AQA Specification focus:

‘The importance of information for decision making; the significance of asymmetric information; imperfect information makes it difficult for economic agents to make rational decisions and is a potential source of market failure.’

Introduction

Imperfect and asymmetric information are crucial concepts in economics, highlighting how unequal access to information can affect decision-making and lead to market failure. These concepts are central to understanding why markets may not always operate efficiently, as economic agents cannot make fully informed choices.

Imperfect Information

Imperfect information occurs when economic agents (consumers, firms, etc.) do not have access to complete or accurate information when making decisions. In an ideal world, all participants in a market would have access to all relevant information, enabling them to make rational, optimal decisions. However, in reality, information is often incomplete, outdated, or hard to interpret, leading to suboptimal decision-making.

For example, consumers might make purchasing decisions based on limited or misleading product information. Similarly, firms may make production or investment decisions based on inaccurate data, leading to inefficiencies and missed opportunities.

Key Characteristics of Imperfect Information

Incomplete Information: Economic agents may only have partial information about prices, product quality, or available alternatives.

Uncertainty: Agents may have to make decisions without knowing all the factors that could affect outcomes, such as future market conditions or changes in consumer preferences.

Misleading Information: Sometimes, the available information may be distorted, either intentionally or unintentionally, leading to biased decision-making.

In markets with imperfect information, participants often face the risk of making poor choices because they lack the necessary data to fully understand the costs, benefits, and risks associated with their decisions.

This diagram depicts the cycle of market breakdown due to adverse selection, where information asymmetry leads to higher-risk individuals dominating the market, further discouraging low-risk participants and potentially causing market failure. Source

Asymmetric Information

Asymmetric information refers to a situation where one party in a transaction has more or better information than the other. This imbalance can create significant problems in markets, as it allows the more informed party to exploit the less informed one.

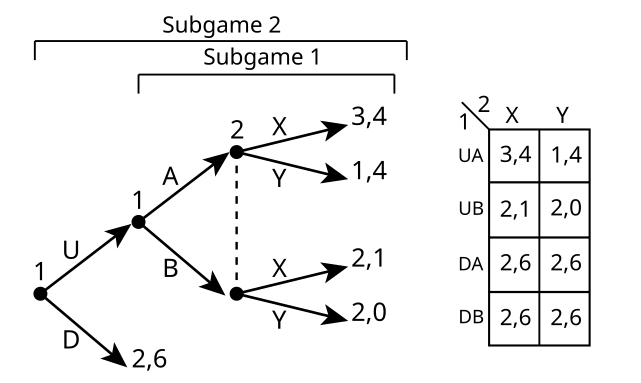

This diagram illustrates a game-theoretic scenario where players make decisions without complete information about others' choices, highlighting the complexities and potential inefficiencies arising from asymmetric information. Source

In many real-world situations, one party in an exchange will know more than the other. For example, a seller might know more about the quality of the product than the buyer, or an employer might have more information about job prospects than an applicant. This disparity can lead to market inefficiencies, as the less informed party may make decisions that are not in their best interest.

Examples of Asymmetric Information

Used Car Market: A classic example of asymmetric information is the used car market, often referred to as a "market for lemons". Sellers have more information about the quality of the car than buyers. As a result, buyers may assume the worst and undervalue all cars, leading to a market where only lower-quality cars are sold.

Insurance Markets: In insurance markets, customers typically know more about their own health and lifestyle than the insurance company. This discrepancy leads to moral hazard, where individuals might take more risks because they know the insurer will bear the costs.

Labour Markets: Employers often have less information about the true abilities of potential employees than the employees themselves. This can lead to inefficiency in hiring decisions.

Effects of Imperfect and Asymmetric Information

Both imperfect and asymmetric information can lead to market failure, a situation where the allocation of goods and services is inefficient. Market failure occurs because economic agents are not making fully informed, rational decisions, leading to outcomes that do not maximise societal welfare.

Market Failure due to Imperfect Information

Overconsumption or underconsumption: When consumers lack information about the health risks of certain products (such as tobacco or alcohol), they may consume more than is socially optimal. Similarly, without full information about the benefits of education or training, individuals may underinvest in their skills.

