prioritise equity can create risks such as:

Rising national debt and higher future interest payments.

Reduced fiscal space for investment in infrastructure or education.

Potential inflationary pressures if financed through borrowing.

Over time, these risks may undermine both economic stability and the sustainability of redistributive policies.

Practice Questions

Define what is meant by the budget balance in government finances. (2 marks)

1 mark for identifying that it is the difference between government revenue and expenditure.

1 mark for specifying that a balanced budget occurs when revenue equals expenditure.

Explain two possible conflicts between achieving budget balance and achieving equity in income distribution. (6 marks)

Up to 3 marks for each conflict explained (2 conflicts required).

1 mark for identifying a conflict (e.g., austerity measures reduce equity).

1 mark for explaining the mechanism (e.g., cuts to welfare disproportionately affect lower-income households).

1 mark for analysis of the impact (e.g., reduced equity may increase social inequality and poverty).

Repeat structure for second conflict (e.g., redistributive policies increase deficits, requiring higher taxes or borrowing).