AQA Specification focus:

‘The basic accelerator process Students will not be required to undertake calculations to illustrate the operation of the accelerator.’

Introduction

The accelerator principle explains how investment levels respond to changes in economic activity, showing how small demand shifts can significantly influence business investment decisions.

Understanding the Accelerator Principle

The accelerator principle is a macroeconomic concept describing the relationship between changes in national income and changes in investment. It suggests that when demand and output rise, firms increase investment in capital goods (like machinery, factories, and technology) to meet the higher demand. Conversely, when demand slows, investment falls, often more sharply than the initial decline in output.

Accelerator Principle: The idea that investment levels are determined by the rate of change in national income or output, rather than the absolute level of output.

This principle highlights why investment is often more volatile than other components of aggregate demand (AD) such as consumption or government spending.

Key Features of the Accelerator

Several important features define the accelerator principle:

Derived demand for capital goods: Firms purchase capital equipment not for its own sake, but because it enables the production of goods and services demanded by consumers.

Investment sensitivity: Even a small rise in consumer demand can lead to a large increase in investment if firms anticipate the need for greater capacity.

Lagged response: Investment often reacts with a delay, as firms require time to assess demand changes and plan new projects.

Volatility of investment: Investment tends to fluctuate more dramatically than consumption, amplifying the ups and downs of the business cycle.

These features show that the accelerator acts as a magnifier within the macroeconomy.

The Mechanism of the Accelerator

The process can be understood step by step:

Increase in demand: Higher consumption or exports increase sales for firms.

Output rises: Firms raise production to meet demand using existing capacity.

Capacity pressures emerge: If growth continues, existing machinery or buildings become insufficient.

New investment: Firms purchase additional capital equipment to expand capacity.

Further growth: Investment itself boosts AD, reinforcing the initial expansion.

The accelerator therefore illustrates how growth in demand can trigger an amplified rise in investment, further boosting economic activity.

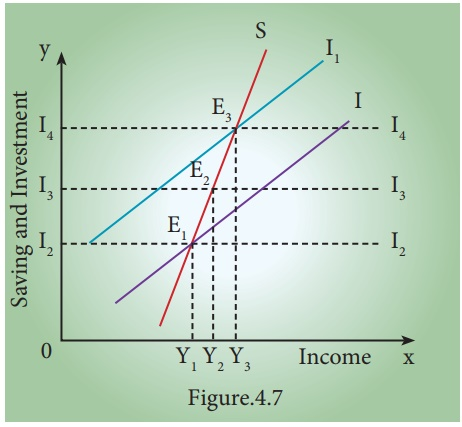

This diagram demonstrates how an increase in consumer demand (from Y₁ to Y₃) leads to a more than proportional increase in investment, illustrating the accelerator effect. The initial rise in income (from Y₁ to Y₂) is due to the multiplier effect, while the subsequent increase (from Y₂ to Y₃) is attributed to the accelerator effect. Source

Relationship with the Business Cycle

The accelerator principle is central to understanding the business cycle, as it explains why investment rises quickly in booms but collapses in recessions. When demand falls, firms not only stop expanding capacity but may also cancel or delay existing projects. The decline in investment then reduces AD further, worsening the downturn.

Thus, the accelerator can help explain both rapid expansions and sharp contractions in an economy.

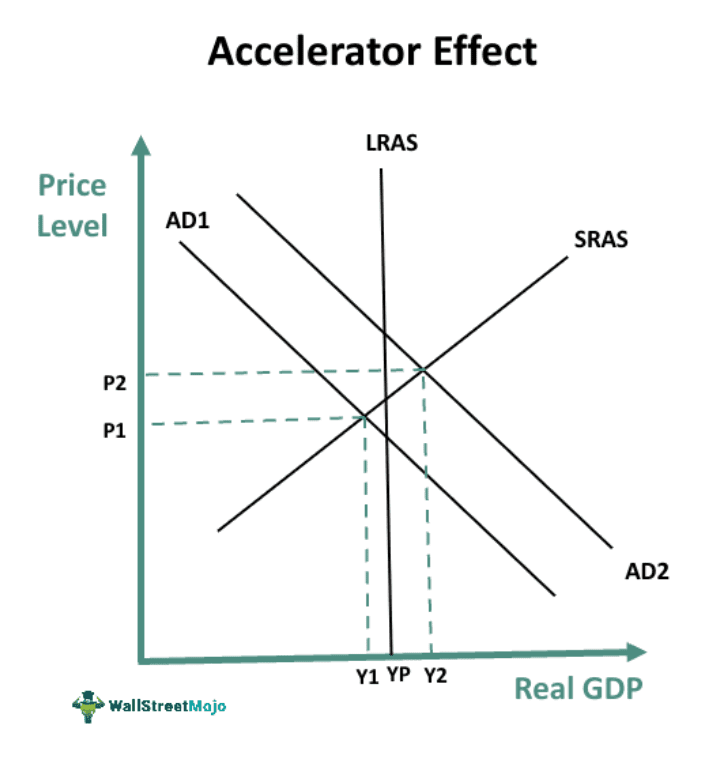

This diagram illustrates how shifts in aggregate demand (from AD₁ to AD₂) affect national income (from Y₁ to Y₂), leading to changes in investment. The rightward shift in AD represents an increase in consumer demand, which, according to the accelerator principle, induces a more than proportional increase in investment. Source

Factors Affecting the Strength of the Accelerator

The impact of the accelerator principle is not uniform; several conditions determine how strongly it operates:

Spare capacity: If firms already have unused capacity, they may not need to invest, even when demand rises.

