AQA Specification focus:

‘The role of AD in influencing the level of economic activity.’

Introduction

Aggregate demand (AD) plays a central role in determining the level of economic activity within an economy. Its fluctuations shape growth, employment, and inflationary pressures across the business cycle.

Understanding Aggregate Demand and Economic Activity

What is Aggregate Demand?

Aggregate demand represents the total planned expenditure on goods and services in an economy at a given overall price level and in a given period. It is composed of consumption (C), investment (I), government spending (G), and net exports (X – M). Together, these components determine how much demand exists for domestic output.

Aggregate Demand (AD): The total planned expenditure on domestically produced goods and services in an economy at a given price level in a specific time period.

The level of aggregate demand reflects the willingness and ability of households, firms, government, and foreign buyers to purchase goods and services, shaping overall economic activity.

The Role of AD in Influencing Economic Activity

Determining National Income

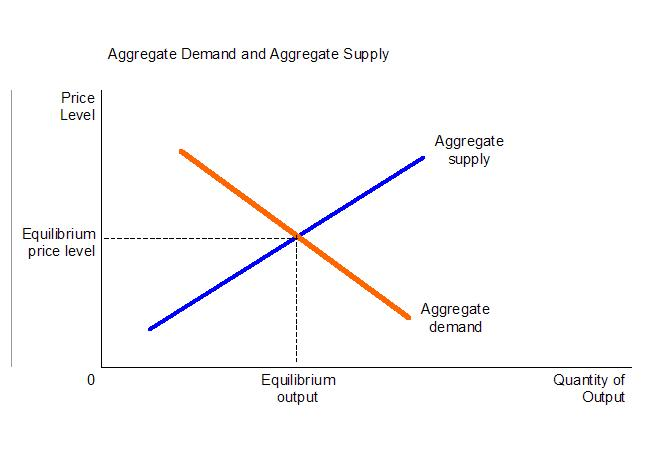

The equilibrium level of national income depends on the interaction of AD with aggregate supply (AS). A higher level of AD generally results in a higher equilibrium level of output and income, provided sufficient capacity exists within the economy.

This diagram depicts the intersection of the aggregate demand and aggregate supply curves, indicating the equilibrium output and price level in the economy. Source

When AD increases, producers expand output to meet rising demand.

If the economy has unused resources, this leads to higher real GDP and lower unemployment.

If the economy is near full capacity, an increase in AD may instead cause higher inflation rather than higher output.

Employment Effects

Aggregate demand strongly influences employment levels:

Rising AD creates greater demand for labour as firms need more workers to expand production.

Falling AD reduces production needs, potentially causing job losses and higher unemployment.

This link between AD and employment is central to macroeconomic policy, as governments often use demand management policies to stabilise jobs.

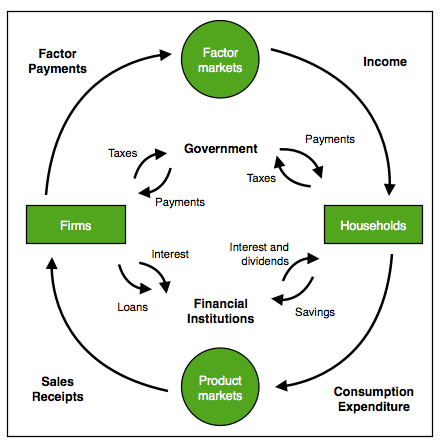

The circular flow of income diagram illustrates how money moves through the economy, showing the interactions between households, firms, and other economic agents. Source

The Transmission of AD into Economic Activity

Short-Run Impacts

In the short run, changes in AD directly affect output and employment:

Increased consumer spending boosts retail sales and manufacturing output.

Greater investment stimulates demand for capital goods and construction.

Government spending injects demand into specific sectors, often with a multiplier effect.

Long-Run Considerations

In the long run, persistent changes in AD can influence inflation expectations, wage demands, and competitiveness. Economies operating close to capacity may see growth constrained by supply-side factors even if AD continues to rise.

AD and the Business Cycle

Phases of the Cycle

Aggregate demand is closely tied to the different phases of the business cycle:

Boom: Strong AD leads to rapid growth but risks inflation.

Recession: Weak AD causes contraction and rising unemployment.

