AQA Specification focus:

‘Students will not be required to calculate liquidity or capital ratios.’

Introduction

In AQA A-Level Economics, understanding liquidity ratios and capital ratios is essential, but calculations are not required. The emphasis is on interpretation, significance, and policy implications.

Understanding Ratios in Financial Regulation

The Role of Ratios

Financial institutions, especially banks, face risks linked to their lending and borrowing. To limit instability, regulators monitor liquidity ratios and capital ratios as indicators of safety and resilience.

Liquidity Ratios

Liquidity ratios indicate the ability of a bank to meet short-term obligations. A high liquidity ratio shows that a bank holds enough liquid assets, such as cash or reserves, to meet customer withdrawals and short-term liabilities.

Liquidity Ratio: A measure of the extent to which a financial institution’s assets can quickly be converted into cash to meet immediate obligations.

Although students are not required to calculate liquidity ratios, appreciating their role in safeguarding the financial system is vital.

Capital Ratios

Capital ratios indicate the proportion of a bank’s assets funded by shareholder equity rather than debt. Strong capital ratios reduce the likelihood of insolvency because losses are absorbed by shareholder funds before threatening depositors or the wider system.

Capital Ratio: A measure of a bank’s financial strength, showing the proportion of assets financed through shareholders’ equity compared to borrowed funds.

Again, calculation is unnecessary for AQA students, but understanding the principle helps explain how regulation works to promote financial stability.

Why Calculations Are Not Required

Emphasis on Concepts over Computation

The AQA specification stresses comprehension of financial stability rather than numerical proficiency. Exam questions may ask students to:

Explain why liquidity is important for banks.

Analyse the role of capital in absorbing risk.

Evaluate how regulators use these ratios to protect the economy.

This means students should focus on interpretation, importance, and implications, not on memorising or applying formulas.

