AQA Specification focus:

‘The causes of changes in the various phases of the economic cycle, including both global and domestic demand-side and supply-side shocks.’

Economic cycles shift due to complex interactions between demand and supply-side forces. Understanding their causes helps explain why economies expand, contract, recover, and face recessions.

The Economic Cycle and Its Phases

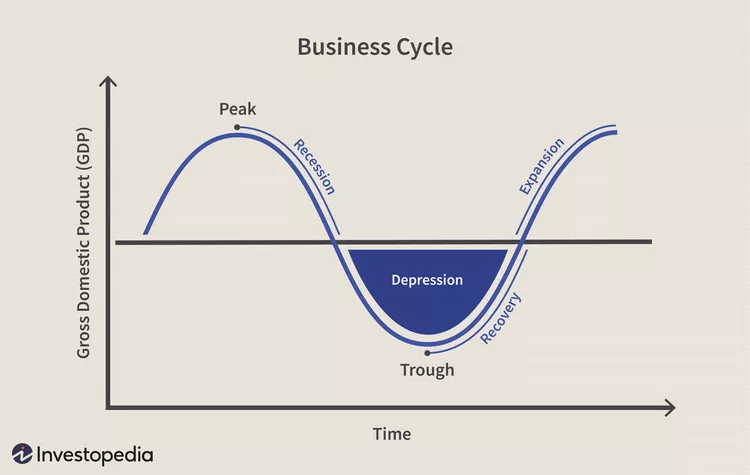

The economic cycle refers to recurring fluctuations in economic activity measured by changes in real GDP. It has four main phases:

Boom (strong growth, low unemployment, rising inflation)

Downturn (slowing growth, investment and consumption fall)

Recession (negative growth, rising unemployment, weak demand)

Recovery (growth resumes, confidence and spending increase)

Shifts between phases result from both domestic and global influences, alongside short-term shocks and long-term trends.

This graph depicts the typical progression of the business cycle, highlighting the alternating periods of economic growth and decline. It serves as a foundational framework for analysing the impacts of various shocks on the economy. Source

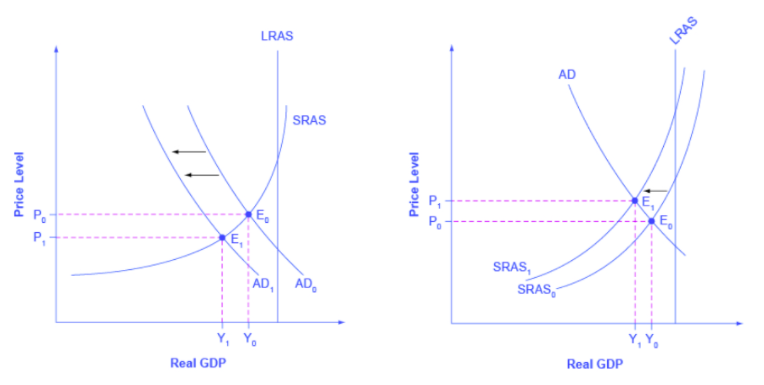

Demand-Side Causes of Phase Changes

Demand-side shocks affect aggregate demand (AD), the total demand for goods and services in an economy at a given price level.

Domestic Demand-Side Shocks

Consumer confidence: A sudden fall, for example due to political instability, reduces consumption and pushes the economy into slowdown.

Government policy: Expansionary fiscal policy (increased spending or tax cuts) can trigger recovery, while austerity measures may deepen a recession.

Interest rates: Higher rates reduce borrowing and spending, dampening growth; lower rates stimulate demand and investment.

Private sector investment: Sudden declines in business investment can reduce demand, leading to downturns.

Global Demand-Side Shocks

Global recessions: Reduced foreign demand for exports leads to contraction in domestic output.

Exchange rate movements: A sharp appreciation makes exports less competitive, reducing demand and growth.

Commodity price changes: A surge in global oil prices raises costs, cutting household real incomes and demand.

Demand-side shock: A sudden and unexpected event that significantly affects aggregate demand in an economy.

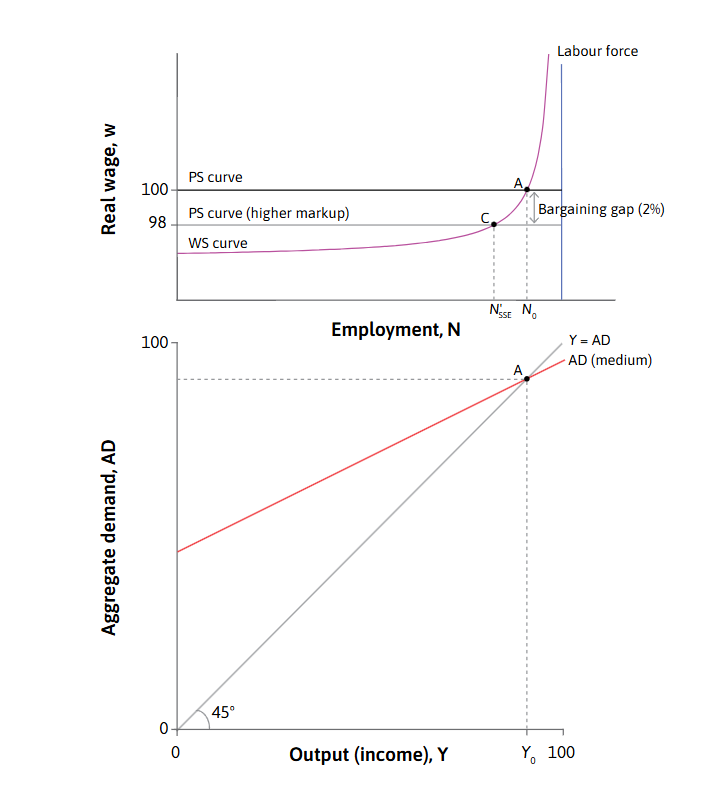

Supply-Side Causes of Phase Changes

Supply-side shocks influence aggregate supply (AS), the total output firms are willing and able to produce.

