AP Syllabus focus:

‘Conservative leaders argued that tax cuts and deregulation would stimulate growth and reshape the economy, changing expectations for federal policy.’

Conservative policymakers in the 1980s advanced supply-side economics, emphasizing tax cuts and deregulation to stimulate investment, expand production, and redefine the federal government’s economic role.

The Intellectual Foundations of Supply-Side Economics

Supply-side economics centered on the belief that reducing barriers to production—especially taxes and federal regulations—would unlock higher economic growth. Advocates argued that traditional Keynesian demand-focused policies were inadequate amid the stagflation of the 1970s.

Supply-Side Economics: An economic theory asserting that growth increases when government reduces taxes and regulations, thereby encouraging investment, entrepreneurship, and productivity.

Supporters contended that lowering marginal tax rates would incentivize individuals and businesses to save, invest, and take entrepreneurial risks. This argument helped conservatives promote a major reorientation of federal policy when Ronald Reagan took office in 1981.

Reagan’s Push for Major Tax Cuts

Reagan placed tax reduction at the center of his domestic agenda, claiming it would unleash economic productivity and combat stagnation.

The Economic Recovery Tax Act of 1981

This landmark legislation represented one of the largest peacetime tax cuts in U.S. history.

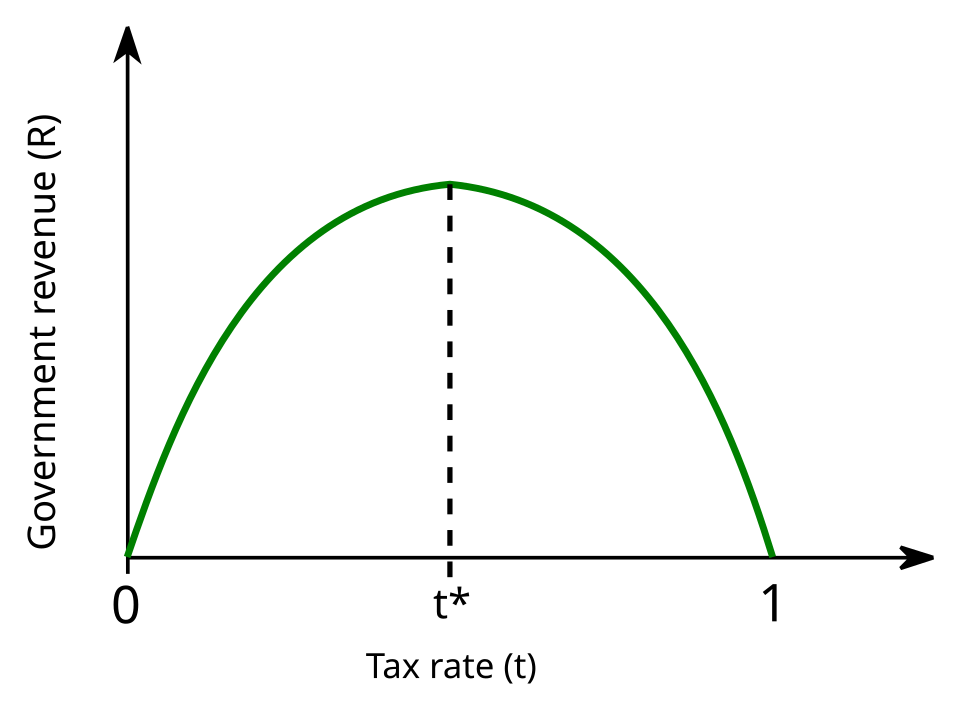

A simple graph of the Laffer Curve shows tax revenue on the vertical axis and the tax rate on the horizontal axis. The arch-shaped curve peaks at an intermediate tax rate, illustrating that both very low and very high tax rates can produce lower revenue. This visual reinforces conservative arguments that cutting high marginal tax rates could, in theory, maintain or even increase total tax receipts. Source.

Its goals included:

Reducing personal income tax rates, particularly for high earners, to encourage investment in the private sector.

Accelerating depreciation schedules to incentivize capital spending by businesses.

Cutting estate and capital gains taxes, which conservatives believed hindered wealth formation and risk-taking.

Supporters argued that these measures would broaden the tax base by stimulating growth. Critics countered that they disproportionately benefited wealthier Americans and risked enlarging the federal deficit.

