AQA Specification focus:

‘The arguments for and against the privatisation of state-owned enterprises.’

Privatisation refers to the transfer of ownership or control of resources, assets, or enterprises from the public sector to the private sector. It has been widely debated in terms of efficiency, equity, and economic performance.

Introduction

Privatisation has been central to modern economic policy, especially in the UK since the 1980s. Supporters claim it increases efficiency and competition, while critics highlight inequality and potential market failure.

Understanding Privatisation

Privatisation is the process of transferring ownership of a business, industry, or service from the state to private individuals or organisations. This can occur through:

The outright sale of state-owned enterprises (SOEs).

Public share offerings in privatised firms.

Contracting out or outsourcing services previously provided by government.

Privatisation: The transfer of ownership or provision of goods and services from the public sector (government/state) to the private sector (individuals or firms).

Privatisation is often justified on the grounds of allocative efficiency (resources directed to their most valued use) and productive efficiency (minimising costs of production).

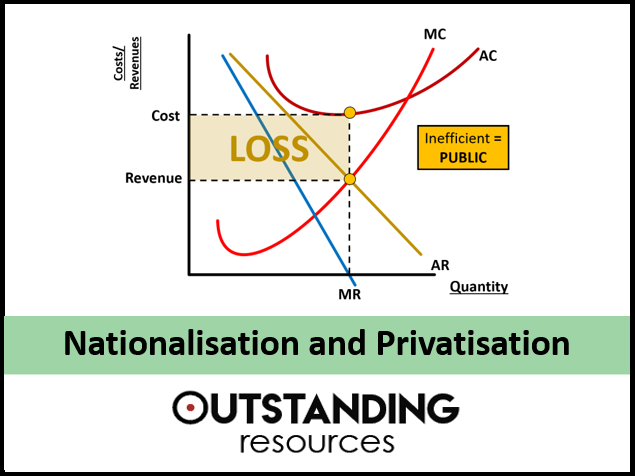

The diagram illustrates the differences between privatised and nationalised industries, highlighting efficiency outcomes. It shows how privatisation may reduce costs and improve efficiency compared with nationalisation. Source

#######################################

Arguments in Favour of Privatisation

1. Efficiency Gains

Private firms typically operate under the pressure of the profit motive, encouraging cost minimisation and innovation. Unlike state monopolies, private firms face competition that can lead to:

Reduced waste and bureaucracy.

More responsive service delivery.

Dynamic efficiency through research and development.

2. Increased Competition

Privatisation may introduce competition into industries previously dominated by state monopolies, such as telecommunications and energy. Competition can lead to:

Lower prices.

Better quality of goods and services.

Greater consumer choice.

However, this benefit depends on whether genuine competition exists; in some industries natural monopoly characteristics remain.

3. Revenue for Government

Selling state assets provides governments with a short-term boost in revenue, which can reduce public sector debt or finance infrastructure projects. For example, the UK’s privatisation of British Telecom and British Gas generated substantial funds.

4. Wider Share Ownership

Privatisation often involves the sale of shares to the public, encouraging a “shareholder culture.” This can:

Increase personal wealth.

Broaden the base of capital ownership.

Strengthen engagement between citizens and the market economy.

5. Reduced Political Interference

Public enterprises may suffer from political pressures, such as keeping employment high or prices low, regardless of efficiency. Privatisation reduces the scope for government failure by removing political influence from production decisions.

6. Focus on Core Activities

Governments can redirect resources from managing industries to core responsibilities such as healthcare, education, and defence. This may enhance overall state efficiency and welfare provision.

Arguments Against Privatisation

1. Natural Monopoly Issues

Some industries, such as water, rail, and electricity distribution, are natural monopolies (industries where one firm can supply the entire market at lower cost than multiple firms). In such cases:

Privatisation may lead to monopoly exploitation.

Consumers may face higher prices and reduced service quality.

Regulation becomes necessary to prevent abuse of market power.

Natural Monopoly: An industry where long-run average costs continue to fall as output increases, making it most efficient for a single firm to supply the market.

2. Inequality and Social Concerns

Privatisation can worsen income and wealth inequality:

Low-income groups may not afford essential services if prices rise.

Wider share ownership may benefit wealthier households disproportionately.

Services with high social value (e.g. healthcare) risk being underprovided if left to market forces.

3. Short-Termism

Private firms may focus on short-term profits rather than long-term investment, leading to:

Underinvestment in infrastructure.

Neglect of staff training and development.

Higher dividends at the expense of reinvestment.

4. Regulatory Problems

Privatised industries often require regulation to prevent exploitation, particularly in utilities. This can create new costs:

Establishing and maintaining regulatory bodies.

Risk of regulatory capture, where regulators act in the interest of the firms they monitor rather than the public.

Regulatory Capture: A situation where regulators are influenced or controlled by the industries they regulate, leading to outcomes favouring firms over consumers.

