AP Syllabus focus:

‘Fiscal policy includes actions by Congress and the president to influence economic conditions, including Keynesian and supply-side positions.’

Fiscal policy is a core economic tool of US national government. Understanding who controls it, how it moves through institutions, and what competing theories prioritise helps explain debates over growth, inflation, unemployment, and deficits.

What Fiscal Policy Is and Who Makes It

Fiscal policy: The use of government spending and taxation by Congress and the president to influence overall economic conditions.

In the United States, fiscal policy is primarily made through laws that change tax rates, spending levels, and budget priorities. The Constitution gives Congress the “power of the purse,” but the president is a central agenda-setter and negotiator.

Congress’s Fiscal Powers

Congress shapes fiscal policy through:

Tax legislation (House-originated revenue bills, committee work, final passage in both chambers)

Spending legislation

Authorisation laws create/continue programmes and set goals

Appropriations laws provide actual funding for agencies and programmes

Budget resolutions that establish overall spending and revenue targets (not signed by the president)

Votes on major fiscal constraints, including the debt limit (statutory cap on total federal borrowing)

The President’s Fiscal Powers

The president influences fiscal policy by:

Proposing a national budget (through the Office of Management and Budget, OMB)

Using the State of the Union and bargaining to set priorities

Signing or vetoing tax and spending bills; veto threats often shape final terms

Directing executive agencies on implementation once funds are appropriated

How Fiscal Policy Moves Through the Budget Process

Fiscal policy outcomes reflect institutional competition and compromise:

The president submits a budget request that signals priorities.

Congressional budget committees propose a budget resolution that sets topline targets.

Authorisation and appropriations committees draft legislation within those targets.

Party leadership and key actors (committee chairs, the Speaker, Senate leaders, the president) negotiate trade-offs, especially when government funding deadlines approach.

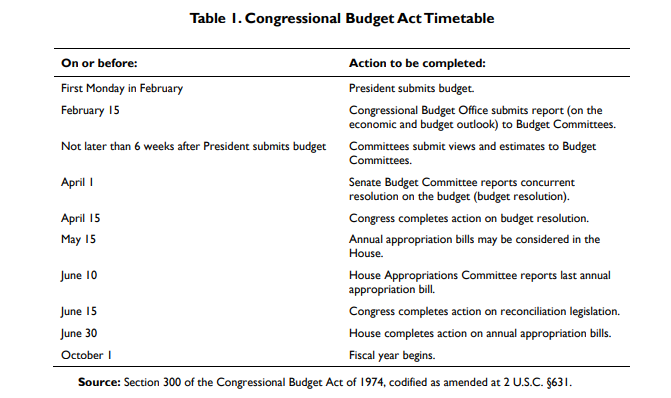

This Congressional Research Service timeline/table summarizes the intended sequence of key federal budget steps (president’s budget submission, congressional budget resolution targets, and appropriations timing). Seeing the calendar structure helps explain why shutdown threats, continuing resolutions, and bargaining crunches are recurring features of U.S. fiscal policymaking.Source

Independent analysis from bodies like the Congressional Budget Office (CBO) can shape debate by projecting costs, growth, and deficit effects.

EQUATION

= Total federal tax and other receipts (dollars)

= Total federal spending (dollars)

A negative budget balance indicates a deficit (requiring borrowing), while a positive balance indicates a surplus.

