AQA Specification focus:

‘The arguments for and against the regulation of markets.’

Introduction

Market regulation involves government intervention in markets to control or influence economic behaviour, aiming to correct market failures or improve outcomes. This concept has both benefits and drawbacks, which are explored through the arguments for and against regulation.

Arguments For Market Regulation

Market regulation is often used by governments to address inefficiencies, protect consumers, and maintain fairness in the economy. Here are the primary arguments in favour of market regulation:

1. Correcting Market Failures

Markets are not always efficient, and government regulation can help correct market failures. For example, when markets fail to produce socially desirable outcomes, such as the provision of public goods or dealing with negative externalities (e.g., pollution), regulation can help.

Public Goods: Regulation ensures the provision of public goods that the private sector may underprovide, such as clean air or national defence.

Externalities: Negative externalities, such as pollution, may be corrected through regulation, for instance, by setting emission limits or levying pollution taxes.

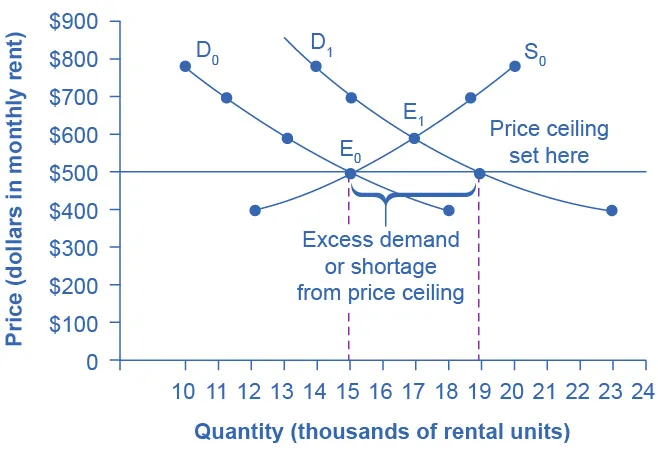

This diagram demonstrates the effects of a price ceiling on market equilibrium. A price ceiling set below the equilibrium price leads to a shortage, as the quantity demanded exceeds the quantity supplied. Such interventions can protect consumers but may also lead to inefficiencies. Source

2. Protecting Consumers

Governments often regulate markets to protect consumers from exploitation. Without regulation, monopolies or firms with significant market power may exploit consumers through unfair prices or low-quality products.

Price Controls: Price caps in essential industries (e.g., utilities) prevent price gouging

Product Safety: Regulation ensures that products meet safety standards, preventing harm to consumers.

3. Ensuring Fair Competition

Regulation can prevent monopolies or anti-competitive behaviour, ensuring that firms operate fairly in a competitive market. This ensures a level playing field and encourages firms to innovate and improve quality.

Antitrust Laws: Governments may regulate markets by preventing monopolistic practices such as price-fixing or collusion.

Encouraging Innovation: By regulating anti-competitive practices, firms are encouraged to compete fairly, leading to innovation and better consumer choice.

4. Ensuring Environmental Sustainability

Environmental protection is a significant reason for market regulation. Markets often fail to address environmental concerns unless forced by regulation. Governments can implement policies to ensure that businesses operate in an environmentally sustainable way.

Pollution Regulation: Government-imposed rules on emissions or waste disposal help businesses reduce their environmental impact.

Sustainability Initiatives: Regulations can encourage businesses to adopt green technologies and reduce their carbon footprint.

Arguments Against Market Regulation

Despite its benefits, market regulation can also have drawbacks. Below are the key arguments against market regulation:

1. Increased Costs and Inefficiency

One of the most common arguments against regulation is that it can lead to higher costs for businesses and consumers. Excessive regulation can increase compliance costs for businesses, which may be passed on to consumers in the form of higher prices.

Regulatory Burden: Regulations can lead to administrative costs for businesses, especially small firms that may struggle to comply with complex rules.

Price Increases: Consumers may face higher prices as businesses pass on the costs of compliance, reducing consumer welfare.

2. Distorting Market Forces

Regulation can distort the natural workings of the market. By setting prices or controlling outputs, governments can interfere with supply and demand, leading to inefficiencies and unintended consequences.

Supply and Demand Imbalance: Price controls may lead to shortages or surpluses, as the market may not adjust naturally to changes in supply or demand.

Market Distortions: Excessive regulation may prevent businesses from responding to market signals, which could stifle innovation and productivity.

3. Regulatory Capture

Governments may be influenced by the industries they regulate, leading to regulatory capture. In such cases, regulators may act in the interests of the firms they are supposed to oversee, rather than the public good. This can result in regulations that favour large firms and hinder competition.

Influence of Lobbying: Large firms may lobby government officials to create regulations that protect their interests, limiting competition.

Weak Enforcement: Regulatory capture can result in weak enforcement of regulations, allowing firms to avoid compliance and maintain monopolistic behaviour.

4. Government Failures

Government intervention in the market can sometimes lead to unintended consequences. Government bodies may not always have the necessary information to regulate effectively, leading to poorly designed policies that do more harm than good.

Inefficient Policy Design: Governments may introduce regulations that are not well-suited to the specific market context, leading to inefficiencies.

