AQA Specification focus:

‘Externalities exist when there is a divergence between private and social costs and benefits.’

Externalities occur when economic activity imposes costs or benefits on third parties not reflected in market prices, creating inefficiencies and potential misallocation of scarce resources.

Understanding Externalities

Externalities are central to market failure analysis. They arise when the actions of producers or consumers have unintended effects on others not directly involved in the transaction. These effects can be either positive or negative, and they create a gap between private costs/benefits and social costs/benefits.

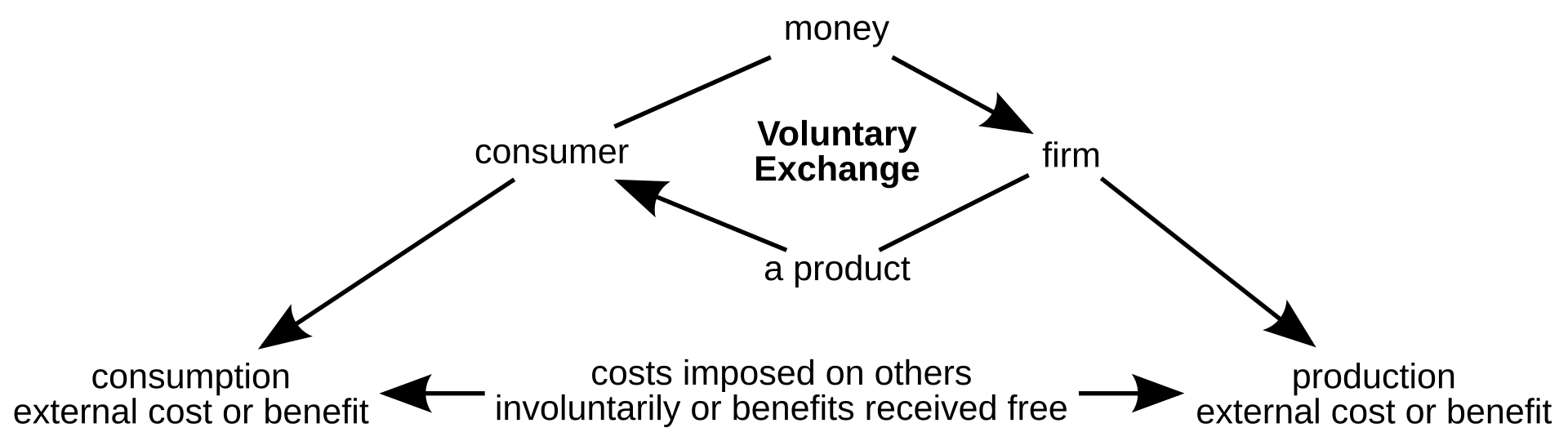

A schematic showing how external effects link market participants to third parties, reinforcing that externalities affect those outside the original buyer–seller transaction. Source

Externality: An unintended side effect of production or consumption that affects third parties who are not part of the market transaction.

The presence of externalities means that market prices may fail to reflect the full costs or benefits of an activity, undermining the efficiency of the price mechanism.

Private Costs and Social Costs

Private costs are the expenses borne directly by an individual consumer or producer when engaging in an economic activity. In contrast, social costs incorporate both private costs and any external costs imposed on society.

Private Cost: The cost directly incurred by an individual or firm from an economic activity.

Social Cost: The total cost to society of an activity, equal to private costs plus external costs.

For example, a factory may pay wages, rent, and raw material costs (private costs), but pollution generated imposes health and environmental costs on third parties (external costs). Together, these create the overall social cost.

