AP Syllabus focus:

‘Policy debates continued over free-trade agreements, the scope of the social safety net, and competing proposals to reform the U.S. financial system.’

Americans confronted shifting economic conditions after 1980, prompting intense political battles over free trade, the social safety net, and how best to regulate financial markets in an increasingly globalized economy.

Free Trade and Economic Globalization

Debates over free trade became central to late-20th-century economic policymaking. Supporters argued that lowering trade barriers would expand markets for U.S. goods and strengthen global competitiveness. Critics warned that increased competition would accelerate job losses, particularly in manufacturing communities already struggling with long-term economic change.

Key Free-Trade Agreements

Major trade agreements in the 1990s and 2000s reshaped political alignments and public expectations of government economic policy.

North American Free Trade Agreement (NAFTA), implemented in 1994, created a trilateral trade bloc among the United States, Canada, and Mexico.

World Trade Organization (WTO) membership further integrated the U.S. into global regulatory frameworks overseeing international trade.

Advocates claimed that such agreements promoted economic efficiency, expanded consumer choices, and strengthened American influence abroad.

Opponents, including labor unions and some environmental groups, asserted that reducing tariffs incentivized outsourcing and undermined domestic labor standards.

Growing anxieties over globalization contributed to political polarization, with free-trade debates increasingly intersecting with concerns about regional inequality, industrial decline, and income stagnation.

Trade, Investment, and National Policy

Federal policymakers sought to balance global competitiveness with domestic economic protection.

Some conservatives and business leaders favored deregulation and open markets, arguing that government intervention distorted economic incentives.

Others, including some bipartisan coalitions, pushed for trade adjustment assistance, intended to support workers displaced by global competition.

Persistent disputes over whether free trade strengthened or weakened long-term American prosperity became a recurring feature of national political discourse.

Conservatives and many pro-business Democrats supported free-trade agreements (FTAs) as a way to expand markets, lower consumer prices, and enhance U.S. competitiveness.

Orthographic map showing the North American Free Trade Agreement area, highlighting the United States, Canada, and Mexico. The image helps visualize regional integration underpinning debates about free trade, job loss, and economic growth. It serves as a geographic reference rather than a detailed policy diagram. Source.

The Social Safety Net and Policy Disputes

Debates over the scope of the social safety net intensified as conservatives pushed to reduce federal spending and reshape welfare programs.

Reforming Public Assistance

The most influential reform effort was the 1996 Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA).

Social Safety Net: Government programs designed to provide economic security and basic welfare support to individuals and families facing hardship.

Lawmakers who supported PRWORA sought to emphasize work requirements, time-limited benefits, and greater state discretion over welfare spending. They argued that earlier federal programs unintentionally encouraged dependency and weakened workforce participation. Many liberals countered that shrinking benefits left vulnerable populations at risk during periods of economic instability, especially as wages stagnated for low-skill workers.

Public debates over federal responsibility, individual accountability, and the moral dimensions of welfare policy highlighted divergent visions of American citizenship and economic fairness.

Medicare, Social Security, and Budget Priorities

Although conservatives frequently criticized entitlement spending, broad public support made major restructuring difficult.

Proposals to privatize Social Security, such as those floated in the early 2000s, faced strong opposition.

Spiraling healthcare costs sparked ongoing efforts to limit Medicare spending, yet substantial reforms proved politically risky.

The tension between fiscal conservatism and the popularity of long-standing programs contributed to recurring budget standoffs.

The 1996 Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) replaced AFDC with Temporary Assistance for Needy Families (TANF), imposing time limits and work requirements on recipients.

President Bill Clinton signs the Personal Responsibility and Work Opportunity Reconciliation Act, a major restructuring of federal welfare policy. The ceremony reflects bipartisan agreement on stricter work requirements and time limits. The image captures the moment of enactment but not the long-term social effects of the law. Source.

Financial Reform and Regulatory Battles

As financial markets expanded and global capital flows accelerated, policymakers debated how much oversight the federal government should exert over the financial system.

Deregulation in the Late 20th Century

Beginning in the 1980s, conservatives promoted reducing federal regulation under the belief that freer markets would fuel innovation and economic growth.

Changes such as the Gramm-Leach-Bliley Act (1999) rolled back earlier New Deal–era restrictions by allowing commercial banks, investment firms, and insurance companies to merge.

Advocates argued that integrated financial services would increase efficiency, while critics warned that loosening regulations heightened systemic risk.

These deregulatory trends encouraged rapid financial expansion but also contributed to vulnerabilities exposed during the 2008 financial crisis.

Crisis, Oversight, and Regulation

The 2008 collapse triggered renewed disputes over the proper role of government in financial markets.

Financial Reform: Legislative and regulatory efforts to oversee financial institutions, manage risk, and prevent systemic instability in the economy.

The 2007–2009 Great Recession exposed the risks of financial deregulation and complex securities tied to the housing market, prompting demands for stronger oversight.