5. Loss of Public Accountability

Public services may prioritise profit over accessibility, reducing accountability to citizens. For example:

Job losses can occur due to cost-cutting.

Less transparency in decision-making.

Reduced commitment to universal service obligations.

6. One-off Revenue Only

While governments receive revenue from selling state assets, this is a one-time benefit. Future profits from these industries are lost to the public sector. In the long run, the state may forgo a steady income stream.

7. Potential for Market Failure

Privatisation can lead to:

Under-provision of merit goods (such as education or healthcare).

Over-provision of demerit goods (such as gambling services).

Worsened externalities if private firms cut corners on safety or environmental standards to reduce costs.

Evaluation and Context

The effectiveness of privatisation depends on:

The market structure of the industry (competitive vs monopolistic).

The strength and independence of regulatory institutions.

The nature of the good or service (essential vs non-essential).

Privatisation is most effective in industries where competition is feasible, and least effective where natural monopoly or strong social value exists. Governments must balance efficiency with equity considerations when deciding whether to privatise.

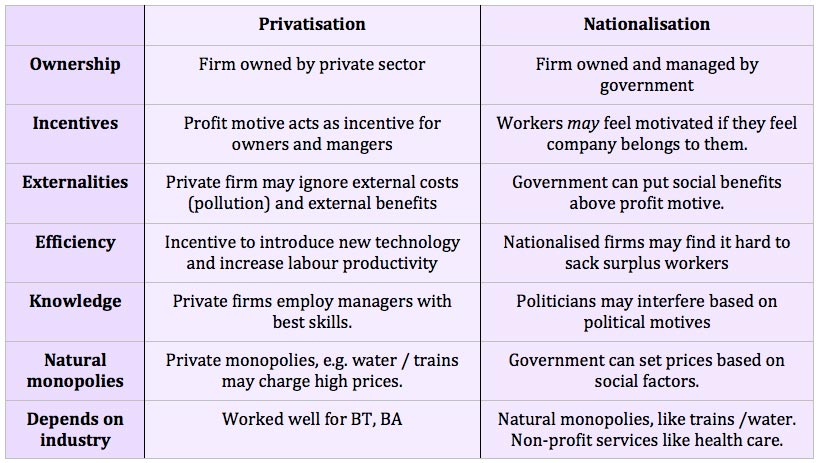

The table compares the advantages and disadvantages of privatisation, covering efficiency, competition, and social welfare. It serves as a concise summary of the key points in the study notes. Source

FAQ

Privatisation can extend beyond the outright sale of enterprises. Governments may use methods such as:

Public-private partnerships (PPPs): Long-term contracts where private firms manage and deliver public services.

Contracting out/outsourcing: Specific services (e.g. waste collection) are provided by private firms under government contracts.

Franchising: Private firms operate services, such as rail, under licence agreements with regulatory oversight.

These approaches enable private involvement without full ownership transfer.

The UK’s privatisation programme, led by Margaret Thatcher’s government, aimed to:

Reduce government borrowing by selling state assets.

Introduce competition into previously monopolistic industries.

Promote a culture of individual share ownership.

This shift reflected a broader movement towards market-oriented policies and a reduction in state intervention in the economy.

In sectors like rail or energy, large capital investments are essential. Privatisation may:

Encourage investment if firms seek long-term profit opportunities.

Discourage investment if firms prioritise short-term shareholder returns.

The outcome often depends on regulatory frameworks and whether firms can recover costs through pricing.

Privatisation is often justified on the grounds of improved consumer choice. This is valid where competition emerges, as in telecommunications.

However, in natural monopoly industries like water or rail, consumer choice is limited. In such cases, privatisation does not automatically increase choice, and regulatory measures become crucial to protect consumers.

Yes. Privatisation can widen income and wealth inequality if:

Share offerings are dominated by wealthy households.

Prices of essential services rise disproportionately for low-income groups.

However, if designed with safeguards (e.g. employee share schemes or price caps), privatisation can distribute benefits more broadly across society.

Practice Questions

Define privatisation. (2 marks)

1 mark for stating that privatisation is the transfer of ownership or provision of goods and services from the public sector to the private sector.

1 mark for recognising that it involves ownership moving from the government/state to private individuals or firms.

Explain two potential disadvantages of privatisation of natural monopoly industries such as water or rail. (6 marks)

Up to 3 marks for each relevant disadvantage explained (maximum 6 marks).

Indicative content may include:

Monopoly exploitation: Privatised natural monopolies may lead to higher prices and reduced quality of service (1 mark identification, 2 marks for development/explanation).

Need for regulation: Privatised monopolies often require government regulation, which creates extra administrative costs and risks regulatory capture (1 mark identification, 2 marks for development/explanation).

Loss of universal service obligations: Firms may prioritise profit over public service, leading to reduced accessibility (credit as alternative valid point).

Award full marks where two disadvantages are both identified and developed with clear economic reasoning. Partial marks for identification without explanation.