AQA Specification focus:

‘The difference between static efficiency and dynamic efficiency.’

Introduction

Efficiency is a key concept in economics, helping evaluate how well resources are used. Static efficiency focuses on short-term outcomes, while dynamic efficiency highlights innovation, investment, and long-term growth.

Understanding Efficiency in Economics

Efficiency describes the relationship between resource use and output in markets. Economists distinguish between static efficiency and dynamic efficiency, which operate over different time horizons and conditions.

Static Efficiency

Static efficiency examines efficiency at a given point in time, usually in the short run, without considering long-term innovation or investment. It has two main dimensions:

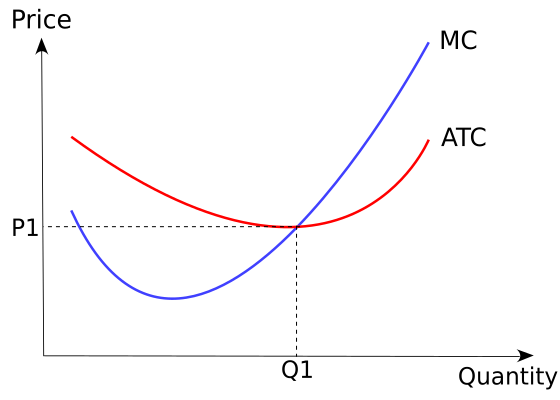

Productive efficiency: When firms produce at the lowest possible average total cost.

Diagram of marginal cost (MC) and average total cost (ATC) with productive efficiency at Q₁, where MC = ATC. This illustrates static efficiency at the lowest average cost. Source

Allocative efficiency: When resources are allocated such that price equals marginal cost, meaning consumer and producer surplus are maximised.

Static Efficiency: The condition where resources are allocated efficiently at a single point in time, incorporating productive efficiency and allocative efficiency.

Static efficiency therefore measures how well firms and markets perform in the short run given existing technology and resources.

Conditions for Static Efficiency

Productive efficiency is achieved when firms operate on the lowest point of the average cost curve.

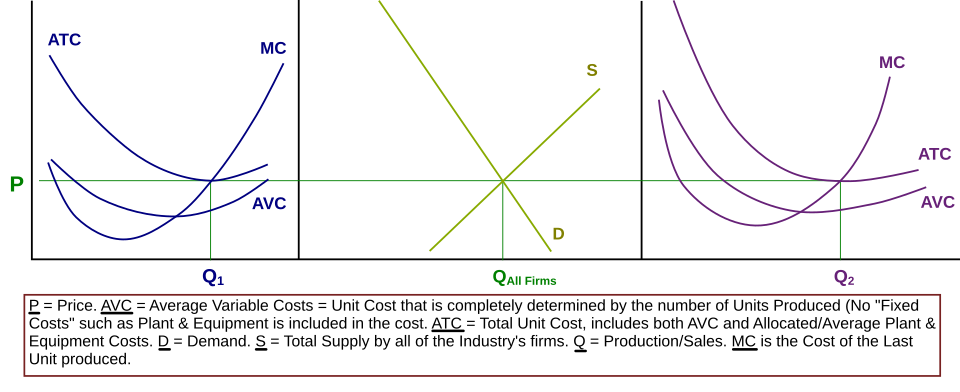

Allocative efficiency is achieved when consumer preferences are fully reflected in the output mix, and P = MC.

These conditions are commonly associated with perfectly competitive markets in equilibrium.

Allocative Efficiency: P = MC

P = Price of the good/service

MC = Marginal Cost of producing one additional unit

This relationship ensures that resources are not wasted, and society’s welfare is maximised at a given point in time.

Standard supply and demand equilibrium marking P and Q*. In perfect competition, this ensures P = MC, capturing allocative efficiency at the market level.* Source

Dynamic Efficiency

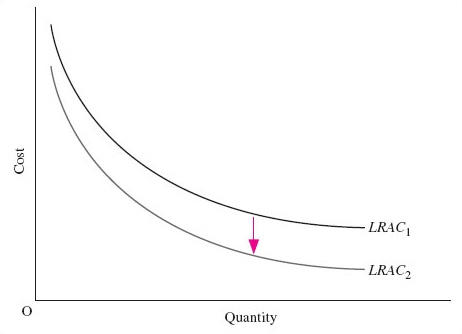

In contrast, dynamic efficiency focuses on efficiency improvements over time. It considers how investment, innovation, and technological progress improve future productive and allocative outcomes.

Dynamic Efficiency: Efficiency achieved when firms improve products, processes, and productivity over time through innovation, research and development, and investment.

Dynamic efficiency recognises that long-run welfare gains often come from new technology, product variety, and efficiency improvements rather than immediate cost minimisation.

