AQA Specification focus:

‘Students should understand how the MPC of the Bank of England uses changes in bank rate to try to achieve the objectives for monetary policy, including the government’s target rate of inflation.’

Introduction

The Monetary Policy Committee (MPC) of the Bank of England plays a central role in controlling inflation and stabilising the economy, primarily through adjusting the Bank Rate.

The Role of the MPC

The MPC is a nine-member committee within the Bank of England. It is responsible for setting the Bank Rate, which is the interest rate charged to commercial banks when they borrow from the Bank of England. This rate acts as the primary instrument of monetary policy and directly influences borrowing, lending, investment, and consumption in the wider economy.

Bank Rate and Monetary Policy Objectives

Government-set Objectives

The UK government sets the objectives for monetary policy. The current primary objective is to maintain price stability, defined as achieving the government’s inflation target, typically 2% as measured by the Consumer Prices Index (CPI). Secondary objectives include supporting growth, employment, and the stability of the financial system.

Mechanism of Bank Rate Adjustments

When the MPC adjusts the Bank Rate, it sets off a chain reaction across the economy.

Lowering the Bank Rate

Reduces the cost of borrowing for households and firms.

Encourages spending and investment, increasing aggregate demand (AD).

May weaken the exchange rate, boosting exports by making UK goods more competitive.

Risks fuelling inflation if demand rises too quickly.

Raising the Bank Rate

Increases borrowing costs, discouraging consumer spending and business investment.

Encourages saving over borrowing.

May strengthen the exchange rate, reducing import costs and easing inflationary pressures.

Risks slowing economic growth and increasing unemployment.

Inflation Targeting

The MPC uses Bank Rate changes to steer inflation towards the government’s target.

Inflation Targeting: A monetary policy strategy where the central bank sets an explicit target for the inflation rate and adjusts policy instruments to achieve it.

If inflation rises above target, the MPC may raise the Bank Rate to reduce spending. Conversely, if inflation falls below target, the MPC may lower the rate to stimulate demand.

Transmission Mechanism of Bank Rate Changes

Changes in Bank Rate influence the economy through several channels:

Market interest rates: Commercial banks adjust lending and saving rates in line with the Bank Rate.

Asset prices: Lower interest rates can raise asset values, increasing wealth and spending.

Exchange rate: A lower Bank Rate reduces demand for sterling, weakening the currency and boosting net exports.

Expectations: The MPC’s actions shape public and business confidence about future inflation and growth.

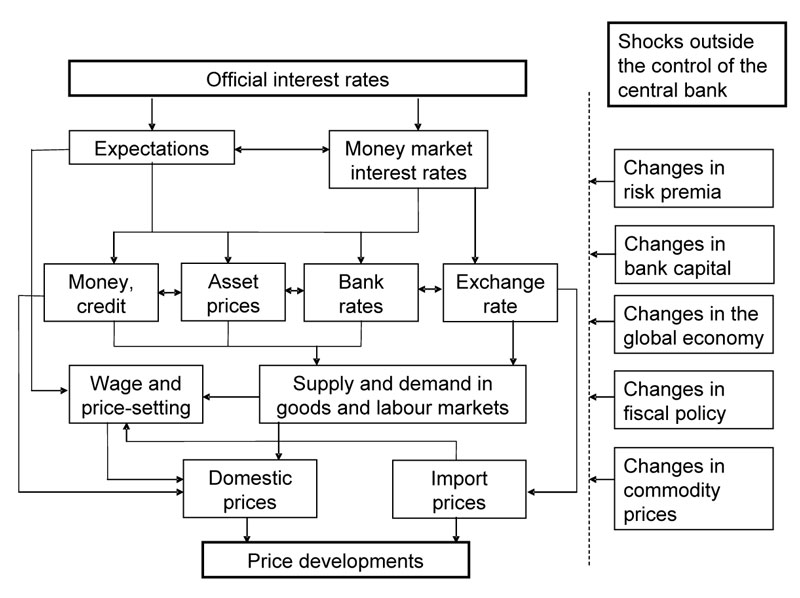

Changes in the official interest rate affect the demand for goods and services produced in the United Kingdom.

This diagram from the European Central Bank depicts the transmission mechanism of monetary policy, showing how changes in the official interest rate influence market interest rates, asset prices, exchange rates, and ultimately aggregate demand and inflation. Source

Balancing Conflicting Objectives

The MPC must carefully weigh trade-offs when adjusting the Bank Rate:

Stability vs growth: Raising rates can stabilise prices but dampen growth.

Employment vs inflation: Lowering rates may reduce unemployment but risks inflation overshooting the target.

Short-term vs long-term impacts: Immediate effects on spending and investment may differ from longer-term inflationary pressures.

