AP Syllabus focus:

‘As the U.S. economy became increasingly urban and industrial, the Great Depression revealed severe vulnerabilities in markets, credit, and employment.’

Rapid industrial expansion masked deep structural weaknesses in credit systems, markets, and employment. These vulnerabilities collided with speculative excess, producing a catastrophic economic crash that exposed the fragility of modern capitalism.

Structural Weaknesses in the U.S. Economy

The late nineteenth and early twentieth centuries generated immense economic growth, but this transformation introduced systemic imbalances that left the United States dangerously exposed when downturns struck. As the syllabus emphasizes, the shift toward an urban and industrial economy produced patterns of production, consumption, and investment that were modern yet fragile. Understanding these underlying weaknesses helps clarify how the Great Depression, rather than being an abrupt anomaly, emerged from long-term vulnerabilities.

Overproduction in Agriculture and Industry

Industrial efficiency soared in the early twentieth century, especially in sectors such as automobiles, steel, and consumer durables. However, productivity increased faster than wages for much of the population, limiting purchasing power.

Factories produced more goods than consumers could reliably buy, creating chronic overproduction, especially in durable goods.

Farmers faced collapsing prices throughout the 1920s due to mechanization, global competition, and post–World War I declines in demand.

Many agricultural communities, already suffering from declining incomes, lacked the capacity to absorb additional economic shocks.

Overproduction: A condition in which the supply of goods exceeds consumer demand, causing falling prices, reduced profits, and economic instability.

These imbalances were manageable during periods of growth but became catastrophic once credit tightened and demand contracted in 1929.

Wage Inequality and Limited Consumer Purchasing Power

Although the United States celebrated rising productivity and new consumer goods, the distribution of income was heavily skewed.

A minority of wealthy Americans captured a disproportionate share of economic gains.

Many workers’ real wages stagnated, even as living costs rose.

The economy relied increasingly on installment buying to maintain consumption levels.

The spread of installment credit, while initially expanding consumer access, created a system in which households could maintain demand only by taking on debt. When confidence faltered, consumers cut back sharply, intensifying economic decline.

Financial Instability and Speculative Behavior

The financial sector was among the most unstable components of the interwar economy. Weak regulation and speculative optimism combined to magnify risk.

Stock Market Speculation and Margin Buying

The 1920s saw a dramatic spike in stock purchases fueled by margin buying, in which investors borrowed most of the money needed to buy shares, using those very shares as collateral.

Investors assumed stocks would keep rising indefinitely.

Brokers lent large amounts of credit based on inflated asset values.

A downturn automatically triggered forced selling, accelerating the collapse.

Margin Buying: Purchasing stock by paying only a small percentage upfront while borrowing the remainder, typically using the purchased stock as collateral.

This speculative structure meant the market lacked the resilience to absorb even modest declines.

Weak Banking Systems and Limited Federal Oversight

Thousands of small, local banks operated with minimal regulation or diversification.

Banks frequently invested depositors’ funds in risky loans or speculative ventures.

Most lacked geographic or sectoral diversification, leaving them vulnerable to local downturns.

There was no federal deposit insurance, so bank failures wiped out personal savings.

When panic began, bank runs spread rapidly, encouraging withdrawals even from solvent institutions. The failure of one bank often triggered the collapse of others due to financial interconnections and public fear.

Credit Contraction and the Fragility of the Economic System

The structural weaknesses in employment, credit, and markets became fully visible when credit conditions tightened in 1929. Because the economy depended so heavily on borrowed money—whether for consumer purchases, stock speculation, or business expansion—the contraction of credit magnified economic decline.

Businesses could not secure loans to maintain inventories or payrolls.

Farmers lost land to foreclosure as credit dried up.

Households were unable to refinance or continue installment payments.

This credit freeze revealed how deeply the U.S. economy had come to depend on easy borrowing during the 1920s expansion.

Employment Vulnerabilities in an Industrializing Nation

Urban and industrial growth created new jobs, but the emerging labor market was highly unstable.

Many industries relied on cyclical demand, leading to immediate layoffs when sales slowed.

Mechanization continued to decrease the need for labor in both agriculture and manufacturing.

Workers lacked unemployment insurance or federal protections, making job loss devastating.

As production plummeted, unemployment soared, exposing the limited social safety net and contributing to widespread hardship.

When the Depression began, unemployment soared into the double digits, and underemployment spread as hours and wages were cut.

This chart shows U.S. unemployment rates, highlighting the unprecedented surge during the early 1930s. The dramatic rise reveals how structural weaknesses in employment intensified the economic crisis. The extended timeline includes extra detail beyond the AP period but helps contextualize the severity of the Depression-era collapse. Source.

The Crash of 1929 and Its Aftermath

The stock market crash of October 1929 did not singlehandedly cause the Great Depression but marked the moment when existing weaknesses converged.

Falling stock prices wiped out speculative fortunes and destabilized investment.

Banks rapidly contracted credit, deepening the downturn.

Businesses cut production, accelerating unemployment and reducing consumer demand.

The stock market crash of October 1929 exposed these weaknesses but did not, by itself, cause the entire Depression.