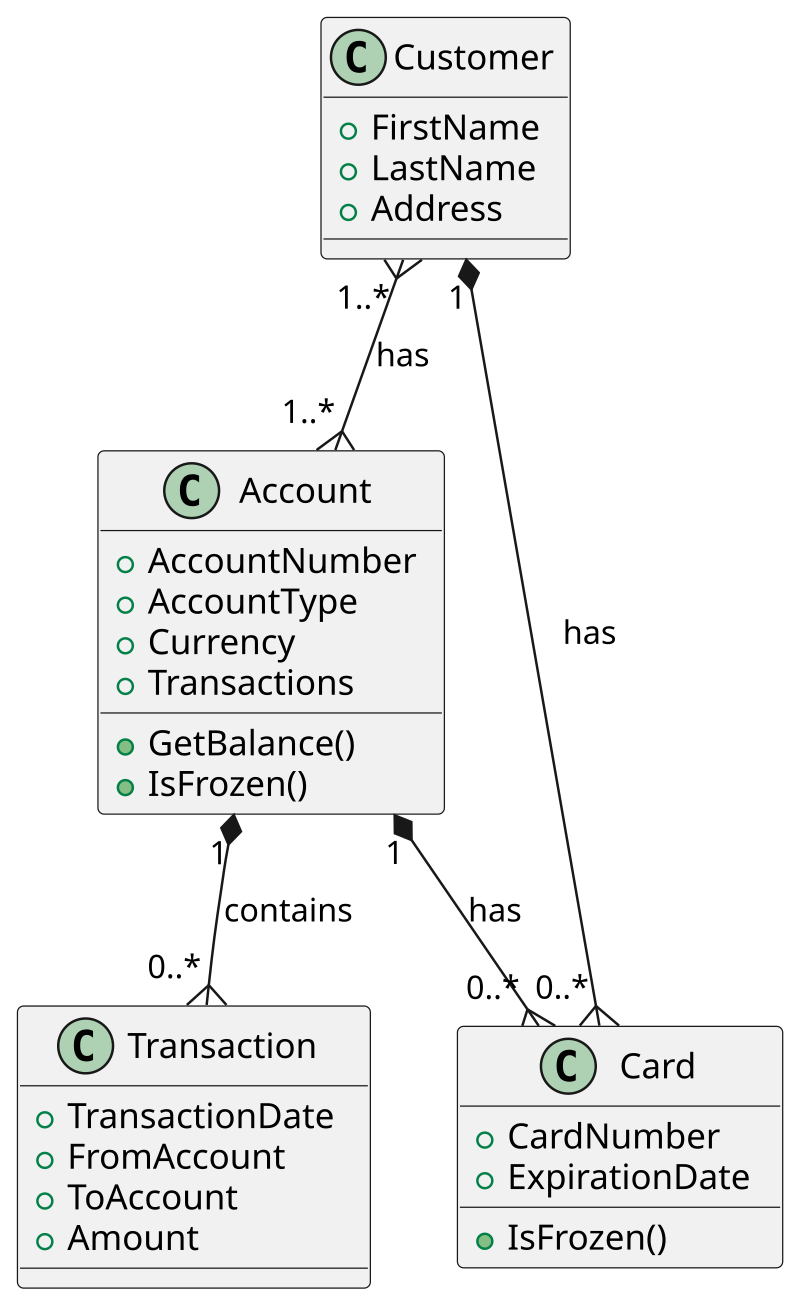

This UML class diagram represents the structure of a bank account system, detailing the relationships between customers, accounts, cards, and transactions. Understanding this structure is crucial for comprehending how banks manage financial data, which underpins the significance of liquidity and capital ratios. Source

Linking to Systemic Risk

Poor liquidity or weak capital ratios increase the risk of bank failure, leading to systemic risk—where instability spreads throughout the financial system and damages the wider economy.

Liquidity Ratios in Practice

How Regulators View Liquidity

Regulators monitor liquidity to prevent sudden collapses. For example, if too many customers demand withdrawals (a bank run), adequate liquidity ensures obligations are met without fire-sales of assets.

Key Points for Students

Liquidity supports short-term security.

Too much liquidity may reduce profitability, as liquid assets often earn lower returns.

Too little liquidity risks insolvency during shocks.

This balance underlines the trade-off between profitability and security, a recurring theme in financial economics.

Capital Ratios in Practice

Regulatory Importance

Capital ratios became particularly significant after the 2008 financial crisis, when undercapitalised banks amplified systemic risks. Higher ratios provide a buffer against loan defaults and asset price collapses.

Key Points for Students

Higher capital ratios = greater ability to absorb losses.

Shareholders bear more risk before depositors are threatened.

Stronger capital positions support confidence in the banking system.

Students must be able to explain why regulators demand minimum capital levels and how this stabilises the economy.

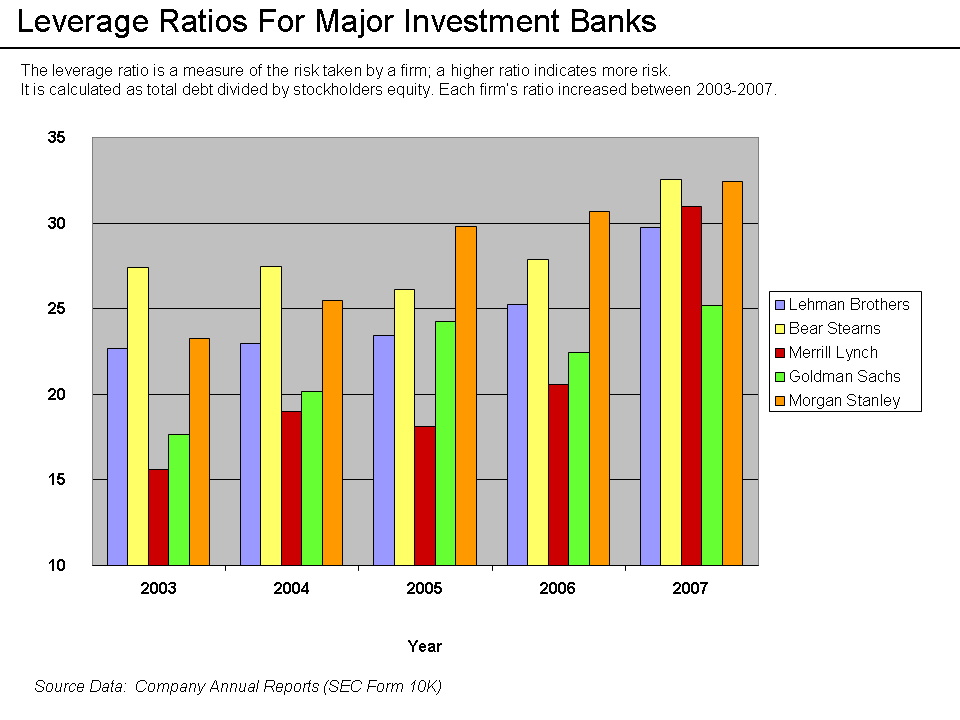

A higher ratio indicates more risk.