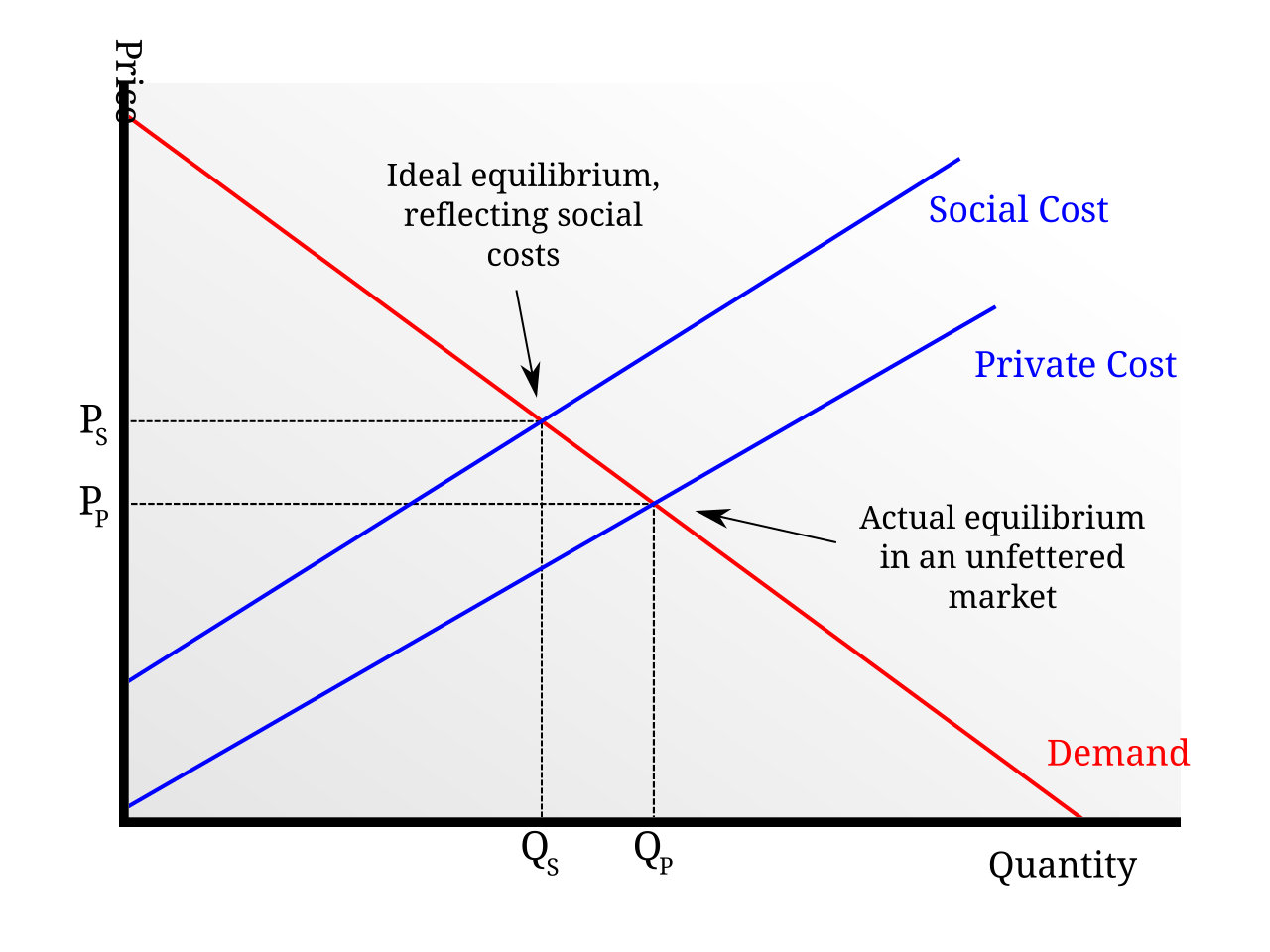

A supply–demand diagram showing a negative externality in production where social cost lies above private cost. The vertical gap represents external costs imposed on third parties. Source

Private Benefits and Social Benefits

Just as costs can diverge, so too can benefits. Private benefits are the direct gains enjoyed by those involved in a transaction, while social benefits reflect the wider advantages to society.

Private Benefit: The satisfaction or utility gained by an individual or firm directly from consumption or production.

Social Benefit: The total benefit to society from an activity, equal to private benefits plus external benefits.

For instance, an individual paying for a vaccination receives immunity (private benefit), but society also benefits from reduced disease transmission (external benefit), producing a larger social benefit.

