AP Syllabus focus:

‘Monetary policy is carried out by the Federal Reserve to influence interest rates and broader economic conditions; the Fed is independent and seeks maximum employment and price stability.’

Monetary policy is a major tool for steering the U.S. economy. In AP Gov, the focus is how the Federal Reserve uses its powers to shape interest rates, while operating independently of day-to-day partisan politics.

Monetary policy and the Federal Reserve

Monetary policy: Actions that influence the availability and cost of money and credit in the economy, primarily through changes in interest rates and banking conditions.

In the United States, monetary policy is carried out by the Federal Reserve (the Fed) rather than by Congress or the president.

This infographic summarizes the Federal Reserve System’s structure (Board of Governors plus 12 regional Reserve Banks) and links that structure to the Fed’s key functions. It also visually connects the Fed’s “dual mandate” (maximum employment and price stability) to major policy tools and the transparency/oversight features that support independence with accountability. Source

The Fed’s choices affect interest rates, borrowing, and spending, which in turn influence employment and inflation.

Federal Reserve: The central bank of the United States, responsible for conducting monetary policy and promoting a stable financial system.

Core goals (what the Fed is trying to achieve)

The Fed is commonly described as pursuing a dual mandate:

Maximum employment: supporting conditions where jobs are widely available.

Price stability: keeping inflation low and predictable so purchasing power is stable over time.

Because interest rates shape borrowing and investment, the Fed’s rate decisions can affect “broader economic conditions,” including:

Consumer spending on credit (autos, credit cards)

Business investment and hiring

Housing demand tied to mortgage rates

Overall inflation pressures

Fed independence (and what that means)

Independence means the Fed can make monetary policy decisions without needing approval from the president or Congress for each change in interest rates. This independence is meant to reduce short-term political pressure to keep rates artificially low before elections.

How independence is built into the institution

Key features that support Fed independence include:

Long terms for governors: members of the Board of Governors serve lengthy, staggered terms, insulating them from immediate political swings.

Decentralised structure: the Fed includes regional Reserve Banks, not just Washington, D.C.

Operational control of policy tools: the Fed can adjust major tools (especially open-market operations) without passing new legislation.

Accountability alongside independence

Independence is not absolute. The Fed remains publicly accountable through:

Congressional oversight (hearings and required reports)

Transparency practices (policy statements, press conferences, published minutes)

The fact that top officials are appointed through elected institutions (nomination and confirmation)

How the Fed influences interest rates and the economy

The Fed most directly shapes short-term interest rates, which ripple outward into broader financial conditions. When the Fed tightens policy, borrowing becomes more expensive; when it eases policy, borrowing becomes cheaper.

