AQA Specification focus:

‘Why the size of the marginal propensity to consume determines the magnitude of the multiplier effect.’

The multiplier effect shows how initial spending changes can trigger wider income and output increases in the economy, with its size determined by the marginal propensity to consume.

The Multiplier Effect and its Importance

The multiplier effect describes how an initial injection of spending into the economy leads to a larger overall increase in national income. This is central to understanding why government spending, investment, or export growth can have effects much greater than the original expenditure.

Multiplier Effect: The process by which an initial increase in spending leads to a proportionately larger increase in national income.

The critical factor that determines the size of this effect is the marginal propensity to consume (MPC) — the proportion of extra income that households spend rather than save.

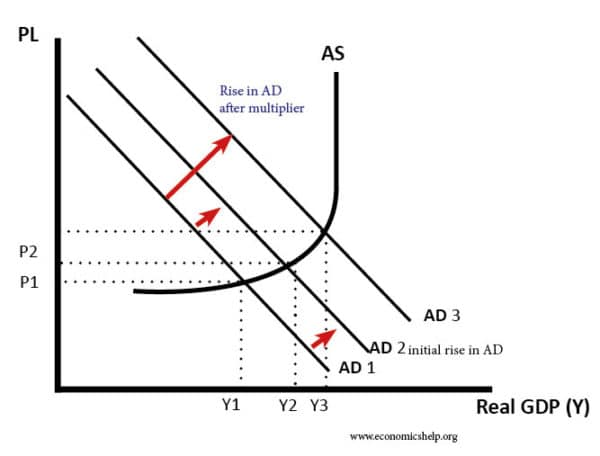

This graph demonstrates how an initial increase in aggregate demand (AD) leads to a larger total increase in national income through successive rounds of spending. The size of the multiplier effect is influenced by the marginal propensity to consume (MPC); a higher MPC leads to a larger multiplier, amplifying the impact of the initial spending. Source

Understanding the Marginal Propensity to Consume (MPC)

The MPC shows how much of any additional income consumers will spend. If households spend most of their new income, the cycle of spending and re-spending is stronger, creating a larger multiplier.

Marginal Propensity to Consume (MPC): The proportion of any additional income that a household spends on consumption rather than saving or withdrawing from the circular flow of income.

For example, if MPC = 0.8, households spend 80% of any additional income and save or withdraw the remaining 20%.

The Relationship Between MPC and the Multiplier

The link between the multiplier and MPC can be expressed mathematically.

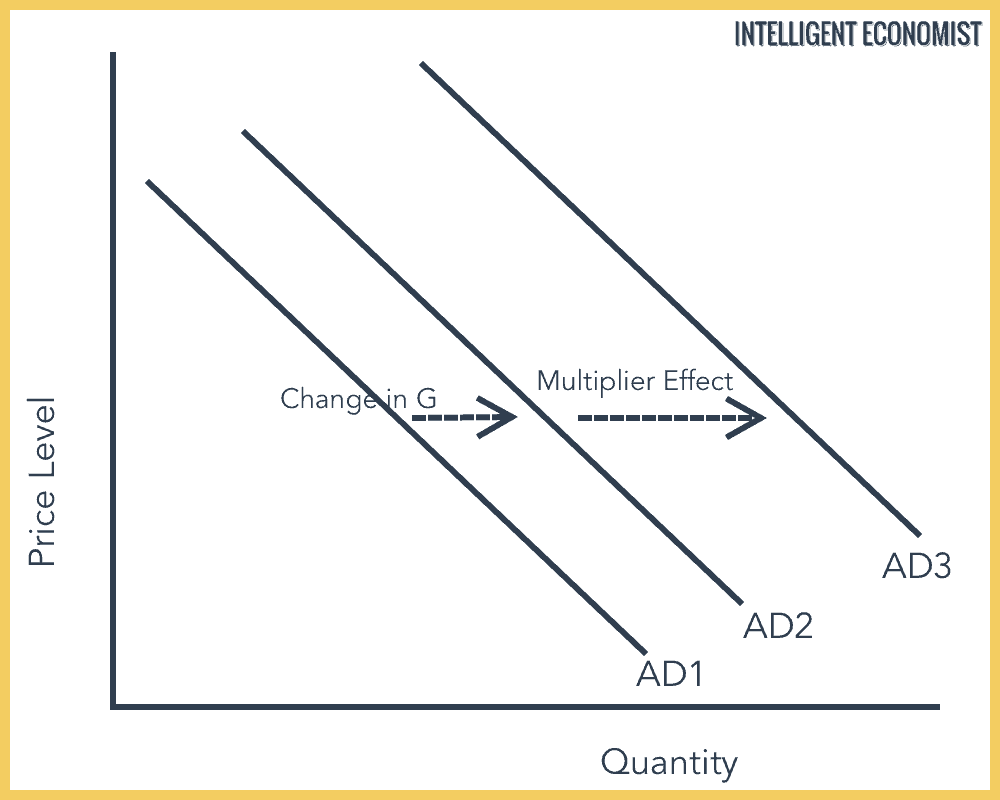

The formula for the multiplier effect is given by k = 1 / (1 - MPC), where k represents the multiplier and MPC is the marginal propensity to consume. This equation shows that a higher MPC leads to a larger multiplier, amplifying the impact of initial spending on national income. Source

Multiplier (k) = 1 ÷ (1 – MPC)

k = multiplier size

MPC = marginal propensity to consume (no units, value between 0 and 1)

A higher MPC results in a smaller denominator (1 – MPC), meaning the multiplier (k) becomes larger. Conversely, if MPC is low, the multiplier shrinks.