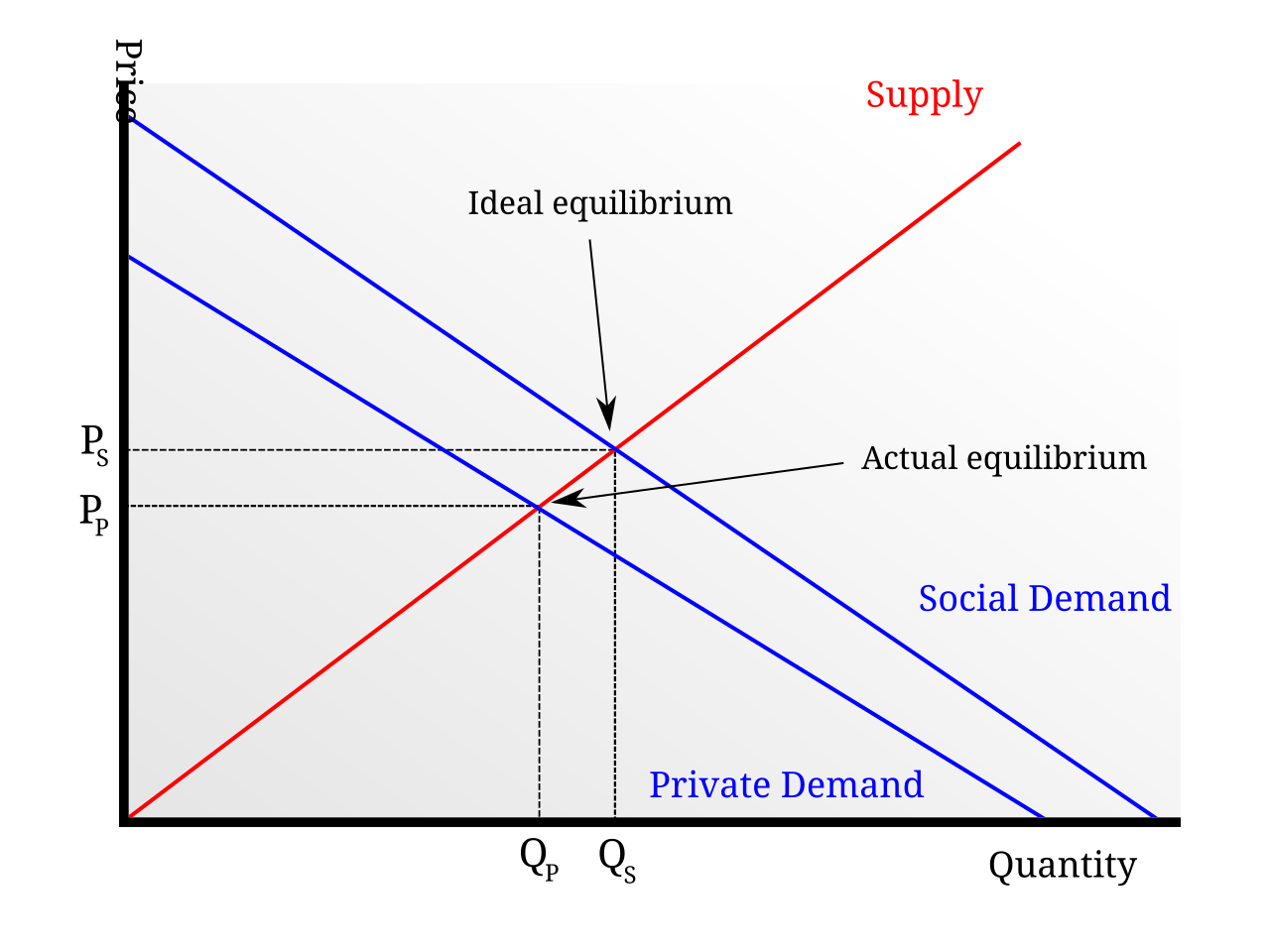

A demand–supply diagram illustrating a positive externality in consumption where social demand lies above private demand, capturing additional benefits gained by third parties. Source

Divergence Between Private and Social Costs/Benefits

The distinction between private and social measures is crucial. A divergence occurs when:

Negative externalities mean that social costs > private costs.

Positive externalities mean that social benefits > private benefits.

When markets fail to account for these divergences, resources may be misallocated, leading to overproduction (in the case of negative externalities) or underproduction (in the case of positive externalities).

Market Failure: A situation in which the free market fails to allocate resources efficiently, often due to the presence of externalities.

