AQA Specification focus:

‘Students should be aware that perfect competition, in both product and labour markets, provides a yardstick for judging the extent to which real world markets perform efficiently or inefficiently, and the extent to which a misallocation of resources occurs.’

Perfect competition is a theoretical market structure used as a benchmark in economics. It helps evaluate how efficiently real-world markets allocate resources compared to this ideal model.

Perfect Competition as a Yardstick

Economists use perfect competition as a benchmark to assess market outcomes. This model provides a reference point to evaluate whether actual markets achieve efficiency or suffer from market failure. Perfect competition is not a description of most real-world markets but rather a tool of critical evaluation.

Characteristics of Perfect Competition as a Benchmark

When applying perfect competition as a standard, economists focus on the following:

Large number of firms: No individual producer has market power.

Homogeneous products: Goods are identical and fully substitutable.

Perfect information: Consumers and producers know prices, quality, and availability.

Freedom of entry and exit: Firms can enter or leave the market without significant barriers.

Price-taking behaviour: Firms cannot influence the market price and must accept the equilibrium price.

These characteristics allow economists to compare the efficiency of actual markets against the ideal.

Efficiency under Perfect Competition

Allocative Efficiency

Allocative Efficiency: Occurs when resources are distributed so that price (P) = marginal cost (MC), meaning the value consumers place on a good equals the cost of producing it.

Perfect competition achieves allocative efficiency, as firms produce the output where consumer willingness to pay matches production cost. Any deviation indicates potential misallocation of resources in real markets.

Productive Efficiency

Productive Efficiency: Achieved when firms produce at the lowest point on the average cost (AC) curve, minimising costs per unit.

In the long run, competitive pressures force firms to produce at the lowest possible cost, ensuring productive efficiency.

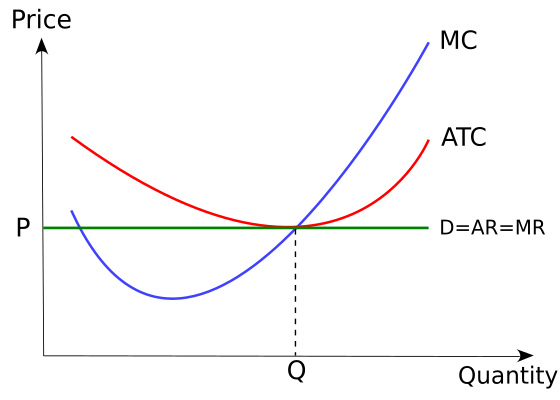

A perfectly competitive firm in long-run equilibrium sets output where AR=MR=MC at the minimum of AC, ensuring both allocative and productive efficiency. Source

Dynamic Efficiency

Dynamic Efficiency: Efficiency over time, achieved through innovation, investment in technology, and improvements in quality.

While perfect competition secures allocative and productive efficiency, it is often criticised for limited incentives for innovation, making it less successful in ensuring dynamic efficiency.

Perfect Competition vs. Real-World Markets

Product Markets

In agricultural markets, products such as wheat or maize often resemble perfect competition because goods are relatively homogeneous and entry barriers are low.

In contrast, most manufacturing and service industries exhibit product differentiation, branding, and barriers to entry, making them imperfectly competitive.

Labour Markets

Perfect competition is also used to analyse labour markets. The benchmark assumes identical workers, free movement, and perfect information about wages and conditions. In reality:

Workers differ in skills, experience, and productivity.

Information about jobs and wages is imperfect.

Trade unions, minimum wages, and regulations influence outcomes.

Thus, labour markets often diverge significantly from the benchmark, highlighting inefficiencies.

Misallocation of Resources

One of the main uses of the model is to identify where misallocation of resources occurs. Misallocation arises when output levels do not correspond to consumer preferences or when firms operate with higher than necessary costs.

Under monopoly, firms restrict output and charge higher prices, leading to deadweight welfare loss.

