AQA Specification focus:

‘Concepts such as sunk costs and hit-and-run competition.’

Introduction

In A-Level Economics, understanding sunk costs and hit-and-run competition is crucial for analysing contestable markets, where entry and exit conditions shape firm behaviour and industry performance.

Sunk Costs

Definition and Explanation

Sunk Costs: Expenditures that cannot be recovered once incurred, regardless of whether a firm continues or exits production.

Sunk costs are particularly significant in determining the contestability of a market. If sunk costs are high, exiting the industry imposes large irretrievable losses, discouraging potential new entrants. Conversely, in industries where sunk costs are low, firms can enter and leave markets more freely, increasing competition.

Examples of Sunk Costs

Advertising campaigns: Once money is spent on advertising, it cannot be recovered.

Specialised machinery: Equipment with no alternative use outside the industry becomes unrecoverable if production ceases.

Research and development (R&D): Investments in product design may be wasted if the firm leaves the market.

Role in Market Structures

Sunk costs influence:

Barriers to entry: Higher sunk costs increase barriers, reducing contestability.

Pricing behaviour: Firms in high sunk cost industries may adopt strategies to recoup expenditure, often sustaining higher prices.

Industry dynamics: Markets with low sunk costs tend to attract greater short-term competition.

Hit-and-Run Competition

Definition and Explanation

Hit-and-Run Competition: The process where firms enter a market to take advantage of temporary supernormal profits and then exit quickly when conditions become less favourable.

This concept is central to contestable market theory, where the threat of entry and exit disciplines incumbent firms.

Conditions for Hit-and-Run Competition

Low or no sunk costs: Firms can leave the market without significant financial loss.

Supernormal profits available: Incumbent firms earning abnormal profits attract new entrants.

Ease of entry and exit: New firms can enter quickly without prohibitive barriers.

How it Works

Firms observe incumbents making supernormal profits.

They enter the market quickly, exploiting the profit opportunity.

As profits are competed away, or costs rise, they exit before losses occur.

This constant threat ensures incumbents may price closer to the competitive level, even if structurally the market resembles an oligopoly or monopoly.

Hit-and-run entry occurs when potential entrants exploit short-run supernormal profits and exit without penalty once conditions change.

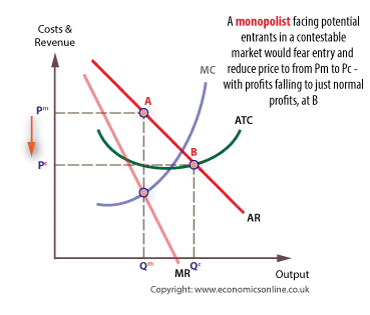

Illustrative contestable-market diagram used in teaching materials. It highlights the link between low sunk costs, easy entry/exit, and the erosion of supernormal profits. This directly underpins the definition of hit-and-run competition. Source

Relationship between Sunk Costs and Hit-and-Run Competition

The extent of hit-and-run competition directly depends on the level of sunk costs:

Low sunk costs → high likelihood of hit-and-run competition, leading to more contestable markets.

High sunk costs → reduced likelihood, reinforcing incumbent power and discouraging entry.

For example, a local café (low sunk costs) can be opened and closed with little loss, while an oil refinery (high sunk costs) involves vast unrecoverable investments, deterring rapid entry and exit.

Implications for Market Performance

Efficiency Outcomes

Allocative efficiency: Hit-and-run competition pushes prices closer to marginal cost (P = MC), benefiting consumers.

Productive efficiency: Firms must minimise costs to survive against potential entrants.

Dynamic efficiency: The need to innovate is heightened, but high sunk costs in R&D-intensive sectors can either promote or inhibit entry, depending on contestability.

Firm Behaviour

Limit pricing: Incumbents may deliberately set lower prices to discourage entry.

Non-price competition: Advertising, branding, or service differentiation may raise sunk costs, reducing contestability.

Strategic barriers: Firms may increase sunk costs artificially (e.g., brand loyalty campaigns) to deter new entrants.

Low or zero sunk costs and the ability to exit freely are central to contestability.

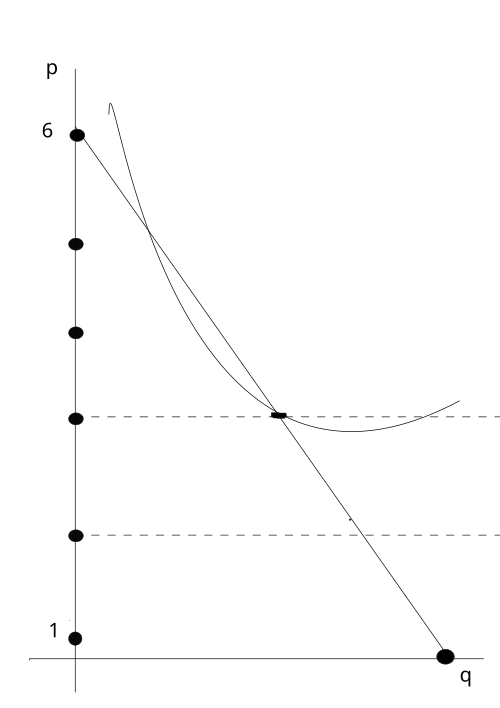

A temporary pop-up shop exemplifying low set-up commitment and easy exit. Such formats minimise sunk costs, enabling short-term market entry to capture transient profits. (Real-world context beyond the diagrammatic model; no extra theory beyond the syllabus.) Source

