AQA Specification focus:

‘The multiplier process and an explanation of why an initial change in expenditure may lead to a larger impact on local or national income.’

Introduction

The multiplier process is a central idea in macroeconomics, showing how an initial increase in spending can generate a chain reaction of further expenditure, magnifying national income.

The Multiplier Process: Core Concept

The multiplier process explains why an initial change in aggregate expenditure — such as government investment, consumer spending, or exports — can produce a disproportionately larger increase in national income.

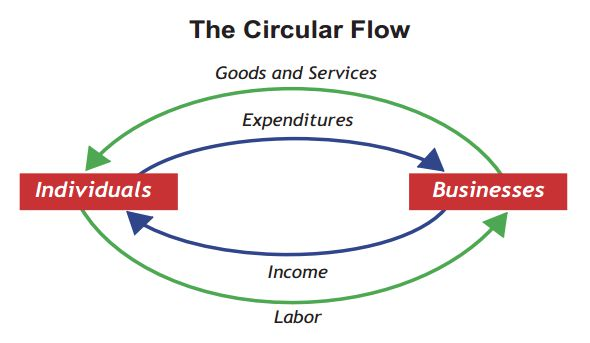

This diagram depicts the basic circular flow of income, highlighting the continuous movement of money between households and firms. It forms the basis for understanding how initial injections into the economy can lead to a multiplied increase in national income. Source

This occurs because one person’s spending becomes another person’s income. That income is then partly re-spent in the economy, creating further rounds of expenditure and income. The cycle continues until the effect diminishes, but the total change in national income is greater than the original injection.

Key Mechanism of the Multiplier

The process works in stages:

Stage 1: An initial injection (government spending, investment, or exports) enters the circular flow of income.

Stage 2: This injection creates new income for households or firms.

Stage 3: A proportion of this income is re-spent in the economy, generating further demand.

Stage 4: Each subsequent round of spending is smaller, as some income is withdrawn through saving, taxation, or imports.

Stage 5: The process continues until the effect becomes negligible, leaving the overall change in national income greater than the initial injection.

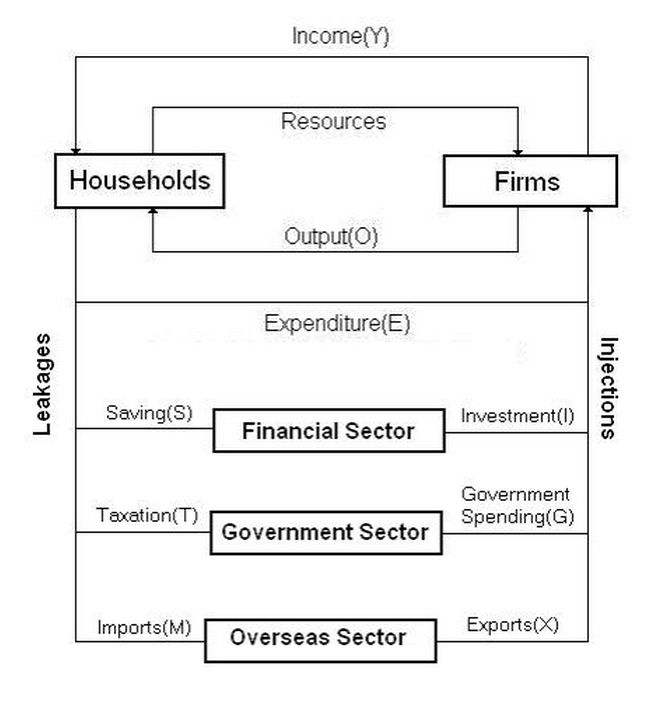

This diagram illustrates the five-sector circular flow of income, including households, firms, government, financial institutions, and the foreign sector. It demonstrates how injections (e.g., government spending, exports) and withdrawals (e.g., taxes, imports) influence the overall economy, affecting the magnitude of the multiplier effect. Source

Definitions and Core Terms

Multiplier: The process by which an initial change in expenditure leads to a larger overall change in national income due to repeated rounds of spending.

The strength of the multiplier depends on the proportion of income that households choose to spend rather than withdraw.

Withdrawals and Leakages in the Process

The multiplier effect weakens because not all new income is re-spent. Instead, part of it is withdrawn from the circular flow:

Savings (S): Income set aside rather than spent.

Taxes (T): Government collections reducing disposable income.