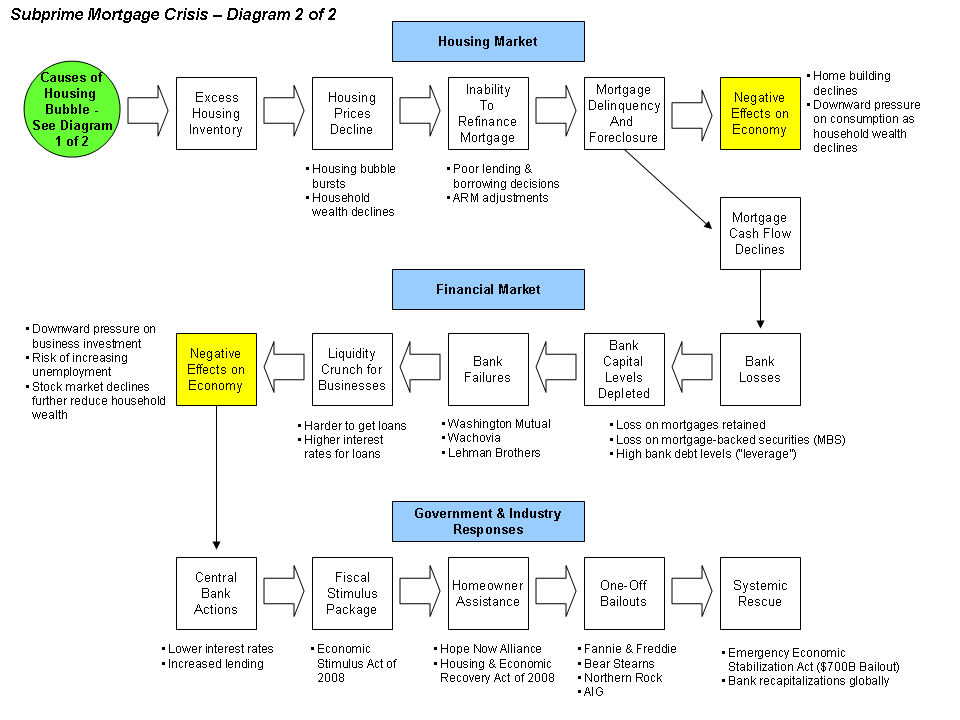

Diagram illustrating how subprime mortgages, falling home prices, and mortgage-backed securities contributed to systemic financial instability. The visual clarifies why policymakers argued for stricter oversight and consumer protections in the aftermath of the crisis. It includes more economic detail than required by the AP curriculum and should be used as a conceptual aid. Source.

Following the crisis, the Dodd-Frank Wall Street Reform and Consumer Protection Act (2010) introduced sweeping changes, including new oversight bodies and enhanced consumer protections. Supporters argued that regulation was necessary to prevent future collapses and restrain risky speculative behaviors. Many conservatives criticized the law as overly burdensome, asserting that excessive regulation stifled economic growth and limited credit availability.

Congressional and public debate reflected deeper ideological divisions over how to balance market freedom, risk management, and consumer protection.

Competing Visions for a Modern Economy

Ongoing conflicts over financial oversight illustrated the broader clash between competing economic philosophies:

Advocates of limited government emphasized individual responsibility, market efficiency, and the dangers of bureaucratic overreach.

Supporters of stronger regulation emphasized economic stability, equitable access, and protection from corporate misconduct.

These disagreements shaped legislative agendas, electoral politics, and public expectations of federal responsibility.

Interconnected Policy Arenas

Free trade, safety-net programs, and financial regulation were deeply intertwined within the larger context of global economic change after 1980.

Free-trade policies influenced labor markets, which in turn shaped welfare debates.

Safety-net reforms affected economic security as workers faced increasing international competition.

Financial system reforms reflected both the opportunities and risks of operating in a globalized economy.

Together, these policy battles revealed enduring tensions in American political life over how much government should intervene in markets, how to promote growth while protecting citizens, and how the nation should adapt to a rapidly evolving global economy.

FAQ

Free-trade debates reshaped traditional party alignments by creating unusual alliances. Many Republicans and pro-business Democrats supported agreements like NAFTA, while labour unions, some environmentalists, and segments of the Democratic Party opposed them.

This realignment contributed to long-term shifts in voter bases, particularly in industrial states where economic anxieties weakened historic ties between working-class voters and the Democratic Party.

Supporters believed decentralising welfare administration would allow states to tailor programmes to local needs.

They argued that flexibility would encourage innovation, reduce bureaucratic inefficiency, and enable closer oversight of recipients. Critics countered that uneven state resources risked creating unequal support across the country.

Critics warned that removing barriers between commercial banking, investment banking, and insurance increased the risk of conflicts of interest.

They argued that larger, more complex financial institutions would be harder to regulate effectively and more vulnerable to collapse during economic downturns, increasing the likelihood of taxpayer-funded bailouts.

Supporters of expanding the safety net argued that global competition put downward pressure on wages and job stability, increasing workers’ need for government support.

Opponents contended that a larger safety net discouraged self-sufficiency and reduced the incentives needed to maintain a competitive workforce.

The crisis led many Americans to view oversight as essential for preventing excessive risk-taking and protecting consumers.

However, others believed that new regulations, such as those in Dodd–Frank, restricted economic growth.

• This divide deepened partisan disagreements over how much government intervention was appropriate in a global financial system.

Practice Questions

(1–3 marks)

Explain one reason why free-trade agreements such as NAFTA generated political debate in the United States after 1980.

(1–3 marks)

1 mark: Identifies a valid reason for political debate (e.g., concern over job losses, effects on domestic industries, or support for expanded international markets).

2 marks: Provides a clear explanation of how this reason contributed to political division.

3 marks: Demonstrates specific knowledge of NAFTA or another free-trade agreement to illustrate the explanation.

(4–6 marks)

Using your knowledge of US history after 1980, evaluate the extent to which debates over financial reform reflected broader ideological disagreements about the role of the federal government.

(4–6 marks)

4 marks: Provides a generally accurate explanation of debates over financial reform, referencing deregulation or post-2008 reform efforts such as Dodd–Frank.

5 marks: Connects these debates to wider ideological disagreements (e.g., market freedom vs. federal oversight; individual responsibility vs. systemic regulation).

6 marks: Supports the argument with specific and relevant evidence, shows awareness of differing viewpoints, and offers a reasoned judgement on the extent of ideological influence.