AQA Specification focus:

‘The policies which are available to influence the distribution of income and wealth and to alleviate poverty.’

Government policies shape the distribution of income and wealth. By using taxes, transfers, and services, policymakers aim to reduce poverty while balancing efficiency, incentives, and fairness.

Taxes as a Redistribution Tool

Taxes are a primary instrument for influencing the distribution of income and wealth. Governments design tax systems to raise revenue and address inequality.

Types of Taxes

Direct taxes: Levied on income and wealth. Examples include income tax, corporation tax, and capital gains tax.

Indirect taxes: Levied on expenditure. Examples include VAT, excise duties, and sales taxes.

Progressive Tax: A tax system where the proportion of income paid in tax rises as income increases.

Regressive Tax: A tax system where the proportion of income paid in tax falls as income increases.

Objectives of Taxation

To redistribute income by taxing higher earners more heavily.

To fund public goods and services, such as education and healthcare.

To influence economic behaviour, e.g. through sin taxes on tobacco or carbon taxes to address externalities.

Progressive income taxes are often seen as central to reducing inequality, while regressive consumption taxes may widen disparities if not offset by transfers.

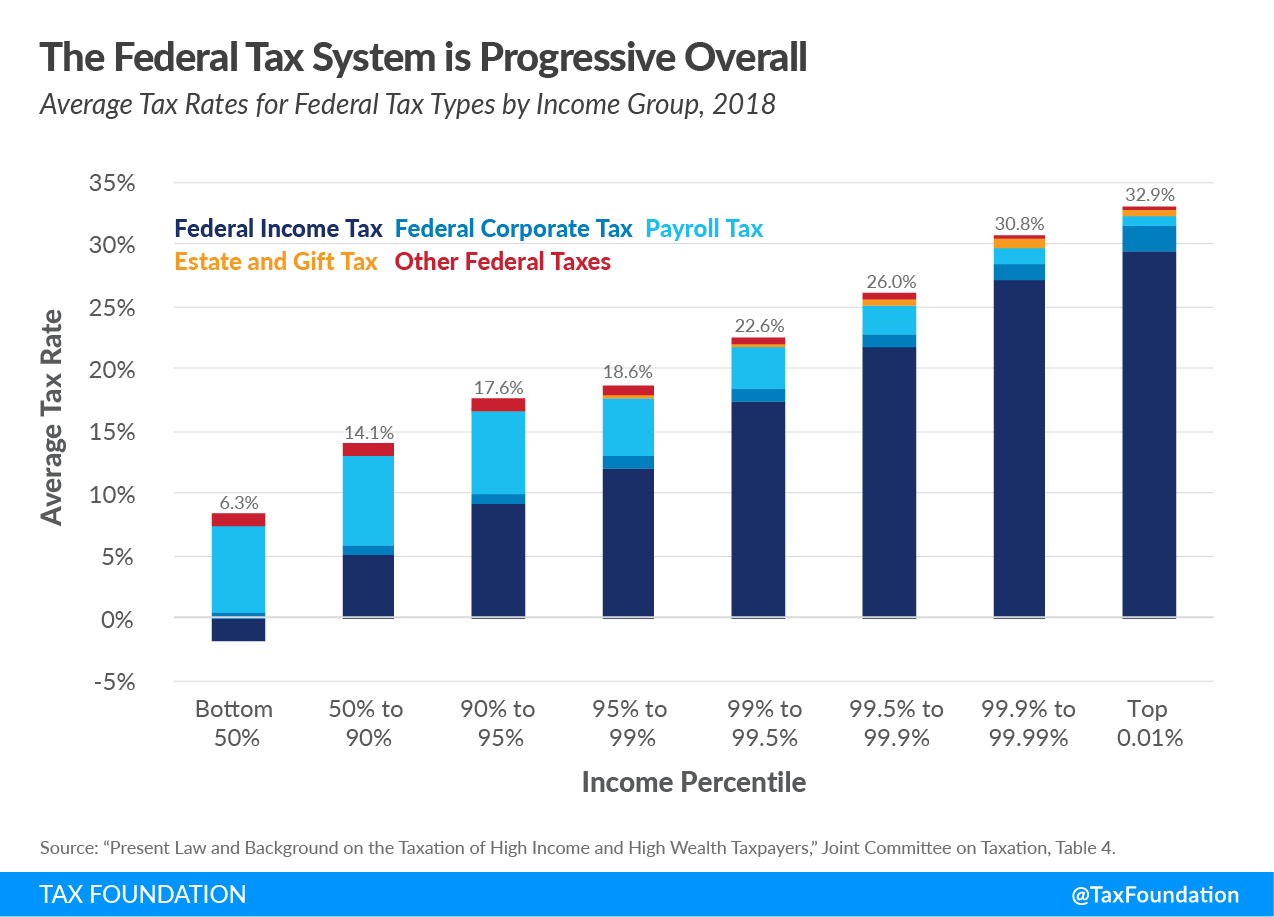

This bar chart compares the average federal tax rates across income percentiles, highlighting the progressive nature of income taxes and the regressive nature of payroll taxes. The data underscores the impact of tax structures on income distribution. Source

Transfers: Direct Redistribution

Transfers involve the redistribution of income through cash or in-kind benefits. They are designed to alleviate poverty and support households in need.

