AQA Specification focus:

‘An in-depth knowledge of the PRA, FPC and the FCA is not expected but students should appreciate their role in trying to maintain the stability of the financial system.’

Introduction

Financial regulators play a crucial role in ensuring the financial system operates smoothly, protecting consumers, and preventing crises. Their work balances economic stability with market confidence.

The Purpose of Regulators in the Financial System

Maintaining Stability

The central purpose of financial regulators is to maintain the stability of the financial system. Stability refers to the ability of financial institutions and markets to function effectively without disruption, even in times of economic stress.

Illustration of the evolution of UK financial regulation, marking the shift from a single regulatory body to the establishment of the PRA and FCA in 2013. Source

Protecting Consumers and Investors

Regulators also protect consumers and investors from unfair practices, excessive risk-taking, and fraud. By enforcing standards of behaviour, regulators seek to build trust and confidence in financial markets.

Ensuring Market Integrity

Market integrity means that financial markets are fair, transparent, and efficient. Regulators work to prevent insider trading, market manipulation, and practices that could undermine the credibility of the system.

Systemic Risk: The risk that the failure of one institution or market segment could spread, leading to instability across the entire financial system.

UK Regulators – General Roles

Although students are not required to know the specific detail of each regulator, an awareness of their broad purposes is valuable. The main regulators in the UK are:

Bank of England (BoE): Oversees monetary stability and acts as the lender of last resort.

Prudential Regulation Authority (PRA): Supervises banks and insurers to ensure they are financially sound.

Financial Policy Committee (FPC): Monitors risks to the financial system and recommends action to reduce systemic threats.

Financial Conduct Authority (FCA): Regulates firms and individuals to ensure fair conduct, protect consumers, and encourage effective competition.

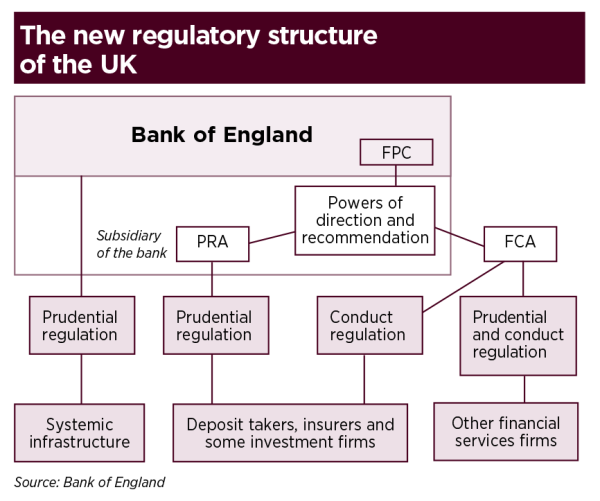

Diagram depicting the UK's financial regulatory framework, highlighting the roles of the Bank of England, PRA, FCA, and FPC within the 'twin peaks' model. Source

Shared Aims of Regulators

Across these bodies, the main purposes include:

Promoting financial stability.

Preventing systemic risk.

Protecting consumers and investors.

Encouraging competition and innovation within safe boundaries.

Safeguarding the overall reputation of the UK financial system.

Why Regulation Is Necessary

Preventing Bank Failures

Banks operate by borrowing short term (deposits) and lending long term (loans). Without proper oversight, this can create maturity mismatch risk, making them vulnerable to liquidity problems. Regulators help minimise this risk by setting rules and capital requirements.

Liquidity: The ease with which assets can be converted into cash without significant loss of value.

Limiting Excessive Risk-Taking

Without regulation, banks might engage in reckless lending or speculative activities. Regulators set limits on activities to ensure that individual failures do not threaten the wider economy.

Reducing Moral Hazard

If financial institutions believe they will be rescued during a crisis, they may take excessive risks. Regulators aim to reduce this moral hazard by enforcing discipline and ensuring firms face consequences for poor decisions.

Moral Hazard: When individuals or firms take greater risks because they believe they will not bear the full costs of failure.

Supporting Confidence in the Financial System

Public confidence is crucial for banks and financial markets. Regulation reassures consumers that their deposits are safe, investments are protected, and firms act responsibly. This confidence reduces the likelihood of events such as bank runs.

