AQA Specification focus:

‘Fiscal policy involves the manipulation of government spending, taxation and the budget balance.’

Introduction

Fiscal policy plays a central role in shaping the economy by adjusting taxation, government spending, and borrowing. Understanding its scope is crucial for analysing economic policy.

What Fiscal Policy Involves

Fiscal policy is the government’s use of spending, taxation, and borrowing to influence both the overall economy and specific sectors. It affects aggregate demand (AD) and aggregate supply (AS), with consequences for growth, employment, inflation, and distribution of income.

Government Spending

Government spending refers to expenditure by the public sector on goods and services such as education, healthcare, defence, and infrastructure. It can be split into categories:

Current spending: Ongoing costs such as salaries for teachers or nurses.

Capital spending: Investment in long-term assets like transport networks or hospitals.

Transfer payments: Welfare benefits, pensions, and unemployment benefits.

Government Spending: Expenditure by the public sector on goods, services, and transfers to support economic and social objectives.

Spending priorities determine how resources are allocated across the economy, influencing short-term economic performance and long-term development.

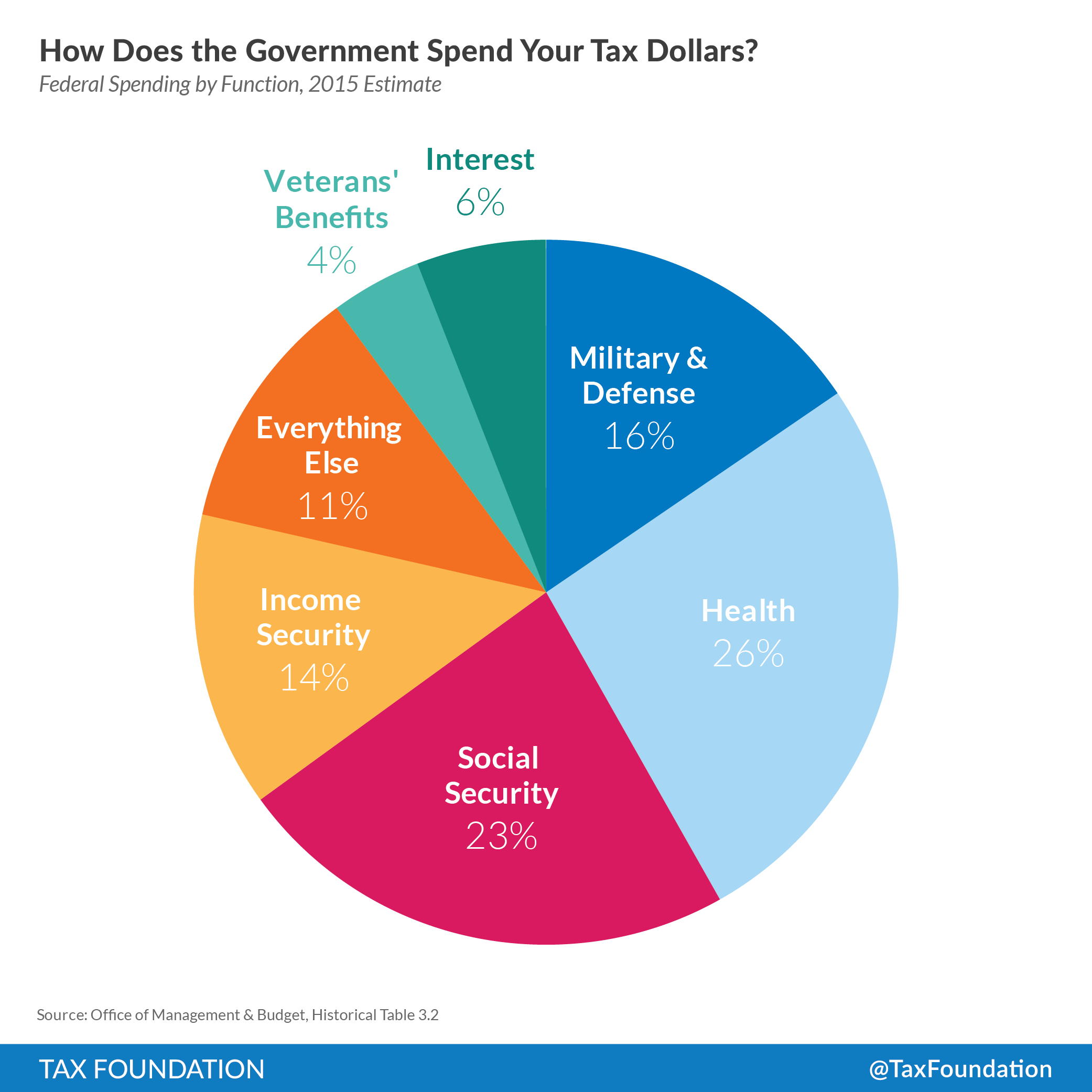

This chart illustrates the distribution of U.S. federal spending across various sectors, highlighting the proportion of funds allocated to areas such as healthcare, defence, and social security. Source

Taxation

Taxation provides revenue for government spending and can be used to influence economic behaviour. Taxes may be imposed on income, consumption, or wealth, with varying effects on incentives and distribution.

Taxation: The process by which a government raises revenue through compulsory charges on individuals and businesses to fund public expenditure.

Taxation has two main functions:

Revenue generation: Funding essential services.

Behavioural influence: Shaping consumption and production, e.g., discouraging smoking with excise duties.

