AQA Specification focus:

‘The implications of the following for the behaviour of firms and the industry: large numbers of producers, identical products, freedom of entry and exit, and perfect knowledge. Firms operating in perfectly competitive markets are price takers.’Introduction

Perfect competition represents a theoretical market structure that provides the foundation for understanding efficiency and firm behaviour. Its strict assumptions shape outcomes for firms and industries.

Core Assumptions of Perfect Competition

Large Numbers of Producers

A perfectly competitive market is characterised by many firms producing and selling output. No single firm is large enough to influence price. Instead, the market price is determined entirely by the forces of supply and demand.

This creates a situation where each firm is a price taker rather than a price maker, as their individual output decisions are too small to affect overall market supply.

Firms operating in perfectly competitive markets are price takers.

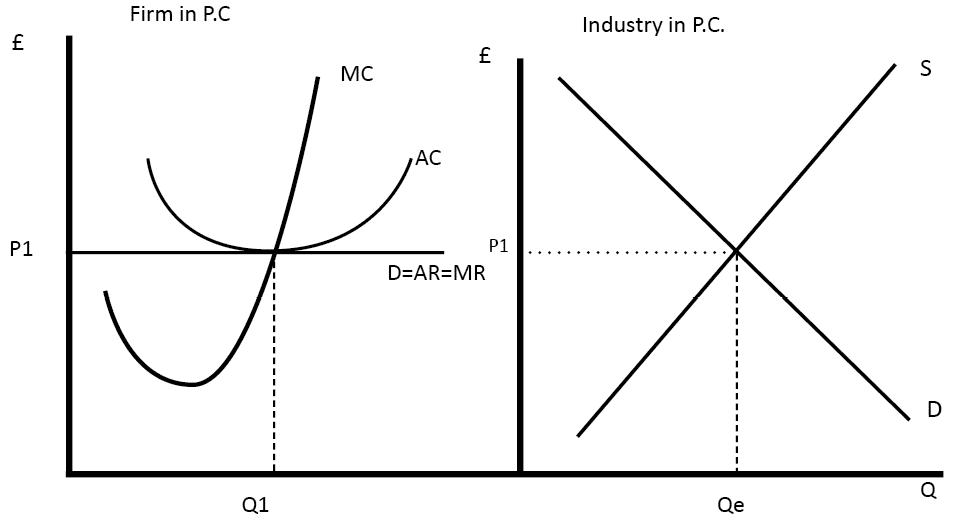

The diagram depicts the equilibrium in a perfectly competitive market, where the firm's demand curve is perfectly elastic at the market price. The firm maximises profit where marginal cost equals marginal revenue, resulting in normal profit in the long run. Source

Identical Products

All firms in this market produce homogeneous products — goods that are perfect substitutes.

Homogeneous Products: Goods that are identical in features and quality, leaving consumers with no preference between suppliers.

This assumption eliminates brand loyalty and product differentiation, meaning the only competitive factor is price.

Freedom of Entry and Exit

The market has no significant barriers to entry or exit. New firms can freely join the industry if profit opportunities exist, and unprofitable firms can leave without excessive cost.

This ensures that in the long run, abnormal profits are competed away, leading to a state where firms earn only normal profit.

Perfect Knowledge

Consumers and producers are assumed to have perfect information about prices, product quality, and production methods.

Perfect Knowledge: A condition in which all participants in a market are fully informed about prices, technology, and quality, enabling rational decision-making.

This prevents firms from charging higher prices or hiding inefficiencies since buyers are fully aware of cheaper or better alternatives.

Implications for Firms

Price Taking Behaviour

Because products are identical and there are many sellers, each firm must accept the market price.

If a firm charges above the market price, it sells nothing, as consumers switch to identical competitors.

If it charges below the market price, it reduces revenue unnecessarily, since buyers can already purchase at the prevailing rate.

Thus, the firm’s demand curve is perfectly elastic at the market price.

Profit Conditions in the Short Run

In the short run, firms may experience different levels of profitability depending on costs.

Some firms may achieve abnormal (supernormal) profit if their costs are lower than others.

Others may face losses if unable to produce efficiently at the market price.

This is only temporary, as the assumption of free entry and exit affects long-run outcomes.

Long-Run Adjustment

Freedom of entry and exit ensures that:

If firms earn abnormal profits, new firms enter, shifting supply outward, lowering price, and eliminating excess profit.

If firms suffer losses, inefficient firms exit, reducing supply and raising price until remaining firms make normal profit.

This dynamic drives the market towards long-run equilibrium.