The Logic Behind the Tax Cuts

Advocates drew on a theoretical relationship between tax rates and government revenue.

EQUATION

= The percentage of income collected by the government

= Total tax income generated for the government

The Laffer Curve suggested that excessively high tax rates reduce revenue by discouraging economic activity, while lower rates might increase revenue by stimulating production.

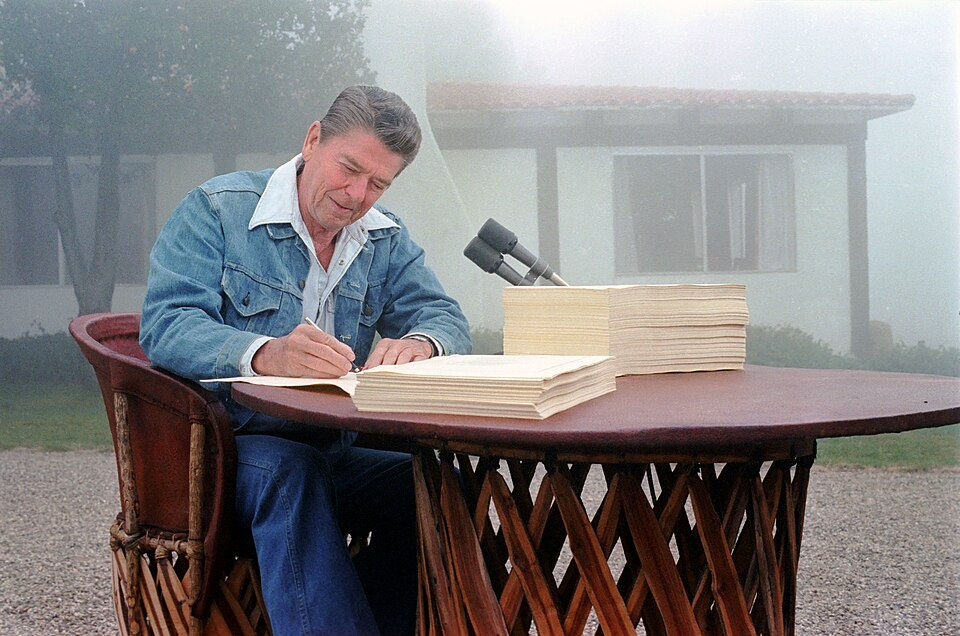

President Ronald Reagan signs the Economic Recovery Tax Act and the Omnibus Budget Reconciliation Act of 1981 at his Rancho del Cielo ranch. The scene captures the moment when key supply-side tax cuts were enacted, embodying conservative efforts to reduce marginal tax rates and promote private-sector growth. The image connects abstract economic theory to the political process that implemented it. Source.

After these reforms, the administration maintained that economic growth would offset lost tax revenues—an expectation debated by economists and policymakers throughout the 1980s.

Deregulation as a Conservative Policy Priority

Alongside tax cuts, deregulation formed the second essential pillar of the conservative program. Leaders argued that removing federal oversight would reduce business costs, increase efficiency, and promote innovation.

Sectors Targeted for Deregulation

Although deregulation had begun in the late 1970s, Reagan accelerated it. Key areas included:

Energy: Lifting price controls on oil and natural gas to encourage domestic production.

Transportation: Continuing deregulation of airlines and trucking to enhance competition.

Finance: Relaxing restrictions on savings and loan institutions, which policymakers believed would increase credit availability.

Communications: Reducing oversight to promote competition and private-sector technological growth.

In each case, conservatives argued that market competition—not federal bureaucracy—was best suited to drive innovation and efficiency.

Changing Expectations for Federal Policy

Conservative leaders viewed supply-side strategies not simply as economic fixes but as tools to shift the nation’s expectations of the federal government. The implementation of these policies aimed to limit government intervention and restore confidence in private enterprise.

A Smaller Federal Footprint in Economic Affairs

The push for lower taxes and deregulation reflected broader ideological goals:

Reining in federal spending, particularly on social programs;

Reasserting the primacy of markets, with government serving a more minimal and supportive role;

Encouraging entrepreneurial culture, aligning economic policy with conservative social values of individual responsibility and self-sufficiency.

While the federal government continued to grow in some areas—especially defense—these reforms reshaped political debates over taxation and regulation for decades.

