AQA Specification focus:

‘How governments can intervene to influence the exchange rate.’

Introduction

Governments intervene in exchange rates to maintain economic stability, correct imbalances, support trade competitiveness, and protect macroeconomic objectives. Intervention occurs directly or indirectly through different methods.

Reasons for Government Intervention

Governments rarely leave exchange rates entirely to market forces. Intervention aims to:

Stabilise currency fluctuations that could damage economic confidence.

Correct balance of payments imbalances by influencing import and export demand.

Maintain competitiveness in international markets.

Control inflation by adjusting the cost of imports.

Attract investment through exchange rate credibility.

Direct Intervention in Foreign Exchange Markets

Central Bank Currency Transactions

Governments, often via central banks, directly buy or sell currencies to influence exchange rate levels.

Direct Intervention: Central bank activity in buying or selling its own currency in foreign exchange markets to influence its value.

Buying domestic currency reduces supply, raising its value (appreciation).

Selling domestic currency increases supply, lowering its value (depreciation).

This approach is most effective when supported by large foreign currency reserves.

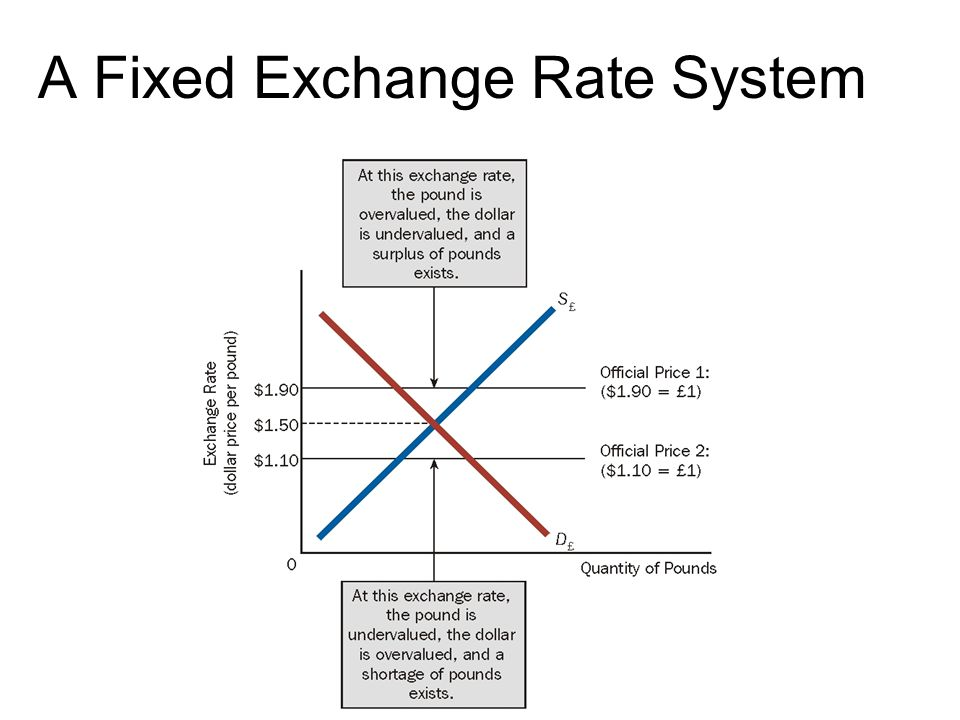

Diagram depicting a fixed exchange rate system where the central bank intervenes to maintain the currency value at a predetermined level. The intersection of supply and demand determines the equilibrium exchange rate, and the central bank's actions ensure stability. Source

Currency Reserves

Foreign currency and gold reserves allow governments to back their own currency in intervention. If reserves are limited, the ability to influence the exchange rate diminishes.

Indirect Intervention: Monetary Policy

Interest Rates and Exchange Rates

Governments influence exchange rates indirectly through monetary policy.

Interest Rate Policy: The adjustment of base interest rates to influence borrowing, investment, and currency attractiveness to international investors.

Raising interest rates: Increases returns for foreign investors, raising demand for domestic currency, causing appreciation.

Lowering interest rates: Reduces returns for investors, reducing demand for the currency, leading to depreciation.

This mechanism links closely to inflation control and wider monetary stability.

