AQA Specification focus:

‘The importance of the institutional structure of the economy in determining aggregate supply, such as the role of the banking system in providing business investment funds, should also be understood.’

Introduction

Institutions and the banking system shape aggregate supply by influencing capital access, resource allocation, and long-term productivity. Their effectiveness directly impacts growth potential and national capacity.

The Role of Institutions in Aggregate Supply

What Are Economic Institutions?

Economic institutions are the formal and informal rules, organisations, and systems that guide economic behaviour. They provide the framework for markets, contracts, property rights, and financial activity.

Economic Institutions: The rules, organisations, and structures that govern and support economic activity, ensuring stability, efficiency, and confidence in the economy.

Institutions underpin aggregate supply because they determine how efficiently resources are mobilised, invested, and utilised across the economy. Strong institutions encourage enterprise and innovation, whereas weak institutions create inefficiencies and uncertainty.

The Banking System and Aggregate Supply

The Function of Banks in the Economy

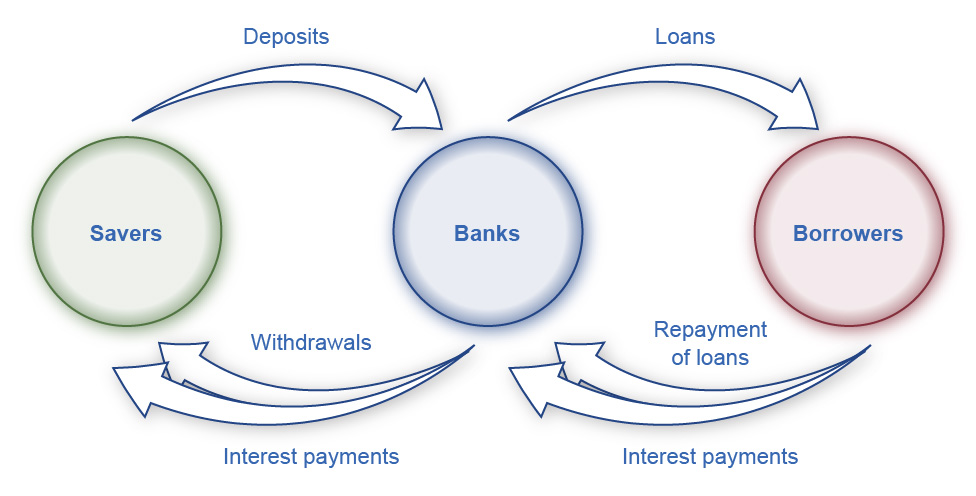

The banking system provides critical financial intermediation between savers and borrowers. By pooling savings, banks allocate capital towards productive business investment. This directly influences the economy’s capacity to produce goods and services.

Banking System: The network of commercial banks, central banks, and other financial institutions that mobilise savings and provide credit for investment and consumption.

This diagram depicts how banks channel funds from savers to borrowers, facilitating investment in the economy. It highlights the intermediary role of banks in mobilising savings for productive use. Source

Key functions include:

Providing business investment funds through loans and credit.

Facilitating payments across the economy.

Mobilising savings and channelling them into productive uses.

Managing risk through financial products and diversification.

Banking and Business Investment

Business investment is a central driver of long-run aggregate supply (LRAS) because it raises capital stock and productivity. Banks influence investment through:

Interest rates: Lower rates make borrowing for investment more attractive.

Credit availability: A strong banking sector increases the flow of funds to firms.

Confidence and stability: Secure banking systems encourage long-term planning.

If banks restrict lending, firms may reduce investment, limiting LRAS growth.

The Importance of Institutional Structure

Property Rights and Legal Systems

For investment to thrive, property rights and reliable legal systems must be in place. Without these, businesses face risks of expropriation or contract breaches, discouraging long-term commitments.

Property Rights: Legal rights to own, use, and transfer assets, which give firms and individuals security in their investments.

A secure legal framework reduces transaction costs, improves trust, and encourages both domestic and foreign investment.

Regulatory Institutions

Regulatory bodies, such as financial authorities, maintain stability in banking and protect depositors. Overly strict regulation can stifle innovation, while too little oversight can lead to instability. Thus, balanced regulation sustains credit supply and aggregate supply growth.

The Central Bank’s Role

The central bank is a pivotal institution in controlling liquidity and ensuring stability in the banking system. It influences aggregate supply through:

Monetary policy: Adjusting interest rates to guide investment.

Lender of last resort: Preventing bank collapses that could choke credit flows.

Regulation and supervision: Ensuring banks lend responsibly and remain solvent.