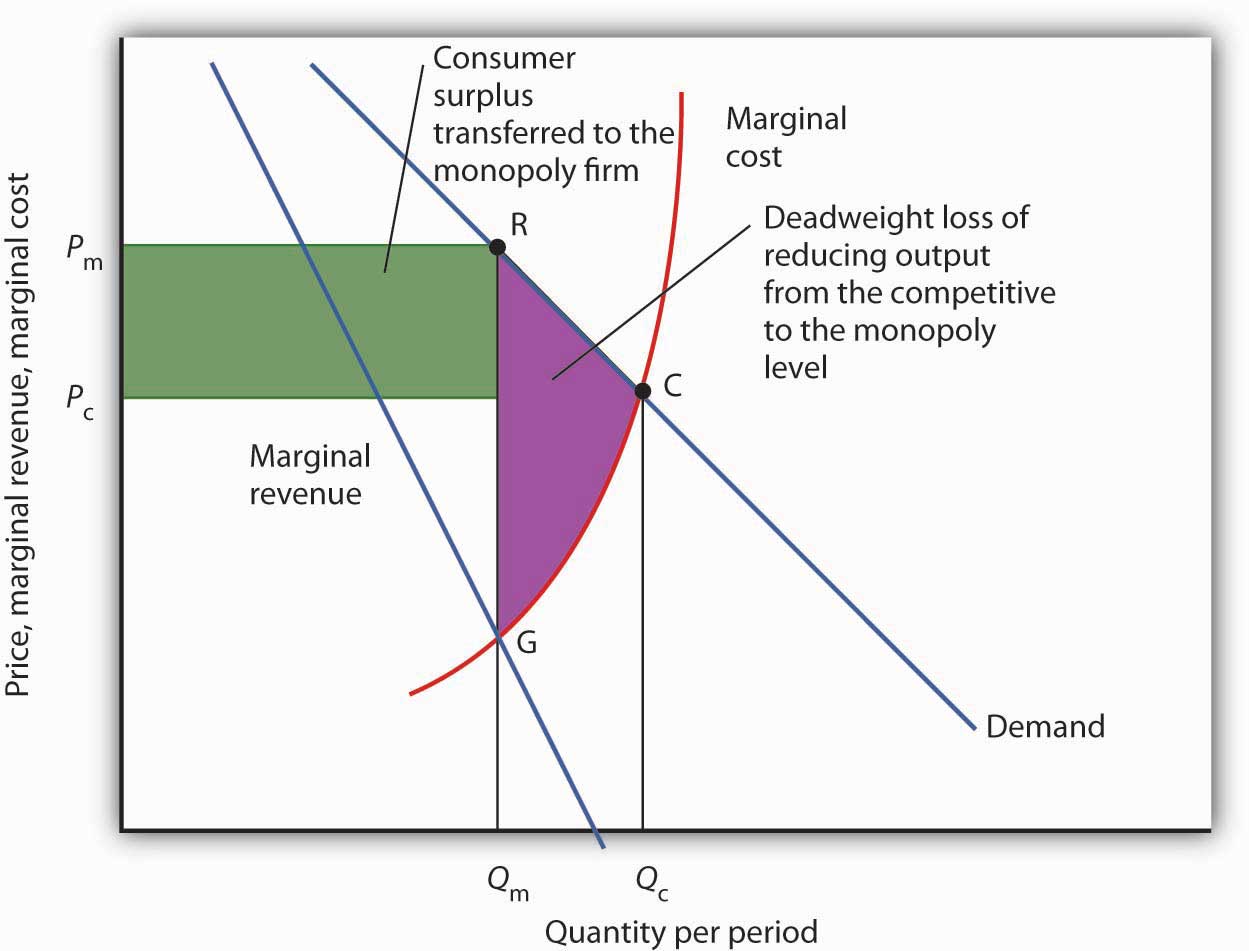

The diagram contrasts competitive output (Q_c, P_c) with monopoly output (Q_m, P_m), highlighting the shaded deadweight loss area from restricted output and higher prices. Source

Under oligopoly, collusion or price rigidity may reduce efficiency.

Under monopolistic competition, excess capacity can prevent full productive efficiency.

By comparing outcomes to the perfect competition model, economists can quantify welfare losses.