Tools and Methods Regulators Use

Rule-Setting and Enforcement

Regulators set rules covering:

Capital requirements.

Liquidity ratios.

Standards of behaviour for financial firms.

Firms must comply with these rules or face sanctions, fines, or removal of licences.

Monitoring and Supervision

Regulators constantly monitor financial institutions through reporting requirements, audits, and on-site inspections to ensure compliance with regulations and identify problems early.

Crisis Management

In times of instability, regulators coordinate responses to limit damage. For example, they may provide emergency funding, enforce mergers, or temporarily guarantee deposits to restore confidence.

Wider Economic Role of Regulators

Promoting Sustainable Growth

Stable financial systems support sustainable growth by ensuring credit flows smoothly to businesses and households. Regulators help avoid cycles of boom and bust caused by uncontrolled lending.

Encouraging Fair Competition

The FCA and other regulators aim to ensure that competition benefits consumers, for example by keeping borrowing costs fair and preventing monopolistic behaviour.

International Cooperation

Financial systems are interconnected globally. Regulators in the UK cooperate with international bodies to ensure risks are managed across borders, limiting the chance of imported instability.

FAQ

The twin peaks model separates financial regulation into two distinct functions. The Prudential Regulation Authority (PRA) focuses on the safety and soundness of financial institutions, ensuring they hold enough capital and liquidity.

Meanwhile, the Financial Conduct Authority (FCA) oversees how firms treat consumers and operate in the market. This separation aims to prevent conflicts and ensure both financial stability and fair conduct are properly addressed.

Regulators build confidence by ensuring financial institutions are stable and consumers are protected.

They do this by:

Requiring firms to hold adequate capital reserves.

Monitoring risks that could threaten stability.

Enforcing rules against misconduct such as fraud or mis-selling.

This reassurance reduces the likelihood of bank runs or widespread distrust in the system.

Financial markets are highly globalised. A shock in one country can quickly spread to others.

UK regulators, including the Bank of England and FPC, work with international bodies like the Financial Stability Board and the Basel Committee on Banking Supervision.

This cooperation ensures consistent rules, helps manage cross-border risks, and reduces the chance of instability being imported into the UK.

Regulators encourage competition by preventing monopolistic behaviour, promoting innovation, and ensuring consumers can access fair deals.

At the same time, they impose safeguards:

Limiting excessive risk-taking by new entrants.

Ensuring all firms, large or small, meet minimum prudential standards.

Monitoring the impact of new products on stability.

This balance helps markets remain dynamic while protecting the financial system.

During a crisis, regulators may intervene quickly to maintain stability and confidence. Actions can include:

Providing emergency liquidity through the central bank.

Temporarily guaranteeing deposits to prevent bank runs.

Enforcing mergers or restructuring of failing institutions.

Imposing restrictions on risky activities.

Such measures aim to contain the crisis and stop contagion from spreading through the wider financial system.

Practice Questions

State one reason why financial regulators are important for consumers and one reason why they are important for the wider financial system. (2 marks)

1 mark for identifying a reason for consumers (e.g., protection from fraud, mis-selling, or unfair practices).

1 mark for identifying a reason for the wider financial system (e.g., ensuring stability, preventing systemic risk, maintaining confidence).

(Max 2 marks)

Explain how financial regulators help to reduce systemic risk and moral hazard in the financial system. 6 marks)

1–2 marks: Basic identification of systemic risk and/or moral hazard (e.g., systemic risk is when failure of one bank threatens the whole system; moral hazard is when banks take more risks believing they will be bailed out).

1–2 marks: Clear explanation of regulators’ role in reducing systemic risk (e.g., through capital and liquidity requirements, supervision of banks, monitoring risk exposure).

1–2 marks: Clear explanation of regulators’ role in reducing moral hazard (e.g., enforcing discipline, imposing fines, requiring firms to face consequences, setting rules to limit excessive risk-taking).

Credit application to UK regulators if included (e.g., PRA ensures banks remain financially sound, FCA regulates behaviour, FPC monitors systemic risk).

(Max 6 marks)