AQA Specification focus:

‘Be able to apply these concepts when discussing economic efficiency and welfare issues, such as price discrimination and the dead-weight losses associated with monopoly.’

Introduction

Consumer and producer surplus provide essential tools for analysing efficiency and welfare in markets. They show how resources are allocated, who benefits, and where inefficiencies arise.

Consumer and Producer Surplus

Consumer Surplus

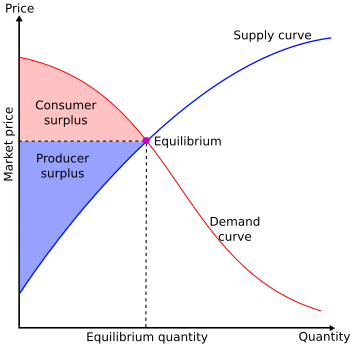

Consumer Surplus: The difference between the maximum price consumers are willing to pay for a good and the actual price they pay.

Consumer surplus measures the net benefit to buyers. A higher consumer surplus implies greater welfare for consumers, typically occurring when prices fall or markets operate efficiently.

Producer Surplus

Producer Surplus: The difference between the minimum price producers are willing to accept for a good and the actual price they receive.

Producer surplus reflects the net gain for firms. It is maximised when producers receive prices above their marginal costs, which can result from market power or favourable demand conditions.

Total surplus equals consumer surplus plus producer surplus.

A clearly labelled demand–supply diagram showing consumer surplus above the market price and producer surplus below it at the competitive equilibrium (P, Q*). This frames total surplus as the sum of the two shaded areas. The image is purposefully simple to emphasise layout and measurement rather than extraneous detail.* Source

Surplus and Economic Efficiency

Allocative Efficiency

Allocative Efficiency: Achieved when resources are distributed so that price (P) equals marginal cost (MC), ensuring no misallocation.

At this point, consumer and producer surplus are maximised jointly, leading to the highest possible total welfare. Any deviation causes either underproduction or overproduction, creating inefficiency.

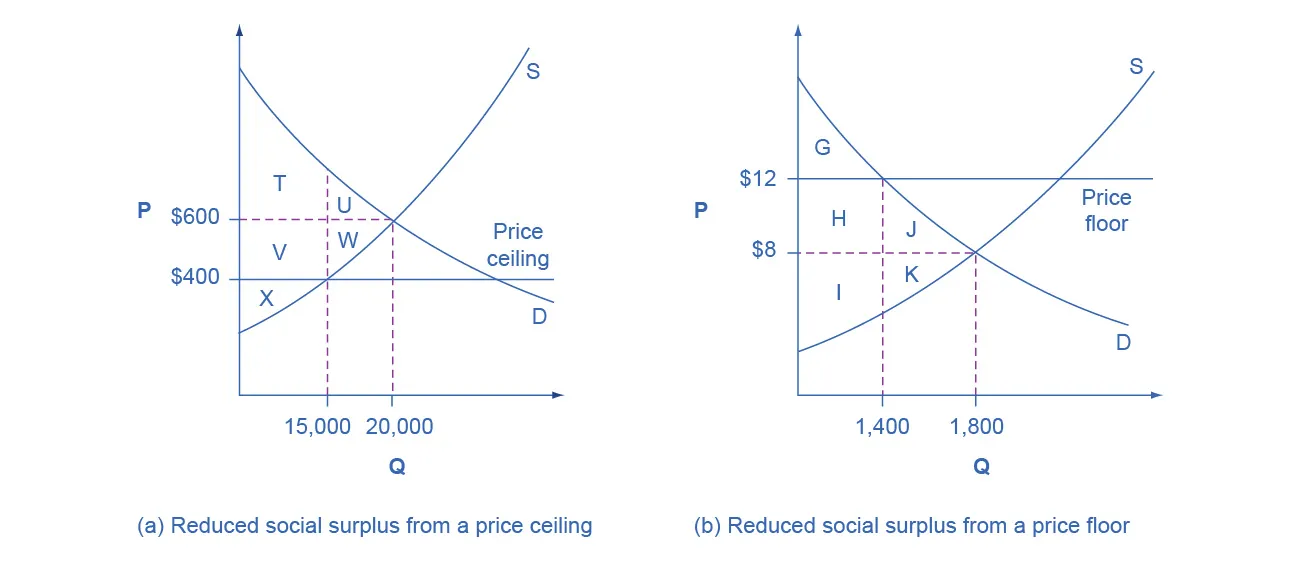

Deadweight Loss

Deadweight Loss: The reduction in total surplus (consumer + producer surplus) caused by market distortions, such as monopoly pricing or taxation.

Deadweight loss is the reduction in total surplus caused by market distortions, such as monopoly pricing or taxation.

Two clean panels show how a price ceiling and a price floor create a deadweight loss triangle and redistribute surplus between consumers and producers. While the example concerns policy controls, the geometry of lost trades generalises to monopoly and other distortions. Extra detail (price-control context) is included only to visualise the DWL and surplus-transfer mechanism. Source

Applying Surplus to Market Structures

Perfect Competition

Firms are price takers.

