AQA Specification focus:

‘The problem of regulatory capture.’

Introduction

Regulatory capture occurs when institutions designed to protect the public interest instead advance the concerns of powerful industries. It undermines competition, fairness, and market efficiency.

Understanding Regulatory Capture

Definition and Core Idea

Regulatory Capture: A situation where a regulatory body, established to act in the public’s interest, instead serves the commercial or political interests of the industry it regulates.

Regulatory bodies are intended to act as impartial overseers. However, due to lobbying, influence, or close ties with the firms they regulate, these agencies may lose independence and become aligned with private rather than social objectives.

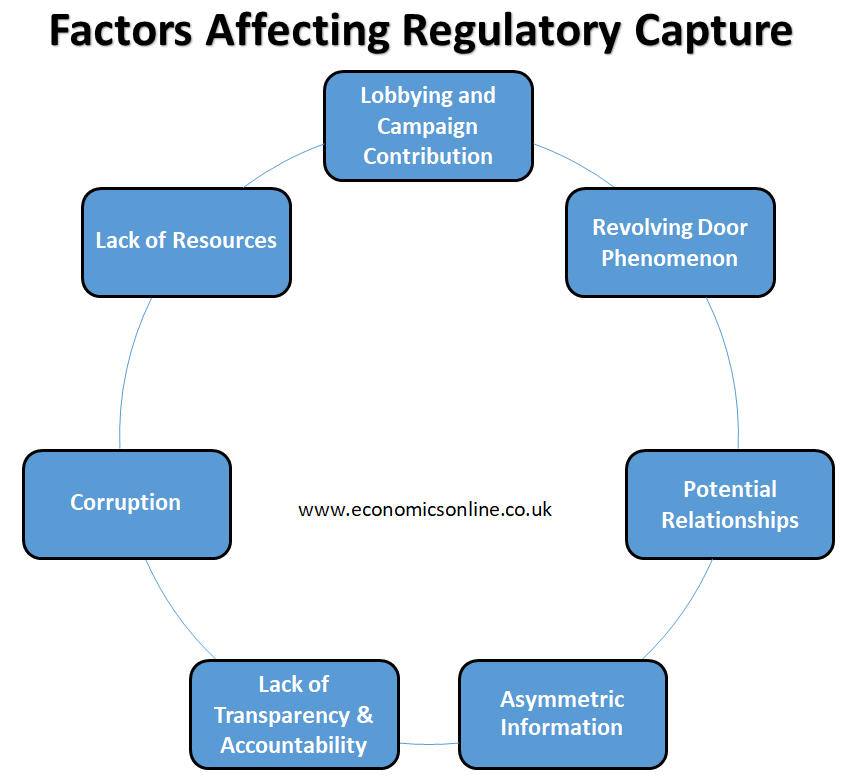

This diagram depicts the process of regulatory capture, where regulatory agencies become influenced by the industries they regulate, resulting in decisions that may prioritize industry interests over public welfare. Source

Why Regulatory Capture Occurs

Industry Influence and Information Asymmetry

Firms often possess far more specialised information about their industry than regulators. This information imbalance can create dependence, with regulators relying heavily on firms’ data and perspectives.

Revolving Door Problem

Many regulators later work in the industries they oversee, or industry executives take positions in regulatory bodies. This revolving door creates incentives for regulators to be sympathetic to firms, in hope of securing future employment.

The "revolving door" phenomenon illustrates the movement of individuals between regulatory agencies and the industries they regulate, potentially leading to conflicts of interest and regulatory capture. Source

Lobbying and Political Pressure

Large firms use lobbying, political donations, and media campaigns to shape regulatory decisions in their favour. Governments under pressure to protect jobs or attract investment may also side with industries.

Risks of Regulatory Capture

Reduced Competition

When captured, regulators may:

Allow mergers or monopolistic practices to proceed unchecked.

Fail to prevent anti-competitive behaviour, disadvantaging smaller firms.

Inefficient Resource Allocation

Regulators might approve projects, subsidies, or pricing structures that benefit firms rather than society. This creates market distortions and leads to a misallocation of resources.

Higher Prices and Poorer Quality

Consumers may face:

Higher prices, as regulators permit firms to exploit monopoly power.