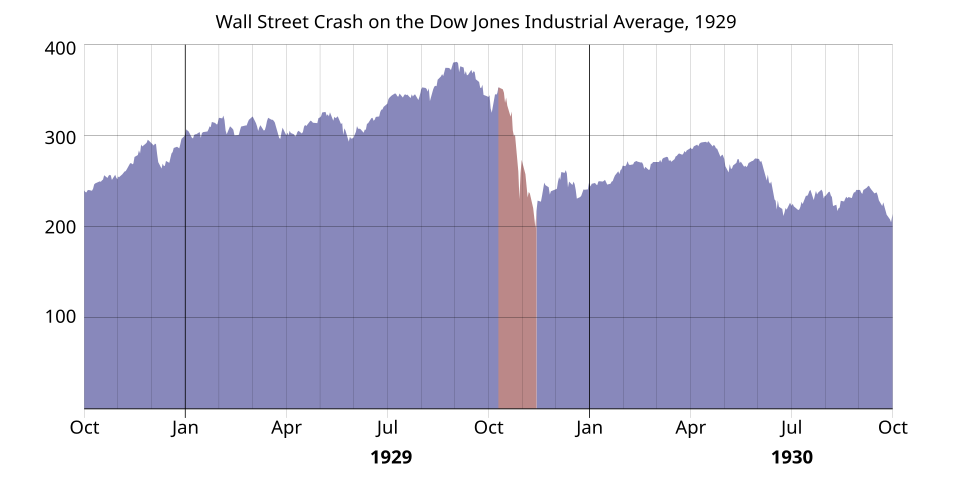

This graph illustrates the steep decline in stock values during the 1929 crash, showing how quickly speculative gains collapsed. The highlighted crash period underscores the instability created by margin buying and weak regulation. Although the graph extends slightly beyond 1929, the additional context helps clarify the ongoing financial turmoil. Source.

The crash revealed what the syllabus underscores: a modern industrial economy could grow rapidly yet remain highly vulnerable when underlying structural weaknesses remained unaddressed.

FAQ

The global economy of the 1920s was fragile, with many European nations struggling to recover from the First World War. Their reduced purchasing power limited overseas demand for American industrial and agricultural goods.

High U.S. tariffs, particularly the Fordney–McCumber Tariff of 1922, further suppressed international trade, making it harder for foreign countries to buy American exports. This intensified overproduction problems and made the U.S. economy more dependent on domestic demand and credit.

Many rural banks depended heavily on loans to farmers, whose incomes had been declining throughout the 1920s. When agricultural prices fell further, farmers defaulted on their debts, weakening banks’ balance sheets.

These institutions often had limited cash reserves and no diversified assets. A single wave of withdrawals could therefore trigger collapse, which then spread fear to otherwise stable banks.

Technological advances increased production far faster than consumer wages, contributing to chronic oversupply.

They also reduced labour needs in industries such as farming and manufacturing. This created structural unemployment and placed downward pressure on wages, weakening purchasing power and making the economy more vulnerable to contraction.

Confidence was essential to sustaining both consumer spending and credit-based investment. When stock prices began falling, fear spread rapidly, prompting investors and consumers to withdraw funds and reduce spending.

As confidence collapsed:

• Banks tightened credit.

• Businesses cut production.

• Consumers postponed purchases.

This psychological shift turned a financial correction into a nationwide economic crisis.

Political leaders and much of the public celebrated unprecedented economic growth and technological progress, reinforcing a belief in minimal government intervention.

Regulators lacked the authority or will to restrain speculation or address banking vulnerabilities. Business leaders resisted reforms that might restrict profits.

These factors created a complacent environment in which warning signs—such as agricultural distress, rising inequality, and expanding household debt—were largely ignored until the system unravelled.

Practice Questions

(1–3 marks)

Identify and explain one structural weakness in the United States economy during the 1920s that contributed to the severity of the Great Depression.

(1–3 marks)

• 1 mark for identifying a relevant structural weakness, such as overproduction, income inequality, reliance on credit, speculative investment, or weak banking regulation.

• 1–2 additional marks for a clear explanation of how this weakness contributed to the depth of the Depression.

Examples of acceptable explanation points include:

– Overproduction reduced prices and profits, leaving firms vulnerable when demand fell.

– Income inequality limited consumer purchasing power, making the economy dependent on credit.

– Reliance on instalment credit increased household vulnerability to downturns.

– Weak banking regulation led to instability and bank failures after the crash.

Full marks require a clear, historically accurate link between the identified weakness and the severity of the economic collapse.

(4–6 marks)

Analyse how weaknesses in the financial system and consumer economy combined to make the 1929 stock market crash more damaging than previous downturns.

(4–6 marks)

Award marks for the following elements:

• 1–2 marks for describing weaknesses in the financial system, such as speculative behaviour, margin buying, lack of federal oversight, or fragile banking structures.

• 1–2 marks for describing weaknesses in the consumer economy, such as wage stagnation, high consumer debt, or limited purchasing power.

• 1–2 marks for analysis showing how these weaknesses interacted to amplify the effects of the crash.

Examples of acceptable analytical points include:

– Margin buying caused rapid selling when prices dipped, turning a market correction into a major collapse.

– Banks’ risky investments and lack of deposit insurance spread panic and credit contraction.

– Consumers already burdened with debt cut spending sharply, deepening the economic decline.

– The combination of weak demand and financial instability created a cascading economic crisis rather than a temporary downturn.

Full marks require a coherent, well-reasoned argument showing the interconnected nature of financial and consumer vulnerabilities.