Main tools used to conduct monetary policy

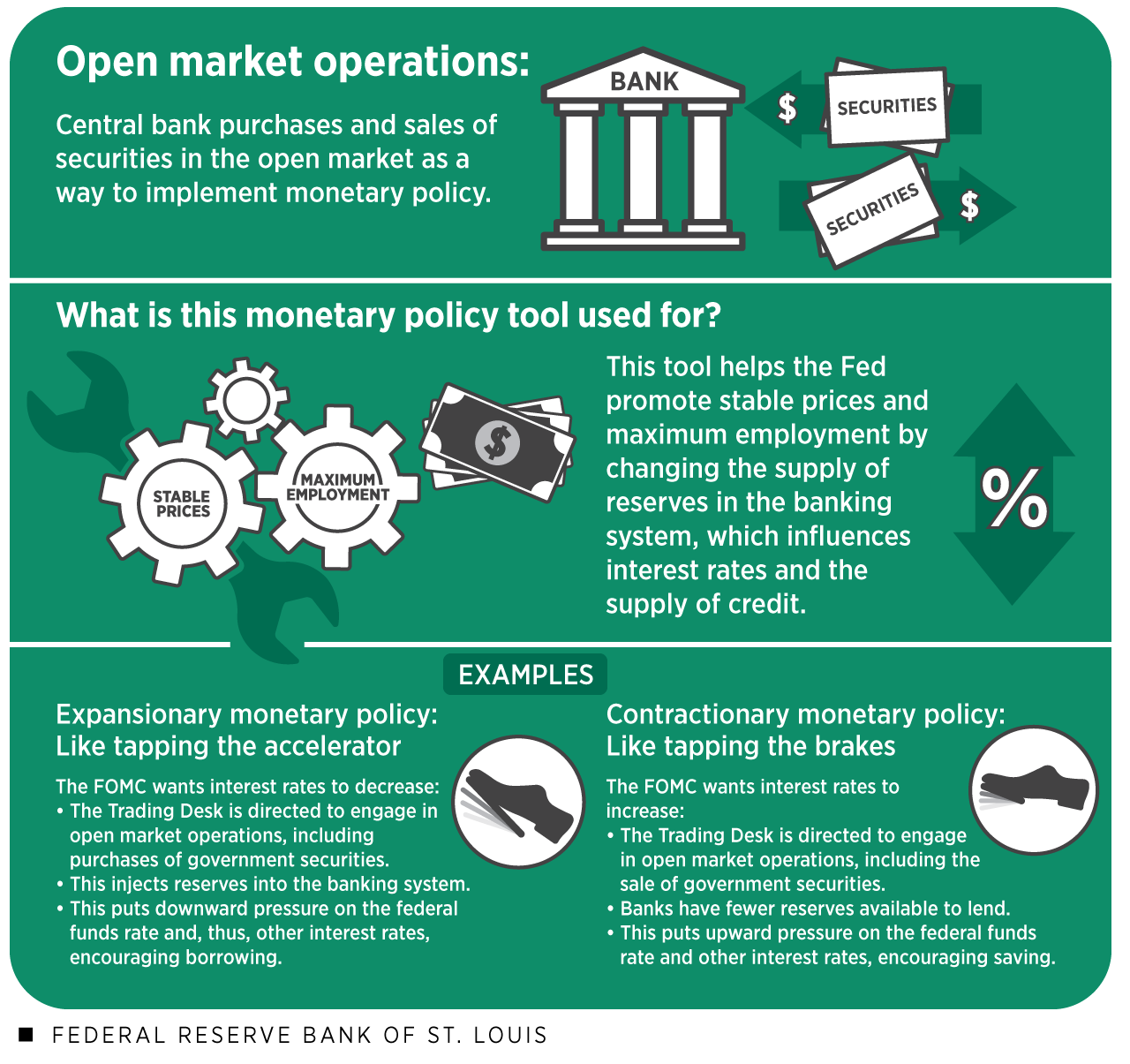

Open-market operations (OMOs): buying and selling government securities to add or drain reserves in the banking system, supporting the Fed’s targeted short-term rate.

This diagram shows how open-market operations work as a buy/sell mechanism for government securities that changes reserves in the banking system. It contrasts expansionary versus contractionary OMOs and explicitly ties those actions to interest-rate movement and credit conditions—exactly the “tool → rates → economy” logic emphasized in AP Gov monetary policy coverage. Source

Discount rate: the interest rate the Fed charges banks for short-term loans; changing it can signal a tighter or looser stance.

Reserve requirements (used rarely): rules about how much banks must hold in reserve, affecting banks’ ability to lend.

Interest on bank reserves: influences banks’ incentives to hold reserves versus expand lending.