Implications for the Industry

Uniform Pricing Across Firms

Since all firms produce identical products and share perfect knowledge, a single market price prevails. Industry behaviour is defined by aggregate supply and demand.

Efficiency Implications

Perfect competition has several key efficiency outcomes:

Allocative Efficiency: Achieved when price equals marginal cost (P = MC), meaning resources are allocated to maximise consumer and producer welfare.

Productive Efficiency: Achieved in the long run when firms produce at the lowest point on their average cost curve.

Allocative Efficiency: A situation where resources are distributed such that consumer and producer surplus is maximised, with price equal to marginal cost.

The industry thus acts as a benchmark against which real-world market efficiency is judged.

Normal Profit as the Long-Run Outcome

Because of free entry and exit, the industry tends towards firms earning normal profit only.

Normal Profit: The minimum level of profit required to keep resources in their current use, covering opportunity costs but providing no extra return.

This ensures that in equilibrium, firms survive but do not earn sustained abnormal profits.

Behavioural Characteristics of Firms in Perfect Competition

Output Decisions

Firms set output where marginal revenue (MR) equals marginal cost (MC) to maximise profit or minimise loss. Since MR = Price in perfect competition, the rule simplifies to:

Produce until MC = Price.

Profit Maximisation Rule: MR = MC

MR (Marginal Revenue) = Additional revenue from selling one more unit

MC (Marginal Cost) = Additional cost of producing one more unit

This ensures firms are making rational production decisions given the market conditions.

Inability to Influence Market Price

Individual firms lack the power to change price. They can only adjust their output in response to cost changes, not the market price itself. This contrasts sharply with monopolies, where price-setting is possible.

Dynamic Adjustment and Survival

Only the most efficient firms survive in the long run. Those unable to reduce costs are forced out due to the pressures of free competition. This drives ongoing efficiency gains across the industry.

Summary of Implications

The assumptions of perfect competition — many firms, identical products, freedom of entry/exit, and perfect knowledge — together create a structure where:

Firms are price takers.

Industry prices are uniform.

Abnormal profits are temporary.

Efficiency outcomes (allocative and productive) are achieved in the long run.

This model serves as a theoretical benchmark, illustrating how competitive pressures shape firm and industry behaviour in ideal conditions.

The spectrum illustrates the varying degrees of competition across different market structures, from perfect competition with many firms and identical products to pure monopoly with a single firm dominating the market. Source

FAQ

In perfect competition, each firm is too small to influence the overall market price. The product is identical across all suppliers, and consumers have perfect knowledge of prices.

If a firm tries to raise its price, it will sell nothing since buyers can purchase identical goods from competitors. If it lowers its price, it only reduces revenue unnecessarily.

Perfect knowledge means both buyers and sellers have full awareness of:

Market prices

Product quality

Production methods

This eliminates uncertainty, prevents firms from charging higher prices, and ensures resources are allocated efficiently. It also removes opportunities for advertising-based brand loyalty, since products are identical and fully understood.

Homogeneous products ensure consumers view all goods as identical, making them perfect substitutes.

This assumption removes non-price competition such as branding or product differentiation. Price is the sole competitive factor, forcing firms to focus on cost efficiency.

Without barriers to entry, new firms can join the market when abnormal profits exist, increasing supply and reducing price.

Equally, the lack of exit barriers means firms facing persistent losses can leave. This process ensures that only normal profit is sustained in the long run, as the market continually self-corrects.

A large number of firms ensures no individual business dominates the market. Each firm is small relative to the whole industry, creating a perfectly elastic demand curve.

This competitive pressure drives firms to produce efficiently, since inefficiency would force them out of the market. Over time, this contributes to both allocative and productive efficiency.

Practice Questions

State two assumptions of a perfectly competitive market. (2 marks)

1 mark for each correct assumption identified (maximum 2 marks).

Acceptable answers include:

Large number of firms in the industry.

Products are homogeneous/identical.

Freedom of entry and exit.

Perfect knowledge among buyers and sellers.

Explain how the assumption of free entry and exit in a perfectly competitive market influences the long-run profitability of firms. (6 marks)

Up to 2 marks for identifying the mechanism of entry and exit:

Firms making abnormal profit attract new entrants, increasing supply.

Loss-making firms leave, reducing supply.

Up to 2 marks for linking to changes in price and profit:

Entry shifts supply outward, lowering price until only normal profit remains.

Exit shifts supply inward, raising price until normal profit is restored.

Up to 2 marks for clear application to long-run equilibrium:

In the long run, firms earn only normal profit.

Abnormal profits or losses are temporary because of the absence of barriers to entry and exit.

Maximum 6 marks: award full marks where the answer shows clear logical progression and accurate use of economic terminology.