Why MPC Determines Multiplier Size

The reason MPC directly determines the magnitude of the multiplier is because the multiplier process relies on successive rounds of consumption spending.

High MPC:

Households spend most of their extra income.

Each round of spending is larger.

The total rise in national income is significant.

Low MPC:

Households save or withdraw more of their extra income.

Each round of spending diminishes quickly.

The multiplier effect is weak, and national income rises less.

This demonstrates why policymakers often aim to stimulate spending behaviour rather than saving if they wish to maximise the multiplier effect.

Withdrawals and the Limiting Role of MPC

The multiplier process does not continue indefinitely because some income is always withdrawn from the circular flow. These withdrawals include savings, taxation, and imports.

A high MPC means fewer withdrawals, as households spend a larger share of their additional income domestically.

A low MPC means larger withdrawals, as more income is saved or spent on imports, reducing the scale of re-spending.

Therefore, the MPC balances injections and withdrawals and explains why the multiplier varies across different economies or economic conditions.

Factors Influencing the Value of MPC

Although MPC is a behavioural ratio, it is shaped by a range of conditions:

Economic Factors

Income levels: Lower-income households tend to have higher MPCs, as they must spend most of their additional income on essentials.

Wealth effects: Wealthier households may save more of any additional income, lowering MPC.

Access to credit: Easy access to borrowing can increase MPC, as consumers are willing to spend more of their disposable income.

Policy and External Factors

Taxation levels: Higher direct taxes reduce disposable income, lowering effective MPC.

Interest rates: High interest rates encourage saving, reducing MPC, while low rates can raise it.

Consumer confidence: High confidence encourages households to spend rather than save, increasing MPC.

Implications for Economic Policy

Understanding why MPC determines the multiplier size is vital for policymakers:

Fiscal policy:

Government spending is more effective when MPC is high, as stimulus translates into stronger income growth.

If MPC is low, fiscal policy has limited effectiveness, as injections quickly leak into savings or imports.

Monetary policy:

Interest rate changes affect household spending and therefore influence MPC.

Expansionary monetary policy is more effective in high-MPC conditions.

Structural policies:

Policies that reduce inequality can increase MPC overall, as lower-income households typically spend more of their income.

Measures that reduce reliance on imports help retain spending domestically, strengthening the multiplier.

Summary Points for Students

To consolidate:

The multiplier effect magnifies an initial injection of spending into a larger rise in national income.

The MPC is the key determinant of the size of the multiplier because it governs how much additional income is spent and re-spent in the economy.

Higher MPC = larger multiplier.

Withdrawals such as savings, taxation, and imports reduce the multiplier effect.

Economic, policy, and behavioural factors influence the MPC, shaping how effective government policy will be in raising national income.

FAQ

A very low marginal propensity to consume (MPC) means households save or withdraw most additional income instead of spending it. This reduces the multiplier effect, so government spending or tax cuts create only a limited rise in national income.

Policymakers may need larger injections or targeted spending towards lower-income groups, who typically have higher MPCs, to achieve stronger growth effects.

In developing economies, households often spend a greater share of additional income on basic goods, leading to higher MPC values.

In contrast, households in developed economies usually save more of their extra income, resulting in lower MPCs.

This difference means the multiplier effect is often larger in developing economies, although leakages like imports can reduce its strength.

When consumer confidence is high, households are more willing to spend extra income, leading to a higher MPC and a stronger multiplier effect.

If confidence is low, even with increased income, households may prioritise saving or debt repayment, reducing the multiplier’s impact.

In the short run, MPC tends to be relatively stable, and changes in spending create quick multiplier effects.

Over the longer term, MPC may change due to:

Shifts in household saving behaviour

Policy changes such as taxation adjustments

Structural changes in the economy

As a result, the multiplier effect can weaken or strengthen over time depending on evolving economic conditions.

Yes, governments can shape household spending behaviour. For example:

Cutting income tax raises disposable income and may increase MPC.

Raising benefits for low-income households often increases MPC, as they spend most of their income.

Policies reducing reliance on imports help retain spending domestically, strengthening the multiplier.

These measures aim to increase overall re-spending of income, magnifying the impact of injections into the economy.

Practice Questions

Define the marginal propensity to consume (MPC) and explain briefly how it influences the size of the multiplier. (2 marks)

1 mark: Correct definition of MPC — the proportion of additional income that is spent on consumption rather than saved.

1 mark: Correct explanation that a higher MPC leads to a larger multiplier because more income is re-spent in the economy.

Explain why the size of the marginal propensity to consume (MPC) determines the magnitude of the multiplier effect. Illustrate your answer with reference to injections and withdrawals. (6 marks)

1 mark: Correct identification of the multiplier effect as the process by which an initial injection of spending leads to a larger increase in national income.

1 mark: Clear definition or explanation of MPC as the proportion of additional income spent on consumption.

1–2 marks: Explanation that a higher MPC means more re-spending of income, leading to larger successive rounds of spending and a bigger multiplier.

1–2 marks: Reference to withdrawals (savings, taxation, imports) reducing the size of the multiplier and how a lower MPC increases the scale of withdrawals.

1 mark: Coherent development of argument showing the direct link between MPC and the magnitude of the multiplier effect.

(Max 6 marks)