Bureaucracy: Overregulation can lead to excessive bureaucracy, which can slow down decision-making and hinder economic growth.

5. Limitations on Economic Freedom

Excessive regulation may limit the freedom of businesses to operate as they see fit. Many argue that the free market should be allowed to function without government interference, as businesses are better equipped to make decisions based on consumer demand and market conditions.

Reduced Flexibility: Businesses may be less able to adapt quickly to changes in the market due to regulatory constraints.

Entrepreneurship Stifling: Regulations that are too strict may discourage entrepreneurs from entering markets, reducing innovation and job creation.

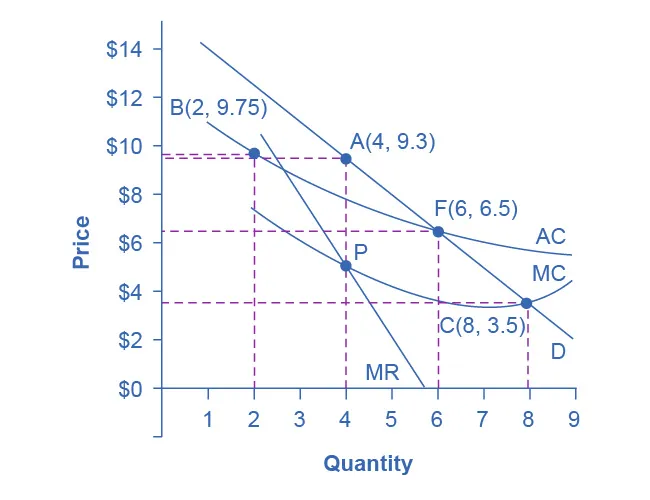

This diagram illustrates different regulatory approaches to natural monopolies. Cost-plus regulation allows firms to cover costs plus a guaranteed profit margin, while price cap regulation sets a maximum price that firms can charge. These methods aim to balance fair pricing with the sustainability of essential services. Source

FAQ

The price mechanism allocates resources by allowing prices to adjust according to supply and demand. It works through three key functions:

Rationing: Prices help determine who gets goods and services when there is limited supply.

Incentive: High prices encourage producers to supply more, while low prices signal that demand is not being met.

Signalling: Price changes signal to consumers and producers when to buy or sell, adjusting behaviour to market needs.

Through these mechanisms, the market coordinates the decisions of buyers and sellers efficiently.

Government regulation of monopolies helps prevent market failure by:

Limiting monopoly power: Regulation can set price caps or enforce antitrust laws to stop monopolistic exploitation.

Promoting competition: By controlling monopolies, regulation ensures a level playing field where smaller firms can compete, encouraging innovation.

Ensuring fair prices: In natural monopolies, like utilities, governments may set fair prices to prevent overcharging consumers.

This intervention aims to correct the inefficiencies caused by monopolies, ensuring fairer and more efficient market outcomes.

The tragedy of the commons occurs when individuals, acting in their self-interest, deplete or damage shared resources. This typically happens with resources like water, air, or fisheries.

Regulation can address this by:

Setting usage limits: Governments can introduce quotas or restrictions on resource use.

Implementing property rights: Assigning ownership or rights over common resources encourages responsible management.

Enforcing penalties: Regulations can impose fines for overuse or pollution, discouraging harmful behaviour.

By regulating shared resources, governments help prevent overuse and ensure sustainability.

Price floors and ceilings are regulatory tools that intervene in markets by setting limits on prices.

Price floors: Set minimum prices (e.g., minimum wage). If set above equilibrium, they create surpluses, as supply exceeds demand.

Price ceilings: Set maximum prices (e.g., rent controls). If set below equilibrium, they cause shortages, as demand exceeds supply.

Both tools aim to protect consumers or producers, but they often lead to market inefficiencies, like shortages or surpluses.

While government intervention can correct market failures, it also comes with drawbacks:

Increased costs: Regulation can increase compliance costs for businesses, often passed on to consumers.

Market distortions: Interventions like price controls can distort supply and demand, leading to inefficiencies.

Regulatory capture: Government bodies may be influenced by the industries they regulate, leading to policies that favour large firms.

These factors can reduce the effectiveness of market regulation and create new inefficiencies.

Practice Questions

Explain one advantage of government regulation of markets. (1-3 marks)

1 mark for identifying an advantage of market regulation (e.g., correction of market failure, protection of consumers, ensuring fair competition).

2-3 marks for providing a detailed explanation of the identified advantage (e.g., "Government regulation can correct market failures by ensuring that public goods are provided, which the private sector may underprovide." or "Regulation ensures that monopolies do not exploit consumers by setting fair prices.").

Evaluate the arguments for and against government regulation of markets. (4-6 marks)

1-2 marks: For providing at least one argument for market regulation (e.g., correcting market failures, protecting consumers).

1-2 marks: For providing at least one argument against market regulation (e.g., increased costs, market distortion, regulatory capture).

1 mark for a clear evaluation or conclusion based on the arguments provided (e.g., "While regulation can correct market failures, it can also introduce inefficiencies and higher costs, making it important to weigh both sides before implementing policy.").

1 mark for clarity and structure (marks should be awarded for clearly stating and developing arguments, with examples or explanations where necessary).