AQA Specification focus:

‘That monopoly power is influenced by factors such as barriers to entry, the number of competitors, advertising and the degree of product differentiation.’

Monopoly power reflects the ability of a firm to influence market prices and outcomes. Understanding its sources and measurement is vital for analysing competition and efficiency.

Sources of Monopoly Power

Barriers to Entry

Barriers to entry are obstacles preventing new firms from entering an industry. High barriers make it difficult for competitors to challenge an incumbent, strengthening monopoly power.

Barriers to Entry: Structural or strategic obstacles that make it costly or difficult for new firms to enter and compete in a market.

Key barriers include:

Economies of scale – Large firms can produce at lower average costs, deterring smaller entrants.

Legal barriers – Patents, licences, or exclusive rights granted by governments.

Control of key resources – Ownership of scarce inputs (e.g., natural resources).

High sunk costs – Irrecoverable expenses, such as advertising or specialised equipment.

High barriers to entry, notably economies of scale in the long run, are a key source of monopoly power.

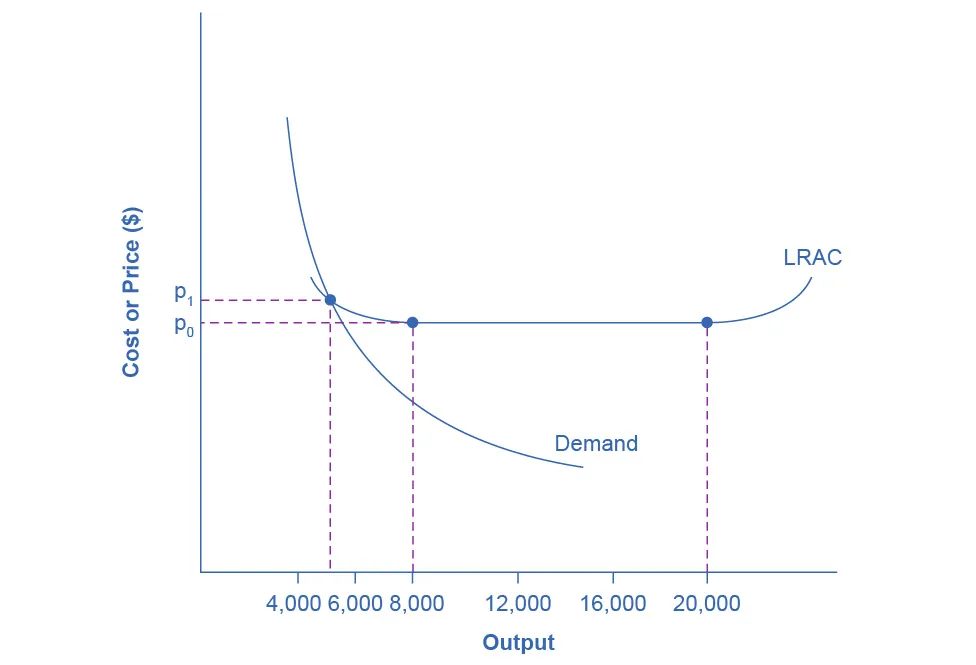

Diagram of economies of scale and natural monopoly where market demand intersects LRAC before minimum efficient scale. It shows why only one firm can supply efficiently, creating a barrier to entry. Source

Number of Competitors

The number of competitors in a market directly influences monopoly power. Fewer competitors reduce pressure to lower prices or improve efficiency.

Monopolies face no direct competition and can exert strong control.

Oligopolies face limited competition but may still wield substantial market power due to interdependence.

Highly competitive markets dilute monopoly power as rivals constrain pricing decisions.

Advertising and Brand Loyalty

Advertising plays a dual role: it informs consumers but also builds brand loyalty, reducing their sensitivity to price changes.

Brand Loyalty: A consumer’s consistent preference for one firm’s products over competitors, often maintained through advertising and reputation.

Extensive advertising campaigns can act as a strategic barrier to entry, as new firms must spend heavily to attract customers.

Strong branding enhances differentiation, allowing firms to charge higher prices than rivals without losing significant demand.

Degree of Product Differentiation

Product differentiation refers to the extent to which products are perceived as unique.

High differentiation – e.g., luxury goods with distinct features or reputations, can create significant monopoly power.

Low differentiation – e.g., basic commodities, restricts monopoly power since consumers easily switch to alternatives.

Measurement of Monopoly Power

Concentration Ratios

Economists measure monopoly power partly through concentration ratios.

Concentration Ratio: A statistical measure showing the proportion of total market output or sales accounted for by the largest firms in an industry.

