AQA Specification focus:

‘Be able to calculate price elasticity of supply; the factors that influence price elasticity of supply; students should be able to interpret numerical values of price elasticity of supply.’

Introduction

Price elasticity of supply (PES) measures how responsive the quantity supplied of a good or service is to changes in its price, a crucial concept for market analysis.

Defining Price Elasticity of Supply

Price Elasticity of Supply (PES): The responsiveness of the quantity supplied of a good or service to a change in its price.

The idea is central to understanding how producers adjust output in response to changing market conditions. A high PES means suppliers can quickly increase output when prices rise, while a low PES suggests inflexibility.

Calculating Price Elasticity of Supply

Price Elasticity of Supply (PES) = % Change in Quantity Supplied ÷ % Change in Price

% Change in Quantity Supplied = (Change in quantity supplied ÷ Original quantity supplied) × 100

% Change in Price = (Change in price ÷ Original price) × 100

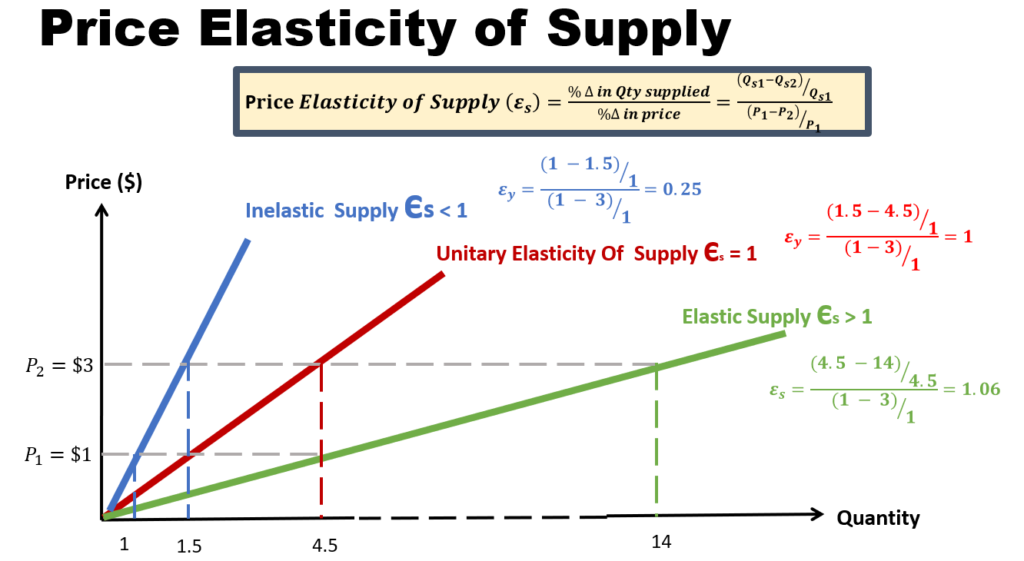

PES values can be interpreted as follows:

PES > 1 (Elastic supply): Quantity supplied changes by a larger percentage than price.

PES < 1 (Inelastic supply): Quantity supplied changes by a smaller percentage than price.

PES = 1 (Unitary elastic supply): Quantity supplied changes by the same percentage as price.

PES = 0 (Perfectly inelastic supply): Quantity supplied does not respond at all to price changes.

PES = ∞ (Perfectly elastic supply): Quantity supplied is infinitely responsive to price changes.

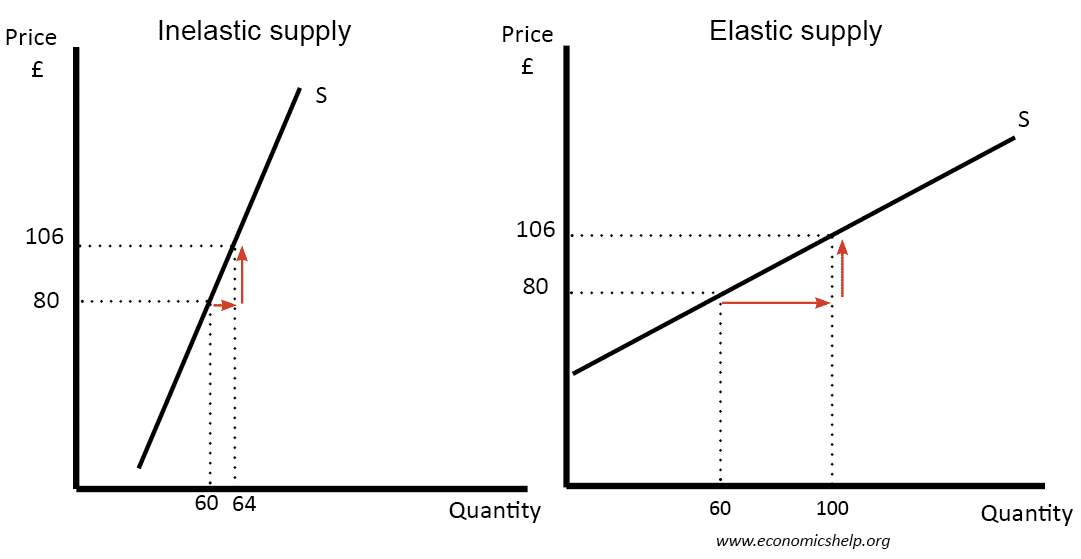

This diagram illustrates the different types of price elasticity of supply, showing how the supply curve's shape changes with varying PES values. Source

Factors Influencing Price Elasticity of Supply

Several factors determine whether supply is elastic or inelastic:

Time Period

Short run: Supply is often more inelastic as firms cannot immediately adjust capacity.