Lower safety or quality standards, since regulators overlook violations.

Inequality and Welfare Loss

The shift in benefits towards firms and shareholders at the expense of consumers results in:

Reduced consumer surplus.

Widening inequality, as economic power becomes concentrated.

Key Characteristics of Regulatory Capture

Subtlety of Influence

Capture is often gradual and difficult to detect. Regulators may believe they are acting in the public interest while adopting the perspective of the industry.

Persistence and Entrenchment

Once established, capture can be very difficult to reverse, as firms continuously reinforce their influence through financial and political means.

Real-World Illustrations

While AQA does not require detailed case studies, awareness of real-world contexts is valuable.

Banking sector: Weak oversight before the 2008 financial crisis is widely cited as an example of regulatory capture, where regulators underestimated systemic risks.

Energy and utilities: Regulators may approve higher consumer prices or relax environmental standards due to pressure from large companies.

These cases show how capture undermines the regulator’s original purpose of protecting public welfare.

Theoretical Risks in Economic Terms

Market Failure Reinforcement

Instead of correcting market failure, captured regulation can worsen it by entrenching externalities, monopolies, and inefficiencies.

Deadweight Loss

By protecting firms from competition, regulatory capture increases deadweight loss—the loss of total welfare in society due to distorted market outcomes.

Evaluating the Problem of Regulatory Capture

Why It Matters

The problem is significant because:

Regulators exist to protect consumers and ensure fair markets.

Capture reverses their role, reducing trust in markets and public institutions.

Balancing the Argument

However, not all regulation is captured. Some agencies maintain independence, particularly where transparency, accountability, and effective monitoring are present.

Preventing Regulatory Capture

Key strategies include:

Transparency: Publishing decisions and justifications to allow public scrutiny.

Accountability: Independent oversight bodies or judicial review of regulatory decisions.

Limits on revolving doors: Restricting employment moves between regulators and industry.

Diverse consultation: Involving consumer groups and independent experts to counterbalance industry input.

FAQ

Lobbying is the process where firms or groups attempt to influence regulators or policymakers, often transparently.

Regulatory capture occurs when lobbying and other influences succeed to the point that regulators consistently act in favour of the industry rather than the public. While lobbying is an activity, capture is the outcome of this influence.

Regulatory capture undermines confidence because consumers perceive regulators as biased. If regulators allow unsafe products, high prices, or weak competition, consumers may feel the system is unfair.

Loss of trust can reduce demand in markets, discourage investment, and weaken the legitimacy of government institutions.

Yes, industries with the following features are more prone:

High complexity (e.g., financial services, energy, pharmaceuticals)

Large firms with significant lobbying budgets

Essential goods and services, where governments face pressure to cooperate with firms

These conditions increase reliance on industry information and make regulators more susceptible to influence.

Over time, regulatory capture can entrench inefficiencies and limit innovation.

Firms may invest more in influencing regulators than improving productivity. This leads to stagnation, persistent market failures, and weaker international competitiveness.

Common strategies include:

Cooling-off periods to limit the revolving door between industry and regulators

Independent watchdogs to audit decisions

Publishing detailed records of meetings between regulators and industry

Encouraging participation from consumer and civil society groups

These measures aim to increase accountability and balance the influence of private interests.

Practice Questions

Define regulatory capture and explain briefly why it can lead to market failure. (2 marks)

1 mark for a clear definition of regulatory capture: when a regulatory body serves the interests of the industry it regulates rather than the public interest.

1 mark for linking to market failure: capture prevents effective regulation, allowing inefficiencies or monopolistic practices to persist.

Using examples, explain how the revolving door problem can contribute to regulatory capture. (6 marks)

1–2 marks: Identifying the revolving door problem (movement of individuals between regulatory agencies and the industries they regulate).

1–2 marks: Explanation of how this creates conflicts of interest (regulators may favour firms in hope of securing future employment, or industry insiders may protect their former employers).

1–2 marks: Application with examples (e.g., financial sector regulation before the 2008 crisis, or utility regulators approving favourable pricing).

Maximum 6 marks: For a clear, developed answer with accurate definition, explanation, and relevant examples.