AQA Specification focus:

‘Regulation of the financial system in the UK, eg the role of the Bank of England, the Prudential Regulation Authority (PRA), the Financial Policy Committee (FPC) and the Financial Conduct Authority (FCA).’

Financial markets require effective regulation to maintain stability and protect consumers. In the UK, several key institutions oversee this system, each with distinct roles and responsibilities.

The Importance of Regulation in the Financial System

Financial systems underpin the functioning of the wider economy, facilitating lending, investment, and payments. Without effective regulation, risks such as systemic failure, moral hazard, and consumer exploitation could undermine stability. Regulation seeks to maintain confidence, safeguard individuals, and reduce the likelihood of financial crises.

The Bank of England (BoE)

The Bank of England (BoE) is the UK’s central bank and plays a vital regulatory role. While it is widely known for managing monetary policy, its responsibilities extend to safeguarding the financial system.

Key Regulatory Functions of the BoE

Oversees overall financial stability through macroprudential policies.

Provides lender of last resort support to banks during liquidity shortages.

Hosts and supports subsidiary regulatory bodies such as the Prudential Regulation Authority (PRA) and the Financial Policy Committee (FPC).

Lender of Last Resort: The provision of emergency liquidity support by the central bank to financial institutions facing short-term funding difficulties, to prevent wider instability.

The Bank of England’s central role ensures coordination among regulators while retaining direct responsibility for systemic oversight.

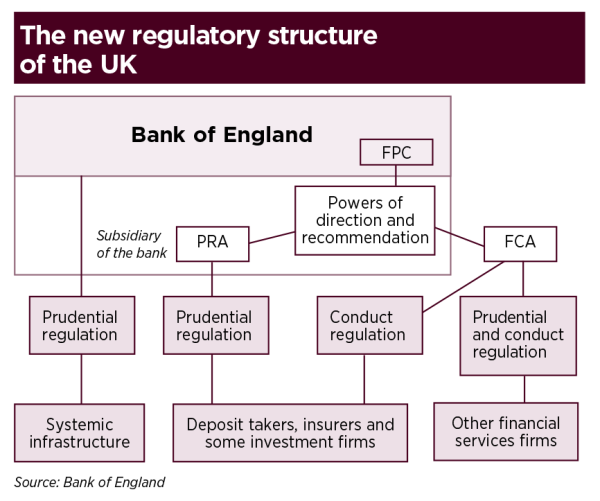

The diagram depicts the UK's financial regulatory framework, showing the interconnections between the Bank of England, PRA, FPC, and FCA. It illustrates how these bodies collaborate to maintain financial stability and regulate financial institutions. Source

The Prudential Regulation Authority (PRA)

The Prudential Regulation Authority (PRA) operates under the Bank of England and is responsible for the prudential regulation of significant financial institutions.

Responsibilities of the PRA

Supervises banks, building societies, credit unions, insurers, and major investment firms.

Ensures institutions maintain adequate capital ratios and liquidity levels.

Focuses on the long-term safety and soundness of the financial sector.

Sets requirements for risk management, governance, and contingency planning.

Prudential Regulation: Rules and oversight designed to ensure financial firms remain stable, solvent, and resilient to shocks, safeguarding both depositors and the wider economy.

By concentrating on resilience, the PRA reduces the chance of bank failures that could spread systemic risk throughout the economy.

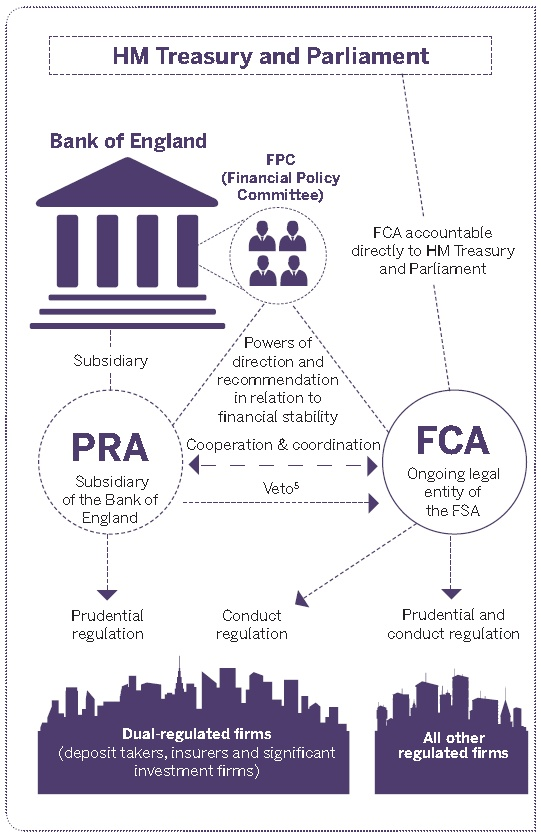

An overview of the UK's 'Twin Peaks' regulatory model, illustrating the separation of prudential regulation by the PRA and conduct regulation by the FCA. This model aims to enhance clarity and accountability in financial oversight. Source

The Financial Policy Committee (FPC)

The Financial Policy Committee (FPC) is a macroprudential regulator within the Bank of England structure. It was created after the 2008 financial crisis, which revealed shortcomings in systemic risk monitoring.

Functions of the FPC

Identifies, monitors, and addresses systemic risks that threaten the UK’s financial stability.

Issues macroprudential tools such as countercyclical capital buffers to manage risks across the system.

Makes recommendations to both the PRA and the Financial Conduct Authority (FCA).

Monitors trends in credit growth, asset prices, and leverage levels.