This misallocation underpins the rationale for government intervention.

Visualising Externalities with Costs and Benefits

Although diagram analysis belongs to a later subsubtopic, the relationship can be understood without graphs. If only private costs and benefits are considered, the equilibrium output may not correspond to the socially optimal level. External costs shift the true cost curve upwards, while external benefits shift the true benefit curve upwards. This creates welfare loss or forgone welfare gains for society.

Key Features of Externalities

They involve third-party effects: externalities affect those not part of the initial decision-making.

They represent market imperfections: prices do not fully reflect costs and benefits.

They can be positive or negative, influencing whether output is above or below the social optimum.

They justify government policies aimed at internalising external costs or benefits.

Equations in Externality Analysis

To formalise the distinction, economists often represent costs and benefits mathematically.

EQUATION

Social Cost (SC) = Private Cost (PC) + External Cost (EC)

PC = Costs borne directly by the producer/consumer

EC = Costs imposed on third parties (e.g., pollution, health damage)

Social Benefit (SB) = Private Benefit (PB) + External Benefit (EB)

PB = Gains to the individual/firm involved

EB = Gains to third parties (e.g., herd immunity, education spillovers)

Recognising these divergences highlights where policy intervention might be justified.

Types of Externalities Relevant to Divergence

Negative Externalities

Production: e.g., industrial pollution, noise from construction.

Consumption: e.g., second-hand smoke, overuse of roads causing congestion.

Positive Externalities

Production: e.g., firms investing in research that benefits other firms.

Consumption: e.g., education increasing social cohesion, vaccination improving public health.

In both cases, the private decision-maker focuses only on private costs and benefits, leaving society with either excessive harm or forgone opportunities.

Implications for Resource Allocation

Markets left to operate solely on private signals will not achieve the socially optimal equilibrium when externalities are present. Key implications include:

Overproduction when private agents ignore external costs.

Underproduction when external benefits are not recognised.

Inefficiency as resources are not directed to their highest-value uses for society.

Welfare loss as potential gains are missed or unnecessary costs are imposed.

Importance of Distinguishing Private and Social Measures

For AQA A-Level Economics, appreciating the difference between private costs/benefits and social costs/benefits is fundamental. It underlies why free markets may fail, why intervention may be necessary, and how economists evaluate whether an activity is beneficial or harmful to society.

FAQ

Private costs are carried directly by the decision-maker, such as wages or raw materials for a firm.

External costs fall on individuals or groups outside the transaction, like nearby residents suffering from pollution.

The key distinction is that private costs influence the decision-maker’s choices, while external costs are ignored in market pricing.

The price mechanism allocates resources based on private costs and benefits.

When externalities exist, the price fails to capture true social costs or benefits.

This means:

Goods with negative externalities may be too cheap, encouraging overconsumption.

Goods with positive externalities may be too expensive, discouraging uptake.

Yes, many activities generate both.

For example, building a new airport creates jobs and improves connectivity (positive externalities), but also produces noise and air pollution (negative externalities).

The overall impact on society depends on which effect is greater and whether policies balance the outcomes.

Social efficiency occurs when resources are allocated to maximise net social welfare.

If externalities exist, private decisions may not achieve this outcome because they ignore external costs or benefits.

Correcting externalities aligns private decision-making with the socially efficient level of output.

Some externalities appear immediately, like traffic congestion from car use.

Others emerge only in the long term, such as climate change from carbon emissions.

Time lags complicate decisions because private agents may underestimate or ignore future external costs or benefits.

Practice Questions

Define the term externality in the context of market failure. (2 marks)

1 mark for recognising it is an effect of economic activity on third parties not directly involved in the transaction.

1 mark for identifying that these effects can be positive or negative and are not reflected in market prices.

Using examples, explain the difference between private costs/benefits and social costs/benefits. (6 marks)

1 mark for defining private costs (costs borne by the individual/firm directly involved).

1 mark for defining social costs (private costs plus external costs imposed on others).

1 mark for defining private benefits (direct gains enjoyed by those in the transaction).

1 mark for defining social benefits (private benefits plus external benefits to third parties).

Up to 2 marks for relevant examples:

e.g., factory pollution for costs; vaccination or education for benefits.

Clear link between example and divergence (private vs social) required for credit.