AQA Specification focus:

‘Students should be able to evaluate the various approaches to redistributing income and wealth and alleviating poverty, recognising the moral and political perspectives.’

Redistribution is one of the most debated areas in economics, involving strong disagreements about fairness, efficiency, and the role of government. Understanding both moral and political perspectives is crucial.

Redistribution of Income and Wealth

Redistribution refers to the ways in which governments use taxation, transfers, and public spending to alter the initial distribution of income and wealth. It is closely linked to the aims of reducing poverty and addressing inequality, while balancing efficiency and fairness.

Moral Perspectives on Redistribution

Moral perspectives focus on ethical beliefs about fairness, justice, and responsibility. Economists and philosophers often adopt contrasting approaches.

Utilitarian Perspective

This view argues that resources should be distributed in a way that maximises total welfare. Since the marginal utility of income tends to decline as people become wealthier, redistribution from rich to poor is often justified.

Rawlsian Perspective

Based on John Rawls’ theory of justice, society should be organised to maximise the well-being of the least advantaged. Redistribution is morally justified if it improves the position of the poorest.

Libertarian Perspective

Libertarians emphasise individual rights and freedom. Redistribution through taxation may be viewed as unjust because it infringes on the right to property and voluntary exchange. This perspective sees inequality as acceptable if it arises from free choices.

Meritocratic Perspective

This approach argues that individuals should be rewarded based on their effort and talent. Redistribution should correct unfair disadvantages (e.g., poverty caused by discrimination or lack of opportunity) but not undermine incentives for achievement.

Political Perspectives on Redistribution

Political ideologies shape how redistribution policies are designed and implemented. These perspectives differ significantly in their view of state intervention.

Left-Wing Perspectives

Greater support for progressive taxation (higher rates on the wealthy).

Expansion of welfare programmes and public services.

Belief that redistribution reduces poverty and inequality, improving social cohesion and fairness.

Right-Wing Perspectives

Preference for lower taxes and limited government intervention.

Emphasis on market outcomes and individual responsibility.

Concerns that excessive redistribution discourages work, saving, and investment, reducing efficiency.

Centrist or Pragmatic Approaches

Support moderate redistribution to tackle extreme poverty and inequality while protecting economic incentives.

Use means-tested benefits, tax credits, and limited progressive taxation.

Evaluating Redistribution: Efficiency, Incentives, and Fairness

The evaluation of redistribution requires weighing up competing arguments.

Efficiency Concerns

Excessive redistribution may reduce incentives to work, invest, and innovate.

However, some redistribution can improve efficiency by addressing market failures (e.g., underinvestment in education and healthcare).

Incentive Effects

High marginal tax rates may discourage productivity.

Well-targeted redistribution (such as investment in education) can increase long-term labour market participation.

Fairness and Value Judgements

Whether redistribution is equitable depends on subjective judgements of fairness.

Some argue fairness means equality of outcomes, while others stress equality of opportunity.

Examples of Redistribution Policies

Progressive taxation: Higher earners pay proportionally more.

Welfare transfers: Universal Credit, child benefits, unemployment support.

Public services: Free healthcare and education, which redistribute in-kind benefits.

Subsidies and tax credits: Designed to support low-income households.