Systemic Risk: The risk that the failure or distress of a financial institution or market could trigger instability across the entire financial system.

The FPC’s role is preventative, focusing on risks that build up gradually and could destabilise the economy if left unchecked.

The Financial Conduct Authority (FCA)

The Financial Conduct Authority (FCA) operates independently of the Bank of England and focuses on the conduct of firms and markets.

Responsibilities of the FCA

Protects consumers from unfair treatment and financial malpractice.

Regulates financial markets to promote integrity, transparency, and competition.

Ensures products offered to consumers are appropriate and not misleading.

Has enforcement powers to fine, sanction, or restrict firms engaging in malpractice.

Conduct Regulation: Rules and oversight designed to ensure firms treat customers fairly, maintain market integrity, and operate with honesty and transparency.

By addressing consumer protection and market behaviour, the FCA ensures trust and fairness in financial dealings.

Interrelationship Between the Regulators

Although each regulator has a distinct focus, their cooperation is essential:

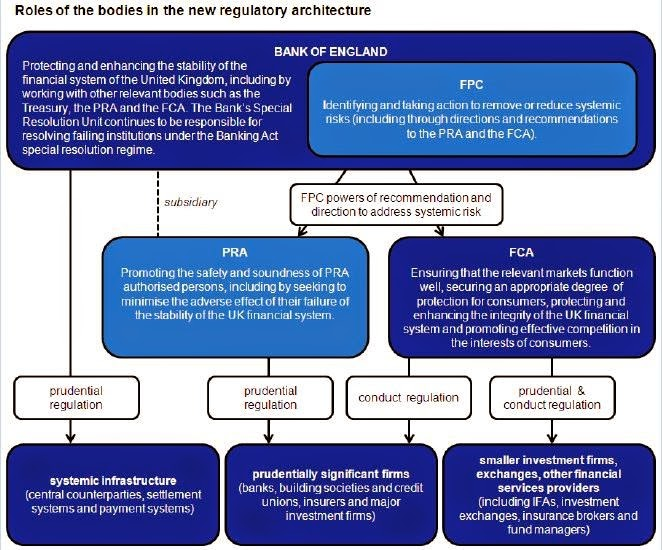

The BoE provides overall stability and coordination.

The PRA ensures institutions remain financially sound.

The FPC identifies and mitigates systemic risks.

The FCA safeguards consumers and market integrity.

Examples of Collaboration

The FPC may recommend tighter capital requirements, which the PRA enforces.

The FCA may identify risky lending practices that threaten systemic stability, alerting the FPC.

During crises, the BoE coordinates emergency measures with both the PRA and FCA.

Together, these regulators form a multi-layered framework designed to prevent instability, protect consumers, and support sustainable economic growth.

A diagram showing the roles of the Bank of England, PRA, FPC, and FCA in the UK's financial regulatory framework. It highlights the functions and interrelationships of these bodies in maintaining financial stability. Source

FAQ

The 2008 crisis exposed weaknesses in the old system, where the Financial Services Authority (FSA) regulated both prudential and conduct issues. This concentration of responsibility meant systemic risks were missed.

The restructure created the ‘Twin Peaks’ model, separating prudential regulation (PRA) from conduct regulation (FCA). The Financial Policy Committee (FPC) was also established to monitor systemic risks across the economy.

The PRA uses a risk-based approach called the Proactive Intervention Framework (PIF). Firms are categorised into stages depending on their financial strength.

Strong firms are monitored less frequently.

Weaker firms face tighter supervision and must provide recovery plans.

Intervention escalates if capital or liquidity levels fall below regulatory thresholds.

The FPC applies tools designed to influence behaviour across the financial system. These include:

Countercyclical capital buffer – increases bank capital requirements when credit growth is excessive.

Sectoral capital requirements – target specific lending areas, such as mortgages.

Loan-to-value (LTV) and debt-to-income (DTI) limits – restrict risky lending in housing markets.

These measures act as safeguards, reducing the build-up of financial imbalances.

The FCA lowers barriers to entry for new firms, particularly fintechs, through initiatives like the regulatory sandbox.

It also enforces transparency rules requiring providers to display clearer information on fees and charges. This prevents established firms from exploiting their market position and improves consumer choice.

The Bank of England coordinates the process through its role in financial stability. The PRA ensures the bank’s viability is assessed and supervises its recovery plans.

The FCA focuses on consumer protection, making sure customers still have access to accounts or compensation schemes.

If insolvency occurs, the Bank of England oversees resolution, working with both the PRA and FCA to minimise disruption to the financial system.

Practice Questions

Identify two key objectives of the Financial Conduct Authority (FCA). (2 marks)

1 mark for each correct objective identified, up to a maximum of 2 marks.

Acceptable answers include:

Protecting consumers from unfair treatment.

Maintaining integrity of financial markets.

Promoting competition in the interests of consumers.

Explain how the roles of the Prudential Regulation Authority (PRA) and the Financial Policy Committee (FPC) differ in maintaining financial stability. (6 marks)

Up to 2 marks for identifying the role of the PRA.

Supervises individual firms (banks, insurers, investment firms). (1 mark)

Ensures firms remain safe, solvent, and hold adequate capital/liquidity. (1 mark)

Up to 2 marks for identifying the role of the FPC.

Focuses on systemic risk across the financial system. (1 mark)

Uses macroprudential tools (e.g. countercyclical capital buffer). (1 mark)

Up to 2 marks for development/comparison.

PRA is microprudential, firm-level regulation, whereas FPC is macroprudential, system-wide regulation. (1–2 marks depending on clarity).

Maximum: 6 marks.