Business confidence: Firms must believe demand increases are permanent, not temporary, before committing to major investment.

Access to finance: The availability of credit and the role of the banking system are crucial for firms wishing to borrow to invest.

Government policy: Fiscal and monetary measures that affect interest rates, taxes, or subsidies can influence investment decisions.

Technological change: Rapid innovation encourages frequent investment, strengthening the accelerator effect.

These factors show that the accelerator does not operate in isolation but interacts with broader economic conditions.

Importance of the Accelerator in Macroeconomics

The accelerator principle is a vital concept because it explains:

Why investment is volatile and more unstable than other parts of AD.

How small changes in demand can create disproportionate swings in economic activity.

Why government policy often targets stability, aiming to smooth investment cycles through fiscal and monetary intervention.

How long-run growth is affected, since sustained investment raises the economy’s productive capacity.

By linking demand growth to capital investment, the accelerator provides insights into both short-term fluctuations and long-term development.

Links with Other Macroeconomic Concepts

The accelerator principle interacts with other areas of the AQA Economics specification:

Multiplier effect: The accelerator often works in tandem with the multiplier. An initial rise in investment boosts income (multiplier), which then triggers further investment (accelerator). Together, these processes reinforce economic growth.

Aggregate demand and aggregate supply: Investment is a key component of AD and also affects long-run aggregate supply (LRAS) by enhancing productive capacity.

Circular flow of income: Injections through investment influence the circular flow, increasing national income and employment.

These connections emphasise the accelerator’s central role in understanding how economies expand and contract.

Criticisms and Limitations

Although powerful, the accelerator principle has limitations:

Simplifying assumptions: It assumes a fixed relationship between output and capital stock, ignoring complexities like economies of scale.

Delayed reactions: In reality, firms often wait for clear signs of sustained demand before investing.

Globalisation effects: Modern firms may outsource production or use foreign investment, reducing the direct accelerator effect domestically.

Uncertainty: Political instability, exchange rates, or global shocks can outweigh the accelerator mechanism.

These limitations remind students that while the accelerator is useful, it must be applied critically.

FAQ

The accelerator principle focuses on how changes in demand affect investment decisions, whereas the multiplier effect explains how an initial injection leads to a magnified impact on income.

The two often interact: increased investment (accelerator) boosts income, which in turn triggers further spending and output (multiplier), reinforcing each other in economic cycles.

Consumption tends to be smoother because it depends largely on household income and basic needs.

Investment, however, is tied to future expectations. Even small shifts in demand can push firms to make large capital spending decisions or withdraw investment entirely, leading to significant fluctuations compared with relatively stable consumer spending.

The model assumes:

A fixed capital-to-output ratio.

Firms adjust investment immediately in response to output changes.

Capital goods are only demanded when needed to support additional output.

In reality, these assumptions may not fully hold due to delays, spare capacity, and uncertainty.

Even when demand rises, firms may hesitate to invest if they believe the increase is temporary.

High confidence strengthens the accelerator effect, as firms expect sustained growth and commit to capital spending.

Low confidence weakens it, as firms adopt a wait-and-see approach, muting the expected investment surge.

Technological innovations often create new demand for capital goods, amplifying the accelerator effect.

For example:

Firms replace outdated equipment more frequently.

Investment occurs not only due to rising demand but also to remain competitive.

This makes investment cycles sharper, as technology-driven upgrades add another layer to the accelerator process.

Practice Questions

Define the accelerator principle in economics. (2 marks)

1 mark for identifying that the accelerator principle relates to investment being influenced by changes in national income/output.

1 mark for stating that investment depends on the rate of change in income/output, not just the absolute level.

Explain how the accelerator principle helps to explain why investment is often more volatile than other components of aggregate demand. (6 marks)

Up to 2 marks for identifying that investment is a derived demand and depends on expected future demand.

Up to 2 marks for explaining that small increases in demand/output can lead to proportionally larger increases in investment due to firms needing new capital equipment.

Up to 2 marks for explaining that when demand falls, firms may sharply reduce or cancel investment, making investment more volatile compared to other components of AD such as consumption.

Award marks for clarity, precision, and relevant use of economic terminology (e.g., volatility, derived demand, national income).