This graph depicts the leverage ratios of major investment banks from 2003 to 2007, illustrating the increased financial risk associated with higher leverage. Higher leverage ratios, such as 30-to-1, indicate more risk, as a small decline in asset value can lead to significant losses. Source

Interpreting Ratios Without Calculation

Conceptual Understanding

Although calculation is excluded, students can be asked to evaluate scenarios such as:

A bank with strong liquidity but weak capital.

A bank with high capital but low liquidity.

The aim is to show how these conditions affect profitability, risk, and financial stability.

Analytical Skills Required

Students should practise discussing:

The advantages and disadvantages of maintaining high ratios.

The impact on lending and economic growth.

The policy trade-offs between safety and efficiency.

Application in Monetary and Regulatory Policy

Liquidity Ratios and Policy

Central banks and regulators impose minimum liquidity requirements to prevent panic-induced collapses. By doing so, they maintain public confidence and reduce contagion risk.

Capital Ratios and Policy

Capital requirements are a tool of macroprudential regulation, designed to protect the system as a whole rather than just individual banks.

Bullet Point Summary for Students

Liquidity ratios = short-term safety, ability to pay obligations.

Capital ratios = long-term resilience, loss-absorbing capacity.

Calculations not required, but explanations and evaluation are key.

Both ratios balance profitability and security.

Regulatory use of ratios links directly to systemic stability.

Exam Focus

What Examiners Expect

Students may encounter questions asking them to:

Explain the difference between liquidity and capital ratios.

Analyse why both are necessary for financial stability.

Evaluate how regulation of these ratios affects the wider economy.

Skills Needed

Clear definitions.

Ability to apply concepts to real-world scenarios.

Evaluation of benefits and drawbacks without resorting to numerical examples.

By keeping these points in mind, students can approach questions confidently, knowing that no calculations are required, but that strong economic reasoning and contextual understanding are essential.

FAQ

The AQA specification emphasises conceptual understanding rather than mathematical application. Ratios are complex, varying across institutions and countries, making precise calculation less important at A-Level.

Students should focus on why regulators use these ratios, the role they play in stabilising financial systems, and the trade-offs between security and profitability. This prepares them to analyse real-world financial issues without becoming lost in technical details.

Liquidity and capital ratios measure different aspects of a bank’s strength, but both contribute to overall stability.

Liquidity ratios protect against short-term shocks.

Capital ratios protect against long-term insolvency.

A bank strong in liquidity but weak in capital may survive immediate withdrawals but collapse under large losses. Equally, strong capital but poor liquidity can still lead to short-term failure during a bank run.

Yes. Regulatory bodies such as the Basel Committee set international frameworks, but countries implement these differently.

Some nations enforce stricter minimum capital requirements.

Liquidity standards also vary, with developed economies often requiring larger buffers.

For A-Level, you don’t need to know the numerical thresholds, but understanding that standards differ helps explain why banks operate differently across countries.

The 2008 financial crisis highlighted weaknesses in bank balance sheets. Many institutions had insufficient capital to absorb losses and poor liquidity when panic struck.

As a result, regulators worldwide tightened requirements, demanding higher levels of both ratios. This shift reflected the recognition that inadequate buffers can turn a financial shock into a full economic crisis.

Yes, overemphasis on safety can restrict growth.

High liquidity reduces funds available for lending, limiting investment and consumption.

High capital requirements reduce risk-taking, but may discourage banks from issuing loans.

This creates a policy trade-off: too little regulation risks instability, but too much can slow economic activity and recovery.

Practice Questions

Explain the difference between a liquidity ratio and a capital ratio. (2 marks)

1 mark for identifying what a liquidity ratio measures (ability to meet short-term obligations/convert assets to cash quickly).

1 mark for identifying what a capital ratio measures (proportion of assets financed through shareholder equity/financial strength of a bank).

Discuss why regulators monitor liquidity ratios and capital ratios, even though AQA students are not required to calculate them. (6 marks)

Up to 2 marks for explanation of liquidity ratios (short-term security, meeting customer withdrawals, preventing insolvency).

Up to 2 marks for explanation of capital ratios (absorbing losses, protecting depositors, reducing insolvency risk).

Up to 2 marks for application and analysis, such as linking to financial stability, systemic risk, or trade-offs (e.g., higher ratios improve stability but may reduce profitability and lending).

Evaluation not required for full marks but creditworthy if included.