This diagram illustrates the effects of a negative supply-side shock, where an increase in production costs shifts the SRAS curve leftward, resulting in higher price levels and reduced output. This scenario exemplifies stagflation, a combination of inflation and economic stagnation. Source

Domestic Supply-Side Shocks

Labour market disruptions: Strikes or shortages of skilled labour reduce output capacity.

Infrastructure failures: Energy blackouts or transport breakdowns limit productive capacity.

Technological change: Innovations can boost growth by raising productivity, initiating a recovery or boom.

Global Supply-Side Shocks

Energy supply disruptions: Wars or sanctions reducing oil and gas supply increase costs and shift AS left.

Natural disasters: Events such as tsunamis or earthquakes can disrupt production chains globally.

Pandemics: Reduced labour supply and disrupted trade flows contract productive capacity.

Supply-side shock: An unexpected event that directly affects the cost of production or productive capacity in an economy.

The Role of Financial Factors in Phase Changes

Financial markets play a crucial role in amplifying or triggering phase changes in the cycle.

Credit availability: Loose lending standards can fuel booms; sudden restrictions or defaults lead to contraction.

Asset price bubbles: Rising house or stock prices encourage spending during booms, but bursting bubbles trigger downturns.

Confidence in banking: Loss of confidence in financial institutions can freeze credit markets, accelerating recessions.

The Interaction of Shocks and Expectations

Phase changes are often magnified by how households and firms expect the economy to behave.

Positive expectations: Encourage spending and investment, supporting recovery.

Negative expectations: Reinforce recessions as consumers save more and firms cut back.

Animal spirits: A term by Keynes describing the instincts and emotions that influence consumer and business confidence, leading to changes in economic activity.

Domestic vs Global Balance

While domestic shocks can drive cycles, globalisation has increased exposure to worldwide developments. For instance:

UK recessions often coincide with US downturns due to trade and financial linkages.

Emerging market crises can spill over, reducing global demand and confidence.

Key Takeaways for AQA Students

Phase changes in the cycle result from both demand-side and supply-side shocks.

Domestic influences (policy, investment, labour markets) interact with global factors (commodity prices, international trade).

Financial instability and expectations often amplify these shifts.

This diagram shows how a leftward shift in the AD curve (representing a decrease in demand) leads to a lower equilibrium output and price level, indicating a contraction in the economy. Conversely, a rightward shift in the AS curve (representing an increase in supply) can lead to higher output and lower price levels, indicating an expansion. Source

FAQ

Government confidence influences fiscal and monetary decisions. If policymakers believe growth is sustainable, they may maintain expansionary measures longer, fuelling a boom.

If confidence falls, governments may introduce austerity or tighten policy too early, pushing the economy into downturn. Political uncertainty can also undermine investment and consumer sentiment, accelerating phase changes.

When households anticipate rising unemployment or falling incomes, they often increase savings and cut back on spending. This reduces aggregate demand and can deepen a downturn.

By contrast, if expectations turn optimistic—perhaps due to new technology or government stimulus—spending may rise sharply, accelerating recovery and leading to stronger growth.

Global trade links mean domestic cycles are highly sensitive to foreign demand. A fall in export orders due to global recession quickly reduces output and investment.

Export-led economies are particularly vulnerable to global demand shocks.

Trade disruptions, such as tariffs or supply chain breakdowns, can trigger phase changes even without domestic instability.

Speculative bubbles, such as rapidly rising property or stock market prices, create artificial boosts to confidence and spending, pushing economies into boom conditions.

When bubbles burst, asset prices fall sharply, reducing household wealth and discouraging investment. This often triggers recessions or prolongs downturns.

Yes. In a boom, a negative supply-side shock (such as rising energy costs) may create inflationary pressures without immediately causing contraction.

During recession, however, the same shock could worsen unemployment and reduce output further. Positive supply-side shocks, like new technology, are most powerful during recovery phases, reinforcing growth momentum.

Practice Questions

Define what is meant by a supply-side shock and give one example. (2 marks)

1 mark for a correct definition: an unexpected event that directly affects the cost of production or productive capacity in an economy.

1 mark for a suitable example, such as an energy price rise, labour strike, or natural disaster.

Explain how both global demand-side shocks and domestic supply-side shocks can cause changes in the phases of the economic cycle. (6 marks)

Up to 2 marks for identifying relevant global demand-side shocks (e.g. fall in export demand, global recession, exchange rate changes).

Up to 2 marks for identifying relevant domestic supply-side shocks (e.g. labour market disruptions, infrastructure failure, technological changes).

Up to 2 marks for explaining how these shocks shift AD/AS and affect GDP growth, causing movement between phases (e.g. expansion to downturn, recession to recovery).

Maximum 6 marks in total: answers must address both global demand-side and domestic supply-side shocks to access full marks.