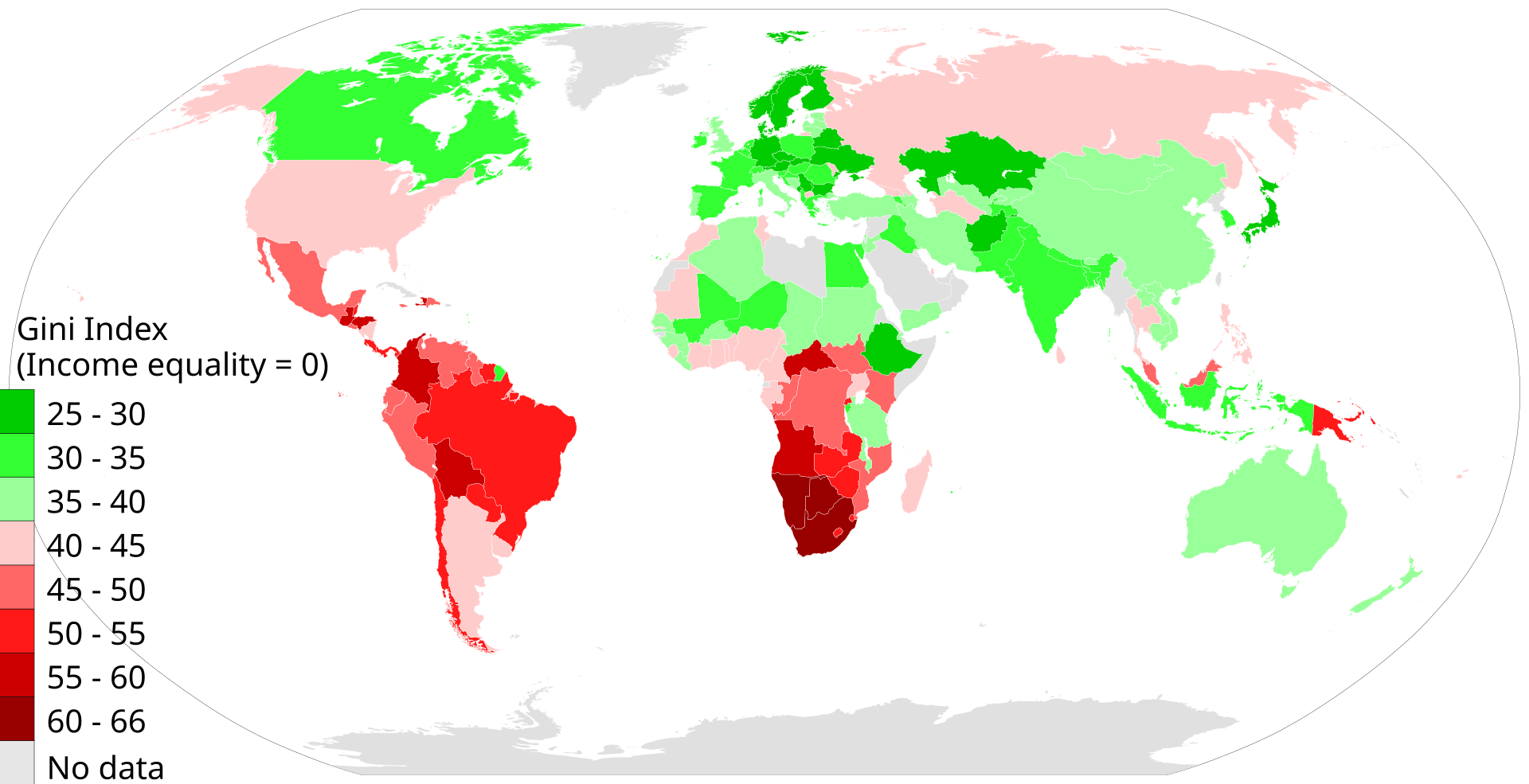

The Gini coefficient is a measure of income inequality.

This map displays the Gini Index values by country as of 2014, highlighting global disparities in income distribution. It provides a visual context for evaluating the effectiveness and fairness of redistribution policies across different nations. Source

Debates and Trade-Offs

Key issues arise when evaluating redistribution:

Equity vs efficiency: Striking a balance between fairness and economic growth.

Short-term vs long-term goals: Immediate poverty relief versus structural reforms to reduce inequality.

Universal vs targeted programmes: Universal benefits may be politically popular, but targeted support may be more cost-effective.

Moral and Political Disagreements in Practice

Redistribution debates are not just economic but also deeply value-laden.

A social-democratic government may prioritise redistribution to achieve greater equality.

A conservative or liberal market government may emphasise incentives, individual responsibility, and minimal state intervention.

Political consensus may form around alleviating extreme poverty, but divisions persist on how far redistribution should go.

Students should understand that excessive inequality is both a cause and consequence of market failure.

