AQA Specification focus:

‘The determinants of AD, ie the determinants of consumption, investment, government spending, exports and imports.’

Aggregate demand (AD) is the total planned spending on a nation’s goods and services at a given price level. Understanding its components and drivers is essential.

Aggregate Demand and Its Components

Aggregate demand consists of five main components: consumption, investment, government spending, exports, and imports. Together, these reflect the total expenditure in an economy.

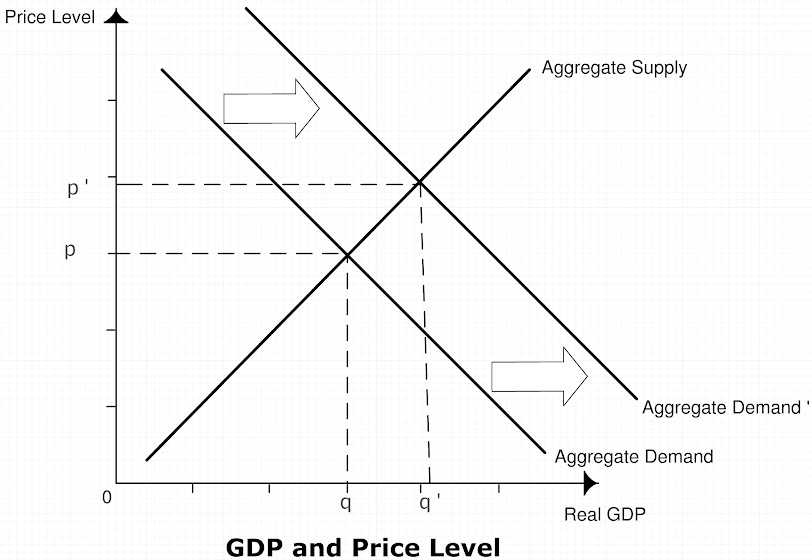

This diagram depicts the aggregate demand curve and shows how shifts occur when there are changes in consumption, investment, government spending, or net exports. The shifts represent changes in the total planned spending in the economy at different price levels. Source

Consumption (C)

Consumption is the largest component of AD in most economies, representing household spending on goods and services. It is primarily driven by:

Disposable income (income available after taxes).

Consumer confidence (expectations about future income and employment).

Interest rates (affecting the cost of borrowing and saving incentives).

Wealth effects (changes in house prices or stock market values).

Consumption: Household expenditure on goods and services within the economy.

When disposable income rises, consumers typically increase spending, shifting AD rightward. Conversely, falling confidence or higher interest rates may reduce consumption, dampening AD.

Investment (I)

Investment is spending by firms on capital goods (e.g., machinery, buildings) intended to increase productive capacity. It is influenced by:

Interest rates: Lower rates reduce borrowing costs, encouraging investment.

Business confidence: Expectations about future profitability.

Access to credit: Availability of loans and finance.

Government policy: Tax incentives, subsidies, or deregulation.

Technological change: Innovations requiring new investment.

Investment: Expenditure by firms on capital goods to increase production capacity.

Investment is more volatile than consumption and strongly linked to economic cycles.

Government Spending (G)

Government spending includes expenditure on goods, services, and public investment such as infrastructure, health, and education. It is determined by:

Fiscal policy decisions (expansionary or contractionary).

Political priorities (defence, welfare, or infrastructure).

Macroeconomic objectives (stimulating growth or reducing unemployment).

In a recession, governments may increase spending to stimulate AD. Conversely, austerity policies reduce government expenditure, contracting AD.

Exports (X)

Exports are goods and services produced domestically but sold abroad. They generate inflows of income into the circular flow. Key drivers include:

Global demand conditions (growth in trading partners’ economies).

Exchange rates: A weaker domestic currency makes exports cheaper abroad, boosting demand.

Competitiveness: Quality, branding, and innovation of domestic products.

Trade policies: Tariffs and trade agreements.

Exports: Goods and services produced domestically and sold to foreign buyers.

Imports (M)

Imports are goods and services produced abroad but purchased domestically. They represent an outflow from the circular flow of income. Determinants include:

Domestic income levels: Higher income increases demand for foreign goods.

Exchange rates: A stronger domestic currency makes imports cheaper.

Consumer preferences: Desire for variety or quality from overseas.

Trade barriers: Tariffs and quotas that limit import demand.

Imports: Goods and services purchased from abroad for domestic use.

Net exports (X – M) is a key determinant of overall AD. A trade surplus increases AD, while a deficit reduces it.