Figure 7 shows a downward shift of the LRAC curve from LRAC₁ to LRAC₂, illustrating how innovation and investment lower long-run costs across all output levels. Source

Drivers of Dynamic Efficiency

Dynamic efficiency is influenced by several factors:

Research and development (R&D): Encourages innovation in products and production methods.

Investment in human capital: Skills and knowledge improve productivity over time.

Investment in physical capital: New machinery and infrastructure reduce costs in the long run.

Technological change: Advances in production processes create greater efficiency.

These drivers help firms maintain competitiveness and generate welfare gains across future periods.

Comparing Static and Dynamic Efficiency

The key difference lies in time horizon and focus:

Static efficiency is about using current resources optimally, given existing technology.

Dynamic efficiency is about improving future outcomes through innovation and investment.

Static efficiency maximises current welfare, while dynamic efficiency ensures sustained growth in welfare.

Trade-offs Between Static and Dynamic Efficiency

In real-world markets, firms often face a trade-off between static and dynamic efficiency.

Pursuing static efficiency may mean minimising costs now but underinvesting in innovation.

Pursuing dynamic efficiency may require higher short-term costs, such as investment in R&D, but leads to long-run benefits.

For example, monopolies may appear inefficient statically (due to higher prices and restricted output) but can sometimes achieve dynamic efficiency if they invest in innovation from their supernormal profits. Conversely, perfectly competitive markets may be highly statically efficient but may struggle with dynamic efficiency due to limited profit incentives for R&D.

Application to Market Structures

Perfect competition: High static efficiency (P = MC, lowest cost production) but weaker dynamic efficiency due to low incentives for innovation.

Monopoly: Weaker static efficiency (higher prices, restricted output) but potential for stronger dynamic efficiency due to R&D funding from abnormal profits.

Oligopoly: May achieve both, depending on strategic behaviour. Collusion reduces static efficiency but high rivalry can encourage dynamic efficiency through product differentiation and innovation.

This demonstrates how static and dynamic efficiency must be considered together when evaluating market performance.

Implications for Resource Allocation

Static efficiency ensures that at any point, resources are not wasted and are allocated according to consumer preferences.

Dynamic efficiency ensures resources are continually reallocated as technology and preferences evolve, fostering long-term welfare and growth.

Understanding both perspectives allows economists to assess not only immediate outcomes but also sustainability and adaptability of markets in the long run.

FAQ

Markets such as perfect competition can achieve static efficiency because firms produce at the lowest cost and allocate resources where P = MC.

However, dynamic efficiency is limited since firms in perfect competition often earn only normal profits, reducing incentives to invest in research and development. Without supernormal profits, innovation and technological progress are less likely.

Monopolies may restrict output and raise prices, leading to static inefficiency.

Yet, abnormal profits provide funds for:

Investment in research and development

Long-term innovation in products and processes

Greater opportunities for cost-saving technologies

This means monopolies can promote dynamic efficiency even while failing in static efficiency.

Dynamic efficiency depends not only on firms but also on demand-side conditions.

Consumers who value innovative products encourage firms to invest in R&D. For example, strong demand for new technologies or sustainable goods can accelerate investment.

If demand is weak or consumers are highly price-sensitive, firms may underinvest in innovation, limiting dynamic efficiency gains.

Government policies can shape both types of efficiency:

Static efficiency: Encouraging competition, reducing barriers to entry, or enforcing price regulation.

Dynamic efficiency: Providing R&D subsidies, tax incentives for investment, or enforcing intellectual property rights.

Policy therefore affects whether firms prioritise short-term cost minimisation or long-term innovation.

Different market structures perform differently over time.

Perfect competition: High static efficiency, low dynamic incentives.

Monopoly: Poor static outcomes, but potential for dynamic efficiency.

Oligopoly: Mixed performance depending on rivalry and collusion.

Recognising this distinction helps economists assess whether short-term outcomes or long-term progress should take priority in evaluating welfare.

Practice Questions

Define static efficiency and dynamic efficiency. (2 marks)

1 mark for an accurate definition of static efficiency (e.g. efficiency at a point in time, including productive and allocative efficiency).

1 mark for an accurate definition of dynamic efficiency (e.g. efficiency over time through innovation, R&D, and investment).

Explain two differences between static efficiency and dynamic efficiency. (6 marks)

Up to 2 marks for identifying a difference in time horizon (static = short run, dynamic = long run).

Up to 2 marks for identifying a difference in focus (static = minimising current costs or P=MC; dynamic = innovation, R&D, investment for future improvements).

Up to 2 marks for development of these points, such as:

Static efficiency ensures maximum current welfare and optimal allocation of resources.

Dynamic efficiency promotes sustained welfare gains by lowering future costs and improving products.

Maximum 6 marks.