Imports (M): Spending directed abroad rather than within the domestic economy.

These withdrawals reduce the successive rounds of spending, slowing the expansionary effect of the initial injection.

Relationship to Aggregate Demand and Income

The multiplier process directly influences the level of aggregate demand (AD) and consequently national income. For example:

An increase in investment stimulates additional demand across sectors.

The repeated cycles of spending amplify output and employment.

The eventual effect is that real GDP rises by a multiple of the initial increase in spending.

Determinants of the Multiplier Size

The size of the multiplier depends on behavioural and structural factors in the economy:

Marginal Propensity to Consume (MPC): The higher the proportion of additional income that is spent, the stronger the multiplier.

Marginal Propensity to Save (MPS): A higher tendency to save reduces the multiplier effect.

Marginal Propensity to Import (MPM): Greater import spending means more leakages, lowering the multiplier.

Taxation Levels: Higher taxes reduce disposable income, weakening successive rounds of spending.

The Mathematical Expression of the Multiplier

Multiplier (k) = 1 ÷ Marginal Propensity to Withdraw (MPW)

MPW = MPS + MPT + MPM

MPS = Marginal Propensity to Save (proportion of income saved)

MPT = Marginal Propensity to Tax (proportion of income taxed)

MPM = Marginal Propensity to Import (proportion of income spent on imports)

This formula shows that the multiplier is inversely related to withdrawals: the greater the leakages, the smaller the final impact on national income.

Local vs National Impact

The multiplier process can operate at both local and national levels:

Local multiplier: Spending on local goods and services increases regional employment and incomes, especially if residents re-spend locally.

National multiplier: In a closed economy, the effect is stronger as fewer resources are leaked abroad. In open economies, imports reduce the multiplier’s size.

The Importance of the Multiplier in Macroeconomic Policy

Policymakers use the multiplier concept to predict the impact of fiscal interventions:

Government spending programmes are expected to generate multiple times their original value in income and output.

Public investment in infrastructure often has a high multiplier, as it stimulates broad sectors of the economy.

Tax cuts can also trigger multiplier effects if households spend rather than save the extra disposable income.

However, the effectiveness of the multiplier is context-dependent. In economies with high savings rates or strong import dependence, the multiplier effect is weaker.

Multiplier Process in Recessionary and Expansionary Contexts

During a recession, an injection (such as stimulus spending) can have a powerful impact, as idle resources allow output to expand without inflationary pressures.

During full employment, the multiplier effect is smaller, as additional spending risks fuelling inflation rather than boosting real output.

FAQ

In a closed economy, most additional spending stays within the domestic market, strengthening the multiplier as fewer withdrawals occur.

In an open economy, some of the spending leaks abroad through imports. This reduces the size of the multiplier since part of the new income does not stimulate domestic production.

Government investment usually involves large-scale spending on infrastructure, directly creating jobs and incomes across multiple industries.

Tax cuts depend on household behaviour. If households save rather than spend the extra disposable income, the multiplier effect is smaller compared to government-led projects.

If consumer confidence is high, households are more likely to spend additional income, raising the marginal propensity to consume and strengthening the multiplier.

When confidence is low, households may save instead, weakening the rounds of spending and limiting the effect on national income.

The multiplier effect is not immediate. Rounds of spending take time to circulate through the economy.

In the short run, the impact may appear limited.

Over months or years, the effect accumulates, especially if injections are sustained.

When inflation is high, additional spending may push up prices rather than increase real output.

This reduces the multiplier’s effectiveness, as income gains are eroded by rising costs and households may cut back on consumption.

Practice Questions

Define the term multiplier in the context of the macroeconomy. (2 marks)

1 mark for recognising that the multiplier refers to a process where an initial change in expenditure leads to a larger overall change in national income.

1 additional mark for explaining that this occurs due to repeated rounds of spending.

Explain why the size of the multiplier effect depends on the marginal propensity to consume (MPC). (6 marks)

1 mark for identifying that a higher MPC means households spend more of any additional income.

1 mark for explaining that this leads to stronger successive rounds of spending.

1 mark for recognising that with a lower MPC, more income is saved, reducing the effect.

1 mark for linking higher spending to a greater increase in aggregate demand (AD).

1 mark for showing understanding that the multiplier is inversely related to withdrawals (savings, taxes, imports).

1 mark for overall coherence and clear application to the multiplier process.