AQA Specification focus:

‘The advantages and disadvantages of monopoly. Students should appreciate that firms operating in monopolistically competitive and oligopolistic markets are price makers and have varying degrees of monopoly power.’

Monopoly and monopoly power influence efficiency, consumer welfare, and firm performance. Understanding the advantages and disadvantages helps evaluate price-making across different market structures.

Monopoly Power and Price-Making

Monopoly power refers to the ability of a firm to set prices above marginal cost due to limited competition. Firms with this power act as price makers, unlike perfectly competitive firms which are price takers. The degree of monopoly power varies across structures:

Monopolies: Very high monopoly power.

Oligopolies: Significant but interdependent power.

Monopolistic competition: Some power due to product differentiation, but constrained by substitutes.

Monopoly Power: The ability of a firm to set and maintain a price above marginal cost due to barriers to entry and limited competitive pressure.

Sources of Monopoly Power

Barriers to entry (legal, structural, or strategic).

Product differentiation through branding or advertising.

Control of resources essential for production.

Economies of scale, lowering costs and discouraging entrants.

Advantages of Monopoly

Economies of Scale

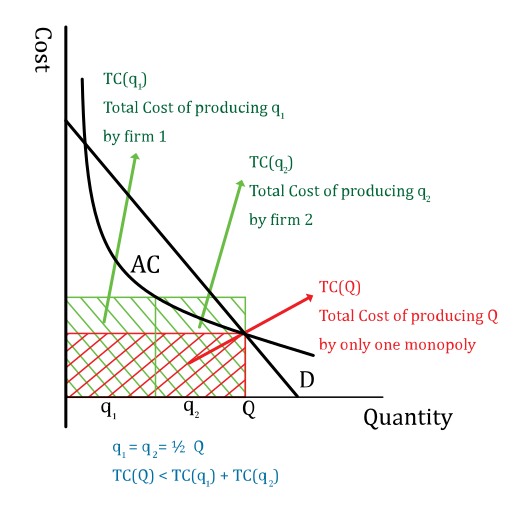

Monopolies can exploit internal economies of scale, reducing average costs as output expands. Lower unit costs may benefit consumers through lower prices if passed on.

Technical economies: Using advanced production methods.

Managerial economies: Specialised management increases efficiency.

Financial economies: Easier access to cheaper capital.

Dynamic Efficiency

With sustained abnormal profits, monopolies may fund research and development (R&D). This promotes innovation, new products, and better technology.

Dynamic Efficiency: Efficiency arising from innovation and investment in new technology that lowers costs or improves products over time.

Natural Monopolies

In industries like utilities, duplication of infrastructure would be wasteful. A monopoly can deliver services more efficiently due to very high fixed costs.

Diagram comparing the total cost of one firm producing output Q with the combined cost of two smaller firms producing q₁ + q₂ = Q. It shows why a natural monopoly can be cost-minimising when long-run average cost falls over the relevant demand range. Labels include AC and D; the two-firm vs one-firm cost blocks are highlighted—extra regulatory details are not shown. Source

Stability and Employment

Monopolies can provide stable prices and secure employment, as long-term profits allow continued operations even during downturns.

Disadvantages of Monopoly

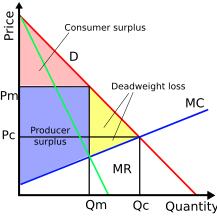

Allocative Inefficiency

Monopolies set price above marginal cost, reducing output compared to socially optimal levels. This leads to deadweight loss, where potential welfare is lost.

A welfare diagram for a profit-maximising monopolist showing Pm > Pc and Qm < Qc relative to perfect competition. Shaded areas indicate consumer surplus, producer surplus, and the deadweight-loss triangle caused by allocative inefficiency. The surplus shading is extra detail beyond the minimum syllabus point, but it clarifies how welfare changes under monopoly. Source

Allocative Efficiency: A state where resources are allocated such that price equals marginal cost, maximising welfare.