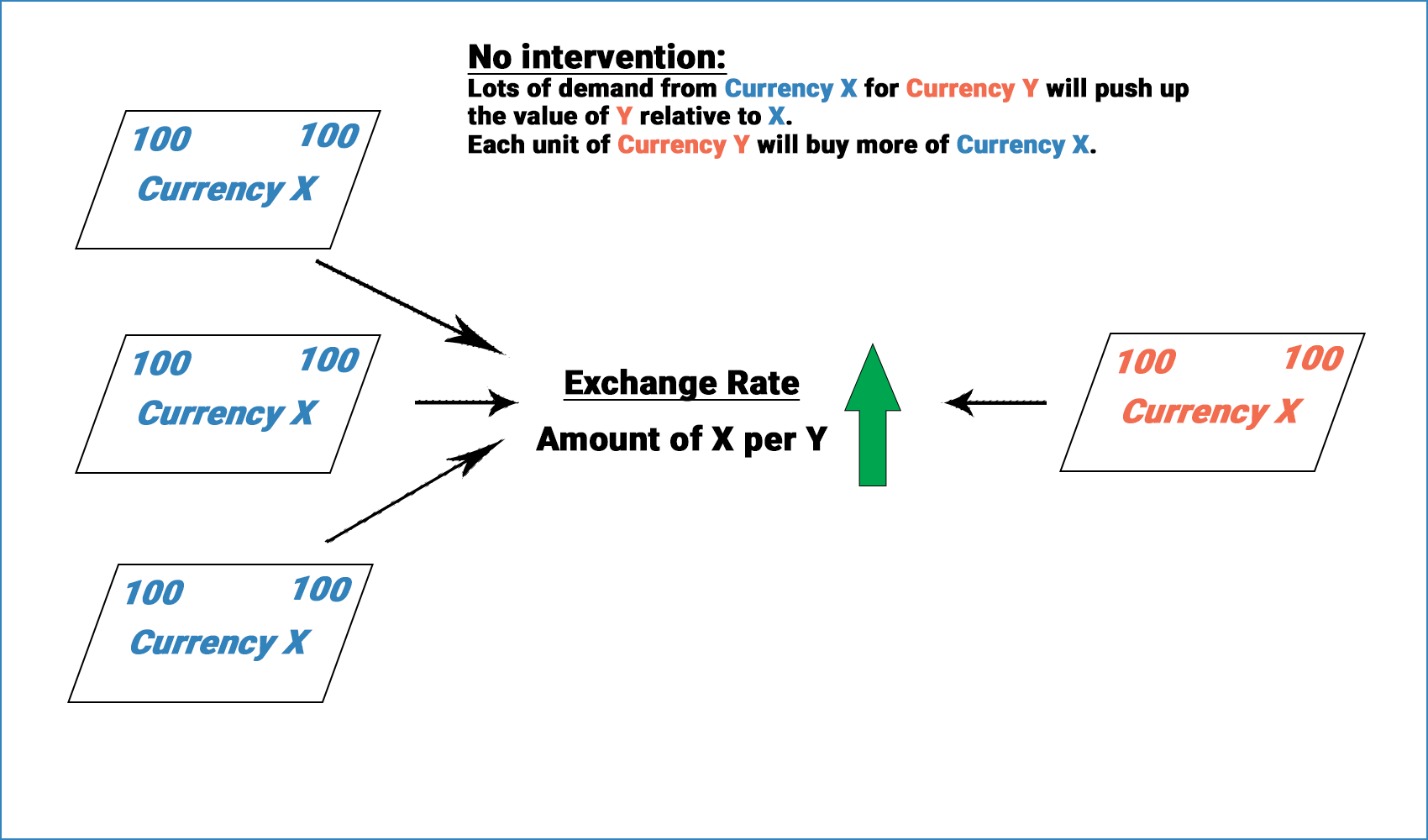

Flowchart illustrating the process of central bank intervention in the foreign exchange market, including the mechanisms of buying and selling currencies to influence exchange rates. Source

Quantitative Easing and Liquidity

Large-scale asset purchases increase money supply, often weakening the exchange rate by making domestic assets less attractive to foreign investors.

Exchange Controls and Restrictions

Governments may impose restrictions to directly manage currency flows:

Limits on currency conversion to prevent rapid capital flight.

Restrictions on foreign investment to stabilise financial markets.

Multiple exchange rate systems for different uses, such as trade and tourism.

These measures are more common in developing economies facing volatility.

Managed Exchange Rate Systems

Managed Float

Many governments adopt a managed floating exchange rate (or "dirty float"), where the exchange rate is primarily market-determined but occasionally influenced by intervention.

Managed Float: An exchange rate system where currency values are mainly determined by supply and demand, but government intervenes occasionally to influence outcomes.

This approach allows flexibility while preventing extreme volatility.

Competitive Devaluation and Currency Wars

Governments sometimes deliberately lower exchange rates to boost exports.

Competitive devaluation occurs when countries devalue simultaneously to gain trade advantage.

Currency wars can lead to retaliatory policies, global instability, and trade tensions.

Costs and Risks of Intervention

While intervention can stabilise an economy, it carries significant risks:

Ineffectiveness: Markets may be too large for governments to influence persistently.