Long run: Supply becomes more elastic because firms can expand production, hire workers, or build new facilities.

Spare Capacity

If a firm has unused resources or capacity, supply is likely to be more elastic since output can be increased without significant extra cost.

Factor Mobility

The ease of moving resources (labour, capital, raw materials) between uses affects elasticity. More mobile factors mean more elastic supply.

Availability of Stocks

Firms with high inventory levels can respond quickly to price increases, making supply more elastic.

Perishable goods typically have inelastic supply because they cannot be stored for long periods.

Production Time

Goods with long production processes (e.g., ships, complex machinery) tend to have inelastic supply in the short run.

Goods produced quickly (e.g., textiles, simple manufactured goods) often show more elastic supply.

Barriers to Entry

High barriers such as patents, regulation, or high capital requirements restrict new firms entering, making supply inelastic.

Low barriers encourage responsiveness and increase elasticity.

Resource Availability

If essential resources are scarce, supply is inelastic.

If resources are abundant and accessible, supply is more elastic.

This diagram outlines the various factors that influence the price elasticity of supply, providing a visual summary of the determinants discussed in the study notes. Source

Interpreting Numerical Values of PES

Interpreting PES values helps to predict how markets react to price changes:

Elastic Supply (PES > 1): Firms can scale output quickly, so price rises lead to significant increases in supply. For example, in industries with standardised production methods.

Inelastic Supply (PES < 1): Firms cannot easily adjust output, so even large price changes have little effect. This often occurs in agriculture where natural factors limit flexibility.

Unitary Elastic Supply (PES = 1): The percentage change in supply matches the percentage change in price.

Perfectly Inelastic Supply (PES = 0): Supply is fixed regardless of price, such as unique works of art or land in a specific location.

Perfectly Elastic Supply (PES = ∞): Firms can supply any quantity at a given price, often a theoretical case but useful for modelling perfectly competitive markets.

Practical Importance of PES

Understanding PES is essential for businesses and policymakers:

For Firms

Pricing decisions: Firms can anticipate revenue effects of price changes.

Capacity planning: Identifying whether investment is needed to increase future elasticity.

For Governments

Tax incidence: Governments consider PES when predicting who bears the burden of indirect taxes. A more inelastic supply means producers bear more of the tax.

Market interventions: Knowledge of PES helps design policies such as subsidies or minimum prices.

For Consumers

PES indirectly affects consumers since the ability of firms to adjust supply influences price stability and availability of goods.

FAQ

Agricultural goods typically have inelastic supply because production depends on biological processes and seasonal cycles. Farmers cannot instantly adjust crop output in response to price changes.

By contrast, manufactured goods are often more elastic as firms can increase production quickly by running additional shifts, hiring more workers, or using spare capacity.

Policies such as subsidies, investment in infrastructure, or reducing regulatory barriers can make supply more elastic by allowing firms to expand production more easily.

However, restrictive policies such as licensing, quotas, or lengthy approval processes can reduce elasticity, making it harder for firms to respond to price changes.

Technological advancements often make supply more elastic by reducing production time and increasing efficiency.

For example:

Automation speeds up production processes.

Improved storage methods extend product lifespan.

Better logistics make supply chains more flexible.

If supply is inelastic, producers cannot easily reduce output when a tax is introduced, so they bear most of the tax burden.

If supply is elastic, producers can cut production or switch markets, shifting much of the tax burden onto consumers instead.

Firms can adopt strategies to make supply more responsive:

Invest in flexible production facilities.

Build and maintain higher stock levels.

Train workers for multi-skilled roles.

Secure multiple suppliers for raw materials.

These measures improve long-run adaptability and make firms better able to respond to changing market prices.

Practice Questions

Define price elasticity of supply and state what it means if the value of PES is less than 1. (2 marks)

1 mark for correctly defining price elasticity of supply as the responsiveness of quantity supplied to a change in price.

1 mark for correctly stating that PES < 1 means supply is inelastic, so the percentage change in quantity supplied is smaller than the percentage change in price.

Explain two factors that influence the price elasticity of supply of a good or service. (6 marks)

Up to 3 marks for each factor explained (maximum of 2 factors).

Identification of factor (1 mark).

Clear explanation of how the factor affects PES (1–2 marks).

Examples:

Time period: Supply is more elastic in the long run as firms can expand capacity, but inelastic in the short run when adjustments are limited. (Up to 3 marks)

Spare capacity: Firms with unused resources can respond quickly to price rises, making supply more elastic. (Up to 3 marks)

Other valid factors include factor mobility, availability of stocks, barriers to entry, or production time.

Maximum: 6 marks.