Political and Economic Outcomes

The long-term results of supply-side initiatives remained contested. Observers noted:

Significant economic expansion in the mid-1980s, partly attributed to tax cuts and deregulation;

Rising federal deficits, which critics linked to reduced revenue;

Growing inequality, as gains were uneven across the population;

Increased financial-sector risk-taking, culminating in crises such as the savings and loan collapse.

Nevertheless, the movement succeeded in redefining policy expectations. Even later administrations often embraced elements of tax reduction and deregulation, reflecting conservative influence beyond the 1980s.

Enduring Influence on U.S. Economic Policy

By advancing major tax cuts and scaling back federal oversight, conservative leaders in the 1980s transformed American economic policymaking. Their supply-side agenda reshaped political discourse, reinforced ideological commitments to limited government, and established a framework that continued to guide debates over taxation, regulation, and growth well into the 21st century.

FAQ

Supporters argued that higher-income individuals were more likely to reinvest additional disposable income into activities that promoted economic growth, such as business expansion, technology purchases, or venture capital.

They maintained that directing benefits to those with the greatest capacity to invest would produce stronger overall productivity gains, which would ultimately benefit the broader economy through job creation and increased output.

Critics contended that the theory overstated the extent to which tax cuts would stimulate investment, arguing that businesses often responded more to market demand than to tax incentives.

Some economists also warned that lowering taxes without equivalent spending cuts risked creating structural deficits, and that the benefits of tax reductions would disproportionately favour wealthier groups rather than broadly supporting middle- and working-class Americans.

Reducing oversight of savings and loan institutions allowed them greater freedom to invest in high-risk ventures.

With limited safeguards, many institutions made unsustainable loans, contributing to the savings and loan crisis of the late 1980s.

• This led to widespread failures.

• The federal government ultimately intervened with costly bailouts.

The episode became a case study in the potential dangers of rapid deregulation without adequate regulatory frameworks.

Supply-side reforms reflected conservative ideals of self-reliance, reduced dependency on government programmes, and belief in market-based solutions.

By promoting entrepreneurship and limiting federal intervention, these policies aligned economic goals with a wider ideological emphasis on personal responsibility and the primacy of private enterprise in shaping national prosperity.

Yes. Regions with strong finance, technology, and service sectors—such as the West Coast and parts of the Northeast—tended to benefit more because these industries were better positioned to expand with new investment.

Manufacturing-heavy regions, particularly in the Midwest, often saw fewer gains.

• Lower taxes did not reverse broader trends of deindustrialisation.

• Investment flowed more readily into emerging high-growth industries rather than older industrial sectors.

Practice Questions

1–3 mark question (short response)

1. Identify one reason why supporters of supply-side economics in the 1980s argued for significant reductions in marginal income tax rates.

(1–3 marks)

Question 1 Mark Scheme (1–3 marks)

Award up to 3 marks:

1 mark for identifying a valid reason.

1–2 additional marks for further detail or explanation of how the reason supports supply-side goals.

Acceptable points include:

Supporters believed that lower marginal tax rates would incentivise individuals and businesses to invest, save, or undertake entrepreneurial activity (1 mark).

Explanation that tax cuts were expected to stimulate economic growth by increasing production and productivity (1 mark).

Explanation that reducing high tax rates might increase total government revenue by encouraging greater economic activity (1 mark).

Maximum: 3 marks.

4–6 mark question (extended response)

2. Explain how supply-side economic policies under President Ronald Reagan sought to reshape the role of the federal government in the U.S. economy.

(4–6 marks)

Question 2 Mark Scheme (4–6 marks)

Award up to 6 marks:

1–2 marks for describing supply-side economic policies (e.g., tax cuts, deregulation).

2–3 marks for explaining how these policies aimed to reduce the federal government’s role.

1 mark for linking these changes to broader conservative goals or their intended long-term effects.

Acceptable points include:

Description of major tax cuts such as the Economic Recovery Tax Act of 1981, which reduced income tax rates and aimed to encourage private investment (1–2 marks).

Explanation that deregulation of sectors such as energy, transport, finance, and communications aimed to reduce federal oversight and allow market forces to guide economic activity (1–2 marks).

Clear argument that these policies were intended to reduce government intervention, promote free-market principles, and shift expectations about the proper scope of federal economic policy (1–2 marks).

Maximum: 6 marks.