Forward-looking Decision-making

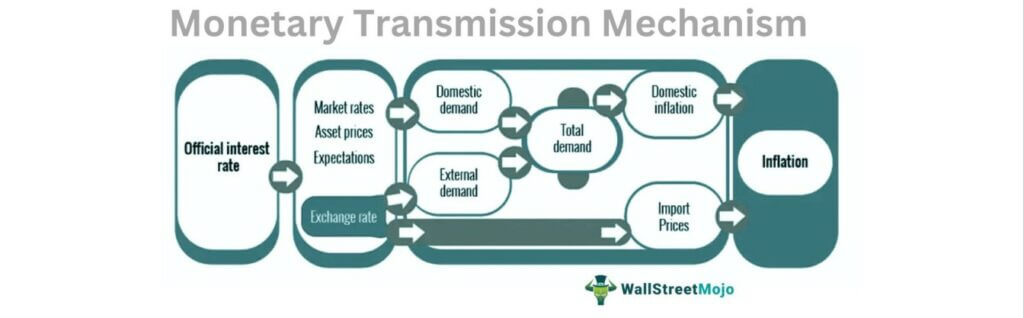

The MPC bases decisions on forecasts rather than current data, since monetary policy effects are delayed.

This diagram from Wall Street Mojo illustrates the monetary transmission mechanism, highlighting how central bank actions affect domestic demand, asset prices, exchange rates, and ultimately inflation. Source

Factors Considered

Current and forecasted inflation trends.

Labour market data (employment, wages).

Global economic conditions, including exchange rates and commodity prices.

Financial market stability.

Use of Bank Rate in Recent Context

Historically, the Bank Rate has been adjusted both upward and downward to stabilise the UK economy during periods of inflationary pressure or economic downturn. For example, in times of financial crisis, lowering the Bank Rate has been a key tool for stimulating demand when private sector activity declines.

Limitations of Bank Rate Policy

While the Bank Rate is the MPC’s primary tool, it has limits:

If rates are already very low, further cuts may have little impact.

External shocks (e.g., oil prices, global recessions) may offset domestic policy effects.

Banks may not fully pass on Bank Rate changes to consumers.

Household and business confidence may not respond as expected.

Complementary Tools

Although the Bank Rate remains central, the MPC may also employ other tools when necessary:

Quantitative easing (QE) to increase liquidity.

Forward guidance to influence expectations about future interest rates.

These tools complement Bank Rate changes in achieving the inflation target and supporting broader policy objectives.

FAQ

If inflation moves more than 1% above or below the 2% target, the Governor of the Bank of England must write an open letter to the Chancellor.

This letter explains why the target has been missed, what action the MPC is taking, and how long it expects inflation to return to target.

The MPC uses the Consumer Prices Index (CPI) because it is internationally comparable and gives a broad measure of price changes in a standard basket of goods and services.

Other measures, like RPI, include housing costs but are less consistent with international standards. Using CPI improves transparency and accountability in policy-making.

The effect of a Bank Rate change is not immediate. It usually takes 12 to 24 months for the full impact to filter through the economy.

This time lag occurs because households and firms adjust spending, saving, and investment gradually. Therefore, the MPC sets policy based on forecasts rather than only current data.

The MPC may decide to keep the Bank Rate steady if:

Inflation is already on course to meet the target.

Risks from raising or lowering rates could destabilise the economy.

External factors, such as global financial shocks, create uncertainty.

By leaving rates unchanged, the MPC avoids unnecessary volatility and waits for clearer signals from the economy.

Expectations strongly influence consumer and business behaviour.

If households and firms believe inflation will rise, they may bring forward spending, which increases demand and inflationary pressure. By signalling changes to the Bank Rate, the MPC can guide expectations and influence decisions today, even before the full effect of policy takes place.

Practice Questions

Define the term inflation targeting in the context of the Monetary Policy Committee (MPC). (2 marks)

1 mark for identifying that inflation targeting involves setting an explicit target for inflation.

1 mark for stating that the MPC adjusts monetary policy instruments (e.g., Bank Rate) to achieve this target.

Explain how the Monetary Policy Committee (MPC) uses changes in the Bank Rate to achieve the government’s inflation target. (6 marks)

Up to 2 marks for describing the mechanism of raising the Bank Rate to reduce inflation (e.g., higher borrowing costs, reduced consumption and investment).

Up to 2 marks for describing the mechanism of lowering the Bank Rate to increase inflation (e.g., cheaper borrowing, higher demand, weaker exchange rate).

1 mark for linking Bank Rate changes to achieving the government’s target of around 2% inflation.

1 mark for recognising that the MPC considers forecasts and the delayed impact of policy (time lag).