Price equals marginal cost, maximising allocative efficiency.

Total surplus is maximised, and deadweight loss is eliminated.

Monopoly

A monopolist restricts output to raise prices above marginal cost.

This creates:

Higher producer surplus (monopoly profits).

Lower consumer surplus (higher prices, less consumption).

Deadweight loss, as some mutually beneficial trades do not occur.

Welfare Analysis in Practice

Price Discrimination

Price Discrimination: The practice of charging different prices to different consumers for the same good, where the price differences are not due to cost differences.

Conditions for price discrimination include market power, the ability to segment the market, and prevention of resale.

Welfare effects:

Consumers: Some may pay more, reducing their surplus, while others may benefit from lower prices.

Producers: Gain extra surplus by capturing more of the consumer surplus.

Overall welfare: Can increase or decrease, depending on whether total output expands or contracts.

Under third-degree price discrimination, output is allocated across segments so that MR₁ = MR₂ = MC, shifting surplus between groups and potentially changing total surplus.

A labelled third-degree price-discrimination diagram with two sub-markets, each with its own demand and marginal-revenue curve, and a common MC. It clarifies why the high-elasticity segment faces a lower price and larger quantity. The figure stays at the appropriate level of detail for A-level welfare analysis. Source

Monopoly Deadweight Loss

When monopoly pricing restricts output, welfare is lost:

Consumers who would have bought at competitive prices no longer do so.

Producers also lose potential gains from sales not made.

The result is a permanent reduction in total surplus.

Surplus Concepts and Efficiency Debates

Stakeholder Impacts

Consumers prefer markets with high consumer surplus (e.g., perfect competition).

Producers may prefer monopoly or oligopoly settings, where surplus is shifted in their favour.

Government policy often intervenes (via regulation, taxation, or subsidies) to correct imbalances and reduce deadweight loss.

Static vs Dynamic Considerations

In the short run, surplus analysis captures immediate welfare outcomes.

In the long run, dynamic efficiency (innovation, investment) may alter surplus patterns, as monopolists could reinvest profits into research, potentially benefiting consumers later.

Key Equations

Total Surplus = Consumer Surplus + Producer Surplus

Deadweight Loss = Total Surplus under Perfect Competition − Total Surplus under Monopoly/Distorted Market

These simple equations help illustrate the welfare effects of different market structures.

Evaluating Efficiency and Welfare with Surplus Concepts

Surplus analysis provides a framework for judging whether markets allocate resources efficiently. By comparing different structures:

Perfect competition → benchmark for efficiency, with no deadweight loss.

Monopoly → reduced consumer surplus, increased producer surplus, overall welfare loss.

Price discrimination → ambiguous outcomes, but essential for understanding how surplus can be redistributed and whether total efficiency rises or falls.

Through these comparisons, economists can assess not only the extent of efficiency in markets but also the distribution of welfare between stakeholders.

FAQ

When demand rises, both consumer and producer surplus can increase if the equilibrium price and quantity rise, as more transactions occur.

When supply shifts outward, consumers benefit from lower prices and higher surplus, while producers gain if the rise in quantity offsets the lower price per unit.

Deadweight loss captures the value of potential trades that do not happen because output is below the socially optimal level.

This means resources are not used in their most valued way, reducing total welfare.

Policies may correct inefficiency by:

Regulating monopolies to prevent excessive price rises.

Imposing or removing taxes and subsidies to align price with marginal cost.

Introducing competition policy to reduce barriers to entry.

These measures aim to move output closer to the efficient equilibrium.

Yes, if the monopolist introduces price discrimination that expands total output.

Some consumers gain access to lower prices in one segment, while producers capture surplus in another. This can raise total welfare despite redistributions.

It allows economists to see not just total welfare, but how it is shared.

Consumers benefit when surplus is large and prices are low.

Producers benefit when prices rise and their surplus expands.

Policymakers assess trade-offs, such as equity versus efficiency, using surplus measures.

Practice Questions

Define consumer surplus and explain how it is represented on a standard demand and supply diagram. (2 marks)

1 mark for correct definition: Consumer surplus is the difference between the maximum price a consumer is willing to pay and the market price actually paid.

1 mark for explaining its representation: Shown as the area under the demand curve and above the market price up to the equilibrium quantity.

Using the concept of deadweight loss, explain how monopoly pricing affects overall economic welfare compared to perfect competition. (6 marks)

1 mark for identifying monopoly restricts output and raises price above marginal cost.

1 mark for stating consumer surplus falls because of higher prices and reduced consumption.

1 mark for stating producer surplus may rise as monopolist captures more profit.

1 mark for defining deadweight loss as the loss of total surplus from mutually beneficial trades that do not occur.

1 mark for explaining that monopoly output is less than socially optimal output, creating deadweight loss.

1 mark for linking to overall welfare: Total surplus falls compared to perfect competition, with resources misallocated.