Interaction Between Institutions and LRAS

How Institutions Affect Aggregate Supply

Institutions affect LRAS in several ways:

Encouraging enterprise through predictable rules and incentives.

Facilitating investment by reducing risk and enabling access to finance.

Promoting productivity with stable financial systems and innovation-friendly policies.

Improving labour and capital mobility by reducing barriers to resource allocation.

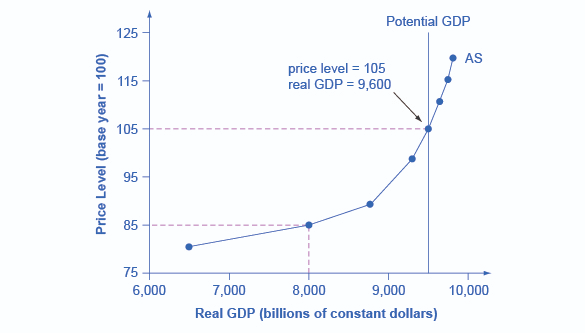

This diagram illustrates the relationship between the aggregate price level and the quantity of output supplied in the economy. The vertical line represents potential GDP, indicating the economy's capacity at full employment, influenced by factors like institutional quality and banking efficiency. Source

Weak Institutions and Economic Capacity

Where institutions are weak:

Corruption undermines trust and increases transaction costs.

Inefficient banking restricts access to credit, especially for small and medium-sized firms.

Unstable financial systems increase risk and discourage investment.

This reduces the economy’s ability to reach its productive potential, lowering LRAS.

Global Perspective on Institutions and Banking

Developed vs Developing Economies

In developed economies, strong banking systems and institutions promote innovation, efficient capital allocation, and sustained growth in LRAS.

In developing economies, weak financial systems often limit access to credit, creating barriers for business expansion and long-run supply growth.

International Institutions

Global institutions like the International Monetary Fund (IMF) and World Bank also influence domestic banking systems. They provide support during crises, promote structural reforms, and help strengthen institutional capacity, indirectly raising aggregate supply potential.

Financial Crises and Institutional Response

Episodes such as the 2008 Global Financial Crisis highlight the importance of institutions and banks in aggregate supply. Inadequate regulation allowed systemic risks to build up, which, when realised, led to severe credit restrictions. Institutional reforms following such crises aim to restore trust and ensure sustainable investment flows.

FAQ

Weak banks often lend cautiously, charge higher interest rates, or fail to extend credit to smaller firms. This restricts access to finance, reducing opportunities for businesses to expand or innovate.

Poor risk management and lack of trust in financial institutions also discourage long-term investment, holding back potential growth in the economy’s productive capacity.

Central banks ensure stability by acting as the lender of last resort, preventing widespread bank failures during crises.

They also:

Set interest rates, influencing the cost of borrowing.

Supervise banks to maintain solvency.

Regulate credit supply to avoid overheating or contraction in the economy.

Foreign investors seek environments with predictable rules, secure property rights, and transparent legal frameworks.

Strong institutions reduce risks of corruption, contract disputes, or expropriation, making foreign firms more willing to invest capital that supports long-run aggregate supply.

Corruption increases transaction costs and creates uncertainty for businesses. Firms may divert resources to bribes rather than productive investment.

This reduces efficiency, deters entrepreneurship, and limits both domestic and foreign capital inflows, ultimately restricting growth in long-run aggregate supply.

Institutional reforms such as improving legal systems, strengthening banking regulations, and reducing corruption can increase investor confidence.

This leads to:

Easier access to credit for firms.

Higher levels of domestic and foreign investment.

Greater innovation and productivity growth.

Over time, these changes support a sustained rightward shift in the long-run aggregate supply curve.

Practice Questions

Define the term property rights and explain why they are important for aggregate supply. (2 marks)

1 mark: Correct definition of property rights (e.g., legal rights to own, use and transfer assets).

1 mark: Explanation of their importance (e.g., provide security for investors, encourage long-term investment, support growth in aggregate supply).

Explain how the banking system can influence long-run aggregate supply (LRAS). (6 marks)

Up to 2 marks: Identification of the role of banks in financial intermediation (e.g., channel savings into investment, provide credit to businesses).

Up to 2 marks: Explanation of how this affects business investment (e.g., more credit → increased capital stock, productivity improvements).

Up to 1 mark: Reference to factors such as interest rates, credit availability, or confidence.

Up to 1 mark: Clear link to long-run aggregate supply (e.g., greater investment expands productive capacity, shifting LRAS to the right).