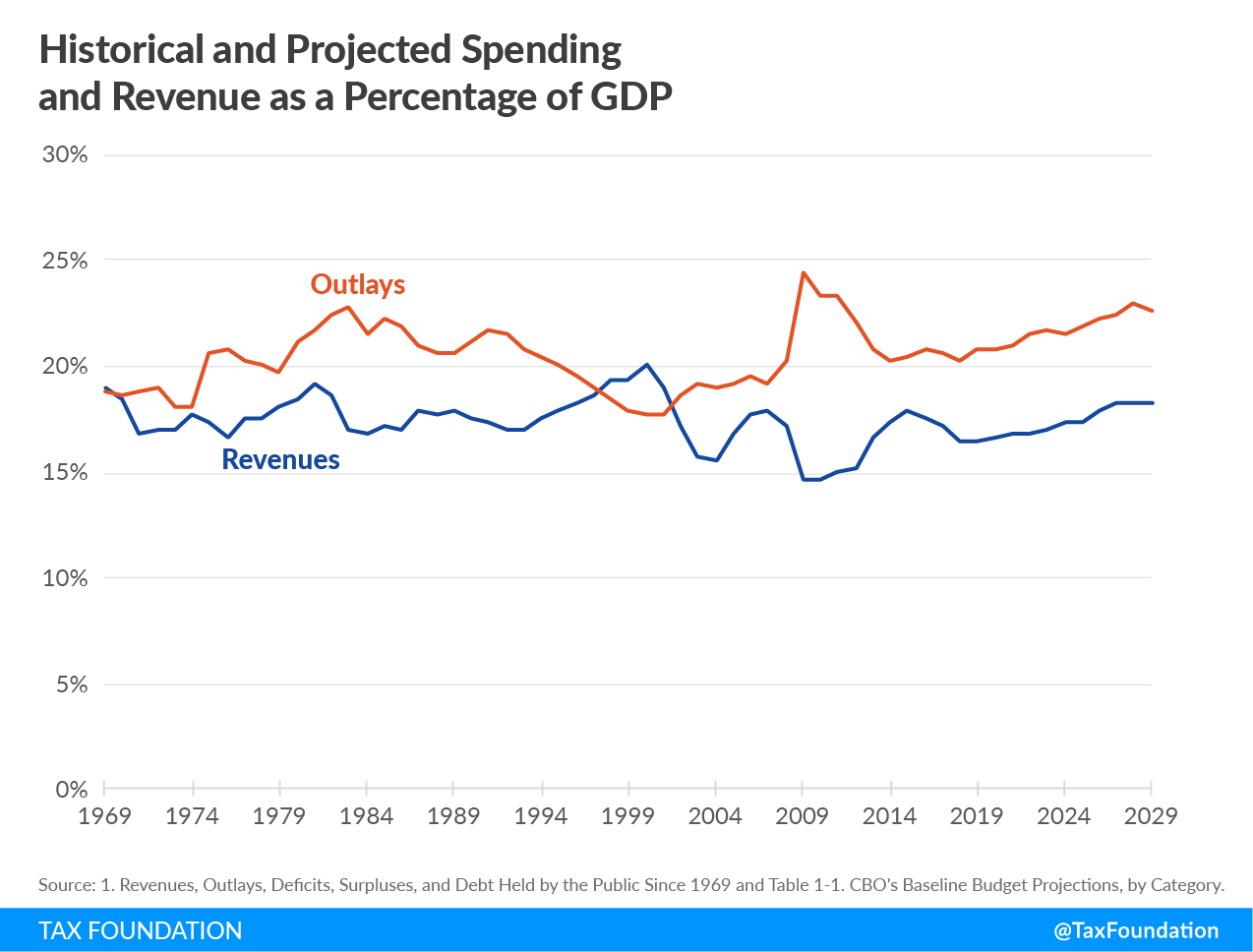

The chart plots federal revenues and outlays as shares of GDP over time, making deficits visible whenever outlays exceed revenues. This visualization links the identity Source

to real historical periods of sustained deficits and occasional surpluses.

Competing Approaches: Keynesian and Supply-Side Positions

Keynesian economics: The view that government can stabilise the economy by adjusting spending and taxes to influence aggregate demand, especially during recessions.

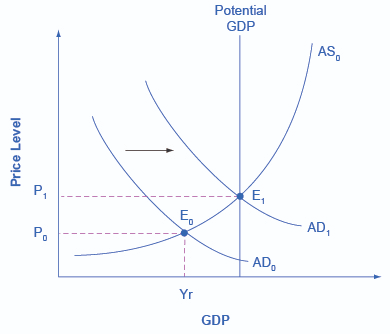

Expansionary fiscal policy (higher government spending and/or lower taxes) is modeled as a rightward shift of aggregate demand from to . The new equilibrium moves closer to potential GDP, illustrating how Keynesian stimulus aims to reduce recessionary unemployment, often with some upward pressure on the price level. Source

Keynesian-oriented fiscal policy generally supports:

Deficit spending during downturns to boost demand and reduce unemployment

Temporary tax cuts or increased government spending (often called “stimulus”)

Reduced spending or higher taxes during high inflation to cool demand (politically difficult)

Supply-Side Fiscal Views

Supply-side arguments emphasise incentives and long-term growth, often supporting:

Lower marginal tax rates to encourage work, saving, and investment

Policies aimed at expanding production (the “supply” of goods and services), rather than primarily managing demand

The claim that growth can partially offset revenue losses from tax cuts, though the size of that effect is contested in policy debates

These approaches become concrete in fights over whether to prioritise short-term job creation, deficit reduction, or long-run growth through incentives.

Why Fiscal Policy Is Politically Difficult

Fiscal policy is not purely technical; it is shaped by democratic conflict and institutional friction:

Time lags: Passing laws takes time; effects may arrive after conditions change.

Divided government: Different party control of Congress and the presidency increases bargaining costs and the likelihood of stalemate.

Mandatory vs discretionary spending: Large budget shares are effectively “locked in” by eligibility rules, narrowing room for rapid adjustments.

Deficit politics: Arguments over debt, intergenerational fairness, and interest costs influence what coalitions are possible.

Distributional conflict: Tax and spending choices create winners and losers, so fiscal policy debates often reflect broader ideological priorities.

FAQ

Dynamic scoring estimates how tax or spending changes might affect overall economic behaviour and growth, altering projected revenues.

It can strengthen arguments that incentives matter, but critics note results depend heavily on modelling assumptions.

Congress may authorise and appropriate spending, but the Treasury still needs legal borrowing capacity to pay obligations.

If the debt limit is not raised or suspended, the government risks delayed payments or default, intensifying political leverage.

A fiscal cliff is a rapid, simultaneous tightening of fiscal policy (tax rises and/or spending cuts) scheduled to occur at set dates.

It matters because cliff deadlines can force last-minute bargaining and produce abrupt economic effects.

Automatic stabilisers are budget features that expand deficits in downturns and shrink them in booms without Congress passing new laws.

Examples include unemployment insurance and progressive income taxes, which respond mechanically to economic changes.

Crowding out is when government borrowing raises interest rates and reduces private investment.

It is most likely when the economy is near full capacity and credit markets are tight; it is less likely when interest rates are already very low.

Practice Questions

(2 marks) Define fiscal policy and identify the two main tools used to implement it.

1 mark: Accurate definition of fiscal policy (government use of taxes/spending to influence economic conditions).

1 mark: Identifies both tools: taxation and government spending.

(6 marks) Explain how Congress and the president each influence fiscal policy, and analyse one way Keynesian and supply-side positions might lead to different policy choices during an economic slowdown.

2 marks (Congress): Explains Congress’s role in taxes and spending (e.g., passing tax laws, authorisation/appropriations, budget targets, “power of the purse”).

2 marks (President): Explains president’s influence (e.g., proposes budget, signs/vetoes, agenda-setting/negotiation, implementation direction).

2 marks (analysis): Clear contrast during slowdown: Keynesian preference for higher spending/tax cuts to boost demand versus supply-side preference for marginal rate cuts/incentives to increase investment and production.