Advantages and Disadvantages

Advantages of Low Sunk Costs and Hit-and-Run Competition

Increased contestability encourages efficiency and lower prices.

Consumers benefit from greater choice and innovation.

Markets remain competitive even without many firms, as the threat of entry disciplines incumbents.

Disadvantages

Excessive entry and exit may cause instability in employment and output.

Firms may avoid long-term investment if they fear rapid entry undermining their returns.

Industries with necessary high sunk costs (e.g., pharmaceuticals, airlines) may struggle to be contestable, limiting the role of hit-and-run competition.

Diagrammatic Context

Although the specification does not require a detailed diagram here, students should understand that in a perfectly contestable market:

Supernormal profits attract entry.

Entry shifts supply outward, lowering price and profits.

Exit occurs once profits are eroded.

This cycle continues until only normal profit remains, even if only a few firms dominate structurally.

In a perfectly contestable market, the mere threat of entry disciplines incumbents to price at or near average cost.

Contestable-market diagram showing price and output where potential entry constrains incumbents. When sunk costs are low and exit is easy, supernormal profits are competed away. The diagram illustrates why hit-and-run entry keeps price close to average cost. Source

Key Takeaways for AQA Exams

Sunk costs are unrecoverable and central in determining market contestability.

Hit-and-run competition relies on low sunk costs, ease of entry/exit, and the presence of supernormal profits.

The interaction between sunk costs and hit-and-run competition shapes firm behaviour, efficiency, and long-term industry performance.

Students should link these concepts explicitly to contestable markets, as highlighted in the specification.

FAQ

Sunk costs are unrecoverable once incurred, such as advertising or specialised equipment. They cannot be regained even if the firm exits.

Fixed costs, by contrast, are costs that do not vary with output but may still be partially recoverable, such as rent if a lease can be terminated or machinery that can be resold.

Thus, all sunk costs are fixed, but not all fixed costs are sunk.

High sunk costs deter new entrants because leaving the market would mean losing large investments with no recovery.

This raises risk for potential firms and reduces the attractiveness of entering industries such as airlines or pharmaceuticals.

Low sunk costs reduce this barrier, making markets more contestable.

Incumbents may deliberately increase sunk costs to discourage rivals.

Examples include:

Heavy investment in branding or advertising that cannot be reused by others.

Building loyalty schemes or customer networks that tie consumers to the firm.

Financing costly R&D projects to signal commitment to the market.

These actions raise the cost of entry and reduce contestability.

Hit-and-run entry can be seen in markets with minimal sunk costs.

Examples include:

Pop-up retail shops operating only during peak seasons.

Online businesses that can be set up and shut down at very low cost.

Short-term financial trading where firms exploit price anomalies and exit quickly.

These cases illustrate how easy entry and exit supports temporary profit-taking.

The key lies in the threat of entry. Incumbents anticipate potential rivals and adjust behaviour.

They may set prices closer to average cost to prevent profit opportunities.

They work to minimise production costs to stay competitive.

They avoid exploiting monopoly power to maintain stability.

This disciplining effect means even concentrated markets can deliver outcomes resembling competitive markets when sunk costs are low.

Practice Questions

Define sunk costs and explain why they are significant in determining market contestability. (2 marks)

1 mark for a correct definition of sunk costs: unrecoverable costs once incurred.

1 mark for explaining that high sunk costs reduce contestability, while low sunk costs increase ease of entry and exit.

Using the concept of hit-and-run competition, explain how the presence of low sunk costs can influence the behaviour of incumbent firms in a contestable market. (6 marks)

1 mark for recognising that hit-and-run competition occurs when firms enter to exploit short-run supernormal profits and exit easily when conditions change.

1 mark for stating that low sunk costs make entry and exit easy, encouraging hit-and-run behaviour.

1 mark for linking this to the threat of potential entry disciplining incumbents.

1 mark for explaining that incumbents may set lower prices (limit pricing) to deter entry.

1 mark for stating that incumbents may reduce supernormal profits to normal profits to prevent hit-and-run entry.

1 mark for discussing efficiency effects, e.g., prices closer to marginal cost, benefiting consumers.