Types of Transfers

Universal benefits: Provided to all, regardless of income. For example, child benefit payments.

Means-tested benefits: Targeted at lower-income households, such as housing benefit or income support.

Social insurance payments: Linked to contributions made, such as state pensions or unemployment benefits.

Means-Tested Benefit: A welfare payment that depends on the recipient’s income and savings, with support directed to those most in need.

Role of Transfers

Transfers are essential in addressing market failures linked to inequality. They:

Provide a safety net against poverty.

Support aggregate demand by sustaining consumer spending during downturns.

Address intergenerational inequality, e.g. pensions reducing poverty in old age.

However, critics argue that poorly designed transfers may create disincentives to work or dependency on welfare.

Services: Indirect Redistribution

Services provided by the government play a key role in influencing long-term distribution of income and wealth.

Public Services and Redistribution

Education: Free or subsidised schooling reduces inequality of opportunity.

Healthcare: Access to services, such as through the NHS, reduces health inequalities.

Housing support: Social housing provision helps lower-income households access affordable housing.

Infrastructure: Public investment benefits poorer communities, improving access to employment opportunities.

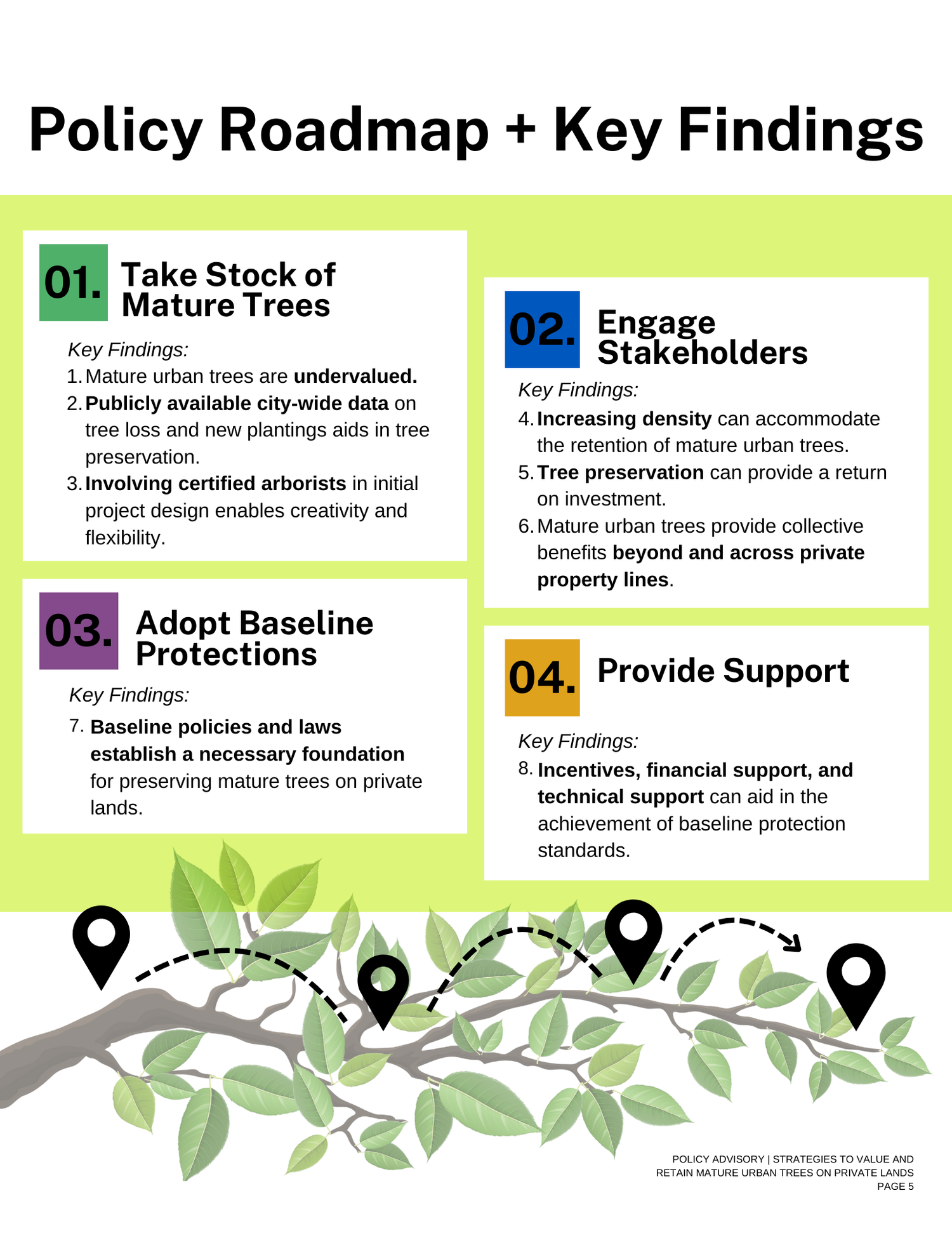

This infographic presents a four-step policy roadmap for urban tree preservation, illustrating how public service initiatives can enhance community well-being and contribute to equitable urban development. Source

Public Service Provision: The supply of services such as healthcare, education, or housing by the government, often financed through taxation and provided free at the point of use.

Advantages of Service Provision

Tackles structural causes of inequality, such as unequal access to education and healthcare.

Avoids some work disincentives associated with cash transfers.

Supports social mobility by reducing barriers for disadvantaged groups.

Balancing Policies: Design Considerations

While taxes, transfers, and services all aim to alleviate poverty, policymakers must balance competing objectives.

Key Considerations

Efficiency vs equity: High taxation may reduce incentives to work or invest, potentially slowing economic growth.

Targeting vs universality: Means-tested benefits reduce costs but may discourage work or savings; universal benefits avoid stigma but increase fiscal pressure.

Short-term vs long-term: Transfers address immediate poverty, while services (e.g. education) reduce inequality in the long run.

Administrative feasibility: Complex welfare systems may be costly to manage and prone to fraud or error.

Policy Mix in Practice

Most governments employ a policy toolkit combining taxes, transfers, and services:

Progressive taxation funds redistributive measures.

Cash transfers address immediate poverty.

Service provision reduces inequality of opportunity.

This integrated approach reflects the complexity of tackling income and wealth disparities while also considering broader economic impacts such as incentives, efficiency, and fiscal sustainability.