Critical Evaluation of Perfect Competition as a Benchmark

Strengths of Using Perfect Competition as a Benchmark

Provides a clear reference point to assess efficiency.

Helps explain the welfare costs of monopoly, oligopoly, or monopolistic competition.

Illustrates the benefits of competitive pressure on prices and costs.

Useful for evaluating government interventions and competition policy.

Weaknesses and Limitations

Unrealistic assumptions: Real markets rarely exhibit perfect information, identical products, or no entry barriers.

Neglect of dynamic efficiency: Innovation often arises in markets with higher profits, not in perfect competition.

Over-simplification: Ignores behavioural and institutional factors that influence markets, such as brand loyalty or government regulation.

Labour market limitations: Worker differences and mobility constraints make the model especially unrealistic in employment contexts.

Applications in Policy and Analysis

Economists and policymakers use the model to assess market performance:

Competition policy: Authorities such as the UK’s Competition and Markets Authority (CMA) use perfect competition as a yardstick when investigating anti-competitive behaviour.

Efficiency comparisons: Evaluations of monopolies, oligopolies, or privatised industries often rely on this model to identify inefficiencies.

Welfare analysis: Helps assess whether government intervention is needed to reduce misallocation and improve outcomes for consumers and producers.

Benchmark vs. Realistic Alternatives

Although perfect competition is the classic benchmark, some argue that more realistic models, such as contestable markets, provide a better framework for assessing efficiency in practice. Contestability considers potential competition rather than assuming away barriers completely.

In conclusion, perfect competition serves as a yardstick for efficiency, illustrating how far real-world markets deviate from the ideal. Its usefulness lies in critical evaluation, not as a literal description of most industries.

FAQ

Perfect competition is rarely found in reality because its assumptions—such as identical products, perfect knowledge, and zero entry barriers—are too restrictive.

It remains valuable because it provides a reference point, allowing economists to measure the extent of inefficiency or distortion in real-world markets compared to the ideal.

Policymakers can identify where interventions may be necessary by comparing real markets with the outcomes predicted under perfect competition.

It highlights potential welfare losses caused by monopoly power.

It helps assess whether regulation, competition policy, or deregulation is needed to improve efficiency.

It provides justification for breaking up cartels or preventing mergers that reduce competition.

In theory, a perfectly competitive labour market ensures wages equal the value of workers’ marginal productivity, creating allocative efficiency.

When actual labour markets deviate—due to trade unions, minimum wages, or information gaps—economists can measure the extent of inefficiency by comparing to the perfect competition benchmark.

While perfect competition maximises efficiency, it often assumes little incentive for innovation or product development.

By contrast, imperfect markets like monopolistic competition or oligopoly can drive innovation, improve product quality, and invest in research through higher retained profits. This highlights a key limitation of the benchmark.

Perfect competition predicts output where price equals marginal cost, ensuring efficient resource use.

A monopoly, however, restricts output and raises prices above marginal cost.

Consumers face higher prices and reduced choice.

The economy suffers a deadweight welfare loss, representing resources not used in ways that maximise societal benefit.

By contrasting these outcomes, the benchmark shows how monopoly behaviour leads to inefficiency.

Practice Questions

Define allocative efficiency and explain how it is achieved under perfect competition. (2 marks)

1 mark for correct definition: Allocative efficiency occurs when price (P) equals marginal cost (MC).

1 mark for explanation: In perfect competition, firms produce at the point where P = MC, meaning resources are allocated according to consumer preferences.

Explain why economists use perfect competition as a benchmark for assessing the efficiency of real-world markets. (6 marks)

Up to 2 marks: Clear explanation that perfect competition is a theoretical model providing a reference point for comparison.

Up to 2 marks: Identification of specific efficiencies achieved under perfect competition (e.g., allocative efficiency where P = MC, productive efficiency at minimum AC).

Up to 1 mark: Reference to misallocation of resources in imperfect markets (e.g., monopoly creating deadweight welfare loss).

Up to 1 mark: Evaluation point (e.g., limitations of the model because assumptions are unrealistic, but still valuable as a yardstick).