A four-firm concentration ratio (CR4) of 80% means the top four firms control 80% of market sales, signalling high market power.

Lower ratios imply greater competition and weaker monopoly power.

The Lerner Index

Another measure of monopoly power is the Lerner Index, which examines the mark-up firms can charge above cost.

EQUATION

Lerner Index (L) = (P – MC) / P

P = Price charged by the firm

MC = Marginal cost of production

If L = 0, the firm is a price taker (perfect competition).

If L approaches 1, monopoly power is strong, with price far above marginal cost.

Elasticity of Demand and Monopoly Power

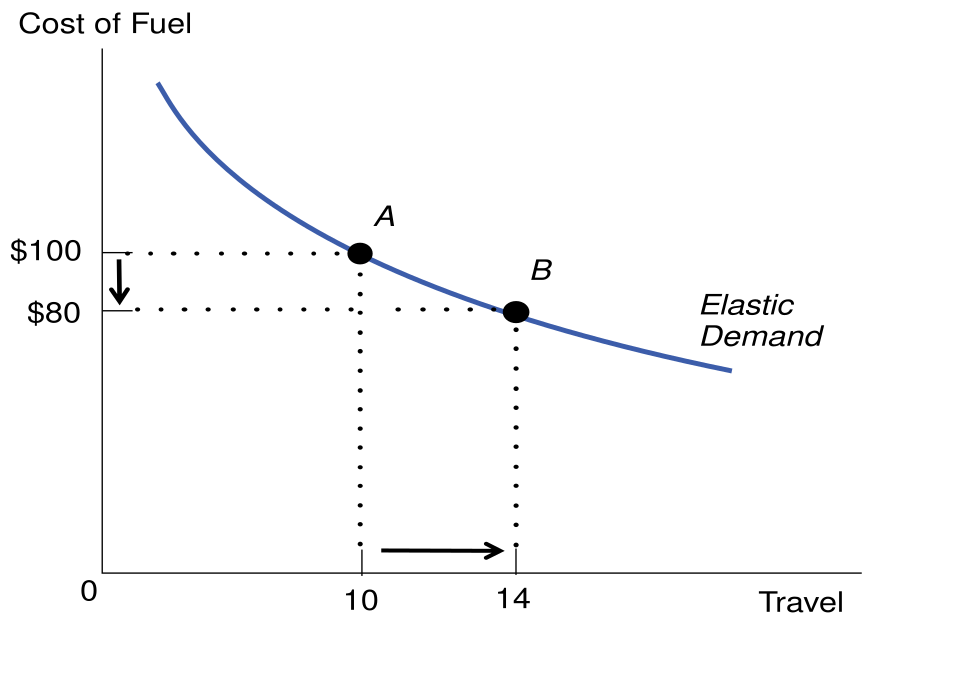

The price elasticity of demand for a firm’s product is another indicator.

Price Elasticity of Demand (PED): The responsiveness of quantity demanded to a change in price, measured as the percentage change in quantity divided by percentage change in price.

Monopoly power is inversely related to the price elasticity of demand (PED) at the chosen price.

Illustration of an elastic demand curve: a small price increase causes a large fall in quantity demanded. It highlights why elastic demand weakens monopoly power. Source