Key Drivers Across Components

Interest Rates

Interest rates influence both consumption and investment. Lower rates reduce borrowing costs, making mortgages and loans cheaper, while discouraging saving. Higher rates typically contract AD.

Confidence

Both consumer confidence and business confidence are central to AD. Optimism leads households to spend more and firms to invest more, shifting AD right.

Fiscal and Monetary Policy

Fiscal policy: Adjustments to government spending and taxation affect G directly and C and I indirectly.

Monetary policy: Interest rate changes and quantitative easing influence consumption and investment.

Exchange Rates

Exchange rate movements affect exports and imports simultaneously. A depreciation boosts exports while reducing imports, improving net exports and raising AD.

Global Conditions

In a globalised economy, world events such as recessions, financial crises, or booms in trading partners strongly affect export demand and hence AD.

Equations Relevant to AD

Aggregate Demand (AD) = C + I + G + (X – M)

C = Consumption

I = Investment

G = Government Spending

X = Exports

M = Imports

This equation summarises how total demand in the economy is the sum of its five components.

AD shifts when any of these components change due to policy, confidence, or external shocks. For example, a tax cut may boost disposable income, raising C, and shifting AD rightward.

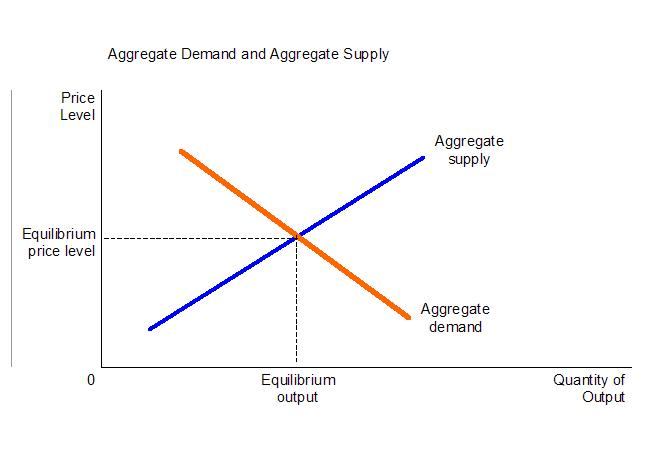

The AD-AS model illustrates the interaction between aggregate demand and aggregate supply, showing how equilibrium is achieved in the economy. This model is essential for analyzing macroeconomic fluctuations and policy impacts. Source

Interconnectedness of Drivers

It is important to recognise the interactions between these drivers:

Rising interest rates may reduce C and I simultaneously.

Expansionary fiscal policy (e.g., higher government spending) can also improve confidence, reinforcing increases in C and I.

A depreciation of the exchange rate boosts X but also raises import costs, potentially fuelling inflation, which may later influence interest rates and confidence.

Together, these interdependent drivers determine the short-run dynamics of aggregate demand.

FAQ

Consumer confidence reflects expectations about future income, job security, and economic stability, while disposable income measures actual earnings after taxes.

Confidence may lead households to spend even if incomes have not yet risen, whereas disposable income is a more direct and measurable factor. Both influence consumption but operate differently.

Investment decisions depend heavily on expectations, interest rates, and business confidence.

Unlike consumption, which is tied to essential household spending, investment can be delayed or cancelled if firms feel uncertain. This makes investment more sensitive to economic shocks and policy changes.

A depreciation of the domestic currency makes exports cheaper and imports more expensive, improving net exports.

By contrast, an appreciation strengthens the currency, raising import demand and reducing export competitiveness.

Fiscal policy affects disposable income and business incentives. For example:

Tax cuts increase household income, raising consumption.

Investment allowances encourage firms to purchase capital.

Spending decisions are therefore shaped not only by government expenditure but also by these indirect effects.

Spending on imports directs income abroad rather than supporting domestic output.

Although imports can benefit consumers by providing choice and lower prices, they reduce national income as money flows out of the domestic economy, weakening AD.

Practice Questions

Define investment as a component of aggregate demand. (2 marks)

1 mark for identifying that investment is spending by firms.

1 mark for specifying that this spending is on capital goods (e.g., machinery, buildings) to increase productive capacity.

Explain two factors that may cause consumption to increase and analyse how this could affect aggregate demand. (6 marks)

Up to 2 marks for identifying factors that increase consumption (e.g., higher disposable income, lower interest rates, improved consumer confidence, rising house prices).

Up to 2 marks for explaining how each factor influences household spending (e.g., lower interest rates reduce borrowing costs, encouraging higher spending).

Up to 2 marks for linking the increase in consumption to an outward shift of aggregate demand (e.g., greater household spending increases total planned expenditure at all price levels, shifting AD to the right).