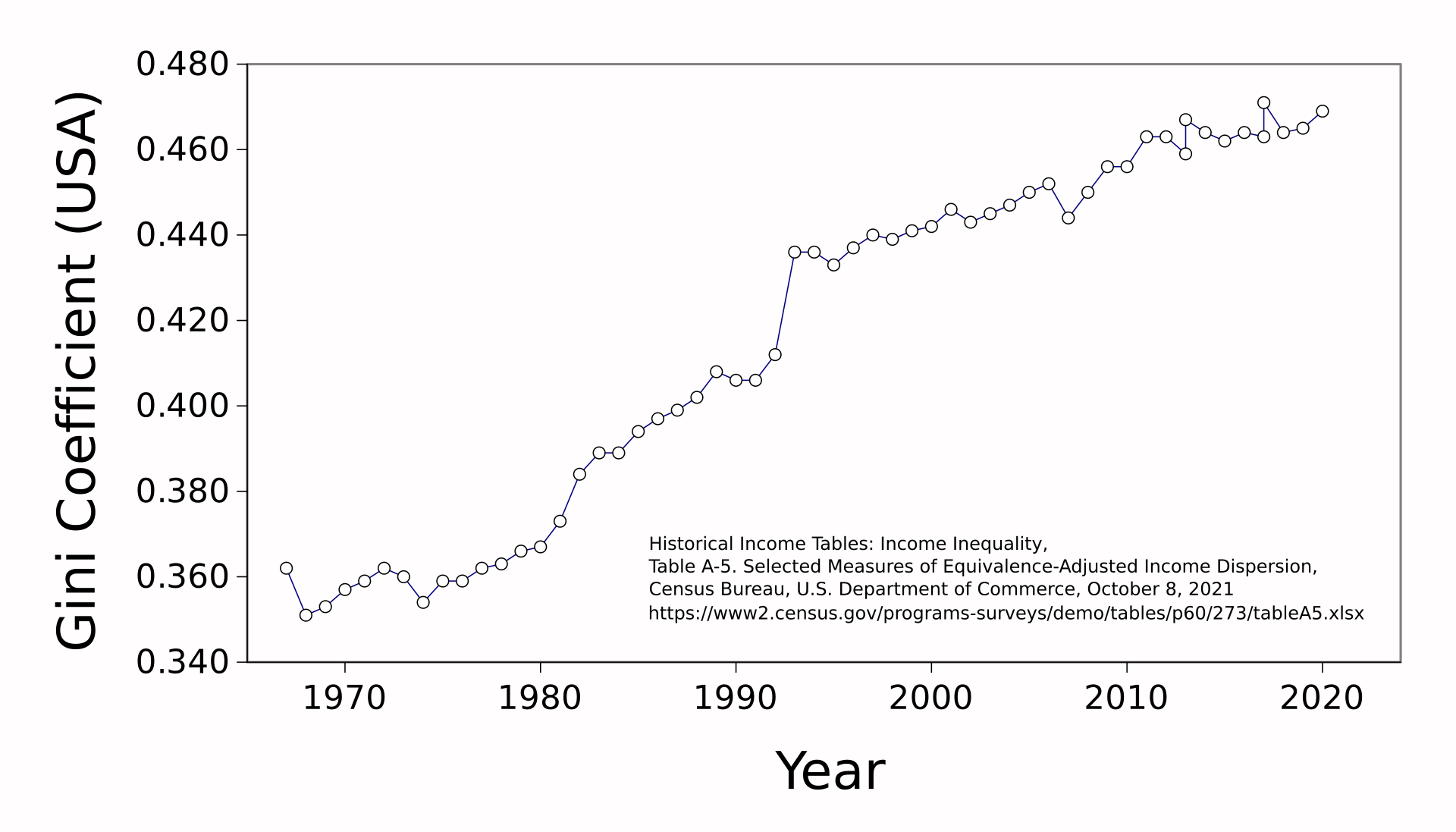

This graph illustrates the trend of income inequality in the United States from 1967 to 2020, as measured by the Gini Coefficient. It serves as a case study for analysing the long-term effects of redistribution policies on economic disparities. Source

Value Judgements in Policy-Making

Redistribution policy is shaped by competing moral and political views. Economists can measure inequality with tools like the Gini coefficient, but deciding whether a distribution is fair requires normative judgements. This is why redistribution remains one of the most contested areas of economic policy.

FAQ

Cultural values influence how societies define fairness. In countries with strong collective traditions, redistribution is often viewed as a shared responsibility.

By contrast, in more individualistic cultures, policies may emphasise self-reliance and limited government support. This explains why redistribution policies vary widely even among nations with similar income levels.

Redistribution is shaped by political ideology as much as by inequality levels

A left-leaning government may expand welfare and progressive taxation.

A right-leaning government may prefer tax cuts and minimal state intervention.

Thus, differences in political priorities explain policy divergence despite similar inequality.

Equality of outcome means reducing differences in income and wealth directly.

Equality of opportunity focuses on providing fair access to education, healthcare, and employment so individuals can succeed on merit.

Redistribution debates often hinge on whether policies should close gaps in outcomes or ensure fair starting conditions.

Critics argue that value judgements make redistribution subjective, leading to disagreements and inconsistent policies.

Decisions about what is “fair” vary between groups, meaning no single policy will satisfy all perspectives.

Some economists argue for relying on measurable data (like the Gini coefficient) to reduce bias, though this cannot fully remove normative debates.

Redistribution can strengthen social cohesion by reducing resentment and promoting fairness.

However, if seen as excessive or unfairly targeted, it may create political division.

Effective redistribution often balances fairness with economic efficiency, helping maintain stability while addressing inequality.

Practice Questions

Define the term equity in the context of income and wealth distribution. (2 marks)

1 mark for stating that equity refers to fairness or justice in the distribution of income and wealth.

1 mark for distinguishing that equity is not the same as equality, but is based on value judgements of what is considered fair.

Explain how moral and political perspectives influence government policies on the redistribution of income and wealth. (6 marks)

1 mark for recognising that redistribution policies are shaped by value judgements.

Up to 2 marks for identifying moral perspectives (e.g., utilitarian, Rawlsian, libertarian, or meritocratic views).

Up to 2 marks for identifying political perspectives (e.g., left-wing support for progressive taxation, right-wing preference for limited intervention, centrist compromise).

1 mark for linking these perspectives to real-world policy choices (e.g., welfare spending, progressive tax systems, or means-tested benefits).

Maximum 6 marks.