Inflationary pressures: Depreciation raises import prices, fuelling inflation.

Resource costs: Using reserves to intervene depletes national savings.

International disputes: Persistent devaluation may breach World Trade Organisation (WTO) rules.

Short-Term vs Long-Term Impact

Short-Term

Stabilisation of volatility.

Immediate correction of imbalances.

Quick influence on investor confidence.

Long-Term

Sustainability depends on reserves and credibility.

Overuse can reduce effectiveness.

Markets often anticipate and counteract intervention.

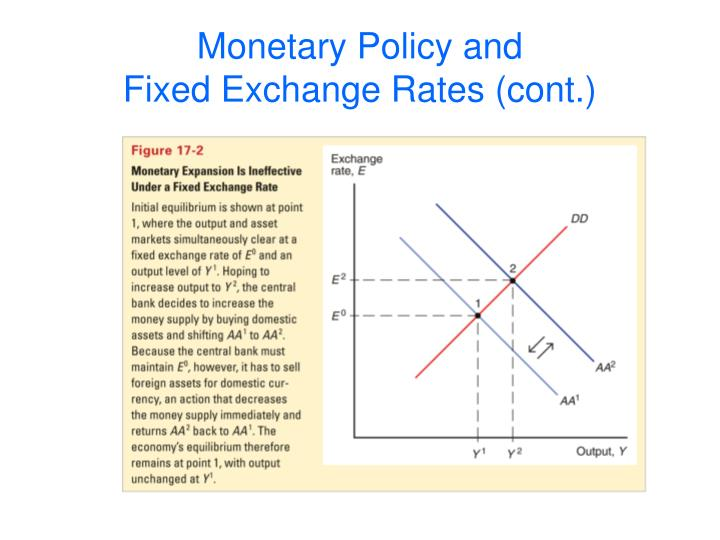

Diagram showing the ineffectiveness of monetary policy under a fixed exchange rate system, where the central bank's actions to adjust the money supply are counteracted by the need to maintain the fixed exchange rate. Source

Summary of Key Methods

Government intervention in exchange rates can occur through:

Direct intervention: Buying/selling currency using reserves.

Monetary policy: Adjusting interest rates or using quantitative easing.

Exchange controls: Imposing restrictions on flows of capital or currency use.

Managed floats: Combining market forces with selective intervention.

Each method reflects a balance between stabilisation needs and risks of distortion in international markets.

FAQ

Indirect intervention, such as altering interest rates, often requires fewer financial resources than direct currency market operations.

It can also influence broader macroeconomic variables like inflation and investment, making it a dual-purpose tool. However, the drawback is that changes in interest rates may not have an immediate or predictable effect on exchange rates, especially in open economies.

Large reserves signal that a government or central bank has the capacity to support its currency for a sustained period. This discourages speculative attacks on the currency.

If reserves are low, markets may doubt the government’s ability to maintain stability, reducing the effectiveness of intervention.

Exporters benefit from a weaker domestic currency, as their goods become cheaper abroad, boosting competitiveness.

Importers face higher costs when the domestic currency is weak, as foreign goods and raw materials become more expensive.

When governments intervene, they must weigh these opposing impacts carefully to avoid harming one sector disproportionately.

Yes. Persistent intervention, particularly if aimed at keeping a currency undervalued, can lead to accusations of unfair trade practices.

The World Trade Organisation (WTO) and the International Monetary Fund (IMF) may become involved if intervention is judged to distort global trade. Such disputes can also strain relations between trading partners.

Currency speculators anticipate government actions and may buy or sell in large volumes before or after intervention.

This can neutralise the intended effect, as the scale of speculative trades often exceeds central bank transactions. Over time, frequent intervention may lose credibility if speculators believe they can consistently counteract it.

Practice Questions

Define direct intervention in the context of exchange rate management. (2 marks)

1 mark for identifying that direct intervention involves the central bank/government buying or selling its own currency.

1 mark for stating that this is done to influence the value of the currency in the foreign exchange market.

Explain how changes in interest rates can be used by a government to influence the exchange rate, and analyse one possible drawback of this method. (6 marks)

Up to 2 marks for explaining that raising interest rates increases returns for investors, leading to higher demand for the domestic currency and appreciation.

Up to 2 marks for explaining that lowering interest rates reduces investor returns, decreasing demand for the currency and depreciation.

Up to 2 marks for analysis of a drawback, such as:

Higher interest rates may dampen domestic investment and consumption.

Lower interest rates may lead to higher inflationary pressures.

Effectiveness depends on international investor confidence and global conditions.

(Max 6 marks: clear explanation of mechanism plus relevant drawback analysis).