Cross-Price Elasticity of Demand

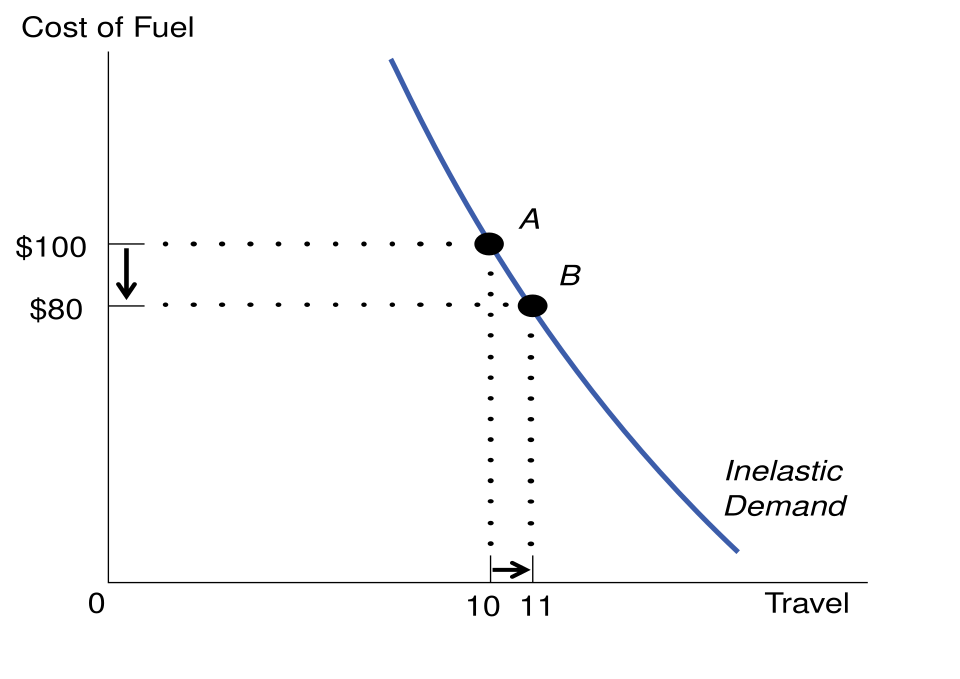

Another perspective comes from cross-price elasticity of demand (XED), which measures substitutability.

Cross-Price Elasticity of Demand (XED): The responsiveness of demand for one product to a change in the price of another product.

High positive XED indicates close substitutes, limiting monopoly power.

Low or zero XED suggests weak substitutes, reinforcing monopoly power.

Where demand is inelastic, consumers’ responsiveness to price is low and a price-making firm can sustain a higher markup above marginal cost.

Illustration of an inelastic demand curve: a price rise leads to a small fall in quantity demanded. This visual shows how inelastic demand strengthens monopoly power. Source

Practical Challenges in Measurement

Data Limitations

Calculating concentration ratios requires accurate, up-to-date sales data, which may not always be available.

Defining the relevant market (product and geographical scope) is complex and influences results.

Non-Price Competition

Traditional measures often overlook non-price strategies, such as innovation, product quality, and advertising intensity, which can increase monopoly power without raising prices.

Dynamic Considerations

Monopoly power is not static. Firms may strengthen it through research and development (R&D) or lose it as new competitors emerge with disruptive technologies.

Key Takeaways on Sources and Measurement

Sources: Monopoly power is influenced by barriers to entry, the number of competitors, advertising, and product differentiation.

Measurement: Tools include concentration ratios, the Lerner Index, and elasticity measures, each with strengths and limitations.

FAQ

Natural monopolies occur when one firm can supply the entire market at lower average cost than multiple competitors. This typically happens when long-run average cost falls continuously over a wide range of output.

Examples include utilities such as water or electricity supply, where duplicating infrastructure would be inefficient. The monopoly power arises because potential entrants cannot operate at such low costs, reinforcing barriers to entry.

The size of monopoly power depends heavily on how the market is defined.

If defined narrowly, a firm may appear dominant (e.g. Coca-Cola in cola drinks).

If defined broadly, monopoly power may look weaker (e.g. Coca-Cola in all soft drinks).

Economists use both product scope and geographical reach when setting boundaries. This choice affects concentration ratios and elasticity measures.

Yes, in some cases advertising improves consumer knowledge, making markets more competitive.

Informative advertising helps customers compare prices and quality, reducing market power.

Persuasive advertising, however, usually builds brand loyalty, raising monopoly power.

The effect depends on whether advertising primarily increases awareness or creates artificial differentiation.

Sunk costs, such as heavy investment in marketing or specialised equipment, act as barriers to entry.

When measuring monopoly power, economists consider how such costs deter potential entrants. If sunk costs are high, even markets with many firms may still allow incumbents to maintain monopoly-like control.

The Lerner Index focuses on the gap between price and marginal cost. However, it can exaggerate monopoly power if marginal cost is difficult to measure accurately.

Additionally, firms with temporary high demand or inelastic demand might show high values, even without long-term barriers to entry. This makes the index less reliable unless combined with other measures like concentration ratios or elasticity analysis.

Practice Questions

Define barriers to entry and explain briefly how they influence monopoly power. (2 marks)

1 mark for a correct definition of barriers to entry (e.g. obstacles preventing new firms entering a market).

1 mark for linking to monopoly power (e.g. high barriers protect existing firms, allowing them to sustain prices above competitive levels).

Explain two ways in which the degree of product differentiation and advertising can increase a firm’s monopoly power. (6 marks)

Up to 3 marks for product differentiation:

1 mark for identifying differentiation (making products distinct in consumers’ eyes).

1 mark for explaining effect (reduced substitutability limits competition).

1 mark for application (e.g. luxury branding allows higher pricing).

Up to 3 marks for advertising:

1 mark for identifying role (building brand loyalty).

1 mark for explaining how this reduces price sensitivity.

1 mark for application (e.g. heavy advertising makes new entrants struggle to gain market share).