Productive Inefficiency

Monopolies may not minimise average costs, leading to X-inefficiency—higher costs due to lack of competition.

X-Inefficiency: When a firm’s average costs are higher than necessary due to lack of competitive pressure.

Consumer Exploitation

Monopolies may charge higher prices and restrict output, harming consumers. There is also less choice and reduced incentive to maintain quality.

Rent-Seeking Behaviour

Abnormal profits may encourage monopolies to focus resources on preserving their power (e.g., lobbying, advertising) rather than innovation.

Risk of Inequality

By extracting consumer surplus, monopolies can redistribute income towards firm owners, exacerbating inequality.

Price-Making Across Market Structures

Perfect Competition

No monopoly power.

Firms are price takers.

Allocative and productive efficiency achieved in the long run.

Monopolistic Competition

Some price-making power due to product differentiation.

High competition ensures abnormal profits are eroded in the long run.

Firms may invest in branding and advertising instead of innovation.

Oligopoly

Firms hold significant but interdependent power.

Strategic behaviour (collusion, cartels, or price leadership) influences prices.

Potential for dynamic efficiency through R&D, but also risk of collusion harming consumers.

Monopoly

Greatest degree of price-making power.

Price set well above marginal cost.

Efficiency depends on regulation, natural monopoly conditions, and innovation incentives.

Evaluation Points

When assessing monopoly and price-making across structures, consider:

Extent of barriers to entry: Higher barriers = stronger monopoly power.

Role of regulation: Can curb excessive prices or force investment.

Market context: Natural monopolies may benefit society, whereas exploitative monopolies reduce welfare.

Dynamic vs static efficiency: Monopolies may be inefficient in the short term but promote innovation in the long term.

FAQ

Governments regulate monopolies to reduce consumer harm and inefficiency. Price caps can prevent excessive prices, while quality standards ensure acceptable service.

In some cases, regulators encourage competition by breaking up dominant firms or reducing entry barriers. This limits monopoly power and helps align prices and output more closely with consumer welfare.

In the short run, monopolies may lack competitive pressure and have little motivation to innovate. Their profits are secure without improving efficiency or products.

In the long run, however, sustained abnormal profits can fund significant research and development. This may lead to dynamic efficiency, with improved technologies and new product offerings.

Monopolies extract consumer surplus by charging higher prices, transferring income from many consumers to a smaller group of shareholders.

This redistribution can widen inequality, as wealth accumulates among firm owners while average households face reduced purchasing power.

Industries with high fixed costs and economies of scale often show monopoly features, such as:

Utilities (electricity, gas, water)

Public transport systems

Telecommunications in markets with few providers

These industries are considered natural monopolies because duplication of infrastructure would be inefficient.

Monopolistic competition: Firms have limited power, constrained by many substitutes.

Oligopoly: Firms have significant power, but behaviour is interdependent.

Monopoly: One firm has the greatest power, setting prices well above marginal cost.

The extent of power depends on entry barriers, product differentiation, and market concentration.

Practice Questions

Define monopoly power and explain briefly how it differs from the position of firms in perfectly competitive markets. (3 marks)

1 mark: Definition of monopoly power (ability to set price above marginal cost due to lack of competition/barriers to entry).

1 mark: Identification that monopolists are price makers.

1 mark: Contrast with perfect competition firms being price takers.

Discuss two disadvantages to consumers of firms possessing monopoly power. (6 marks)

Up to 2 marks: Clear identification of disadvantages (e.g., higher prices, restricted output, reduced choice, lower quality, potential allocative or productive inefficiency).

Up to 2 marks: Explanation of each disadvantage (e.g., higher prices reduce consumer surplus; restricted output leads to deadweight loss; less choice may lower welfare).

1–2 marks: Application and development (e.g., linking to reduced incentive to innovate, or real-world examples such as utility providers).

Maximum 6 marks awarded for two well-explained disadvantages with supporting development.