FAQ

Progressive taxes increase the percentage rate paid as income rises, while proportional taxes apply the same percentage rate to all income levels.

For example, under proportional tax, both low- and high-income earners may pay 20% of their income. Under progressive tax, low earners might pay 10% while high earners pay 40%.

This distinction matters because proportional taxes do little to reduce inequality, whereas progressive taxes actively redistribute income.

Universal benefits are granted to all, regardless of income, avoiding stigma and administrative complexity. Examples include free schooling or child benefit.

Means-tested benefits, however, are targeted to low-income groups, reducing public expenditure but potentially creating disincentives to work or save.

The policy choice often balances efficiency in targeting resources against inclusivity and fairness.

Indirect taxes, such as VAT, take a larger proportion of income from low earners than high earners.

This happens because poorer households spend a greater share of their income on consumption.

Essentials like food, heating, or clothing make up most of their expenditure.

Even small percentage taxes fall disproportionately on their limited income.

Without compensatory policies, indirect taxation can deepen inequality.

Public services such as education and healthcare reduce barriers to opportunity.

Education enhances human capital, allowing individuals from disadvantaged backgrounds to access higher-skilled and higher-paid jobs.

Healthcare reduces productivity losses due to illness and ensures workers from all income levels can participate in the economy more equally.

By addressing root causes, services aim to tackle inequality across generations.

Redistribution policies must balance:

Equity vs efficiency: High taxes can reduce work or investment incentives.

Targeting vs universality: Means-testing saves money but risks exclusion or stigma.

Short-term vs long-term impacts: Transfers relieve immediate poverty, while services like education foster future equality.

These trade-offs shape the sustainability and effectiveness of the policy toolkit.

Practice Questions

Define what is meant by a progressive tax. (2 marks)

1 mark for stating that a progressive tax is one where the proportion of income paid in tax increases as income rises.

1 mark for further clarification, such as noting that higher earners pay a greater percentage of their income in tax compared to lower earners.

Explain how government-provided public services, such as education and healthcare, can reduce inequality in the distribution of income and wealth. (6 marks)

1–2 marks: Basic description that public services are provided free or subsidised, improving access.

1–2 marks: Clear explanation that education improves human capital and job opportunities, reducing income inequality.

1–2 marks: Clear explanation that healthcare reduces health disparities, enabling more equal participation in the labour market.

Full 6 marks for well-developed answers that link both education and healthcare to long-term reduction in inequality of income and wealth, with explicit economic reasoning.