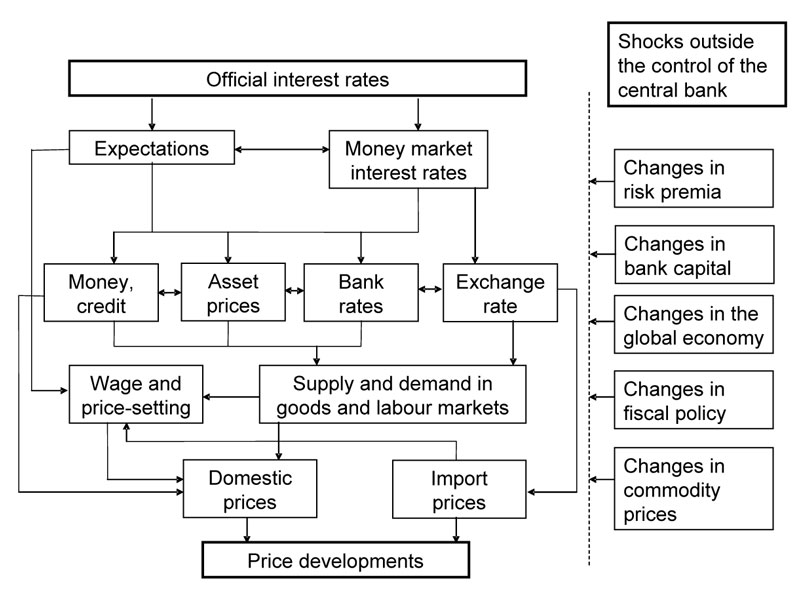

Transmission (how a Fed decision spreads through the economy)

A simplified chain is:

This schematic maps the monetary-policy transmission mechanism: official interest rates affect money-market rates and expectations, which then influence bank rates, credit, asset prices, and the exchange rate. The diagram then traces how these financial conditions feed into demand in goods and labor markets and ultimately into price developments—reinforcing why policy effects arrive with lags and multiple channels. Source

Fed changes policy stance (easing or tightening)

Short-term rates and bank lending conditions shift

Spending and investment rise or fall

Businesses adjust production and hiring

Employment and inflation move toward (or away from) the Fed’s goals

Trade-offs and limits relevant to policy debates

Monetary policy operates with:

Time lags: effects on jobs and inflation can take months to appear.

Uncertainty: the Fed must make choices using incomplete data and forecasts.

Balancing pressures: fighting inflation can slow hiring, while boosting employment can increase inflation risk.

FAQ

It relies on price indices and trend measures, often focusing on underlying inflation by examining persistent categories and expectations.

This helps distinguish temporary shocks from broad, sustained inflation.

The policy rate is a short-term benchmark that influences broader credit conditions.

Mortgage rates reflect longer-term expectations, risk, and market demand for long-term lending.

Officials may wait for clearer evidence because policy works with delays and data can be revised.

They also weigh whether shocks are temporary or likely to persist.

When borrowing demand is weak, the Fed can still ease financial conditions, but the impact may be muted.

It may rely more on communication and broader credit-channel measures.

Guidance can shift expectations about future rates, moving markets even before any immediate tool change.

Clear communication can strengthen credibility around price stability and maximum employment.

Practice Questions

(3 marks) Explain what is meant by the Federal Reserve being “independent” in its conduct of monetary policy.

1 mark: States that the Fed can make monetary policy decisions without needing day-to-day approval from the President or Congress.

1 mark: Links independence to setting interest rates/using policy tools (e.g., OMOs) autonomously.

1 mark: Explains why independence matters (e.g., reduces short-term partisan/electoral pressure).

(6 marks) Describe two tools the Federal Reserve can use to influence interest rates, and explain how changing interest rates can affect inflation and employment.

1 mark: Correctly identifies tool 1 (e.g., open-market operations).

1 mark: Correctly describes how tool 1 works (e.g., buying/selling securities changes reserves and short-term rates).

1 mark: Correctly identifies tool 2 (e.g., discount rate, interest on reserves, reserve requirements).

1 mark: Correctly describes how tool 2 works.

1 mark: Explains link from higher/lower interest rates to spending/investment and inflation.

1 mark: Explains link from higher/lower interest rates to hiring/unemployment (employment effects).