The Budget Balance

The budget balance is the difference between government revenue (mainly taxation) and government expenditure.

Budget Balance: The gap between total government income and total government spending over a fiscal year.

Budget surplus: Revenue exceeds expenditure.

Budget deficit: Expenditure exceeds revenue.

Balanced budget: Revenue equals expenditure.

Budget Balance = Government Revenue – Government Expenditure

Government Revenue = Taxes and other income

Government Expenditure = Current spending + Capital spending + Transfer payments

A persistent deficit increases national debt, while surpluses may allow debt repayment.

Objectives of Fiscal Policy

Fiscal policy aims to achieve both macroeconomic stability and microeconomic objectives. Its uses include:

Stabilisation: Managing the business cycle by stimulating demand in recessions or restraining it during booms.

Resource allocation: Directing spending towards priority sectors such as education or healthcare.

Redistribution: Reducing inequality through progressive taxation and welfare transfers.

Debt management: Ensuring borrowing remains sustainable.

Fiscal Policy and Aggregate Demand

Fiscal policy directly influences aggregate demand (the total spending in the economy). For instance:

Increasing government spending raises AD.

Cutting taxes boosts disposable income and consumption.

Reducing spending or raising taxes lowers AD.

These tools are often referred to as fiscal stimulus (expansionary policy) and fiscal austerity (contractionary policy).

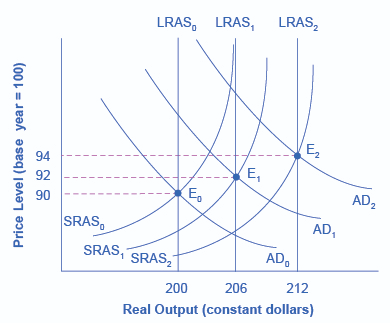

This diagram demonstrates how fiscal policy, through changes in government spending or taxation, can shift the aggregate demand curve, impacting national output and price levels. Source

Fiscal Policy and Aggregate Supply

Although less direct, fiscal policy can also affect aggregate supply by:

Funding education and training, raising workforce productivity.

Investing in infrastructure, improving efficiency.

Using tax incentives to encourage business investment.

By supporting long-term productive capacity, fiscal policy contributes to sustainable growth.

Types of Fiscal Policy

Fiscal policy can be divided into two main categories:

Expansionary fiscal policy:

Higher government spending

Lower taxes

Used to reduce unemployment and stimulate growth

Contractionary fiscal policy:

Lower government spending

Higher taxes

Used to reduce inflationary pressure and restore balance

Both approaches must balance short-term goals with long-term sustainability.

Discretionary vs Automatic Fiscal Policy

Discretionary fiscal policy: Deliberate changes in taxation and spending decided by government policy.

Automatic stabilisers: Elements of the fiscal system that adjust automatically with the economic cycle (e.g., unemployment benefits rise in a recession without new policy changes).

Automatic Stabilisers: Fiscal mechanisms that change government spending and revenue automatically in response to changes in economic activity, reducing volatility without deliberate policy action.

These stabilisers help smooth fluctuations without constant government intervention.

Importance of Fiscal Policy

Fiscal policy is a key instrument of economic management. Its significance lies in:

Providing funding for essential services and infrastructure.

Ensuring fair distribution of resources through taxation and transfers.

Influencing macroeconomic conditions such as growth, employment, and inflation.

Supporting long-term development by directing resources towards investment in human capital and technology.

By manipulating government spending, taxation, and the budget balance, fiscal policy plays a decisive role in shaping the economy’s direction and performance.

FAQ

Fiscal policy relies on government decisions about taxation, spending, and borrowing, whereas monetary policy uses interest rates, money supply, and credit controls.

Fiscal policy is often set through the government’s budget, while monetary policy is typically implemented by a central bank, such as the Bank of England.

In the short term, fiscal policy can quickly alter demand through tax cuts or spending increases.

In the long term, fiscal policy shapes growth by funding infrastructure, education, and innovation, which strengthen the economy’s productive potential.

Developed economies often use fiscal policy for stabilisation, focusing on unemployment, inflation, and growth cycles.

Developing economies may prioritise fiscal policy for infrastructure, poverty reduction, and social development.

The capacity to raise taxes and borrow effectively also varies, influencing the policy’s reach.

Fiscal policy is influenced by government priorities and political ideologies.

A government favouring welfare may increase spending and progressive taxation, while one focused on efficiency might cut taxes and reduce state intervention.

The effectiveness of fiscal policy depends on when measures are introduced.

Early action can prevent deeper recessions.

Late intervention may fuel inflation or debt.

Delays caused by political processes or forecasting errors can reduce policy impact, a problem known as the “time lag” in fiscal policy.

Practice Questions

Define fiscal policy. (2 marks)

1 mark for identifying that fiscal policy involves government use of spending and taxation.

1 mark for recognising that it also involves management of the budget balance or borrowing.

Explain how changes in government spending can influence aggregate demand in an economy. (6 marks)

1 mark for stating that government spending is a component of aggregate demand (AD = C + I + G + (X–M)).

1 mark for recognising that increased government spending directly raises AD.

1 mark for explaining that higher AD leads to increased output or economic growth.

1 mark for linking this to employment, e.g., more public sector jobs or multiplier effects.

1 mark for recognising the opposite effect: reduced government spending lowers AD.

1 mark for clear development, e.g., impact on inflationary pressures or overall macroeconomic stability.