Recovery: Increasing AD restores growth and jobs.

Slump: Persistently low AD depresses output and investment.

These shifts explain why policymakers monitor AD trends closely.

Key Influences on AD’s Role

Consumption

Household spending, the largest component of AD, depends on disposable income, interest rates, and consumer confidence. Changes in consumption directly influence economic activity levels.

Investment

Business investment drives productive capacity and short-term demand. Fluctuations in investor confidence and access to credit can amplify the impact of AD on activity.

Government Spending

Fiscal policy decisions regarding taxation and spending alter AD significantly. Expansionary fiscal policy (higher spending or lower taxes) increases AD, stimulating growth, while contractionary measures reduce it.

Net Exports

The balance of exports and imports also plays a role. Rising exports expand AD and boost domestic production, while higher imports may weaken AD if they replace domestic output.

The Multiplier Effect and AD’s Influence

A change in AD often leads to a proportionately larger change in national income through the multiplier process. When spending increases, it generates income for others, who in turn spend more, creating a cycle of expanding demand.

Multiplier Effect: The process by which an initial change in expenditure leads to a more than proportionate change in national income.

This reinforces AD’s crucial role in influencing the overall level of economic activity, as relatively small injections can have significant macroeconomic consequences.

Policy Implications

Governments and central banks use monetary and fiscal policy to manage AD:

Monetary policy influences AD through interest rates, exchange rates, and credit availability.

Fiscal policy affects AD via taxation and spending decisions.

By adjusting AD, policymakers aim to stabilise output, control inflation, and maintain employment, reflecting its central importance in the macroeconomy.

AD and Macroeconomic Objectives

The role of AD in influencing economic activity ties directly to key macroeconomic objectives:

Economic Growth: Higher AD sustains growth by encouraging production.

Full Employment: Strong AD reduces unemployment by generating jobs.

Price Stability: Excessive AD risks inflation, requiring careful balance.

Balance of Payments: AD shifts can affect imports and exports, influencing external stability.

Through these channels, aggregate demand shapes not only the level of economic activity but also the broader health of the economy.

FAQ

When spare capacity exists, firms can increase production to meet higher aggregate demand without significant price rises. This boosts output and employment directly.

However, when spare capacity is limited, further increases in demand place pressure on resources. This leads to inflation rather than higher output, highlighting why spare capacity is central in determining AD’s effect on economic activity.

Aggregate demand can stimulate growth quickly by encouraging firms to produce more and hire additional workers.

Yet, in the long term, growth depends on supply-side factors such as productivity and technology. This means that while AD is vital for short-run changes in economic activity, it cannot sustain long-term growth alone.

Consumer confidence affects how households use their disposable income. If confidence is high, people spend more, increasing aggregate demand and stimulating activity.

When confidence falls, households may save instead, reducing consumption and weakening AD. This shows how expectations about the future directly shape economic performance.

Governments can support AD through targeted fiscal measures:

Increased public spending on infrastructure creates direct employment.

Tax cuts raise disposable income, encouraging consumer spending.

Subsidies and grants stimulate investment.

Such measures amplify the positive employment effects of rising AD, particularly during downturns.

Excessive focus on raising AD can cause inflation if the economy is near capacity. This erodes purchasing power and destabilises growth.

It may also widen trade deficits if higher AD leads to increased imports. Thus, while boosting AD can aid recovery, it must be balanced with supply-side policies to ensure sustainable outcomes.

Practice Questions

Define aggregate demand and explain briefly how it influences the level of economic activity. (2 marks)

1 mark for correctly defining aggregate demand as the total planned expenditure on goods and services in an economy at a given price level in a specific time period.

1 mark for explaining that changes in aggregate demand affect output, employment, and income levels (e.g., higher AD increases output and jobs, lower AD reduces them).

Using the AD/AS framework, explain how an increase in aggregate demand might influence both output and employment in the short run. (6 marks)

Up to 2 marks for identifying that an increase in AD shifts the AD curve to the right.

Up to 2 marks for explaining that this leads to a higher equilibrium level of real output.

1 mark for noting the effect on employment, i.e., firms will hire more workers to meet rising demand.

1 mark for recognising that the impact depends on spare capacity; if close to full employment, inflationary pressures may arise instead of higher output.