Inefficient resource allocation: Firms may overproduce or underproduce certain goods and services if they do not have the complete data they need to make decisions. For instance, companies may invest in obsolete technology or fail to innovate because they lack insight into market trends.

Market Failure due to Asymmetric Information

Adverse Selection: This occurs when one party in a transaction has information that causes the other party to make a suboptimal choice. For example, if only high-risk individuals buy insurance because they know their health status better than the insurer, the insurance company ends up with a disproportionately high number of claims, raising prices for everyone.

Moral Hazard: This happens when one party takes on more risk because they do not bear the full consequences of that risk. For instance, if an individual has comprehensive health insurance, they may be less motivated to take care of their health, knowing that the costs will be covered by the insurer.

Addressing Imperfect and Asymmetric Information

Economists and policymakers have suggested several ways to address the issues of imperfect and asymmetric information in markets.

Government Intervention

Regulation: Governments can regulate industries to ensure that firms provide accurate and truthful information to consumers. For example, food labelling laws mandate that companies disclose nutritional information.

Consumer Protection Laws: These laws ensure that consumers are not misled by false or deceptive advertising and that they can access reliable information about products and services.

Market Solutions

Signalling: In markets with asymmetric information, one party may try to signal their quality or reliability to the other party. For example, a firm may offer warranties to signal that their product is of high quality.

Screening: Buyers or employers can use methods such as background checks or trials to gather more information and reduce the information gap.

Technology and Information Availability

The rise of the internet has made it easier for consumers to access information and make more informed decisions. Online reviews, comparison websites, and social media platforms provide consumers with more data to make rational decisions. However, it is essential to consider the reliability and accuracy of this information to avoid falling victim to misinformation.

In conclusion, imperfect and asymmetric information are fundamental economic concepts that can lead to market inefficiencies and failure. By understanding these concepts, students can appreciate the importance of information in decision making and the potential need for government regulation or market solutions to address these issues.

FAQ

Imperfect information is a broad term describing situations where decision-makers lack accurate, full, or timely information.

Incomplete information is a type of imperfect information where some relevant details are entirely missing, such as the durability of a product before purchase.

While incomplete information refers specifically to missing facts, imperfect information also includes cases of outdated, misleading, or misunderstood data.

When one party has more knowledge than the other, they can exploit this advantage.

For example, sellers may hide defects in products, or job candidates might exaggerate skills, knowing the other party cannot easily verify them.

This imbalance can lead to:

Exploitation of the less-informed party

Erosion of trust in the market

Reduced willingness to trade

Sellers may raise prices to compensate for risks linked to uninformed buyers or hidden product flaws.

In insurance markets, this occurs when providers increase premiums to cover the higher likelihood of claims from high-risk customers attracted by the policy — a process linked to adverse selection.

Technology reduces information gaps through tools like comparison websites, online reviews, and transparent data reporting.

However, it cannot eliminate the issue entirely because:

Information can still be inaccurate or biased

Data overload can make decision-making harder

Some information (e.g., personal health risks) remains private

Trust helps reduce the need for perfect knowledge in transactions.

Businesses can build trust through:

Consistent product quality

Transparent communication

Independent verification (e.g., third-party audits)

High trust can lower transaction costs and encourage market participation, even when information gaps exist.

Practice Questions

Define asymmetric information and explain why it can lead to market failure. (2 marks)

1 mark for a correct definition:

Asymmetric information occurs when one party in a transaction has more or better information than the other.1 mark for linking to market failure:

This imbalance can cause one party to make poor decisions, resulting in inefficient allocation of resources.

Using an example, explain how imperfect information may cause consumers or producers to make suboptimal decisions. Analyse two ways in which governments might reduce the negative effects of imperfect information. (6 marks)

1 mark for identifying an example of imperfect information (e.g., lack of nutritional labelling leading to unhealthy food consumption).

1 mark for explaining why it leads to suboptimal decisions (e.g., consumers overconsume harmful products).

Up to 2 marks for explaining one method of government intervention (e.g., regulation requiring product labelling) and how it addresses imperfect information.

Up to 2 marks for explaining a second method of government intervention (e.g., public awareness campaigns) and how it addresses imperfect information.

Maximum 1 additional mark for clear use of economic reasoning linking the intervention to improved market outcomes.